Investors push Mesoblast (ASX:MSB) 18% lower this week, company's increasing losses might be to blame

The Mesoblast Limited (ASX:MSB) share price is down a rather concerning 34% in the last month. But that doesn't change the fact that the returns over the last year have been spectacular. In fact, it is up 544% in that time. So it is not that surprising to see the stock retrace a little. Only time will tell if there is still too much optimism currently reflected in the share price. We love happy stories like this one. The company should be really proud of that performance!

Since the long term performance has been good but there's been a recent pullback of 18%, let's check if the fundamentals match the share price.

View our latest analysis for Mesoblast

Given that Mesoblast didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Mesoblast saw its revenue shrink by 24%. This is in stark contrast to the splendorous stock price, which has rocketed 544% since this time a year ago. It's pretty clear the market isn't basing its valuation on fundamental metrics like revenue. Typically, when we see this in a biotech stock, it's because investors are getting excited about an impending drug development milestone, such as clinical trial results. While this gain looks like speculative buying to us, sometimes speculation pays off.

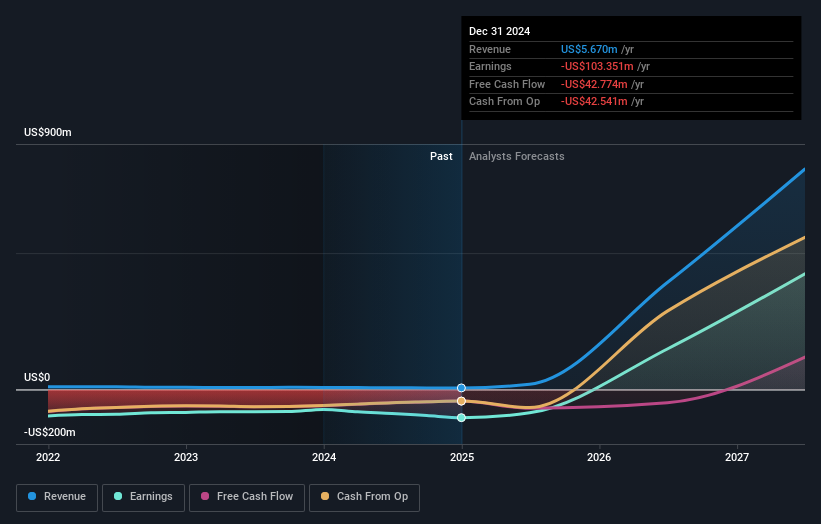

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. If you are thinking of buying or selling Mesoblast stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

It's nice to see that Mesoblast shareholders have received a total shareholder return of 544% over the last year. That gain is better than the annual TSR over five years, which is 11%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Mesoblast better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with Mesoblast (including 1 which is significant) .

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

If you're looking to trade Mesoblast, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:MSB

Mesoblast

Engages in the development of regenerative medicine products in Australia, the United States, Singapore, and Switzerland.

Exceptional growth potential and good value.