- Australia

- /

- Construction

- /

- ASX:SND

3 Penny Stocks On The ASX With Market Caps Up To A$300M

Reviewed by Simply Wall St

As the Australian market eases into 2025, the ASX 200 is set to open slightly higher, reflecting a cautious optimism following Wall Street's recent rally. Amidst these broader market movements, investors often seek opportunities in lesser-known sectors where smaller companies can offer unique growth potential. Penny stocks, although sometimes seen as a niche investment area, continue to capture interest with their potential for value and growth when backed by solid financial fundamentals. In this context, we will explore three penny stocks on the ASX that stand out for their financial strength and promise of long-term success.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.575 | A$67.4M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.54 | A$334.88M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.88 | A$238.78M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$218.54M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.945 | A$109.06M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.13 | A$346.8M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.905 | A$105.38M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.91 | A$484.45M | ★★★★☆☆ |

| IVE Group (ASX:IGL) | A$2.10 | A$325.27M | ★★★★☆☆ |

Click here to see the full list of 1,051 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

OM Holdings (ASX:OMH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: OM Holdings Limited is an investment holding company involved in the mining, smelting, trading, and marketing of manganese ores and ferroalloys globally, with a market cap of A$282.80 million.

Operations: The company generates revenue primarily from its Smelting segment, which accounts for $441.70 million, and its Marketing and Trading segment, contributing $631.02 million.

Market Cap: A$282.8M

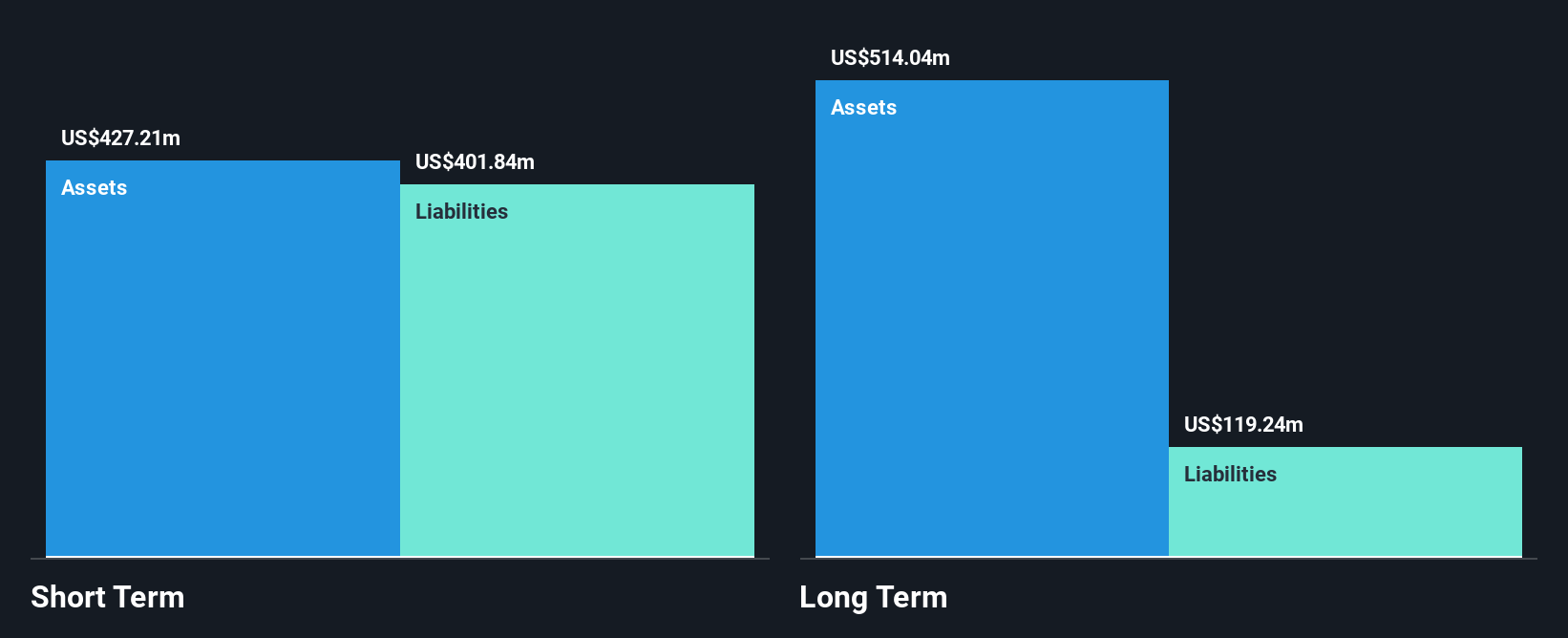

OM Holdings Limited, with a market cap of A$282.80 million, faces challenges as its current net profit margin of 2% has decreased from 5.3% last year, and earnings growth was negative at -68.8%. Despite these setbacks, the company's debt is well covered by operating cash flow (48.4%), and short-term assets ($424.2M) surpass both short- and long-term liabilities. The board is experienced with an average tenure of 14.8 years, though Return on Equity remains low at 2.8%. Recent updates include stable production guidance for FY2024 and significant sales in Ferrosilicon and Manganese Alloys.

- Unlock comprehensive insights into our analysis of OM Holdings stock in this financial health report.

- Assess OM Holdings' future earnings estimates with our detailed growth reports.

Saunders International (ASX:SND)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Saunders International Limited, with a market cap of A$118.82 million, offers design, construction, fabrication, shutdown, maintenance and industrial automation services for steel storage tanks and concrete bridges in Australia and the Pacific Region.

Operations: The company's revenue is derived from its Steel Storage Tanks, Concrete Bridges, and Structural Mechanical Piping segment, which generated A$216.08 million.

Market Cap: A$118.82M

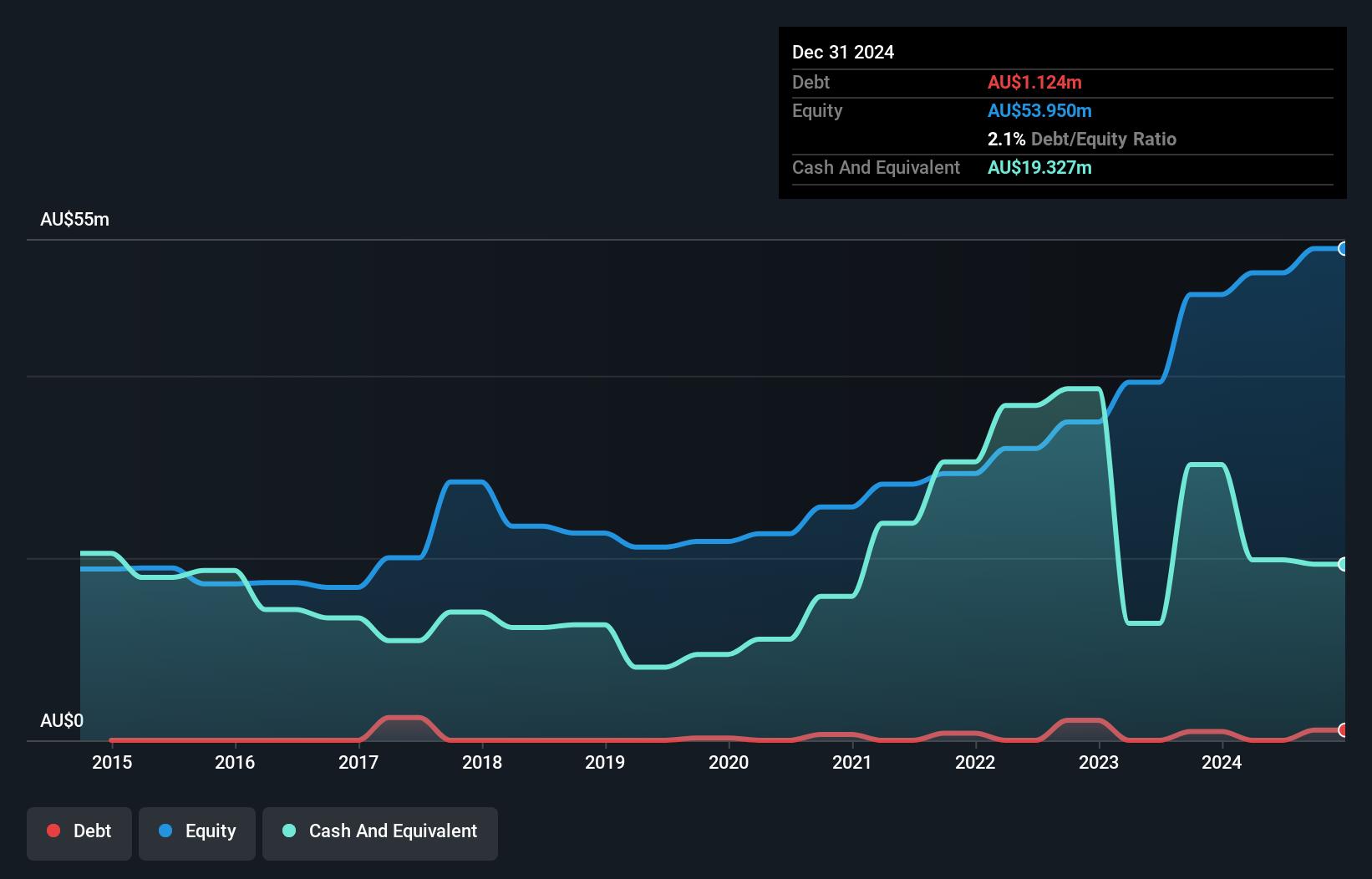

Saunders International Limited, with a market cap of A$118.82 million, operates debt-free and maintains strong liquidity, as its short-term assets (A$66.9M) exceed both short- (A$50.9M) and long-term liabilities (A$11.1M). Despite trading at 63.8% below fair value estimates, the company faces challenges with negative earnings growth (-1.3%) over the past year compared to industry averages and a slight decline in net profit margins from 4.7% to 4.3%. While it has achieved profitability over five years with high-quality earnings, recent significant insider selling raises concerns about future prospects.

- Navigate through the intricacies of Saunders International with our comprehensive balance sheet health report here.

- Understand Saunders International's track record by examining our performance history report.

Zeotech (ASX:ZEO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zeotech Limited focuses on the exploration and evaluation of mineral properties in Australia, with a market cap of A$92.69 million.

Operations: The company's revenue segment is primarily derived from exploration activities, amounting to A$0.78 million.

Market Cap: A$92.69M

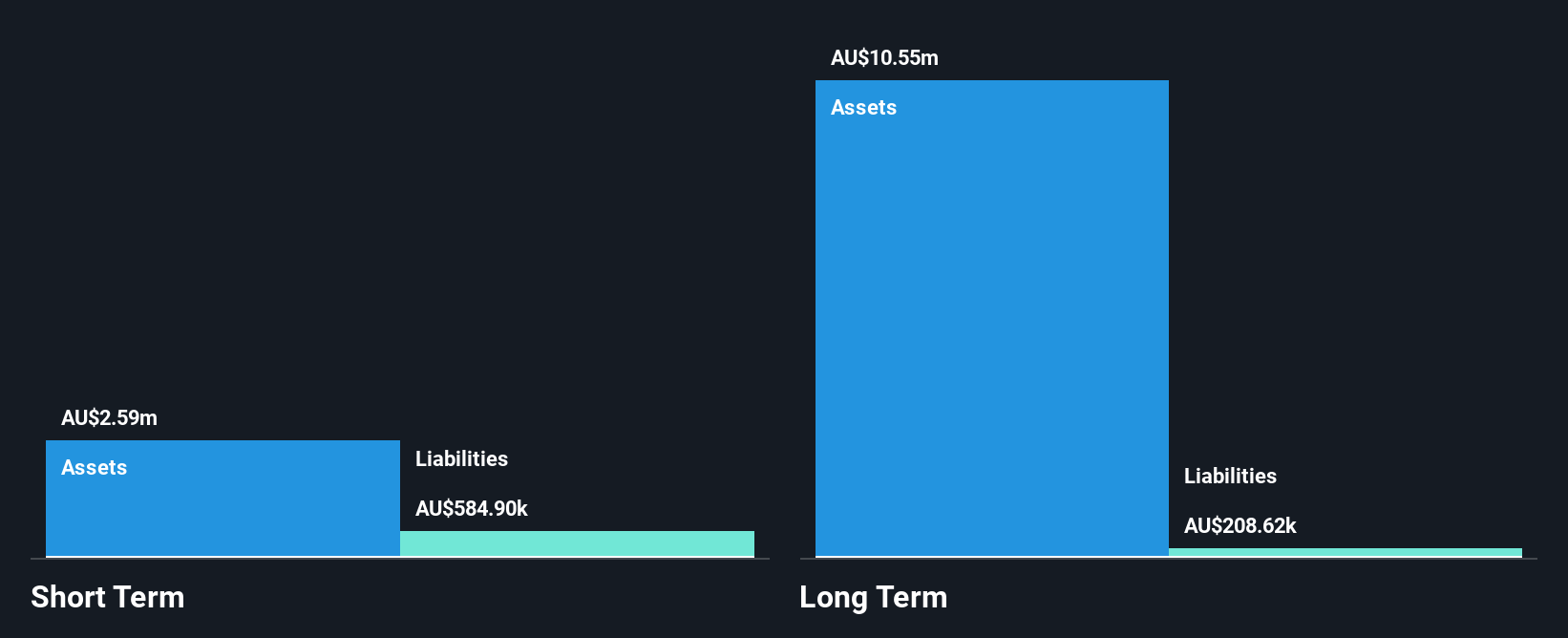

Zeotech Limited, with a market cap of A$92.69 million, remains pre-revenue, generating only A$0.78 million from exploration activities. The company operates debt-free and its short-term assets (A$2.3M) cover both short- (A$1.1M) and long-term liabilities (A$248.2K). Despite a stable weekly volatility of 12%, the share price is highly volatile over three months, challenging investor confidence alongside shareholder dilution due to a recent equity offering of A$1.82 million at AUD 0.03 per share. The management team is relatively new with an average tenure of one year, potentially impacting strategic continuity.

- Click to explore a detailed breakdown of our findings in Zeotech's financial health report.

- Examine Zeotech's past performance report to understand how it has performed in prior years.

Next Steps

- Reveal the 1,051 hidden gems among our ASX Penny Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SND

Saunders International

Provides design, construction, fabrication, shutdown, maintenance, and industrial automation services to organizations of steel storage tanks and concrete bridges in Australia and the Pacific Region.

Flawless balance sheet and fair value.

Market Insights

Community Narratives