- Australia

- /

- Specialized REITs

- /

- ASX:ASK

Undervalued Small Caps In Australia With Insider Action October 2024

Reviewed by Simply Wall St

As the Australian market remains relatively stable, with the ASX 200 opening nearly flat and investors closely watching upcoming inflation data, small-cap stocks are drawing attention amidst this cautious economic backdrop. In such an environment, identifying promising small-cap opportunities often involves looking at those with strong fundamentals and potential catalysts that align with current market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| GWA Group | 16.6x | 1.6x | 41.13% | ★★★★★★ |

| Magellan Financial Group | 8.2x | 5.2x | 31.53% | ★★★★★☆ |

| Tabcorp Holdings | NA | 0.4x | 21.93% | ★★★★★☆ |

| SHAPE Australia | 13.9x | 0.3x | 35.88% | ★★★★☆☆ |

| Collins Foods | 17.8x | 0.7x | 7.93% | ★★★★☆☆ |

| Dicker Data | 19.6x | 0.7x | -62.23% | ★★★★☆☆ |

| Corporate Travel Management | 19.5x | 2.3x | 5.81% | ★★★★☆☆ |

| Coventry Group | 237.6x | 0.4x | -17.31% | ★★★☆☆☆ |

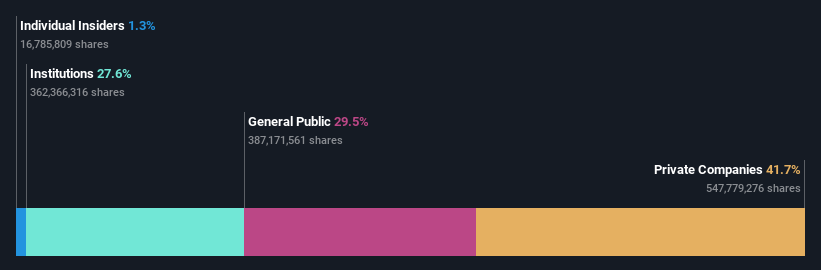

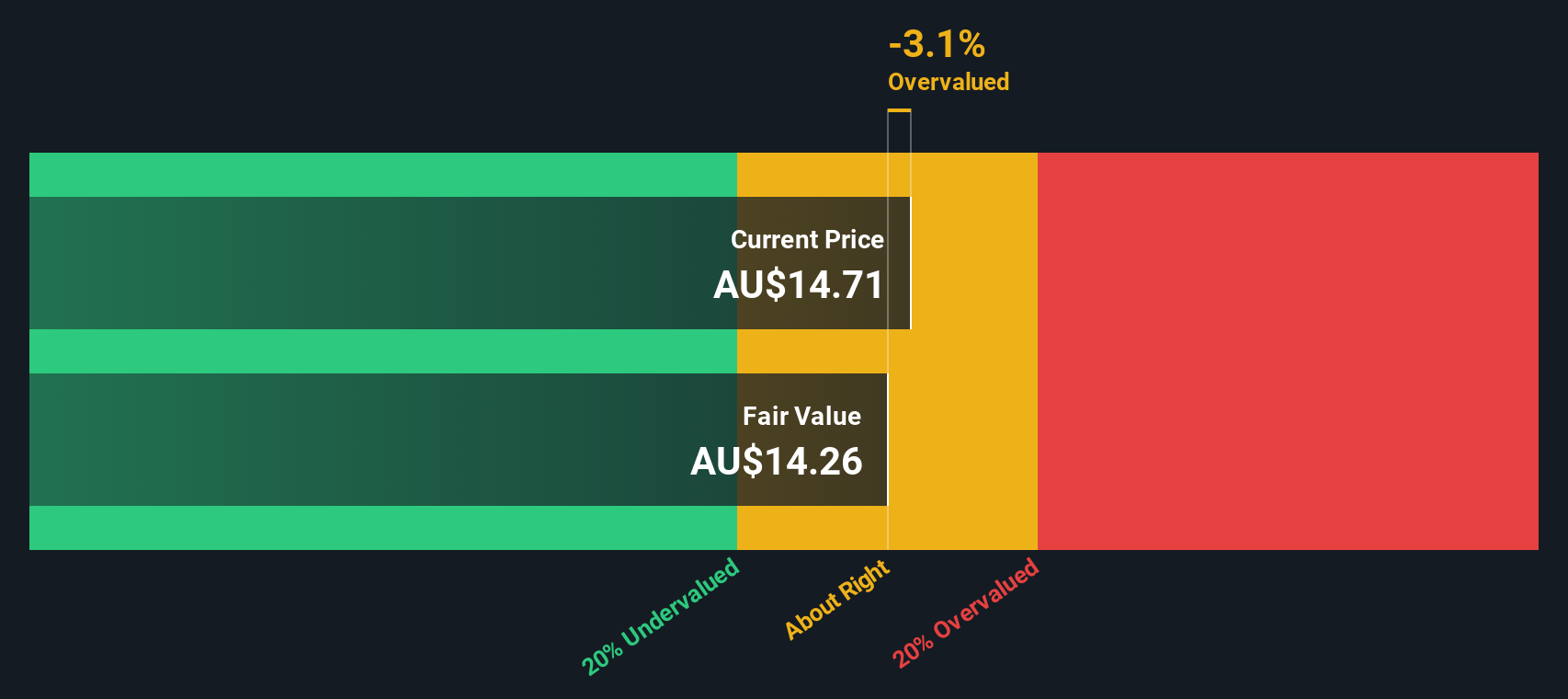

| Abacus Storage King | 12.4x | 7.8x | -31.31% | ★★★☆☆☆ |

| Credit Corp Group | 23.4x | 3.1x | 33.51% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Abacus Storage King (ASX:ASK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Abacus Storage King operates in the self-storage sector, providing rental and merchandising services, with a market cap of A$1.25 billion.

Operations: ASK generates revenue primarily from rental and merchandising activities. The company's cost of goods sold (COGS) has been consistently around A$41.90 million to A$42.46 million in recent periods, while its operating expenses have shown an upward trend, reaching approximately A$70.77 million by the latest period. Notably, ASK's net income margin saw a significant increase to 62.67% in the most recent period, reflecting improved profitability despite rising costs.

PE: 12.4x

Abacus Storage King, a player in the self-storage sector, has been navigating changes with recent board shifts and dividend affirmations. Despite a forecasted 6.74% annual revenue growth, its earnings are expected to decline by an average of 1.7% annually over the next three years. The company relies on external borrowing for funding, which poses higher risk but is currently manageable given their financial position. Insider confidence was shown through share purchases earlier this year, signaling potential optimism about future prospects amidst these challenges.

- Navigate through the intricacies of Abacus Storage King with our comprehensive valuation report here.

Evaluate Abacus Storage King's historical performance by accessing our past performance report.

Corporate Travel Management (ASX:CTD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Corporate Travel Management is a company that provides travel services across Asia, Europe, North America, and Australia/New Zealand with a market cap of A$2.89 billion.

Operations: Corporate Travel Management generates revenue primarily from its travel services across Asia, Europe, North America, and Australia/New Zealand. The company's cost of goods sold (COGS) has shown an upward trend over the years, impacting its gross profit margins. The gross profit margin has fluctuated significantly, with recent figures around 40.60%. Operating expenses have been substantial due to general and administrative costs and depreciation & amortization expenses.

PE: 19.5x

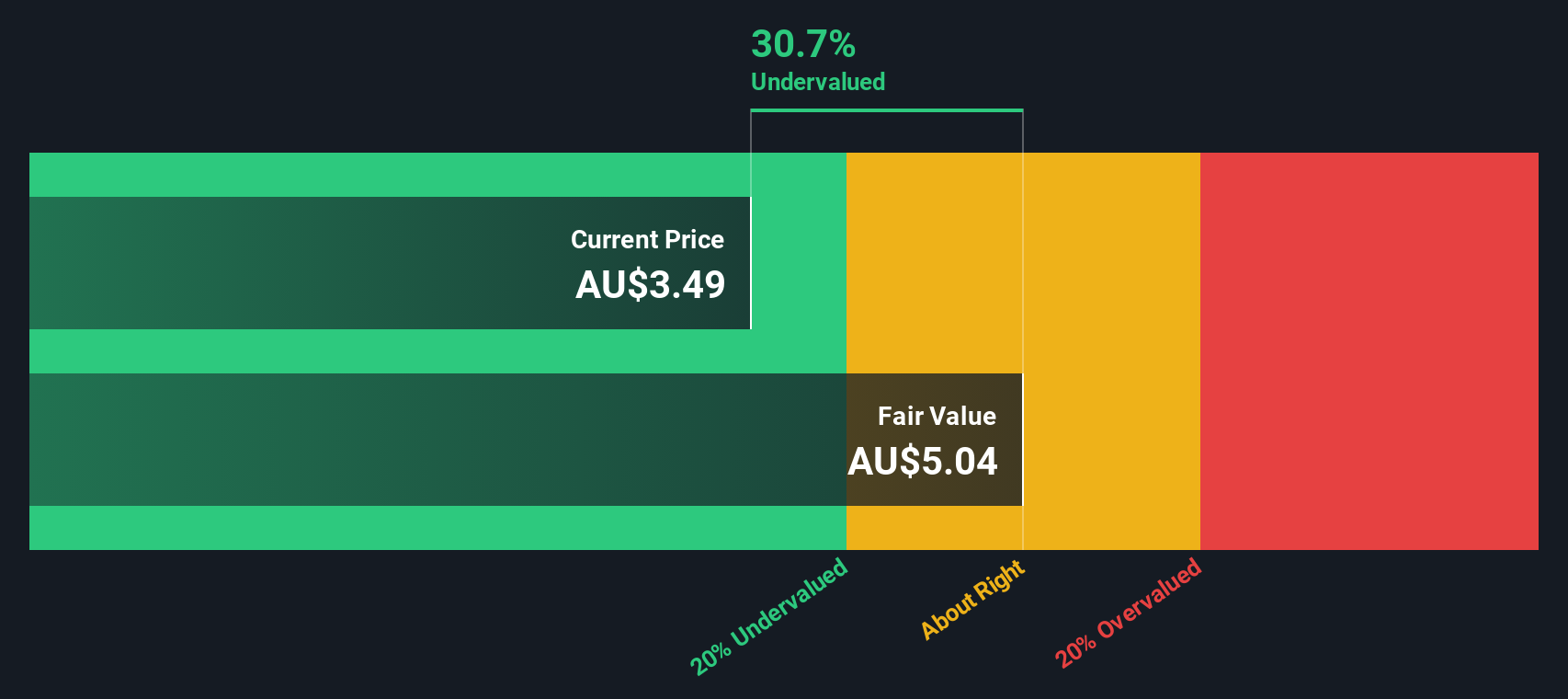

Corporate Travel Management, a smaller player in the Australian market, has shown insider confidence with Jamie Pherous purchasing 87,500 shares for A$1.4 million. This reflects a positive outlook despite the company's reliance on riskier external borrowing for funding. Recent financials reveal growth, with revenue increasing to A$716.86 million from A$660.08 million year-over-year and net income rising to A$84.45 million from A$77.57 million. Additionally, their share buyback plan increased by 8 million shares up to June 2025 suggests strategic capital management amidst evolving auditor relationships and dividend adjustments.

Insignia Financial (ASX:IFL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Insignia Financial is a financial services company that provides advice, platform solutions, and asset management services, with a market capitalization of A$2.63 billion.

Operations: Insignia Financial generates revenue primarily from its Platforms segment, followed by Advice and Asset Management. The company's gross profit margin has shown an increasing trend, reaching 36.72% in the latest period. Operating expenses are a significant cost component, with general and administrative expenses being the largest portion within this category.

PE: -11.7x

Insignia Financial, a small player in Australia's financial sector, faces challenges with its external borrowing as the sole funding source. Despite reporting a net loss of A$185.3 million for the year ending June 2024, compared to A$51.4 million net income previously, there's insider confidence with recent share purchases hinting at potential long-term value. Earnings are projected to grow significantly by 56% annually, suggesting possible future recovery amidst current hurdles like leadership changes and financial setbacks.

- Click to explore a detailed breakdown of our findings in Insignia Financial's valuation report.

Understand Insignia Financial's track record by examining our Past report.

Taking Advantage

- Reveal the 23 hidden gems among our Undervalued ASX Small Caps With Insider Buying screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Abacus Storage King, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ASK

Abacus Storage King

Owns, operates, and manages a self-storage operating platform in Australia and New Zealand.

Good value with proven track record.

Market Insights

Community Narratives