- Australia

- /

- Office REITs

- /

- ASX:CMW

3 ASX Growth Companies Insiders Are Investing In

Reviewed by Simply Wall St

Amidst the backdrop of a declining ASX200, which recently closed 0.67% lower at 8,150 points due to investor concerns over Middle Eastern conflicts, certain sectors like Energy have emerged as strong performers. In such volatile market conditions, growth companies with high insider ownership can be particularly appealing as they may indicate confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Catalyst Metals (ASX:CYL) | 17% | 54.5% |

| Genmin (ASX:GEN) | 12% | 117.7% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 71.5% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Pointerra (ASX:3DP) | 20.1% | 126.4% |

| Liontown Resources (ASX:LTR) | 14.7% | 49.8% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Let's review some notable picks from our screened stocks.

Cromwell Property Group (ASX:CMW)

Simply Wall St Growth Rating: ★★★★☆☆

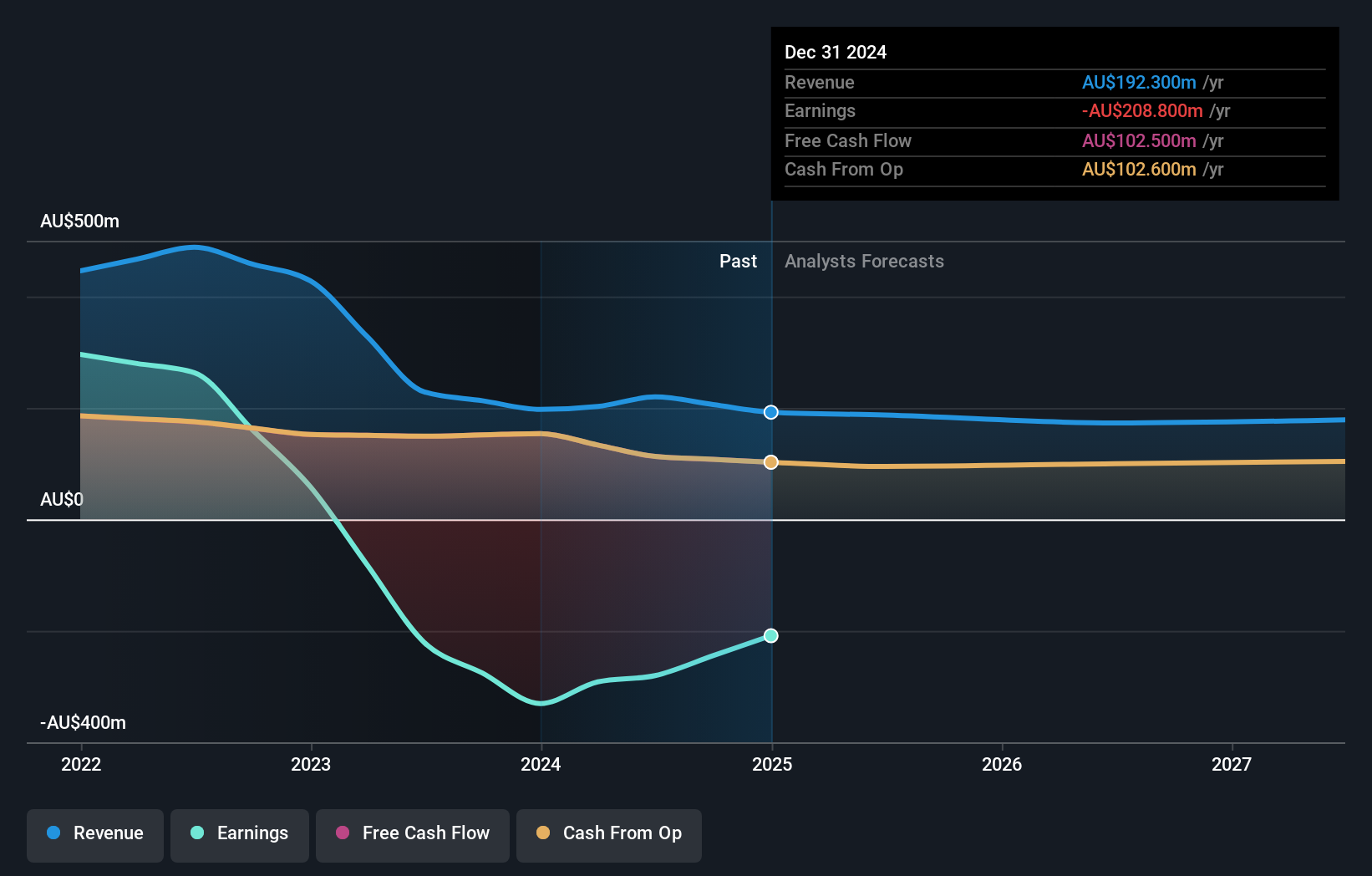

Overview: Cromwell Property Group (ASX:CMW) is a real estate investor and fund manager operating across three continents with a market capitalization of A$1.18 billion.

Operations: The company's revenue is derived from three main segments: Co-Investments (A$127.50 million), Investment Portfolio (A$194.30 million), and Funds and Asset Management (A$94.90 million).

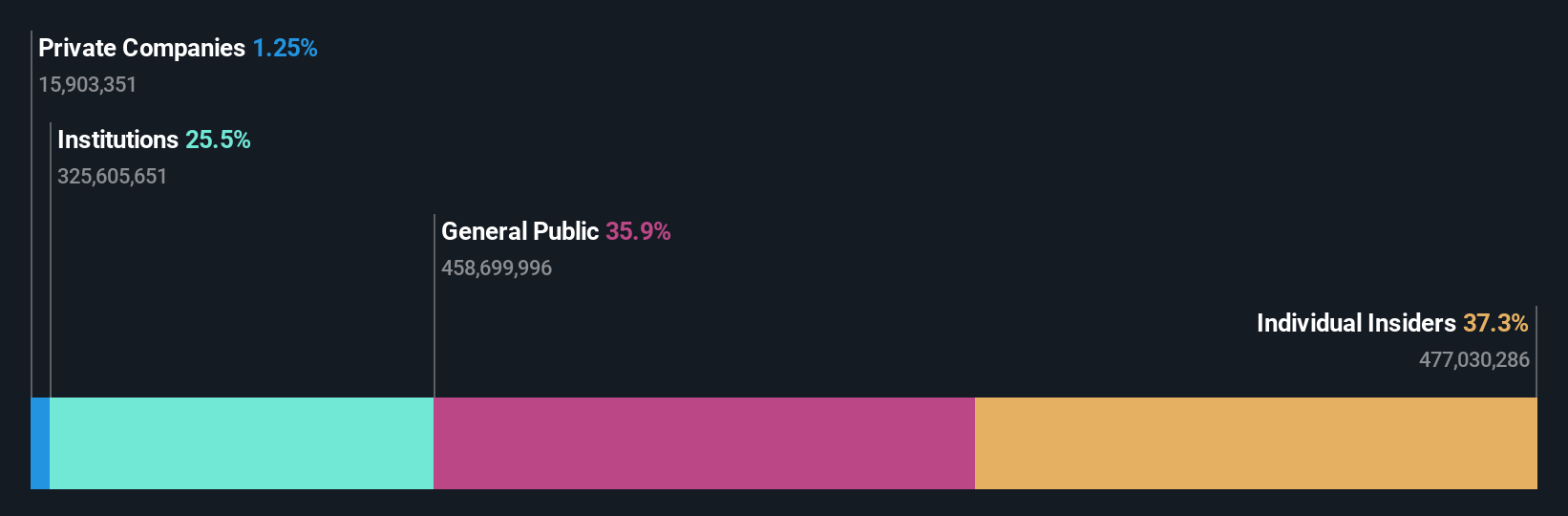

Insider Ownership: 13.9%

Earnings Growth Forecast: 45.9% p.a.

Cromwell Property Group faces challenges with a net loss of A$531.6 million for the year ending June 2024, yet it is forecasted to become profitable in three years, outpacing average market growth. Revenue is expected to grow at 6.3% annually, slightly above the Australian market rate. Despite a dividend yield of 6.67%, sustainability concerns arise due to insufficient earnings coverage. Insider trading activity over the past three months remains unclear, indicating stability in insider ownership behavior.

- Click here and access our complete growth analysis report to understand the dynamics of Cromwell Property Group.

- The analysis detailed in our Cromwell Property Group valuation report hints at an inflated share price compared to its estimated value.

Mesoblast (ASX:MSB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mesoblast Limited is a company focused on developing regenerative medicine products across Australia, the United States, Singapore, and Switzerland with a market cap of A$1.70 billion.

Operations: The company's revenue segment includes the development of a cell technology platform for commercialization, generating $5.90 million.

Insider Ownership: 22.2%

Earnings Growth Forecast: 60.8% p.a.

Mesoblast, with strong insider ownership and minimal recent insider selling, is positioned for significant growth. The company's earnings are forecasted to grow 60.82% annually, with revenue expected to increase by 45.8% per year, surpassing market averages. Despite a recent drop from the S&P/ASX Emerging Companies Index and a net loss of US$87.96 million for FY2024, Mesoblast's potential FDA approval for Ryoncil could enhance its growth trajectory in treating pediatric SR-aGVHD.

- Get an in-depth perspective on Mesoblast's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Mesoblast's current price could be quite moderate.

Qualitas (ASX:QAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Qualitas (ASX:QAL) is a real estate investment firm specializing in direct investments across various real estate classes and geographies, distressed debt acquisitions and restructuring, third-party capital raisings, and consulting services, with a market cap of A$749.45 million.

Operations: The company's revenue is derived from Direct Lending, which contributes A$26.79 million, and Funds Management, which adds A$13.61 million.

Insider Ownership: 27.2%

Earnings Growth Forecast: 22.4% p.a.

Qualitas has substantial insider ownership with recent significant insider buying, indicating confidence in its growth potential. The company reported a revenue increase to A$84.02 million and net income of A$26.18 million for FY2024, reflecting solid financial performance. Earnings are forecasted to grow at 22.4% annually, outpacing the broader Australian market's growth expectations. However, the return on equity is projected to remain low at 9.1%, and the dividend track record appears unstable despite recent increases.

- Take a closer look at Qualitas' potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Qualitas is trading beyond its estimated value.

Where To Now?

- Discover the full array of 98 Fast Growing ASX Companies With High Insider Ownership right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CMW

Cromwell Property Group

Cromwell Property Group (ASX:CMW) is a real estate investor and fund manager with operations on three continents and a global investor base.

Average dividend payer low.