ASX's August 2024 Top Stock Picks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

The Australian market has climbed 1.2% in the last 7 days and is up 9.8% over the last 12 months, with earnings forecast to grow by 13% annually. In this favorable environment, identifying undervalued stocks can provide significant opportunities for investors looking to capitalize on potential growth while minimizing risk.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LaserBond (ASX:LBL) | A$0.705 | A$1.36 | 48.2% |

| Fenix Resources (ASX:FEX) | A$0.43 | A$0.86 | 49.8% |

| Elders (ASX:ELD) | A$9.52 | A$18.11 | 47.4% |

| Shine Justice (ASX:SHJ) | A$0.695 | A$1.32 | 47.3% |

| Domino's Pizza Enterprises (ASX:DMP) | A$32.77 | A$63.47 | 48.4% |

| Orora (ASX:ORA) | A$2.04 | A$3.91 | 47.8% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| City Chic Collective (ASX:CCX) | A$0.105 | A$0.20 | 47.6% |

| SiteMinder (ASX:SDR) | A$5.60 | A$10.44 | 46.4% |

| Sandfire Resources (ASX:SFR) | A$8.70 | A$16.53 | 47.4% |

Here's a peek at a few of the choices from the screener.

Goodman Group (ASX:GMG)

Overview: Goodman Group is an integrated property group with global operations across Australia, New Zealand, Asia, Europe, the United Kingdom and the Americas, boasting a market cap of A$69.21 billion.

Operations: The company's revenue segments span Australia (A$1.23 billion), New Zealand (A$0.45 billion), Asia (A$0.98 billion), Europe (A$1.67 billion), the United Kingdom (A$0.76 billion) and the Americas (A$2.34 billion).

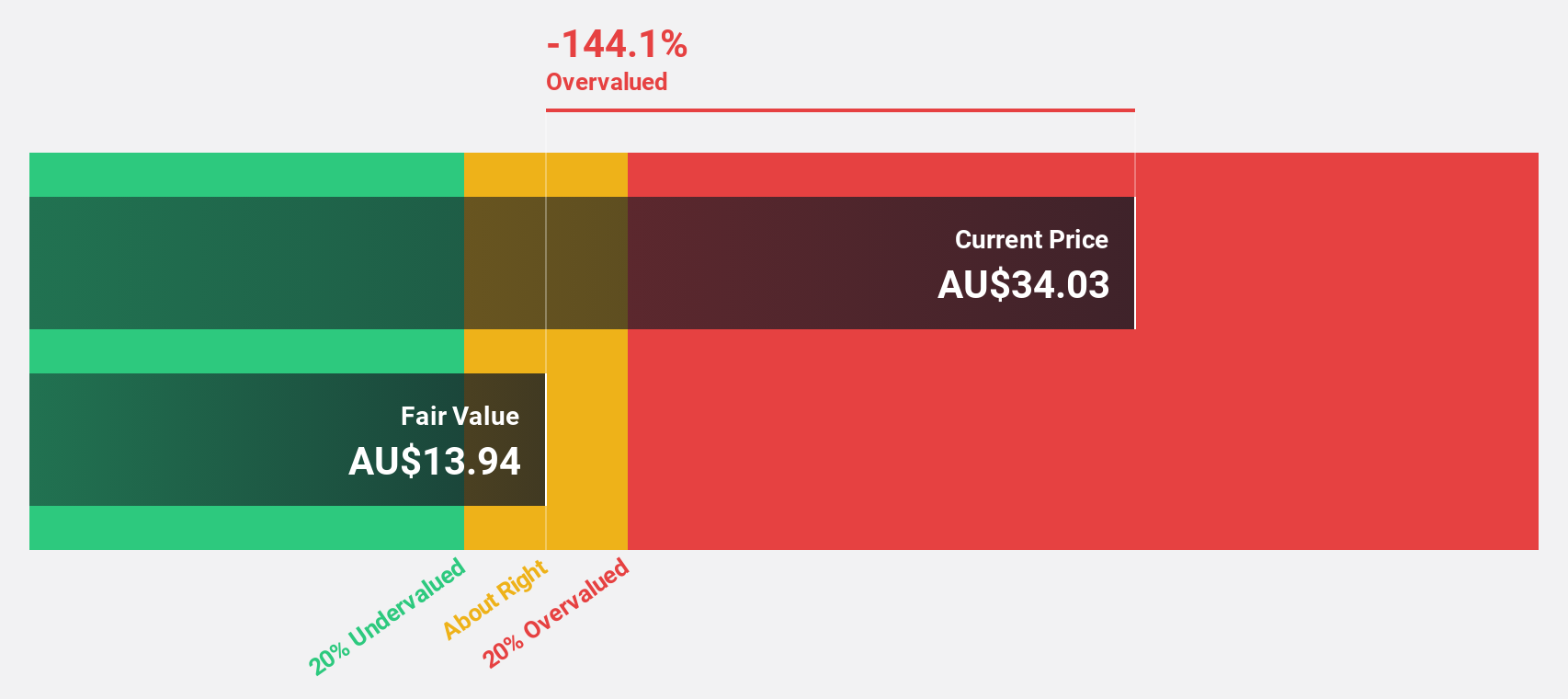

Estimated Discount To Fair Value: 10%

Goodman Group (A$36.44) is trading below its fair value estimate of A$40.5, making it an undervalued stock based on cash flows. Earnings are forecast to grow 28.57% annually over the next three years, outpacing both revenue growth (20.5%) and the broader Australian market's earnings growth (13.2%). Despite lower profit margins this year, Goodman upgraded its fiscal 2024 earnings guidance with a projected EPS growth of 13% and a full-year distribution of A$0.30 per share.

- Our growth report here indicates Goodman Group may be poised for an improving outlook.

- Click here to discover the nuances of Goodman Group with our detailed financial health report.

Lynas Rare Earths (ASX:LYC)

Overview: Lynas Rare Earths Limited, with a market cap of A$5.87 billion, engages in the exploration, development, mining, extraction, and processing of rare earth minerals in Australia and Malaysia.

Operations: Revenue from rare earth operations amounted to A$604.08 million.

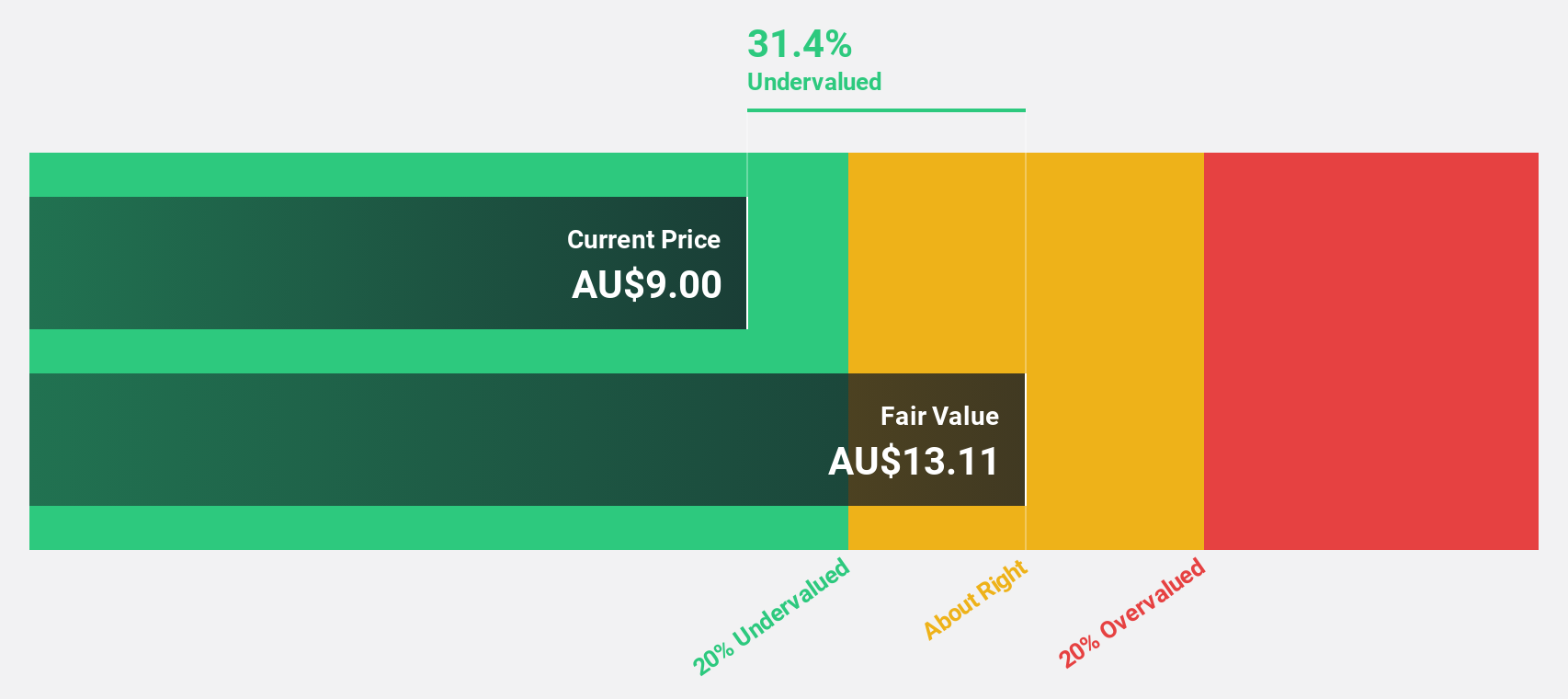

Estimated Discount To Fair Value: 34.5%

Lynas Rare Earths (A$6.28) is trading significantly below its fair value estimate of A$9.58, presenting an undervalued opportunity based on cash flows. Earnings are forecast to grow 33.2% annually over the next three years, outpacing both revenue growth (28.8%) and the broader Australian market's earnings growth (13.2%). However, profit margins have declined from 54.8% to 33.1%, and Return on Equity is expected to remain low at 14.4%.

- The growth report we've compiled suggests that Lynas Rare Earths' future prospects could be on the up.

- Navigate through the intricacies of Lynas Rare Earths with our comprehensive financial health report here.

SEEK (ASX:SEK)

Overview: SEEK Limited, with a market cap of A$8.03 billion, provides online employment marketplace services across Australia, South East Asia, Brazil, New Zealand, Mexico, the United Kingdom, Europe and internationally.

Operations: Revenue Segments (in millions of A$): SEEK's revenue is derived from Employment Marketplaces - ANZ (A$827.80 million), Employment Marketplaces - OCC (A$42.20 million), Employment Marketplaces - SEEK Asia (A$248.80 million), Employment Marketplaces - Brasil Online (A$32.10 million), and Employment Marketplaces - Platform Support (A$44.50 million).

Estimated Discount To Fair Value: 10.8%

SEEK Limited (A$22.55) is trading below its fair value estimate of A$25.29, indicating it may be undervalued based on cash flows. Despite a high debt level and declining profit margins from 20.3% to 8.6%, earnings are forecast to grow significantly at 22.18% annually over the next three years, outpacing the Australian market's growth rate of 13.2%. Recent executive changes and structural reorganization aim to enhance operational efficiency and AI integration starting July 2024.

- Our expertly prepared growth report on SEEK implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of SEEK here with our thorough financial health report.

Seize The Opportunity

- Dive into all 37 of the Undervalued ASX Stocks Based On Cash Flows we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SEK

SEEK

Engages in the provision of online employment marketplace services in Australia, South East Asia, New Zealand, the United Kingdom, Europe, and internationally.

Reasonable growth potential with adequate balance sheet.