- Australia

- /

- Metals and Mining

- /

- ASX:WAF

West African Resources (ASX:WAF) Valuation in Focus After Burkina Faso Seeks Larger Stake in Kiaka Gold Mine

Reviewed by Simply Wall St

West African Resources (ASX:WAF) has been thrust into the spotlight after the Burkina Faso government made a move to acquire an additional 35% stake in its flagship Kiaka gold mine. This request, part of a broader nationalization push in the region, was significant enough to trigger a trading halt as the miner reassesses its position and options. For investors, the situation is more than just regional politics; it is about risk, ownership, and the entire growth equation for one of the ASX’s key gold producers.

This development comes on the back of some strong headline numbers for West African Resources during the first half of 2025, with both revenue and net income growing sharply and earnings per share doubling year-over-year. Yet the market’s momentum has started to shift, with gains of 9% over the past three months following a remarkable 113% jump over the year. The interplay between strong fundamentals and rising sovereign risk creates a very different investment backdrop compared to previous years of steady expansion.

The immediate question facing shareholders, after this year’s significant run and the current volatility, is whether all this risk and future growth is already priced into the stock or if uncertainty is opening up a unique buying window.

Most Popular Narrative: 23% Undervalued

According to community narrative, West African Resources appears significantly undervalued. The analysts’ consensus price target is notably higher than the current market price.

The successful commissioning and ramp-up of the Kiaka Gold Project, with first gold poured ahead of schedule and under budget, positions West African Resources for a material production increase in 2025 and beyond. This is expected to boost revenue and deliver significant operating leverage as fixed costs are absorbed over higher output. Unhedged exposure to record-high gold prices, combined with persistent global economic uncertainty and heightened demand for gold as a safe-haven asset, is likely to sustain strong realized sales revenues and robust operating cash flows.

What powers this bullish narrative? Behind the headline valuation is a roadmap full of strategic moves, surprising growth forecasts, and bold financial assumptions. Which numbers could make or break this undervaluation story? Explore the full narrative to uncover the specific projections that analysts are considering for West African Resources’ future.

Result: Fair Value of $3.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if grid power at Kiaka is delayed or there is a spike in operating costs, upbeat forecasts could quickly be dampened and West African Resources’ outlook may be reshaped.

Find out about the key risks to this West African Resources narrative.Another View: Discounted Cash Flow Insight

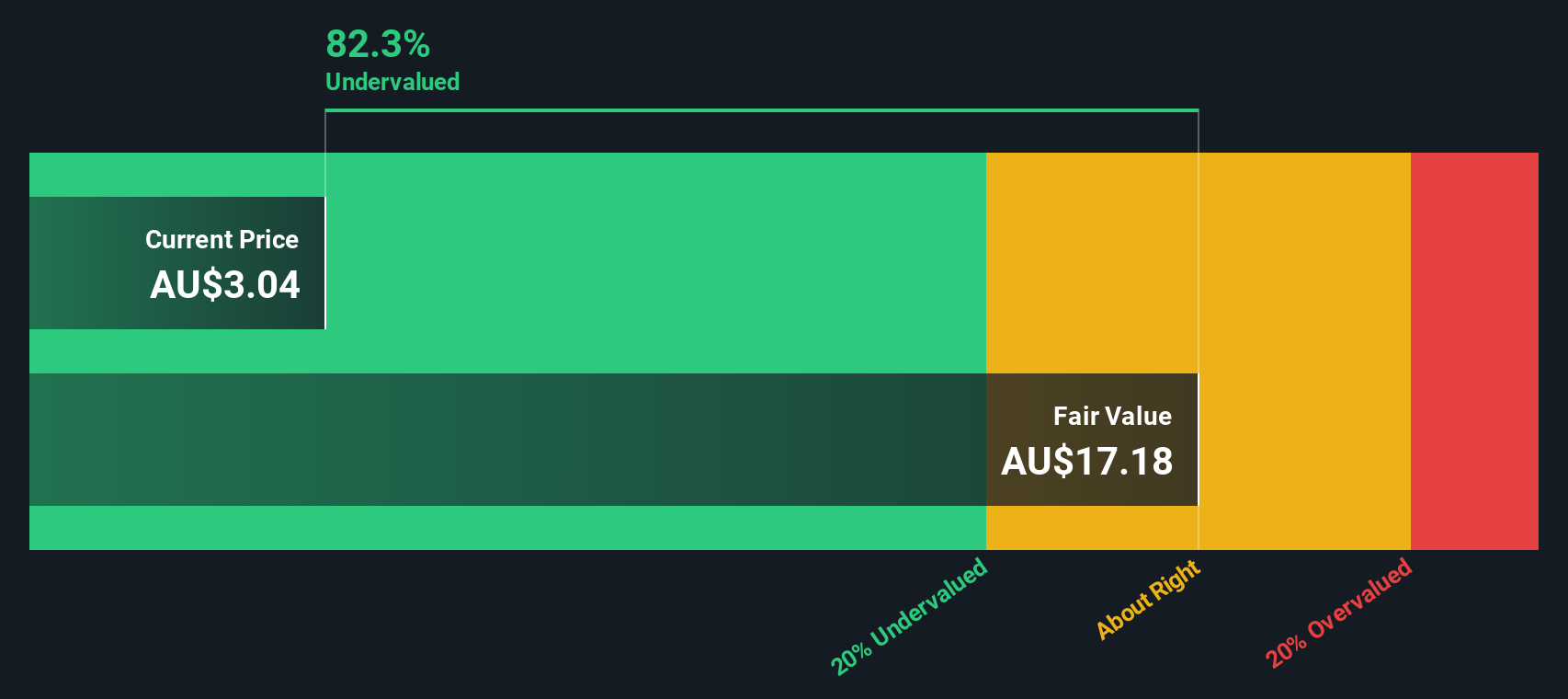

Looking from a different angle, our DCF model tells a story of deeper undervaluation. This approach focuses on projected future cash flows and presents a second argument that complicates the straightforward narrative from analyst targets. Could both really be right?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out West African Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own West African Resources Narrative

If you have your own perspective or want to challenge the consensus, you can analyze the numbers yourself and shape your own outlook in just a few minutes. Do it your way

A great starting point for your West African Resources research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Winning Investment Angles?

Broaden your portfolio by targeting stocks with fresh momentum and untapped potential. Don’t wait for the next opportunity to slip away. Make the most of market shifts by using these powerful tools:

- Jumpstart your search for underappreciated gems with undervalued stocks based on cash flows that could be flying under the radar right now.

- Boost your income potential by tapping into dividend stocks with yields > 3%, featuring companies offering robust yields greater than 3%.

- Spot the future leaders in healthcare technology when you uncover the latest breakthroughs through healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if West African Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ASX:WAF

West African Resources

Engages in the mining, mineral processing, acquisition, exploration, and project development of gold projects in West Africa.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives