Discovering Opportunities: 5G Networks And 2 Other ASX Penny Stocks To Watch

Reviewed by Simply Wall St

The Australian market is experiencing a mix of optimism and caution, with recent economic developments in China and the U.S. influencing investor sentiment. In such fluctuating conditions, identifying stocks with strong fundamentals becomes crucial for investors seeking potential growth opportunities. Penny stocks, often representing smaller or newer companies, continue to offer intriguing possibilities for those willing to explore beyond traditional investments.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.51 | A$316.27M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.97 | A$320.75M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.6675 | A$92.24M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.695 | A$830.68M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.82 | A$233.81M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$222.46M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.94 | A$109.1M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.90 | A$483.46M | ★★★★☆☆ |

Click here to see the full list of 1,047 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

5G Networks (ASX:5GN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: 5G Networks Limited is a digital services company offering cloud enabling solutions in Australia and New Zealand, with a market cap of A$53.43 million.

Operations: The company generates revenue from two main segments: Wholesale, contributing A$8.86 million, and Enterprise, accounting for A$40.48 million.

Market Cap: A$53.43M

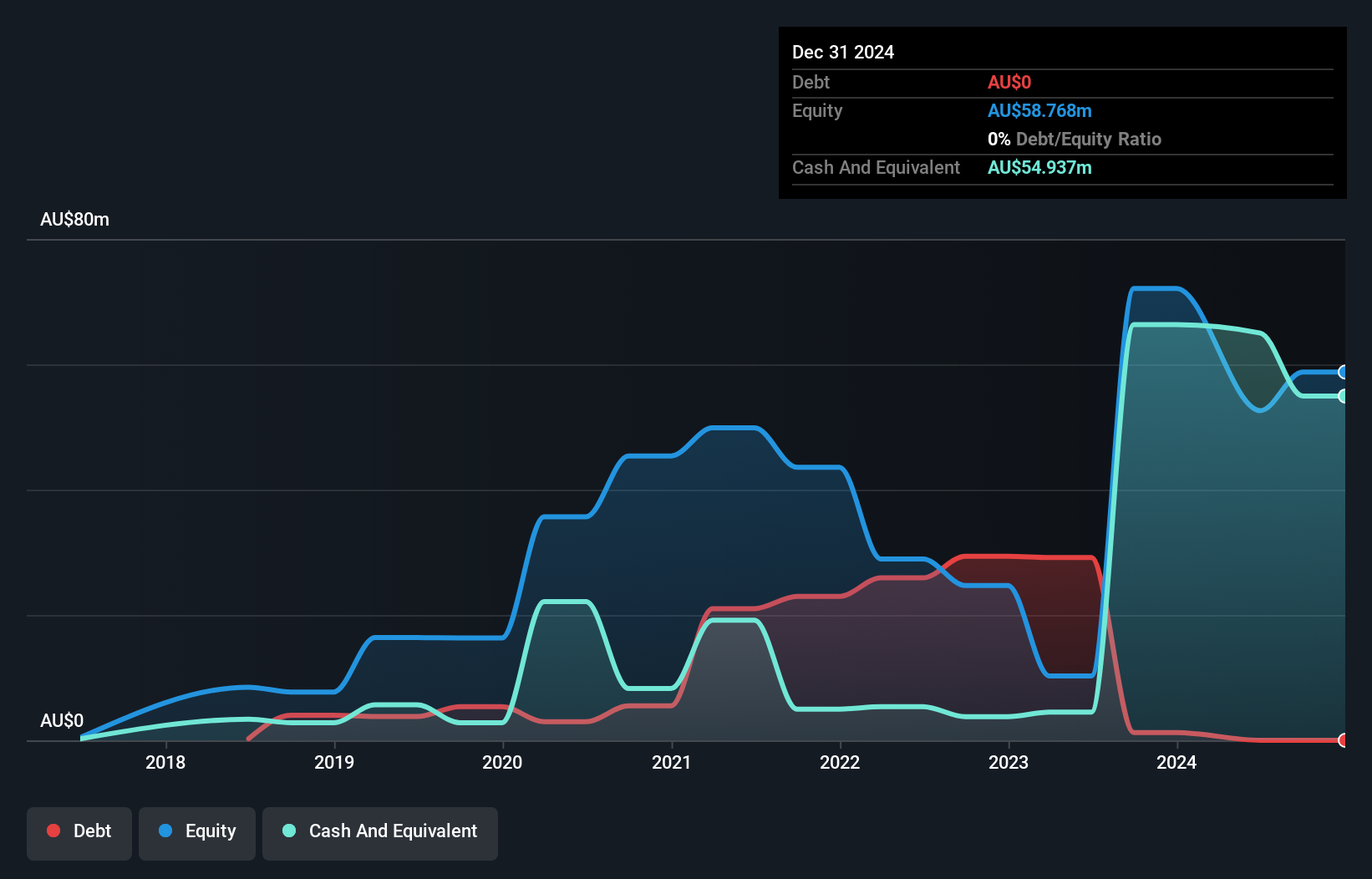

5G Networks Limited, with a market cap of A$53.43 million, operates in the digital services sector across Australia and New Zealand. The company is currently unprofitable but maintains a strong financial position with no debt and sufficient cash runway for over three years based on current free cash flow. Its short-term assets significantly exceed its liabilities, providing stability despite declining earnings over the past five years. Recent developments include a board-approved buyback plan and the appointment of Hugh Robertson as an independent non-executive director, bringing extensive expertise in corporate finance and strategic planning to bolster its leadership team.

- Jump into the full analysis health report here for a deeper understanding of 5G Networks.

- Examine 5G Networks' past performance report to understand how it has performed in prior years.

Australian Strategic Materials (ASX:ASM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Australian Strategic Materials Ltd is an Australian company that operates as an integrated producer of critical metals for advanced and clean technologies, with a market cap of A$93.38 million.

Operations: The company generates revenue from its operations in Korea, contributing A$1.57 million, and from the Dubbo Project, which adds A$1.53 million.

Market Cap: A$93.38M

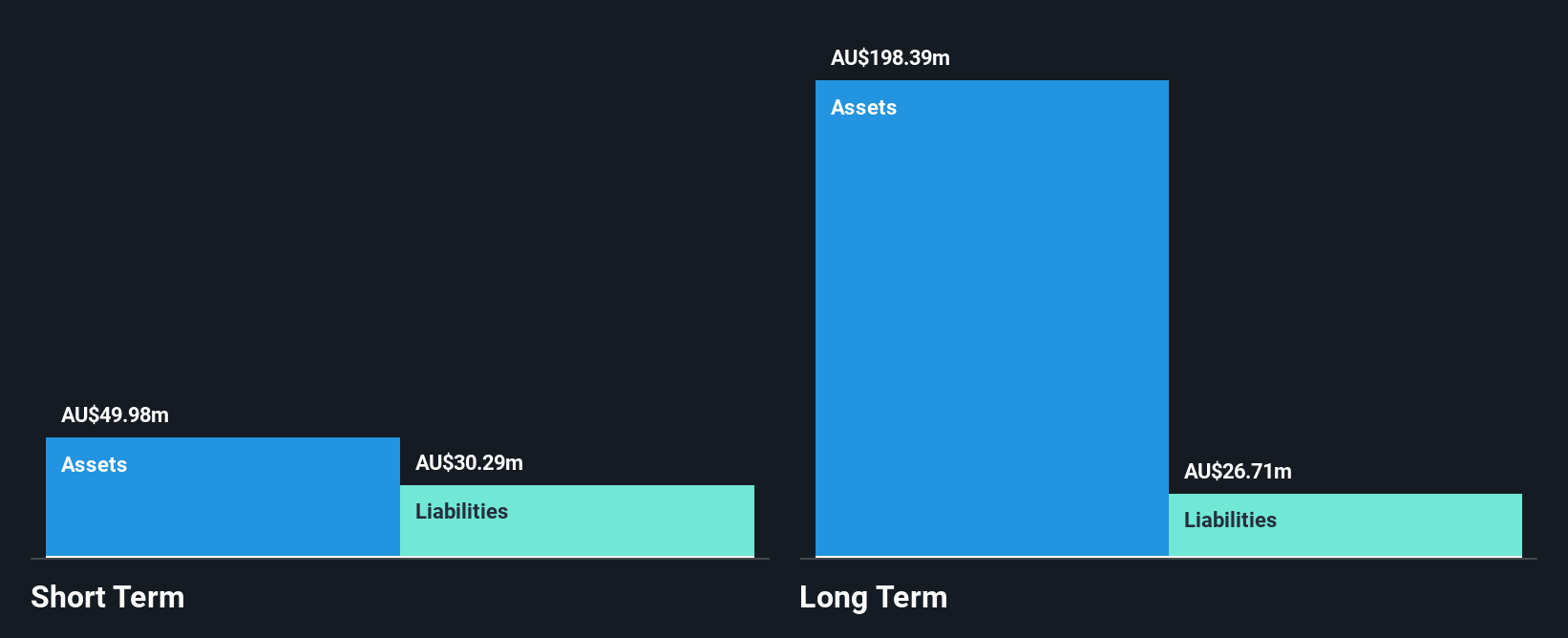

Australian Strategic Materials Ltd, with a market cap of A$93.38 million, is currently pre-revenue and unprofitable, facing challenges such as a negative return on equity and increased losses over five years. However, it benefits from a strong cash position exceeding its total debt and short-term assets covering both short- and long-term liabilities. Recent developments include securing A$5 million in government funding for the Dubbo Project's rare earth production initiatives. Despite shareholder dilution over the past year, ASM's strategic partnerships and government support aim to advance its critical minerals project towards construction by 2026.

- Take a closer look at Australian Strategic Materials' potential here in our financial health report.

- Gain insights into Australian Strategic Materials' past trends and performance with our report on the company's historical track record.

WAM Strategic Value (ASX:WAR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: WAM Strategic Value Limited focuses on investing in discounted assets and has a market capitalization of A$205.34 million.

Operations: The company generates revenue through investing activities amounting to A$38.34 million.

Market Cap: A$205.34M

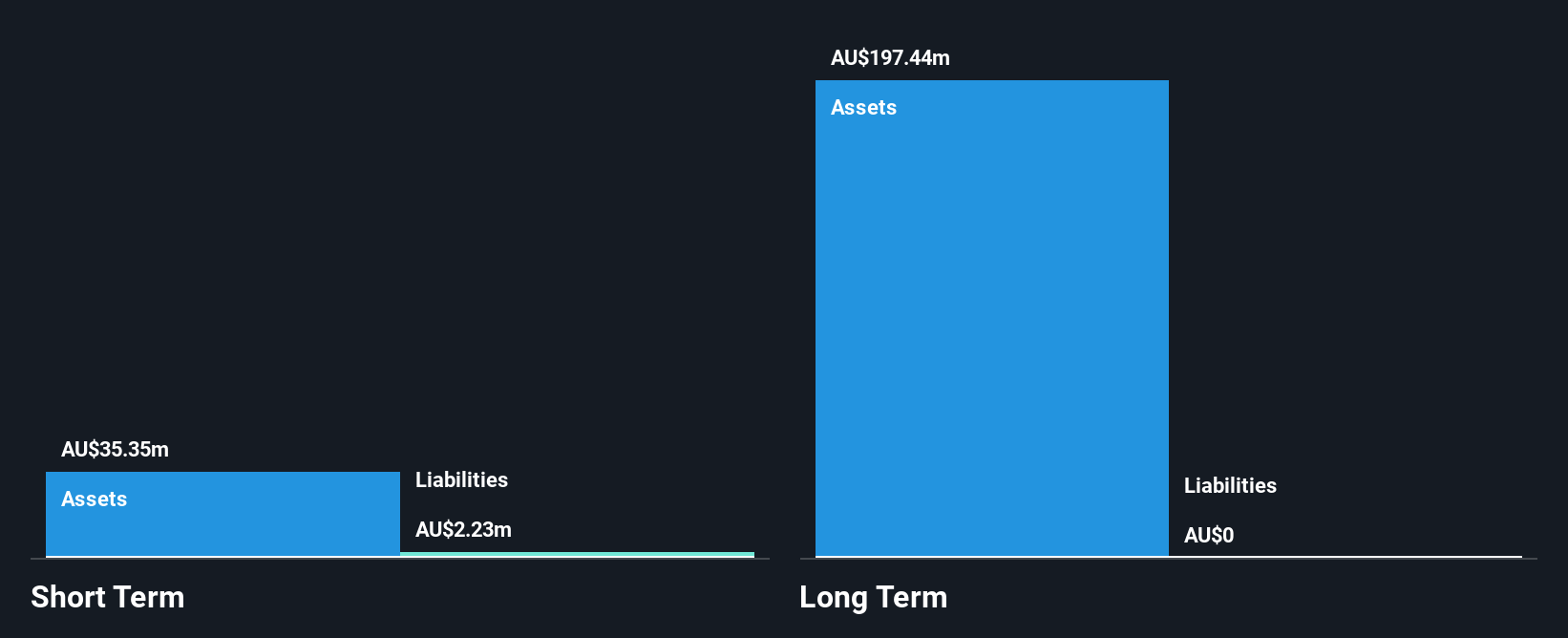

WAM Strategic Value Limited, with a market capitalization of A$205.34 million, demonstrates solid financial health by being debt-free and having short-term assets (A$19.4M) that exceed liabilities (A$11.5M). Its Price-to-Earnings ratio of 9.3x suggests it offers good value compared to the broader Australian market average of 20.5x. The company has experienced significant earnings growth of 40.1% over the past year, outpacing the industry average of 15.6%. Despite a decrease in net profit margins from last year, WAM maintains high non-cash earnings quality and stable weekly volatility at 2%.

- Click to explore a detailed breakdown of our findings in WAM Strategic Value's financial health report.

- Evaluate WAM Strategic Value's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 1,044 more companies for you to explore.Click here to unveil our expertly curated list of 1,047 ASX Penny Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:5GN

5G Networks

A digital services company, provides cloud enabling solutions in Australia and New Zealand.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives