- Australia

- /

- Metals and Mining

- /

- ASX:WAF

West African Resources (ASX:WAF) Eyes Expansion Opportunities Amid Strong Earnings and Market Growth

Reviewed by Simply Wall St

West African Resources (ASX:WAF) continues to capture attention with its recent strategic advancements in gold production and exploration across Burkina Faso. The company has made headlines with its latest development, the Sanbrado Gold Project, which is set to significantly boost production capacity and enhance operational efficiency. In the following report, we explore key areas such as financial performance, strategic initiatives, and potential challenges that could impact West African Resources' growth trajectory.

Unlock comprehensive insights into our analysis of West African Resources stock here.

Unique Capabilities Enhancing Valmont Industries's Market Position

Valmont Industries has demonstrated impressive earnings growth, with a 9.4% annual increase over the past five years. This growth rate significantly outpaces the construction industry average of 26.6%, highlighting the company's strong performance. The company's net profit margin has improved to 7.4% from 3.7% last year, indicating enhanced operational efficiency. Furthermore, Valmont's dividend payments have been stable and well-covered by earnings, with a low payout ratio of 16.2%. This financial health, coupled with reliable dividend increases over the past decade, underscores the company's financial position. Additionally, Valmont is currently trading at 30.5% below its estimated fair value, suggesting potential undervaluation in the market, which could attract investors looking for growth opportunities.

Strategic Gaps That Could Affect Valmont Industries

However, the company faces certain challenges that could impact its future performance. Valmont's return on equity, at 19.3%, is slightly below the desired threshold of 20%, indicating room for improvement in generating shareholder value. The company's revenue growth is projected at 3.1% per year, which is slower than the US market's forecast of 9.1%. This could limit its competitive edge in a rapidly growing market. Additionally, Valmont's net debt to equity ratio of 44.2% is considered high, potentially posing financial risks if not managed effectively. These factors highlight areas where strategic adjustments may be necessary to align with industry standards.

Areas for Expansion and Innovation for Valmont Industries

Despite these challenges, Valmont has significant opportunities for expansion and innovation. The company's earnings are forecasted to grow at 9.03% annually, presenting a promising outlook for future profitability. This growth potential is further enhanced by Valmont's trading position, which is below its fair value estimate, suggesting room for price appreciation. By capitalizing on these opportunities, Valmont can strengthen its market position and drive long-term growth. The company's proactive approach to resource expansion and exploration initiatives could also extend its operational capabilities and market reach.

Regulatory Challenges Facing Valmont Industries

Valmont must navigate several external threats that could impact its operations. Significant insider selling in the past three months raises concerns about potential internal challenges or shifts in company strategy. Moreover, the company's high level of debt could pose financial risks, especially if market conditions become unfavorable. These factors, combined with the need to manage regulatory and geopolitical uncertainties, require careful strategic planning to ensure sustained growth and stability. Addressing these threats effectively will be crucial for Valmont to maintain its competitive edge and capitalize on its strengths.

To gain deeper insights into West African Resources's historical performance, explore our detailed analysis of past performance. To learn about how West African Resources's valuation metrics are shaping its market position, check out our detailed analysis of West African Resources's Valuation. See what the latest analyst reports say about West African Resources's future prospects and potential market movements. Explore the current health of West African Resources and how it reflects on its financial stability and growth potential.Conclusion

Valmont Industries has shown a strong financial performance, with impressive earnings growth and improved profit margins, which positions it well for future growth. Some challenges such as a slightly lower return on equity and high debt levels exist, but the company's strategic focus on expansion and innovation provides a promising outlook. The current market price, being 30.5% below its estimated fair value, indicates that there may be significant potential for price appreciation, making it an attractive option for investors seeking growth opportunities. By addressing its strategic gaps and managing external threats effectively, Valmont can enhance its shareholder value and maintain its competitive edge in the industry.

Turning Ideas Into Actions

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

```Valuation is complex, but we're here to simplify it.

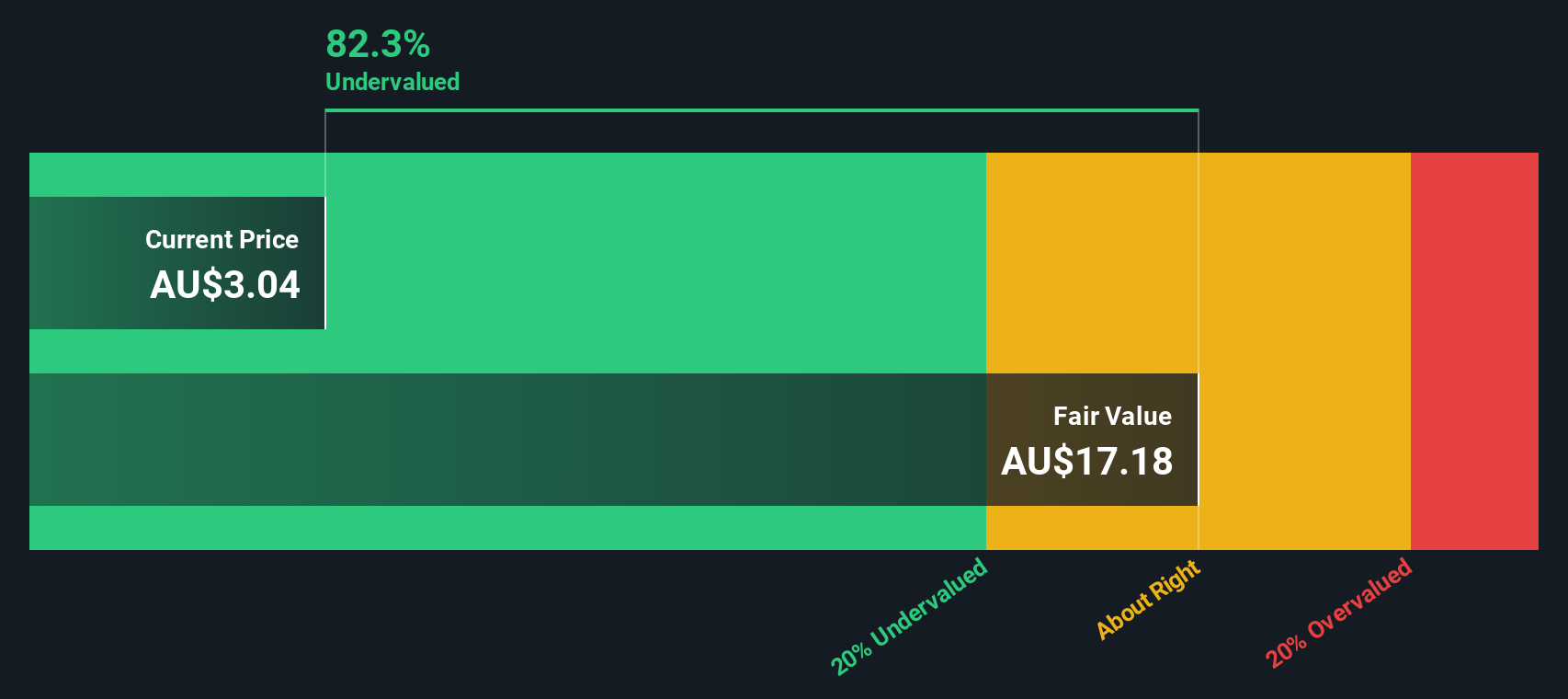

Discover if West African Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WAF

West African Resources

Engages in the mining, mineral processing, acquisition, exploration, and project development of gold projects in West Africa.

Exceptional growth potential with flawless balance sheet.