- Australia

- /

- Retail Distributors

- /

- ASX:SNL

ASX Value Stock Opportunities For September 2025

Reviewed by Simply Wall St

In the last week, the Australian market has remained flat, yet it has shown a robust 7.2% increase over the past year with earnings forecasted to grow by 11% annually. In this context, identifying undervalued stocks involves seeking those that offer strong fundamentals and growth potential at attractive valuations amidst these promising market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Resimac Group (ASX:RMC) | A$1.08 | A$2.13 | 49.3% |

| Reckon (ASX:RKN) | A$0.61 | A$1.18 | 48.3% |

| PolyNovo (ASX:PNV) | A$1.57 | A$3.12 | 49.6% |

| PEXA Group (ASX:PXA) | A$16.81 | A$33.42 | 49.7% |

| NRW Holdings (ASX:NWH) | A$4.48 | A$8.63 | 48.1% |

| Kinatico (ASX:KYP) | A$0.30 | A$0.53 | 43.7% |

| IDP Education (ASX:IEL) | A$5.40 | A$10.63 | 49.2% |

| Elders (ASX:ELD) | A$7.65 | A$14.04 | 45.5% |

| Credit Clear (ASX:CCR) | A$0.26 | A$0.47 | 44.1% |

| CleanSpace Holdings (ASX:CSX) | A$0.77 | A$1.41 | 45.3% |

Let's review some notable picks from our screened stocks.

Lynas Rare Earths (ASX:LYC)

Overview: Lynas Rare Earths Limited, with a market cap of A$14.52 billion, is involved in the exploration, development, mining, extraction, and processing of rare earth minerals in Australia and Malaysia.

Operations: The company generates revenue of A$556.51 million from its rare earth operations in Australia and Malaysia.

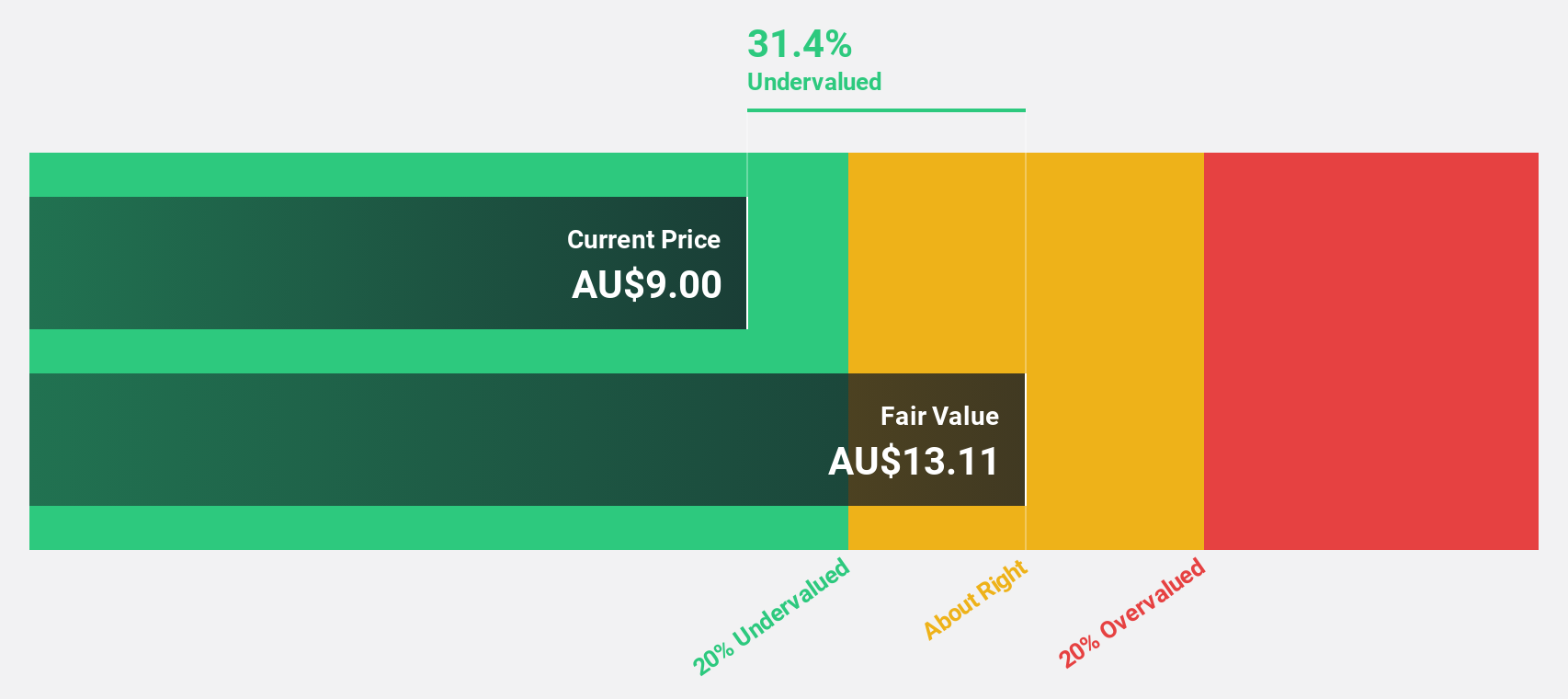

Estimated Discount To Fair Value: 28.0%

Lynas Rare Earths is trading at A$14.63, significantly below its estimated fair value of A$20.32, indicating potential undervaluation based on cash flows. Despite recent net income decline to A$7.99 million from A$84.51 million, earnings and revenue are expected to grow substantially at 42.8% and 28.2% annually, surpassing market averages. However, profit margins have decreased from 18.2% to 1.4%. The company recently completed a follow-on equity offering of A$750 million which may impact future valuations.

- Our growth report here indicates Lynas Rare Earths may be poised for an improving outlook.

- Take a closer look at Lynas Rare Earths' balance sheet health here in our report.

PEXA Group (ASX:PXA)

Overview: PEXA Group Limited operates a digital property settlements platform in Australia and has a market capitalization of A$2.99 billion.

Operations: The company's revenue segments include Exchange at A$313.82 million, International at A$60.71 million, and Digital Solutions at A$19.09 million.

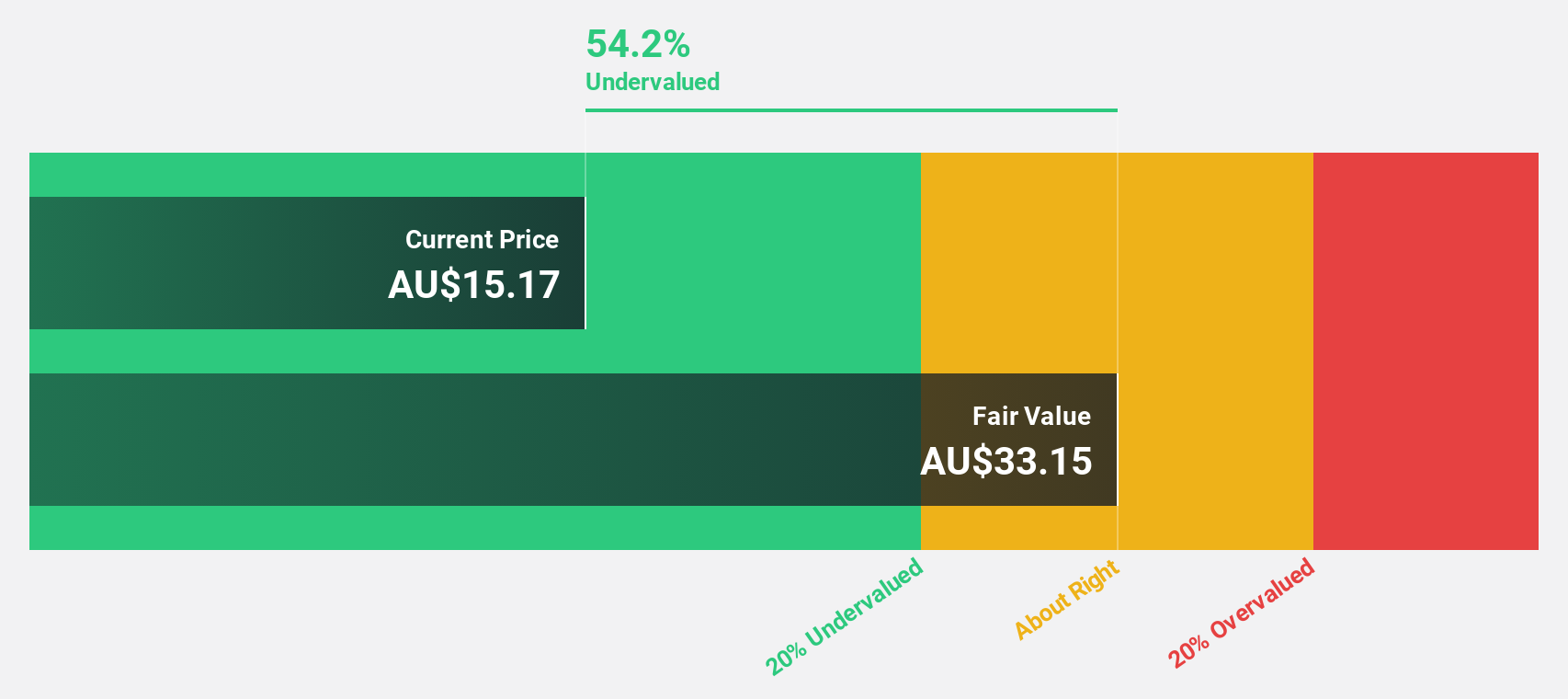

Estimated Discount To Fair Value: 49.7%

PEXA Group, trading at A$16.81, is considerably undervalued with a fair value estimate of A$33.42, presenting an opportunity based on cash flows. Despite a net loss increase to A$76.08 million for fiscal 2025, revenue grew to A$393.63 million from the previous year and is expected to outpace the Australian market at 11.5% annually. The company has completed a share buyback worth A$18.9 million and anticipates becoming profitable within three years, enhancing its investment appeal despite current challenges in profitability and management transitions.

- Insights from our recent growth report point to a promising forecast for PEXA Group's business outlook.

- Click to explore a detailed breakdown of our findings in PEXA Group's balance sheet health report.

Supply Network (ASX:SNL)

Overview: Supply Network Limited supplies aftermarket parts to the commercial vehicle market in Australia and New Zealand, with a market cap of A$1.49 billion.

Operations: The company generates revenue of A$349.46 million from providing aftermarket parts for the commercial vehicle sector in Australia and New Zealand.

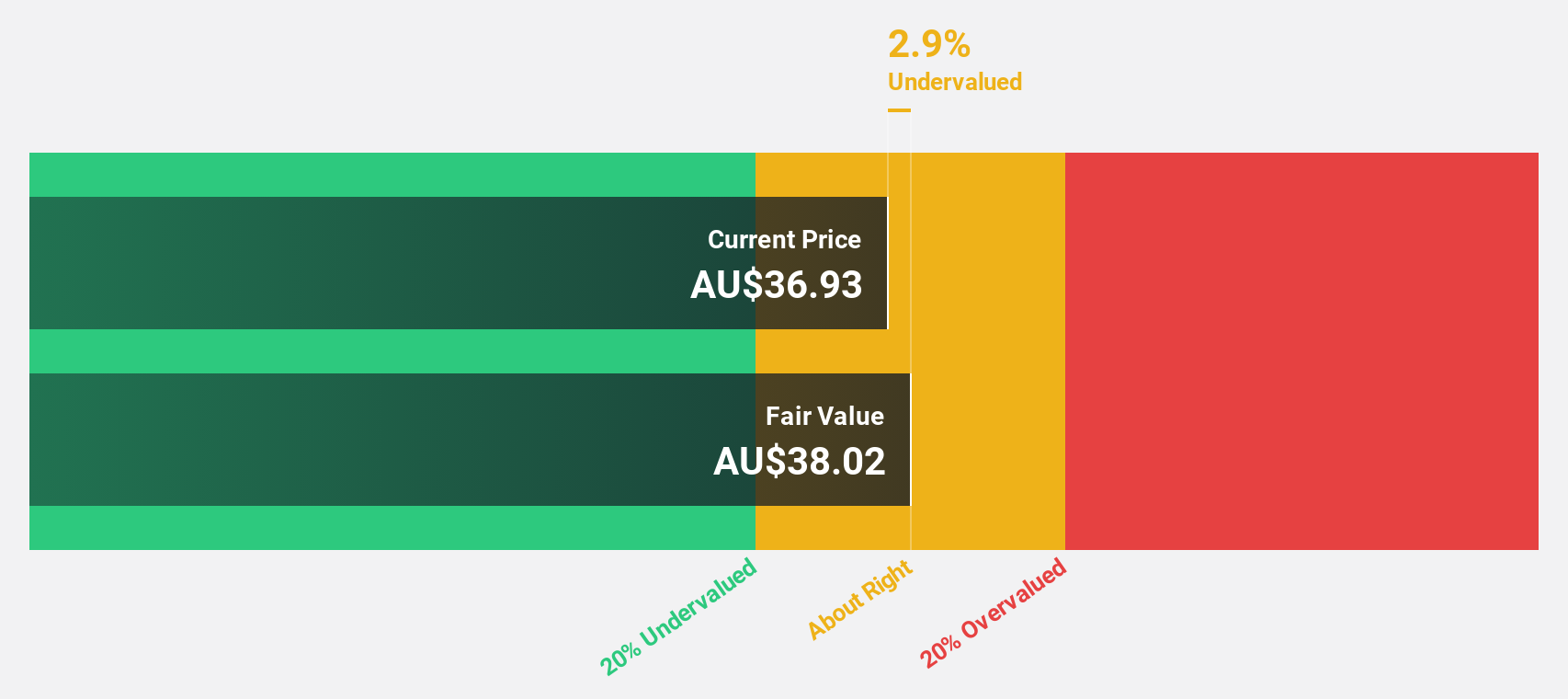

Estimated Discount To Fair Value: 10.3%

Supply Network Limited, trading at A$34.29, is slightly undervalued with a fair value estimate of A$38.22, supported by strong cash flow fundamentals. Recent earnings results show net income increased to A$40.02 million on sales of A$348.83 million for fiscal 2025. Earnings growth is forecasted at 14.3% annually, outpacing the Australian market's average and driven by robust revenue growth projections of 10.9% per year despite operational transitions ahead.

- Our earnings growth report unveils the potential for significant increases in Supply Network's future results.

- Navigate through the intricacies of Supply Network with our comprehensive financial health report here.

Taking Advantage

- Embark on your investment journey to our 34 Undervalued ASX Stocks Based On Cash Flows selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SNL

Supply Network

Provides aftermarket parts to the commercial vehicle market in Australia and New Zealand.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives