This article will reflect on the compensation paid to David Harrison who has served as CEO of Charter Hall Group (ASX:CHC) since 2004. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Charter Hall Group.

Note: The company does not report funds from operations, and as a result, we have used earnings per share in our analysis.

See our latest analysis for Charter Hall Group

Comparing Charter Hall Group's CEO Compensation With the industry

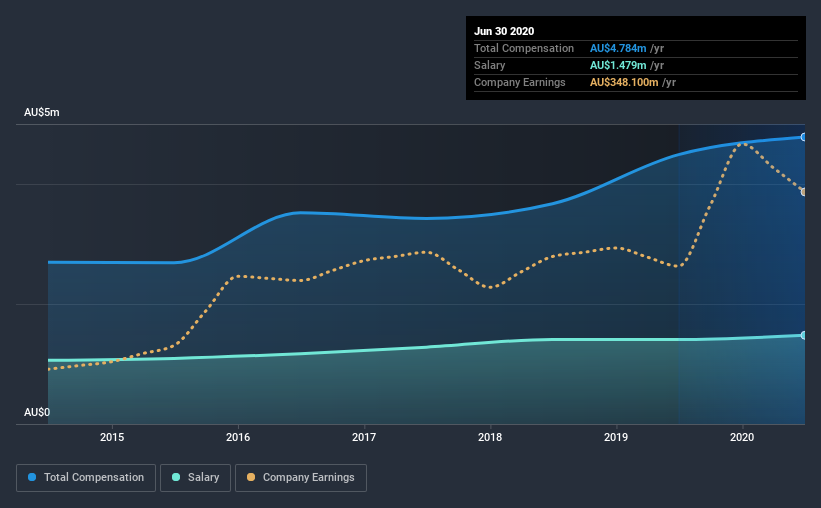

According to our data, Charter Hall Group has a market capitalization of AU$6.3b, and paid its CEO total annual compensation worth AU$4.8m over the year to June 2020. That's just a smallish increase of 6.5% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at AU$1.5m.

In comparison with other companies in the industry with market capitalizations ranging from AU$2.7b to AU$8.8b, the reported median CEO total compensation was AU$5.0m. From this we gather that David Harrison is paid around the median for CEOs in the industry. What's more, David Harrison holds AU$18m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$1.5m | AU$1.4m | 31% |

| Other | AU$3.3m | AU$3.1m | 69% |

| Total Compensation | AU$4.8m | AU$4.5m | 100% |

Talking in terms of the industry, salary represented approximately 51% of total compensation out of all the companies we analyzed, while other remuneration made up 49% of the pie. Charter Hall Group sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Charter Hall Group's Growth

Charter Hall Group's earnings per share (EPS) grew 6.9% per year over the last three years. Its revenue is up 38% over the last year.

It's great to see that revenue growth is strong. With that in mind, the modestly improving EPS seems positive. We'd stop short of saying the business performance is amazing, but there are enough positives to justify further research, or even adding the stock to your watch-list. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Charter Hall Group Been A Good Investment?

Boasting a total shareholder return of 145% over three years, Charter Hall Group has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

As we noted earlier, Charter Hall Group pays its CEO in line with similar-sized companies belonging to the same industry. However, the company's EPS growth numbers over the last three years is not that impressive. At the same time, shareholder returns have remained strong over the same period. There is room for improved company performance, but we don't see the CEO compensation as a big issue here.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Charter Hall Group that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading Charter Hall Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:CHC

Charter Hall Group

Charter Hall is Australia’s leading fully integrated diversified property investment and funds management group.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)