- Australia

- /

- Healthtech

- /

- ASX:4DX

3 ASX Penny Stocks With Market Caps Under A$400M

Reviewed by Simply Wall St

The Australian market has recently experienced a downturn, with the ASX closing the year on a two-day losing streak and most sectors ending in the red. In such fluctuating conditions, identifying stocks with potential resilience and growth becomes crucial. Penny stocks, despite being an older term, remain relevant as they often represent smaller or newer companies that might offer unique opportunities when backed by solid financial health.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.88 | A$238.78M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.955 | A$318.31M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.51 | A$316.27M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$842.94M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.88 | A$103.99M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$217.98M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$2.00 | A$112.19M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.90 | A$483.46M | ★★★★☆☆ |

Click here to see the full list of 1,053 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

4DMedical (ASX:4DX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: 4DMedical Limited is a medical technology company operating in the United States and Australia, with a market cap of A$197.39 million.

Operations: The company derives its revenue from the medical technology research and development of lung function analysis, totaling A$3.75 million.

Market Cap: A$197.39M

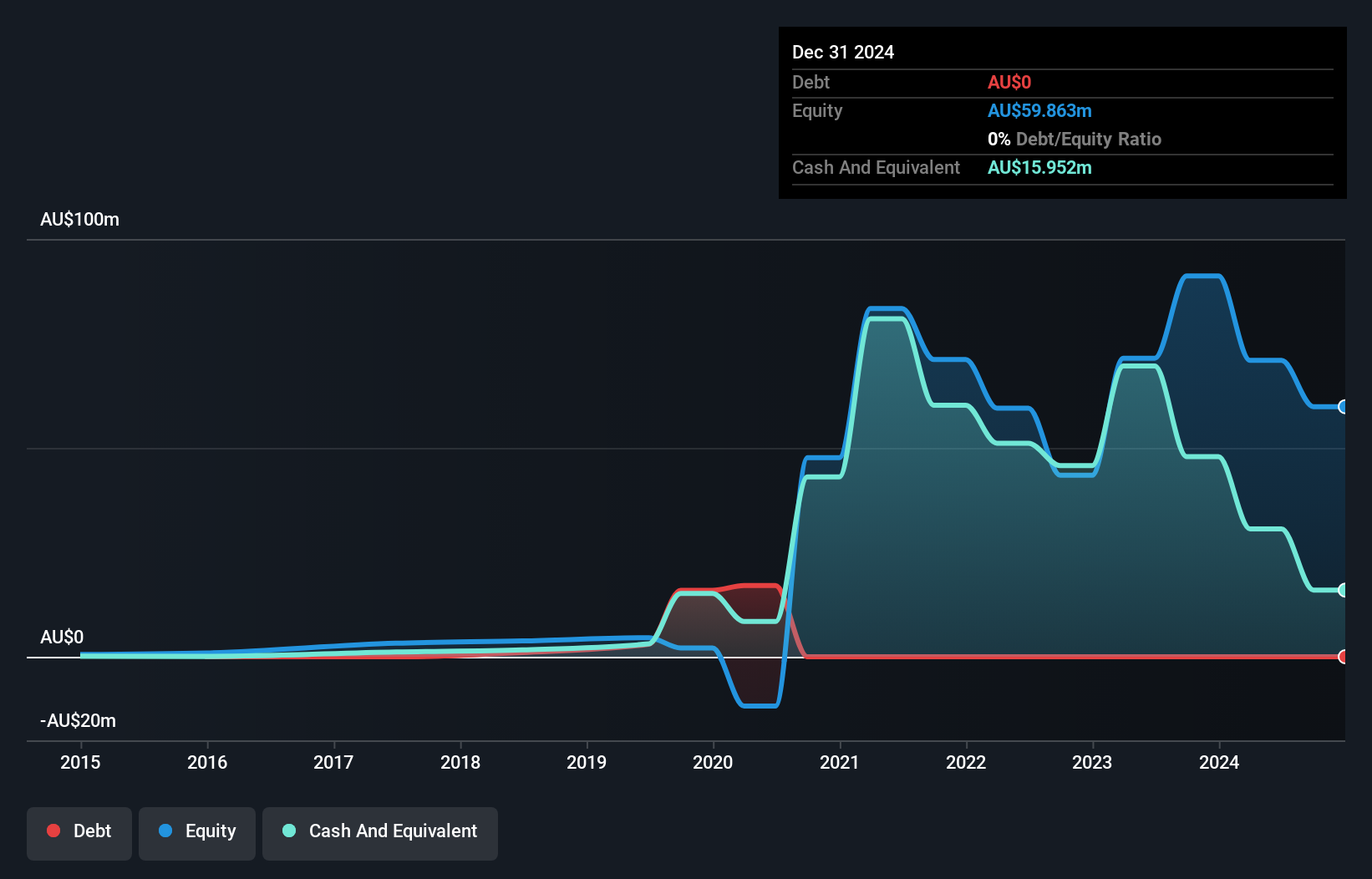

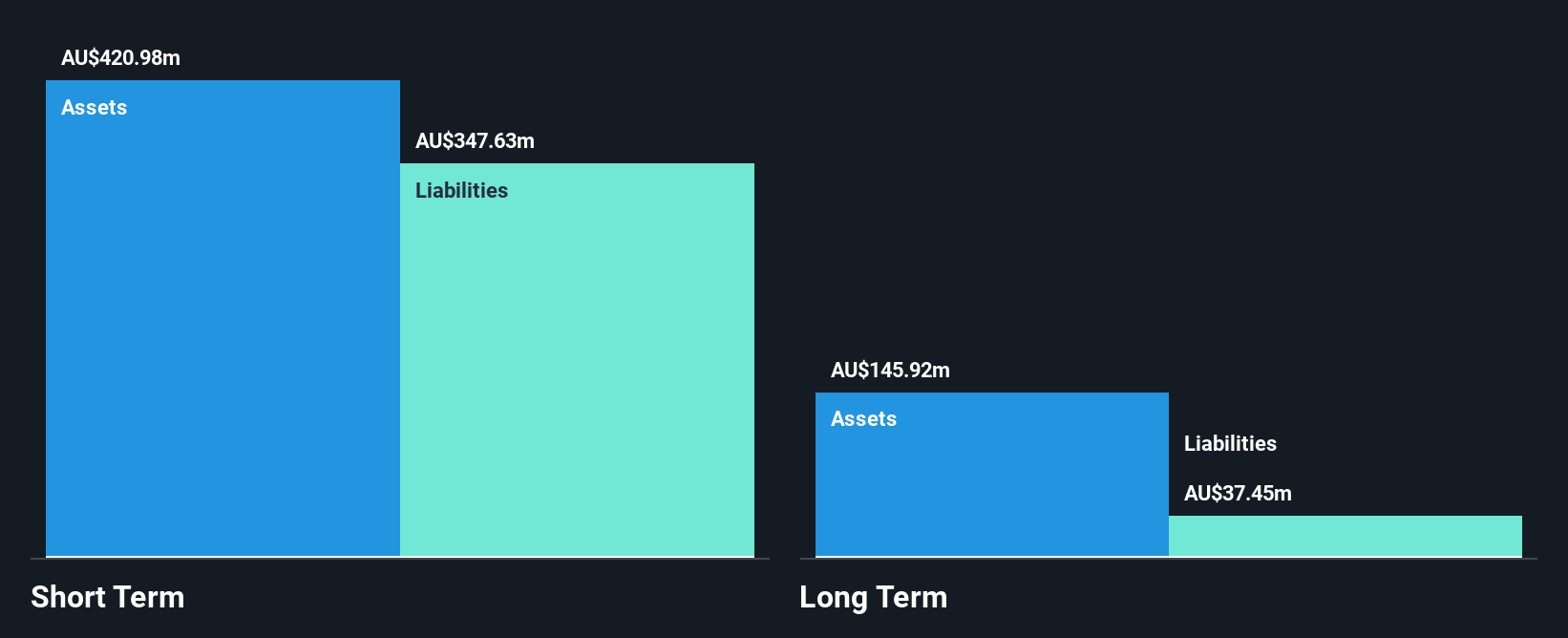

4DMedical Limited, with a market cap of A$197.39 million, is pre-revenue and unprofitable, focusing on lung function analysis technology. Despite having no debt and short-term assets exceeding liabilities, the company faces challenges with less than a year of cash runway if free cash flow remains stable. Management's inexperience may impact strategic direction as they navigate increasing losses over the past five years at 19.4% annually. Shareholder dilution occurred last year by 5.2%. While revenue is forecast to grow significantly, profitability isn't expected within three years. Recent board changes include John Livingston transitioning to a Non-Executive Director role in January 2025.

- Jump into the full analysis health report here for a deeper understanding of 4DMedical.

- Evaluate 4DMedical's prospects by accessing our earnings growth report.

Mach7 Technologies (ASX:M7T)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mach7 Technologies Limited offers enterprise imaging data sharing, storage, and interoperability solutions for healthcare enterprises across various regions globally, with a market cap of A$96.50 million.

Operations: The company's revenue is derived from Software Licenses (A$13.17 million), Professional Services (A$4.07 million), and Maintenance and Support (A$11.87 million).

Market Cap: A$96.5M

Mach7 Technologies Limited, with a market cap of A$96.50 million, focuses on healthcare imaging solutions and has recently launched UnityVue, an innovative radiology software platform. Despite being unprofitable, the company benefits from a strong cash position with short-term assets (A$33.9M) exceeding both short-term (A$15.1M) and long-term liabilities (A$6.1M). Mach7 is debt-free and maintains a positive free cash flow runway for over three years if current conditions persist. However, its management team lacks extensive tenure experience, which might influence strategic execution as it aims to capitalize on projected revenue growth of 71.41% annually amidst stable stock volatility.

- Click here to discover the nuances of Mach7 Technologies with our detailed analytical financial health report.

- Learn about Mach7 Technologies' future growth trajectory here.

OFX Group (ASX:OFX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: OFX Group Limited offers international payments and foreign exchange services across the Asia Pacific, North America, Europe, the Middle East, and Africa with a market cap of A$333.62 million.

Operations: The company's revenue is derived from the Asia Pacific (A$91.22 million), Europe (A$36.80 million), and North America (A$88.75 million) regions.

Market Cap: A$333.62M

OFX Group Limited, with a market cap of A$333.62 million, operates in international payments and foreign exchange services across multiple regions. Despite recent earnings declines—net income dropped to A$10.71 million for the half-year ending September 2024 from A$15.78 million a year prior—the company maintains financial stability with short-term assets (A$394.3M) exceeding both short-term (A$302M) and long-term liabilities (A$60.3M). OFX's cash reserves surpass total debt, indicating prudent financial management amid high stock volatility compared to peers. The company completed a significant share buyback program while analysts anticipate potential price appreciation based on fair value assessments and future earnings growth projections.

- Navigate through the intricacies of OFX Group with our comprehensive balance sheet health report here.

- Gain insights into OFX Group's future direction by reviewing our growth report.

Seize The Opportunity

- Access the full spectrum of 1,053 ASX Penny Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:4DX

4DMedical

Operates as a medical technology company in the United States and Australia.

Flawless balance sheet low.

Market Insights

Community Narratives