- Australia

- /

- Metals and Mining

- /

- ASX:WGX

Is Now the Right Time to Consider Westgold Resources After Its 78% Price Surge in 2025?

Reviewed by Bailey Pemberton

If you are trying to figure out what to do with Westgold Resources stock right now, you are definitely not alone. There is a lot to unpack with this name, especially after such a dramatic run-up in the past year. Just look at these numbers: the share price is up a staggering 77.9% year-to-date, and over the last three years it has soared an eye-watering 545.4%. Even in the past month, it has gained 22.1%, despite losing 8.1% in the last week as traders lock in profits and markets digest some big moves.

So what has been sparking all this action? Much of the momentum can be traced back to Westgold Resources’ recent developments in the gold sector, particularly moves to streamline its operations and improve mining efficiencies. While nothing headline-shaking has broken in the past week, ongoing optimism surrounding gold prices and strategic improvements at the company have helped reframe investor expectations and risk perceptions. This renewed confidence is clear in the stock’s longer-term rally, even if it is encountering the occasional bump such as last week’s dip.

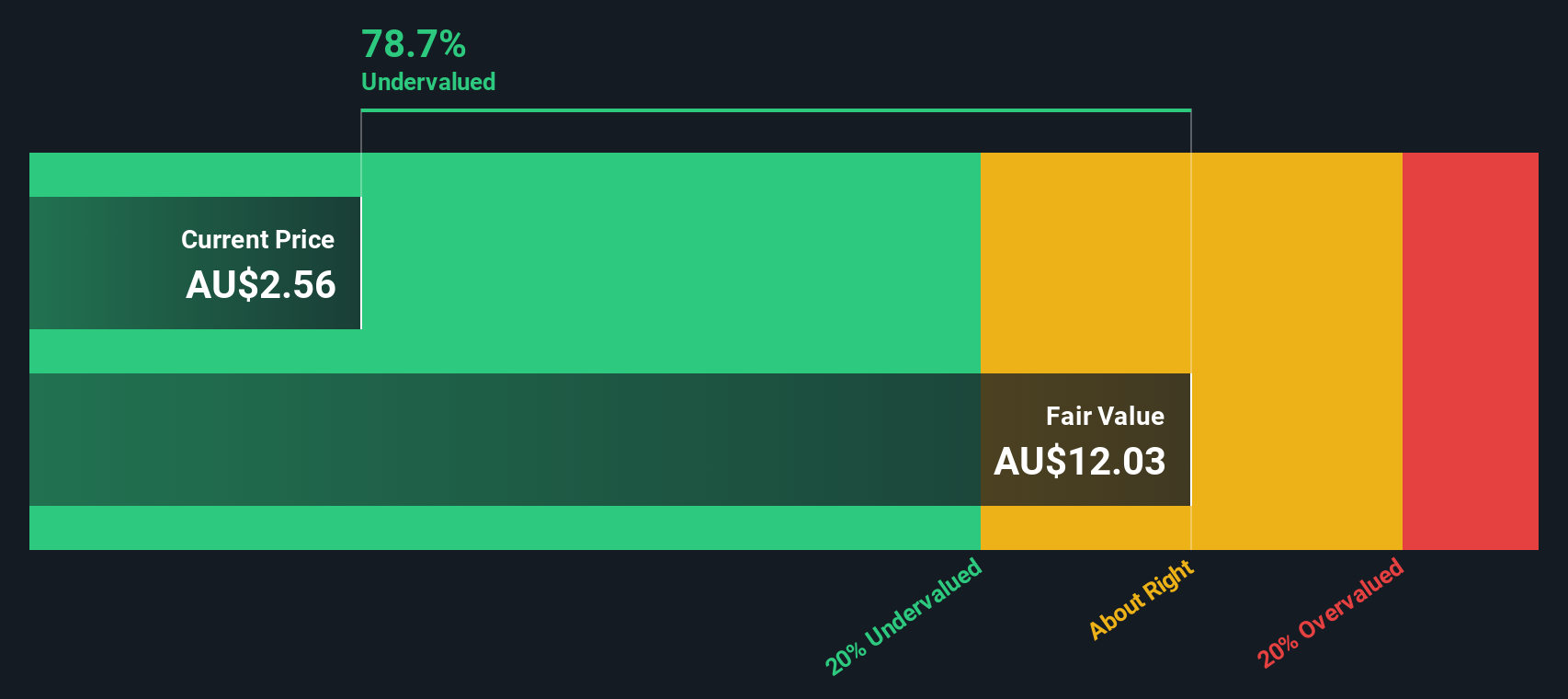

For investors focused on good value, it is worth noting that Westgold Resources clocks in with a valuation score of 3 out of 6. In other words, by several key metrics, the company still appears undervalued, but it does not pass every test. If you are weighing whether the current price is a good entry point or if it has run too far, understanding this valuation score is going to be crucial.

Let us break down exactly how this valuation picture comes together using different approaches. Later, I will share one perspective many overlook that can offer an even deeper view of whether Westgold Resources is truly undervalued.

Approach 1: Westgold Resources Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model looks at Westgold Resources by forecasting its future cash flows and discounting them back to today. This provides an estimate of the present value of the business. In practice, this involves closely examining how much cash the company can generate, both now and in the years ahead, while accounting for the value of money over time.

Currently, Westgold Resources posted a last twelve months free cash flow (FCF) of negative A$4.4 million, reflecting recent operational challenges. Analyst estimates suggest the company’s FCF could increase meaningfully, reaching A$532.5 million in 2026 and peaking at A$993.5 million by 2028. By 2030, projections show FCF moderating to A$633 million. While analyst coverage only extends five years, the latter numbers are careful extrapolations intended to provide a more complete long-term view.

Based on these projections, the DCF model arrives at an intrinsic value of A$13.08 per share. With Westgold Resources trading at a 60.7% discount to this figure, this indicates that the stock appears strongly undervalued on a cash flow basis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Westgold Resources is undervalued by 60.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Westgold Resources Price vs Earnings

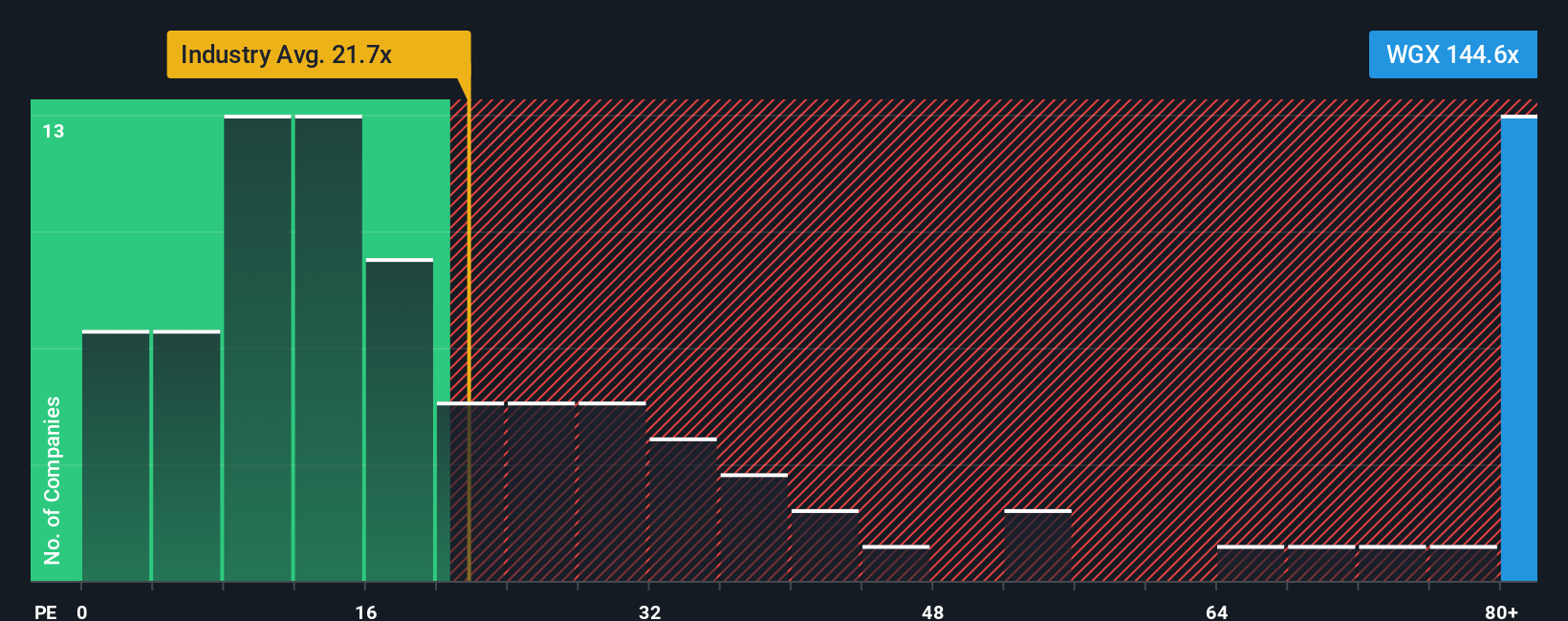

The price-to-earnings (PE) ratio is a go-to valuation tool when analyzing profitable companies because it highlights the price investors are willing to pay for each dollar of earnings. This makes it one of the simplest ways to see whether a company's stock price fairly reflects its current and future profit potential.

Growth prospects and risk play major roles in setting what is considered a "normal" or "fair" PE ratio. If a company is expected to grow quickly or is perceived as less risky, a higher PE multiple can be justified. On the other hand, slower growth or greater uncertainty generally calls for a lower ratio.

Currently, Westgold Resources trades at a PE ratio of 139.7x. This stands significantly above the metals and mining industry average of 21.9x and the average of its peers at 26.4x. At first glance, this might raise eyebrows, but context matters. Simply Wall St's Fair Ratio, calculated at 44.5x, takes a broader perspective by factoring in elements like the company’s specific growth outlook, profit margin, its position in the industry, and market capitalization. This Fair Ratio offers a more meaningful benchmark than simply looking at the industry or peers because it adapts to the unique characteristics of Westgold Resources.

With the company's actual PE ratio much higher than the Fair Ratio, this analysis suggests that Westgold Resources is currently overvalued based on its earnings multiple.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

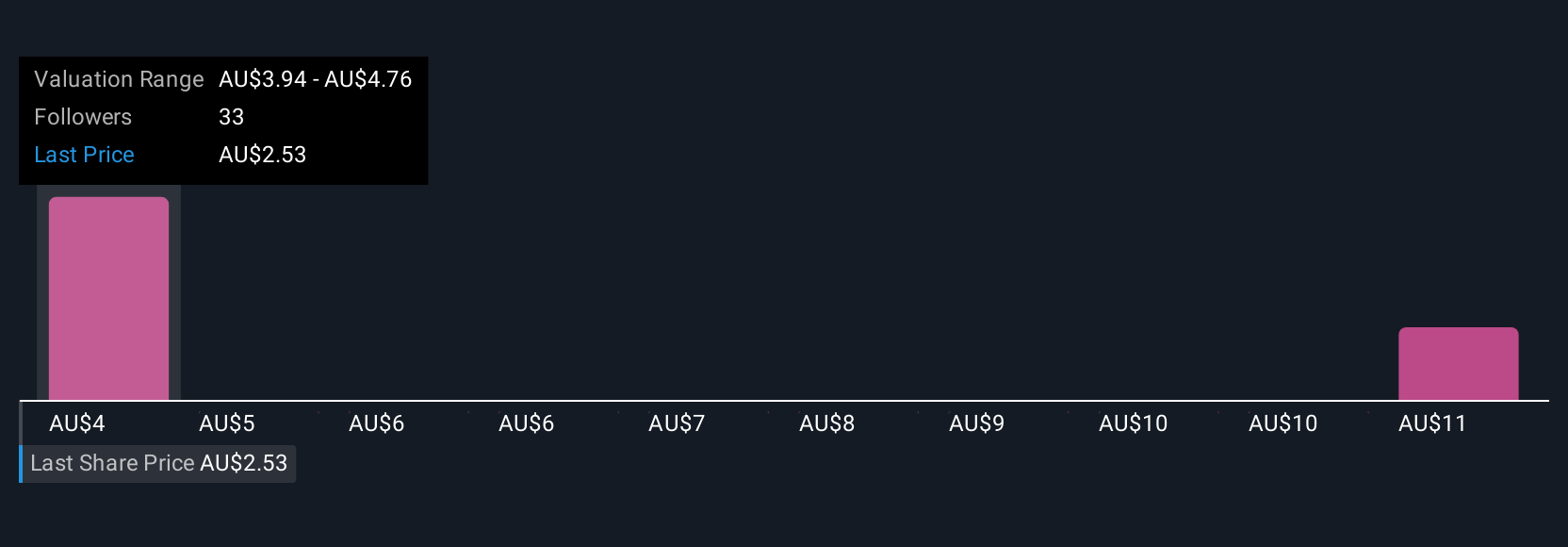

Upgrade Your Decision Making: Choose your Westgold Resources Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your unique investment story for a company; it is how you connect the facts and future expectations with your own view about Westgold Resources’ prospects, putting your assumptions about things like future revenue, profit margins and fair value into a personalized forecast. Narratives help make investing more intuitive, allowing you to translate what you believe will happen for a company into clear numbers and compare your Fair Value directly to the current market price. This feature is available to everyone on Simply Wall St’s Community page, where millions of investors regularly share and debate their perspectives, and these Narratives update automatically as new information like results or news is released, keeping your analysis relevant. For example, one investor might create a Narrative for Westgold Resources where rapid operational upgrades and strong gold prices justify a high fair value of A$6.51. Another may be more cautious, highlighting risks from rising costs or integration and settling on a lower value of A$3.76. With Narratives, you can see and test both sides before making your own call.

Do you think there's more to the story for Westgold Resources? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Westgold Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WGX

Westgold Resources

Engages in the exploration, development, and operation of gold mines in Western Australia.

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)