Did CSL’s (ASX:CSL) Bet on VMX-C001 and FILSPARI’s Guideline Endorsement Just Shift Its Growth Story?

Reviewed by Sasha Jovanovic

- VarmX recently announced a strategic collaboration with CSL to advance the development of VMX-C001, a new treatment designed to rapidly restore blood coagulation in patients on FXa direct oral anticoagulants who require urgent surgery or experience severe bleeding; this deal includes CSL fully funding global late-stage trials and providing VarmX shareholders with an upfront payment of US$117 million for an exclusive option to acquire the company, with further milestone and sales-based payments totaling up to US$2.09 billion.

- FILSPARI® has also been newly recognized in the KDIGO 2025 clinical guidelines as the first-line therapy for IgA Nephropathy-induced nephron loss, underscoring the therapy’s role as the only Dual Endothelin Angiotensin Receptor Antagonist with proven benefit over existing standard treatment in pivotal trials, a major endorsement that could reshape clinical practice in kidney care.

- We'll consider how these developments, including the KDIGO guideline endorsement for FILSPARI®, influence CSL's investment narrative, outlook and perceived growth potential.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

CSL Investment Narrative Recap

For shareholders, believing in CSL means seeing enduring global demand for plasma and specialty biotechnology, robust innovation, and disciplined cost management as foundations for sustainable growth. The recent VarmX collaboration strengthens CSL’s late-stage pipeline, but its effect on near-term earnings likely hinges on timely new product uptake and cost-saving initiatives; persistent cost pressures in plasma collection remain a material risk that investors shouldn’t overlook.

The FDA approval of HEMGENIX earlier this year stands out as a relevant milestone, underscoring CSL’s strategic bet on advanced therapeutics to offset any delays or setbacks elsewhere in the pipeline and amplify future revenue streams.

However, investors should also be alert to cost headwinds in the core plasma business, as failure to achieve anticipated efficiency gains could...

Read the full narrative on CSL (it's free!)

CSL's narrative projects $18.1 billion revenue and $4.2 billion earnings by 2028. This requires 5.3% yearly revenue growth and a $1.2 billion earnings increase from $3.0 billion today.

Uncover how CSL's forecasts yield a A$284.79 fair value, a 47% upside to its current price.

Exploring Other Perspectives

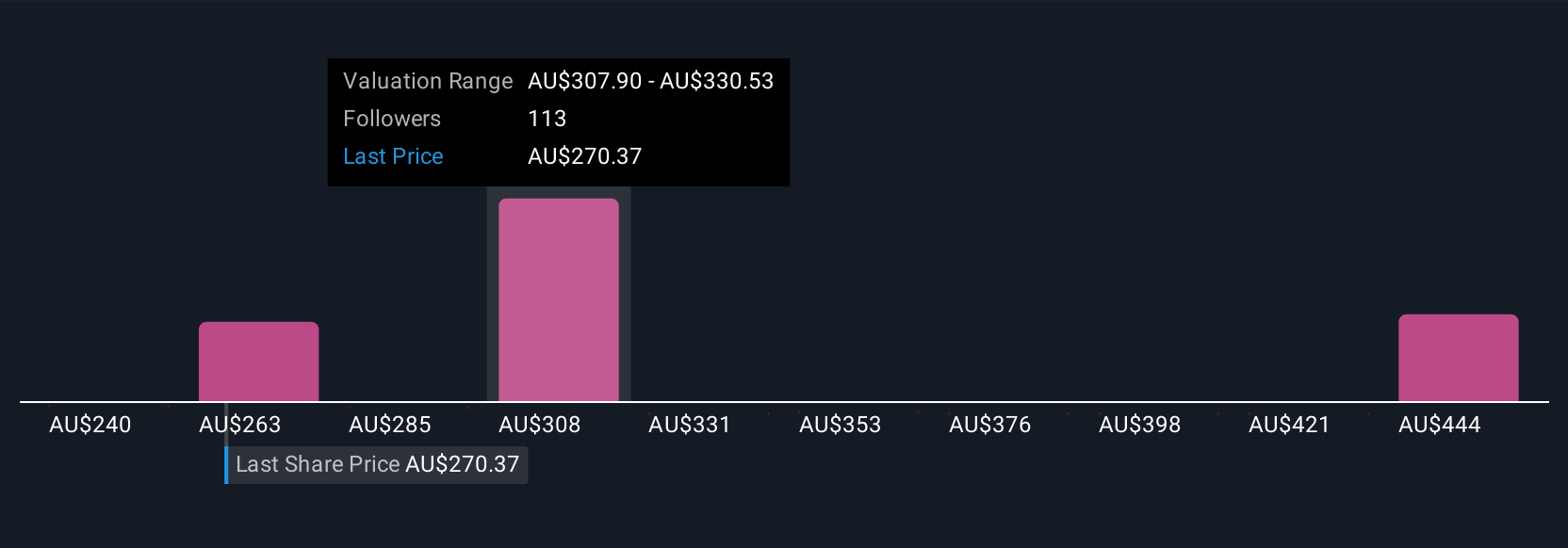

Twenty private investors in the Simply Wall St Community generate fair value estimates for CSL between A$239.81 and A$330.22. With cost pressures from plasma collection and efficiency gains far from guaranteed, take a closer look at alternative viewpoints.

Explore 20 other fair value estimates on CSL - why the stock might be worth just A$239.81!

Build Your Own CSL Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CSL research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free CSL research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CSL's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CSL

CSL

Engages in the research, development, manufacture, market, and distribution of biopharmaceutical products and vaccines in Australia, the United States, Germany, the United Kingdom, Switzerland, China, Hong Kong, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives