- Australia

- /

- Metals and Mining

- /

- ASX:WAF

Shareholders Are Raving About How The West African Resources (ASX:WAF) Share Price Increased 829%

It might be of some concern to shareholders to see the West African Resources Limited (ASX:WAF) share price down 20% in the last month. But that does not change the realty that the stock's performance has been terrific, over five years. In fact, during that period, the share price climbed 829%. Impressive! So we don't think the recent decline in the share price means its story is a sad one. Only time will tell if there is still too much optimism currently reflected in the share price.

It really delights us to see such great share price performance for investors.

View our latest analysis for West African Resources

While West African Resources made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 5 years West African Resources saw its revenue grow at 115% per year. Even measured against other revenue-focussed companies, that's a good result. Fortunately, the market has not missed this, and has pushed the share price up by 56% per year in that time. It's never too late to start following a top notch stock like West African Resources, since some long term winners go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

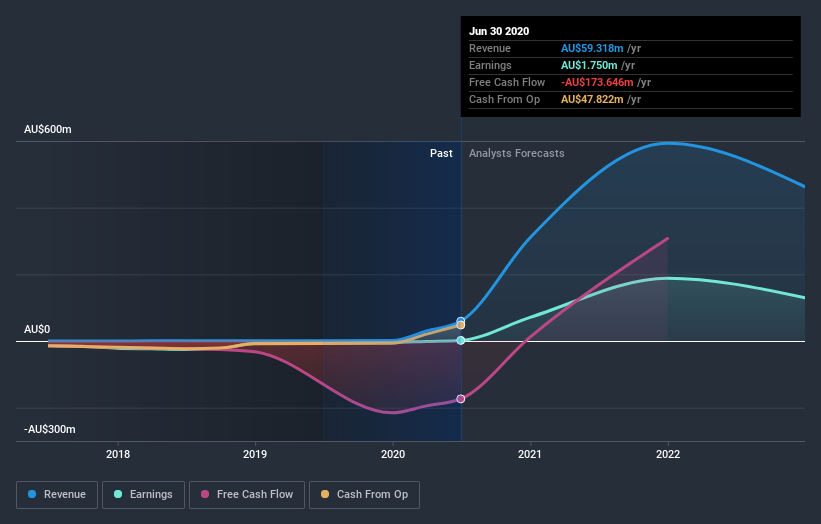

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how West African Resources has grown profits over the years, but the future is more important for shareholders. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's good to see that West African Resources has rewarded shareholders with a total shareholder return of 23% in the last twelve months. However, that falls short of the 56% TSR per annum it has made for shareholders, each year, over five years. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. It's always interesting to track share price performance over the longer term. But to understand West African Resources better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for West African Resources (of which 2 shouldn't be ignored!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

When trading West African Resources or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if West African Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:WAF

West African Resources

Engages in the mining, mineral processing, acquisition, exploration, and project development of gold projects in West Africa.

Exceptional growth potential with flawless balance sheet.