Last Update 03 Dec 25

Fair value Decreased 1.12%CSL: Shares Will Recover As Seqirus Headwinds Ease After Recent Pullback

Analysts have trimmed their price target on CSL slightly, from about A$230 to A$225, reflecting tempered expectations for Seqirus amid weaker U.S. vaccination trends and the indefinite deferral of the planned vaccine business demerger, even as they note that the recent share price correction has opened a more attractive entry point.

Analyst Commentary

Analyst views on CSL have turned more constructive following the share price pullback, even as earnings expectations have been nudged lower to reflect the softer outlook for Seqirus.

Bullish Takeaways

- Bullish analysts argue that the recent share price correction has overshot fundamentals, creating a more attractive entry point relative to long term growth prospects.

- The move to a Buy rating, despite a slightly reduced price target, is framed as a valuation call, with upside seen as earnings normalize and sentiment around Seqirus stabilizes.

- Long term growth in CSL’s core businesses, including plasma and broader specialty therapies, is viewed as intact, supporting a premium multiple once near term headwinds abate.

- The indefinite deferral of the vaccine demerger is now seen by some as largely priced in, which limits further downside from structural uncertainty.

Bearish Takeaways

- Bearish analysts highlight that weaker U.S. vaccination uptake at Seqirus is pressuring near term revenue and margin assumptions, which is used to justify the lower price target.

- The downgrade at the annual general meeting is viewed as a signal that execution risk around Seqirus is higher than previously expected, particularly if vaccination trends do not rebound.

- The decision to defer the vaccine demerger introduces strategic uncertainty, and some caution that it may constrain management’s ability to unlock value in the near term.

- With guidance reset lower, there is concern that further earnings downgrades could follow if macro or demand conditions deteriorate, which could limit multiple expansion in the short run.

What's in the News

- CSL lowered its financial year 2026 revenue growth guidance to 2% to 3%, down from 4% to 5%, citing softer performance expectations in the first half of the year (Corporate Guidance).

- CSL appointed Chief Strategy Officer Ken Lim as Chief Financial Officer effective 7 October 2025, with current CFO Joy Linton to support a transition period before retiring (Executive Changes).

- CSL entered a major strategic collaboration with VarmX to fund and support global Phase 3 development, manufacturing, and pre-launch activities for VMX-C001, and secured an exclusive option to acquire VarmX for up to approximately USD 2.2 billion in upfront, milestone, and sales-based payments (Strategic Alliances).

Valuation Changes

- Fair Value Estimate, eased slightly to A$244.20 from A$246.96, implying a modest reduction in long term intrinsic value assumptions.

- Discount Rate, edged up marginally to 6.99% from 6.96%, reflecting a small increase in the required return applied to future cash flows.

- Revenue Growth, ticked up fractionally to 4.22% from 4.21%, signaling a near unchanged but slightly more optimistic top line outlook.

- Net Profit Margin, dipped marginally to 21.62% from 21.64%, indicating a very small reduction in expected profitability over the forecast period.

- Future P/E, eased slightly to 25.0x from 25.0x previously, pointing to a near unchanged valuation multiple applied to forward earnings.

Key Takeaways

- Operational transformation and investment in innovation are expected to drive margin expansion, earnings growth, and faster introduction of high-value therapies.

- Market expansion, a focused business structure, and strong demand for plasma and specialty products support sustainable top-line growth and premium positioning.

- Revenue and margin growth are threatened by market competition, regulatory risks, high costs, slow new product uptake, and execution challenges from restructuring efforts.

Catalysts

About CSL- Engages in the research, development, manufacture, marketing and distribution of biopharmaceutical products and vaccines in Australia, the United States, Germany, the United Kingdom, Switzerland, China, Hong Kong, and internationally.

- CSL is undertaking significant operational transformation initiatives, targeting over $0.5 billion in cost savings by FY28, focusing on increased efficiency in plasma collection, manufacturing, and R&D, which should expand margins and support stronger net earnings growth as these benefits are realized.

- The company is leveraging advances in biotechnology-with a refreshed late-stage pipeline (including gene therapies and high-margin products like ANDEMBRY and HEMGENIX)-and plans to reinvest around half of cost savings into innovation and clinical development, potentially accelerating top-line revenue growth from new product launches benefiting from increased acceptance and effectiveness of biologic and precision therapies.

- CSL expects robust long-term demand in its core plasma and specialty franchises, supported by the rising prevalence of chronic diseases and global population aging, positioning the business for sustainable revenue growth as these demographic health trends continue to expand the addressable market.

- The demerger of Seqirus is expected to unlock simplification and focus for both resulting companies, enhancing capital allocation, speed of decision-making, and driving revenue and earnings growth through greater business agility and independent strategic execution.

- Ongoing geographic expansion and market development (e.g., growth in China and new market entry for products like FLUAD and Ferinject) are capitalizing on rising global healthcare spending and broadening access, which should underpin future revenue growth and further support the company's premium pricing power and margin trajectory.

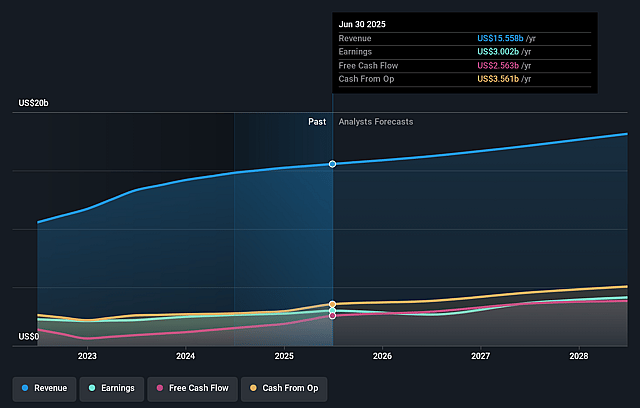

CSL Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CSL's revenue will grow by 5.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 19.3% today to 22.9% in 3 years time.

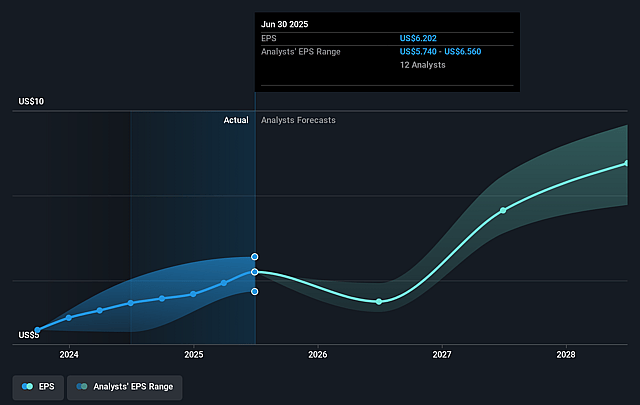

- Analysts expect earnings to reach $4.2 billion (and earnings per share of $8.67) by about September 2028, up from $3.0 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $4.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.2x on those 2028 earnings, up from 21.8x today. This future PE is greater than the current PE for the AU Biotechs industry at 21.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.57%, as per the Simply Wall St company report.

CSL Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying price competition and non-regrettable tender losses in key plasma and iron markets, alongside increased international generic activity, pose sustained risks to both top-line revenue growth and gross margins, particularly as the company deliberately chooses not to chase lower-margin contracts.

- Slower-than-expected uptake of new product launches (e.g., ANDEMBRY, HEMGENIX) and R&D pipeline setbacks, combined with discontinued or delayed clinical programs, could undermine both revenue acceleration and long-term earnings growth.

- Persistent cost pressures-particularly related to plasma collection (donor compensation, labor costs, fixed cost absorption from underperforming centers), combined with slower realization of planned cost reductions, threaten to compress net margins if not adequately offset by price or efficiency gains.

- Heightened regulatory and policy risks, such as the implementation of Medicare Part D reform, Most Favored Nation (MFN) pricing, or potential sector-specific tariffs, may restrict CSL's pricing power or directly reduce U.S. revenues and earnings.

- Demerger of Seqirus and ongoing organizational restructuring introduce significant execution risk, including one-off restructuring costs and long transition timelines for cost savings, which may constrain near-to-medium-term net profit and create uncertainty around future earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$284.792 for CSL based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$316.67, and the most bearish reporting a price target of just A$225.54.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $18.1 billion, earnings will come to $4.2 billion, and it would be trading on a PE ratio of 26.2x, assuming you use a discount rate of 6.6%.

- Given the current share price of A$206.62, the analyst price target of A$284.79 is 27.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.