The Australian market has been navigating a complex landscape, influenced by global trade tensions and fluctuating commodity prices. Amidst these conditions, investors are increasingly looking for opportunities that balance affordability with growth potential. Penny stocks, often seen as remnants of past market eras, continue to attract attention due to their unique position in offering both risk and reward. In this context, we explore three penny stocks that stand out for their financial strength and potential to uncover hidden value in the current economic climate.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.575 | A$67.4M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.49 | A$303.87M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.88 | A$103.99M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.54 | A$106.04M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.935 | A$315.05M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$3.00 | A$248.73M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.19 | A$339.21M | ★★★★☆☆ |

| Vita Life Sciences (ASX:VLS) | A$1.825 | A$101.54M | ★★★★★★ |

| Nickel Industries (ASX:NIC) | A$0.735 | A$3.15B | ★★★★★☆ |

Click here to see the full list of 1,032 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

IVE Group (ASX:IGL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: IVE Group Limited operates in the marketing sector in Australia with a market capitalization of A$339.21 million.

Operations: The company generates revenue from its advertising segment, which amounts to A$972.82 million.

Market Cap: A$339.21M

IVE Group Limited, with a market capitalization of A$339.21 million, operates in Australia's marketing sector and has shown significant earnings growth of 61% over the past year, surpassing industry averages. Despite its high debt levels, with a net debt to equity ratio considered high at 64.2%, the company maintains good coverage of interest payments through EBIT and operating cash flow covers its debt well. However, its dividend yield of 8.22% is not fully supported by earnings. Recent board changes aim to enhance governance structures as Paul Selig transitions from Executive Director to Non-Executive Director.

- Navigate through the intricacies of IVE Group with our comprehensive balance sheet health report here.

- Assess IVE Group's future earnings estimates with our detailed growth reports.

Ramelius Resources (ASX:RMS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ramelius Resources Limited is involved in the exploration, evaluation, mine development and operation, production, and sale of gold with a market cap of A$2.91 billion.

Operations: The company's revenue is primarily generated from its operations at Edna May, contributing A$399.34 million, and Mt Magnet, which accounts for A$483.23 million.

Market Cap: A$2.91B

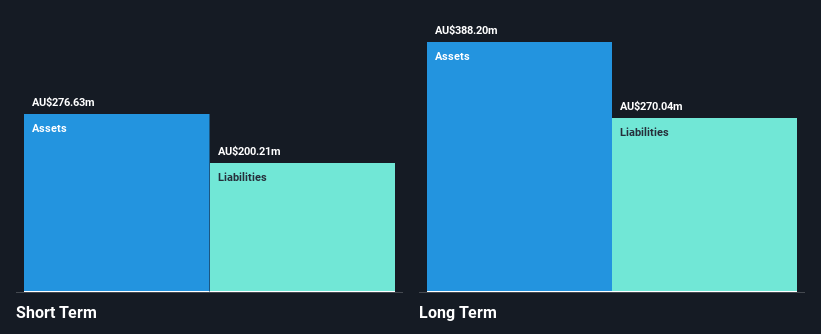

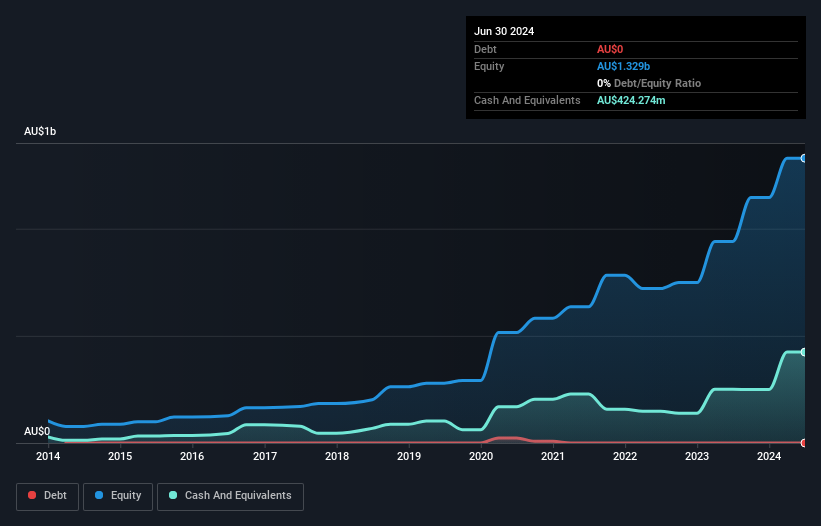

Ramelius Resources, with a market cap of A$2.91 billion, has demonstrated strong financial health and operational performance. Its short-term assets of A$547.2 million comfortably cover both short-term and long-term liabilities, indicating robust liquidity. The company is debt-free, eliminating concerns about interest coverage or cash flow constraints related to debt servicing. Recent earnings growth of 251.8% significantly outpaces its five-year average and the broader Metals and Mining industry growth rate, reflecting high-quality earnings despite a forecasted decline in future earnings by 6.6% annually over the next three years. Speculation surrounds potential strategic acquisitions like Carosue Dam Operations from Northern Star Resources to bolster its Rebecca-Roe project portfolio.

- Click here and access our complete financial health analysis report to understand the dynamics of Ramelius Resources.

- Learn about Ramelius Resources' future growth trajectory here.

Zeotech (ASX:ZEO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zeotech Limited is involved in the exploration and evaluation of mineral properties in Australia, with a market cap of A$96.39 million.

Operations: The company's revenue segment is derived entirely from exploration, amounting to A$0.78 million.

Market Cap: A$96.39M

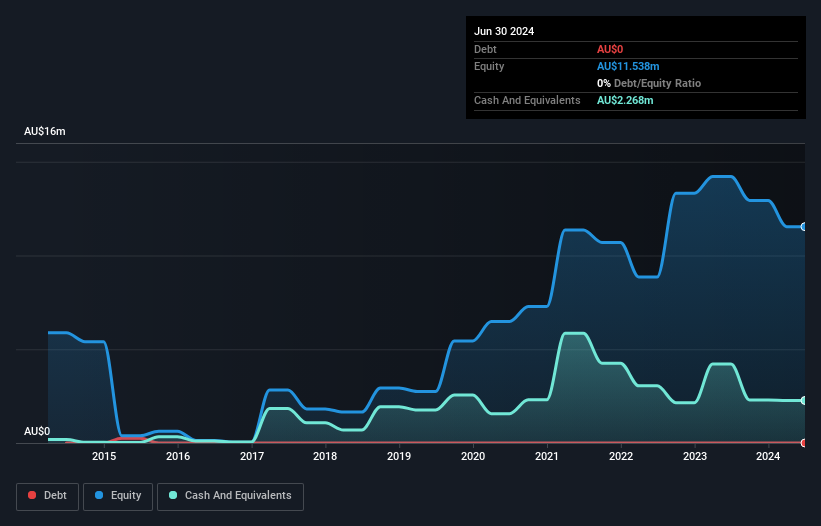

Zeotech Limited, with a market cap of A$96.39 million, is pre-revenue, generating less than US$1 million from its exploration activities. The company's short-term assets of A$2.3 million exceed both its short-term and long-term liabilities, indicating a stable financial position despite being unprofitable with a negative return on equity of -47.92%. Zeotech's stock has experienced high volatility recently, and while the company is debt-free and shareholders haven't faced dilution over the past year, it faces challenges in extending its cash runway beyond 8-10 months without additional capital infusion. Recent participation in the Noosa Mining Conference highlights ongoing investor engagement efforts.

- Get an in-depth perspective on Zeotech's performance by reading our balance sheet health report here.

- Gain insights into Zeotech's past trends and performance with our report on the company's historical track record.

Key Takeaways

- Jump into our full catalog of 1,032 ASX Penny Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IGL

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives