As the Australian stock market closes on a positive note with a modest gain in the ASX 200, investors are digesting the Reserve Bank of Australia's recent minutes that highlight persistent inflation concerns. In this environment, growth companies with high insider ownership can be particularly appealing as they often signal strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Acrux (ASX:ACR) | 20.2% | 91.8% |

| AVA Risk Group (ASX:AVA) | 15.7% | 77.3% |

| IperionX (ASX:IPX) | 19% | 67% |

| Pointerra (ASX:3DP) | 20.8% | 126.4% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Change Financial (ASX:CCA) | 26.7% | 99.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Here we highlight a subset of our preferred stocks from the screener.

Accent Group (ASX:AX1)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Accent Group Limited operates in the retail, distribution, and franchise sectors for lifestyle footwear, apparel, and accessories across Australia and New Zealand with a market capitalization of A$1.36 billion.

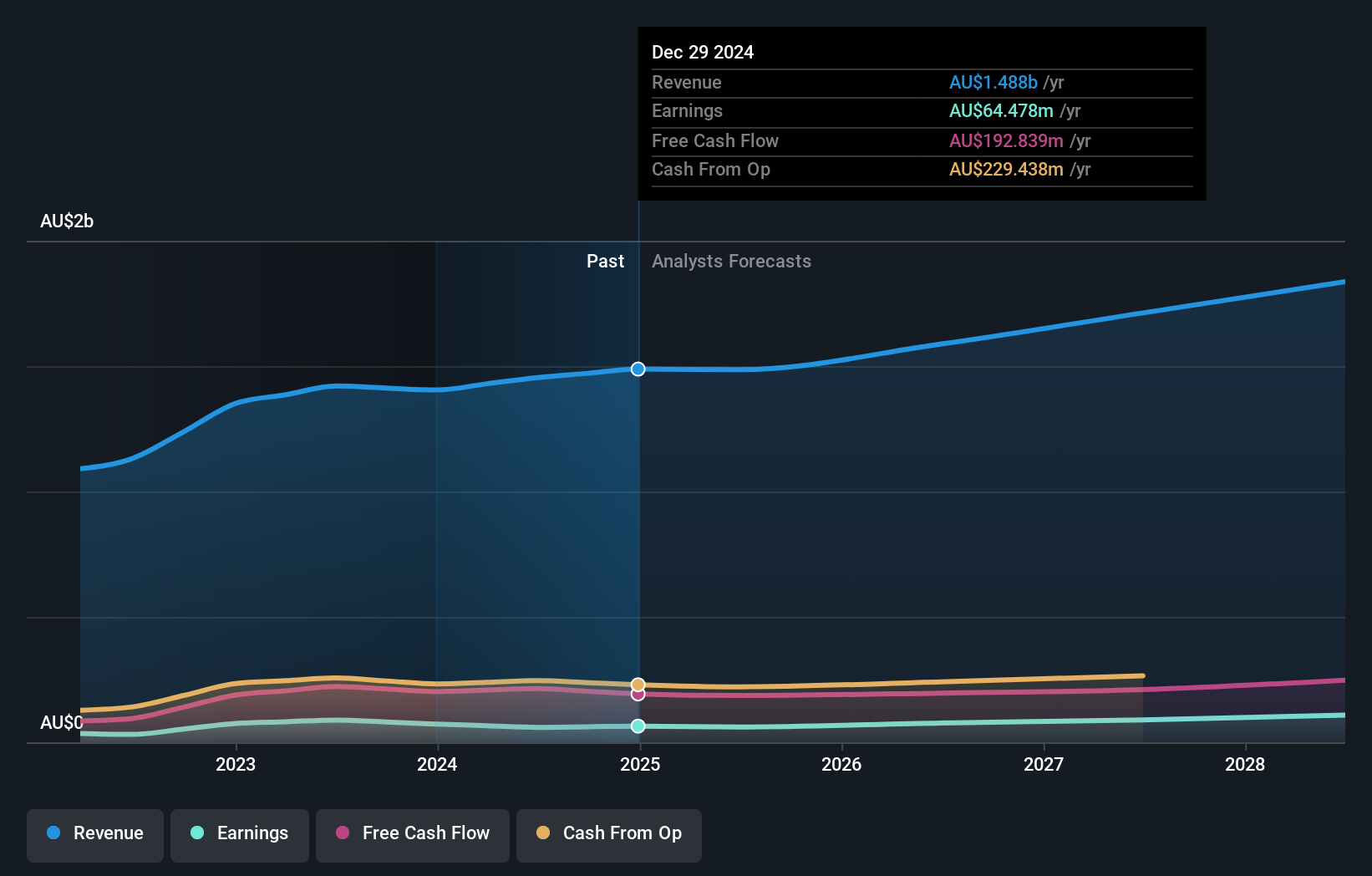

Operations: The company's revenue is primarily derived from its Retail segment, which generated A$1.27 billion, and its Wholesale segment, contributing A$463.20 million.

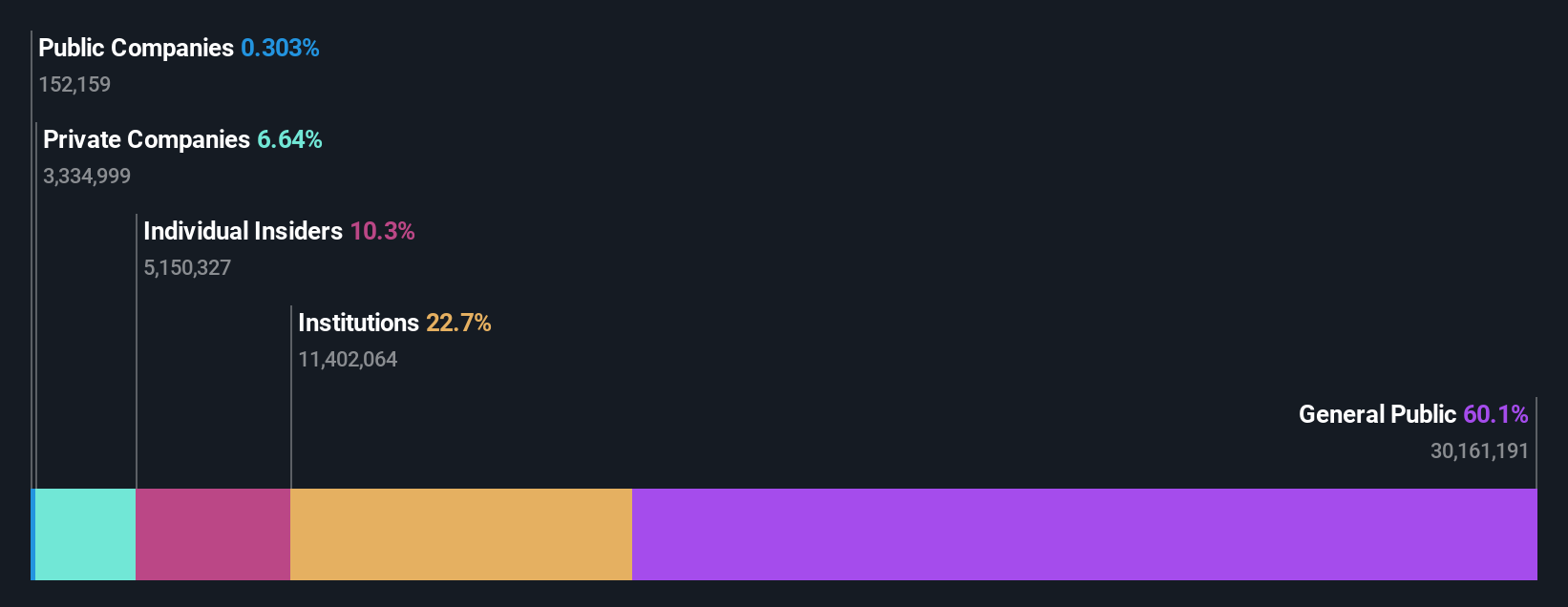

Insider Ownership: 14.8%

Earnings Growth Forecast: 13.7% p.a.

Accent Group shows potential as a growth company with high insider ownership. Its earnings are forecast to grow at 13.7% annually, outpacing the Australian market's growth rate of 12.5%. However, profit margins have declined from 6.2% to 4.1%. The stock is trading at a significant discount to its estimated fair value, suggesting potential undervaluation. Recent board appointments, including Dave Forsey as an Independent Non-Executive Director, may enhance strategic direction and expansion efforts.

- Delve into the full analysis future growth report here for a deeper understanding of Accent Group.

- In light of our recent valuation report, it seems possible that Accent Group is trading behind its estimated value.

Clinuvel Pharmaceuticals (ASX:CUV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Clinuvel Pharmaceuticals Limited is a biopharmaceutical company that develops and commercializes treatments for genetic, metabolic, systemic, and life-threatening disorders across Australia, Europe, the United States, Switzerland, and internationally with a market cap of A$606.85 million.

Operations: The company's revenue is primarily derived from its Biopharmaceutical Sector, amounting to A$88.18 million.

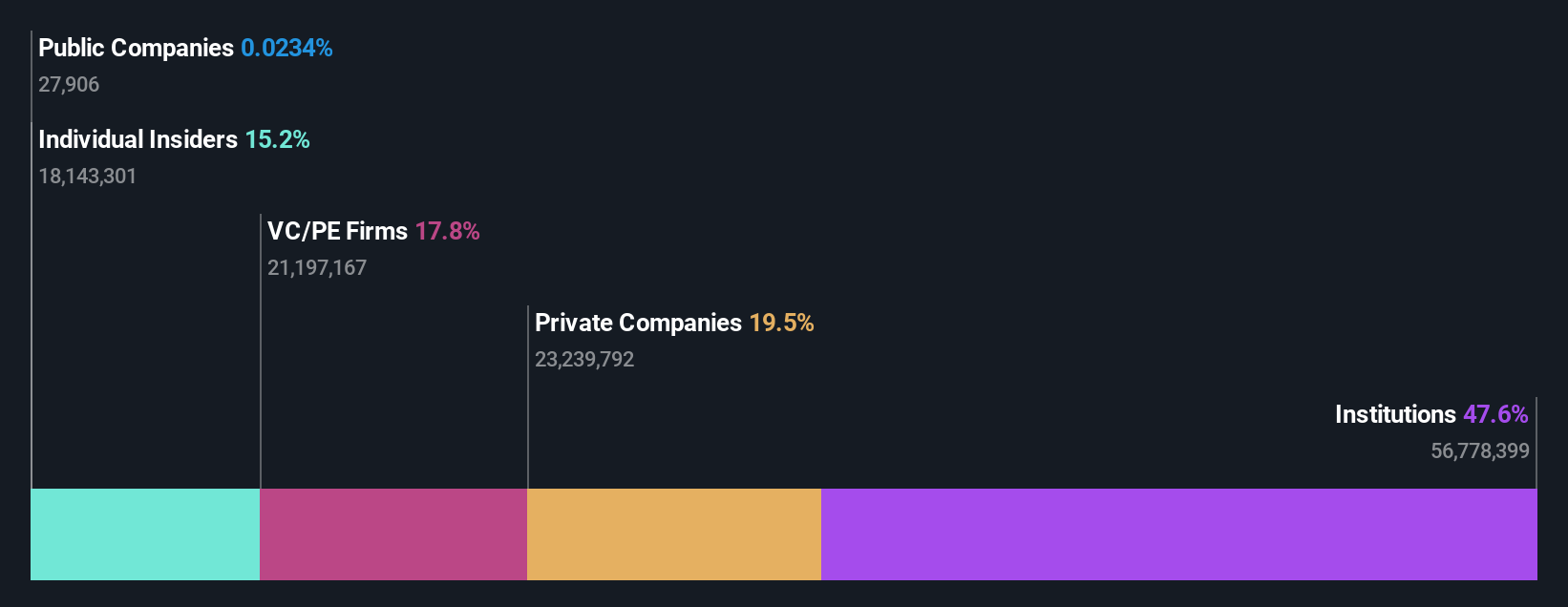

Insider Ownership: 10.4%

Earnings Growth Forecast: 26.2% p.a.

Clinuvel Pharmaceuticals demonstrates strong growth potential with its earnings forecast to grow significantly at 26.2% annually, surpassing the Australian market's average. The company is trading well below its estimated fair value, suggesting it may be undervalued. Recent developments include a New Drug Submission in Canada for SCENESSE®, targeting erythropoietic protoporphyria treatment, which could expand its market presence if approved. Clinuvel's focus on innovative therapies supports its growth trajectory and high-quality earnings profile.

- Click to explore a detailed breakdown of our findings in Clinuvel Pharmaceuticals' earnings growth report.

- The valuation report we've compiled suggests that Clinuvel Pharmaceuticals' current price could be quite moderate.

Guzman y Gomez (ASX:GYG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guzman y Gomez Limited owns, operates, and franchises quick service restaurants in Australia, Singapore, Japan, and the United States with a market cap of A$4.18 billion.

Operations: The company generates revenue from its quick service restaurant operations, amounting to A$364.99 million.

Insider Ownership: 12.8%

Earnings Growth Forecast: 46.3% p.a.

Guzman y Gomez is experiencing solid growth with a 31.9% revenue increase over the past year and earnings projected to grow 46.33% annually, outpacing the Australian market's average. Insider buying has surpassed selling in recent months, indicating confidence from within. The company was recently added to the S&P Global BMI Index, enhancing its visibility. Despite a forecasted low return on equity of 12%, Guzman y Gomez is expected to become profitable within three years.

- Click here and access our complete growth analysis report to understand the dynamics of Guzman y Gomez.

- The analysis detailed in our Guzman y Gomez valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Reveal the 95 hidden gems among our Fast Growing ASX Companies With High Insider Ownership screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CUV

Clinuvel Pharmaceuticals

A biopharmaceutical company, focuses on developing and commercializing treatments for patients with genetic, metabolic, systemic, and life-threatening disorders in Australia, Europe, the United States, Switzerland, and internationally.

Exceptional growth potential with flawless balance sheet.