3 ASX Stocks Estimated To Be Up To 50.2% Below Intrinsic Value

Reviewed by Simply Wall St

As the Australian market wraps up 2024 with a two-day decline, the ASX has seen most sectors retreat into negative territory, marking a year-end characterized by profit-taking and sectoral losses. In this environment of fluctuating indices and cautious investor sentiment, identifying undervalued stocks becomes crucial for those seeking potential opportunities amidst broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Data#3 (ASX:DTL) | A$6.39 | A$12.30 | 48% |

| SKS Technologies Group (ASX:SKS) | A$1.945 | A$3.85 | 49.4% |

| Atlas Arteria (ASX:ALX) | A$4.75 | A$9.54 | 50.2% |

| Charter Hall Group (ASX:CHC) | A$14.35 | A$28.70 | 50% |

| Cettire (ASX:CTT) | A$1.51 | A$3.02 | 49.9% |

| Telix Pharmaceuticals (ASX:TLX) | A$24.61 | A$46.58 | 47.2% |

| Ansell (ASX:ANN) | A$33.82 | A$60.33 | 43.9% |

| Genesis Minerals (ASX:GMD) | A$2.47 | A$4.90 | 49.6% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Syrah Resources (ASX:SYR) | A$0.205 | A$0.37 | 44.1% |

We're going to check out a few of the best picks from our screener tool.

Atlas Arteria (ASX:ALX)

Overview: Atlas Arteria Limited owns, develops, and operates toll roads with a market cap of A$6.89 billion.

Operations: The company's revenue segments include APRR with A$1.70 billion, ADELAC at A$36.90 million, Warnow Tunnel generating A$25.10 million, Chicago Skyway contributing A$128.90 million, and Dulles Greenway bringing in A$115 million.

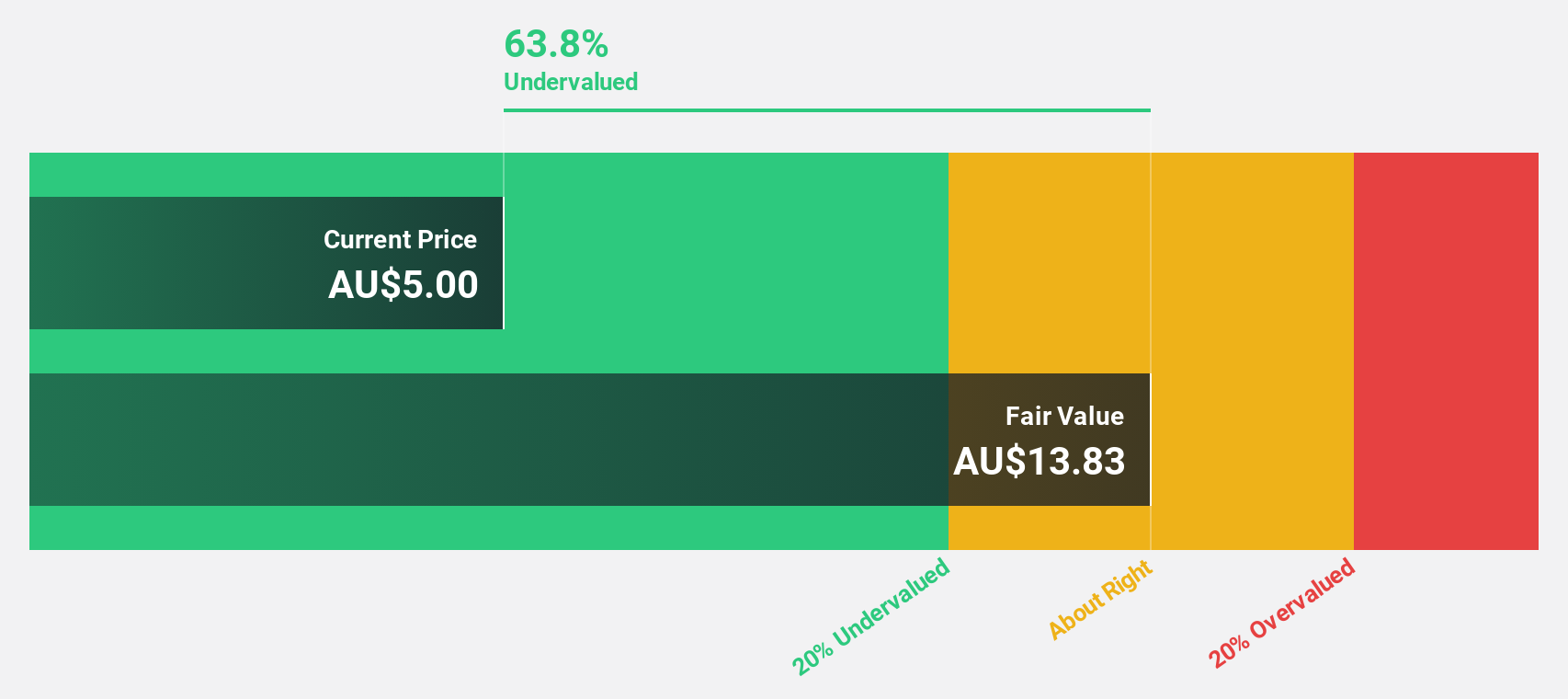

Estimated Discount To Fair Value: 50.2%

Atlas Arteria is trading at A$4.83, significantly below its estimated fair value of A$9.64, highlighting potential undervaluation based on cash flows. Despite a forecasted low return on equity of 8.2% in three years, the company expects robust earnings growth at 22.31% annually, outpacing the Australian market's 12.6%. Recent board changes and increased toll revenue further underscore operational adjustments and growth prospects, though its dividend yield of 8.28% lacks coverage by earnings or free cash flow.

- The growth report we've compiled suggests that Atlas Arteria's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Atlas Arteria.

Megaport (ASX:MP1)

Overview: Megaport Limited offers on-demand interconnection and internet exchange services to enterprises and service providers across various regions including Australia, New Zealand, Asia, North America, and Europe, with a market cap of A$1.18 billion.

Operations: The company's revenue is derived from three main geographical segments: Europe (A$31.88 million), Asia-Pacific (A$52.58 million), and North America (A$110.81 million).

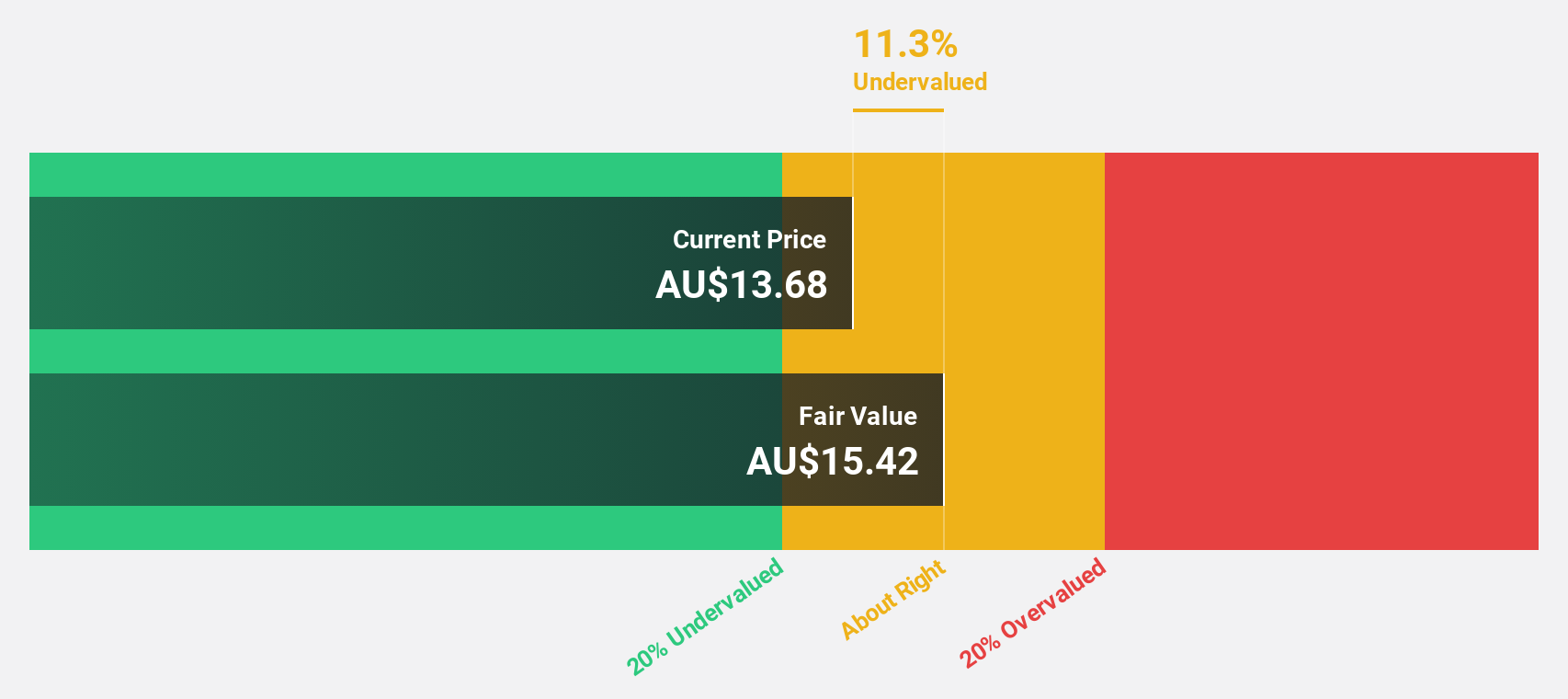

Estimated Discount To Fair Value: 38.9%

Megaport is trading at A$7.37, significantly below its estimated fair value of A$12.05, suggesting potential undervaluation based on cash flows. The company has recently expanded into Brazil and Europe, enhancing its global footprint and connectivity offerings. Although its return on equity is forecast to be low at 17.9%, earnings are expected to grow significantly at 27.9% annually, surpassing the Australian market's growth rate of 12.6%.

- Upon reviewing our latest growth report, Megaport's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Megaport with our comprehensive financial health report here.

PWR Holdings (ASX:PWH)

Overview: PWR Holdings Limited specializes in the design, production, and sale of cooling products and solutions across various international markets, with a market capitalization of A$790.43 million.

Operations: The company's revenue segments consist of PWR C&R generating A$41.98 million and PWR Performance Products contributing A$111.26 million.

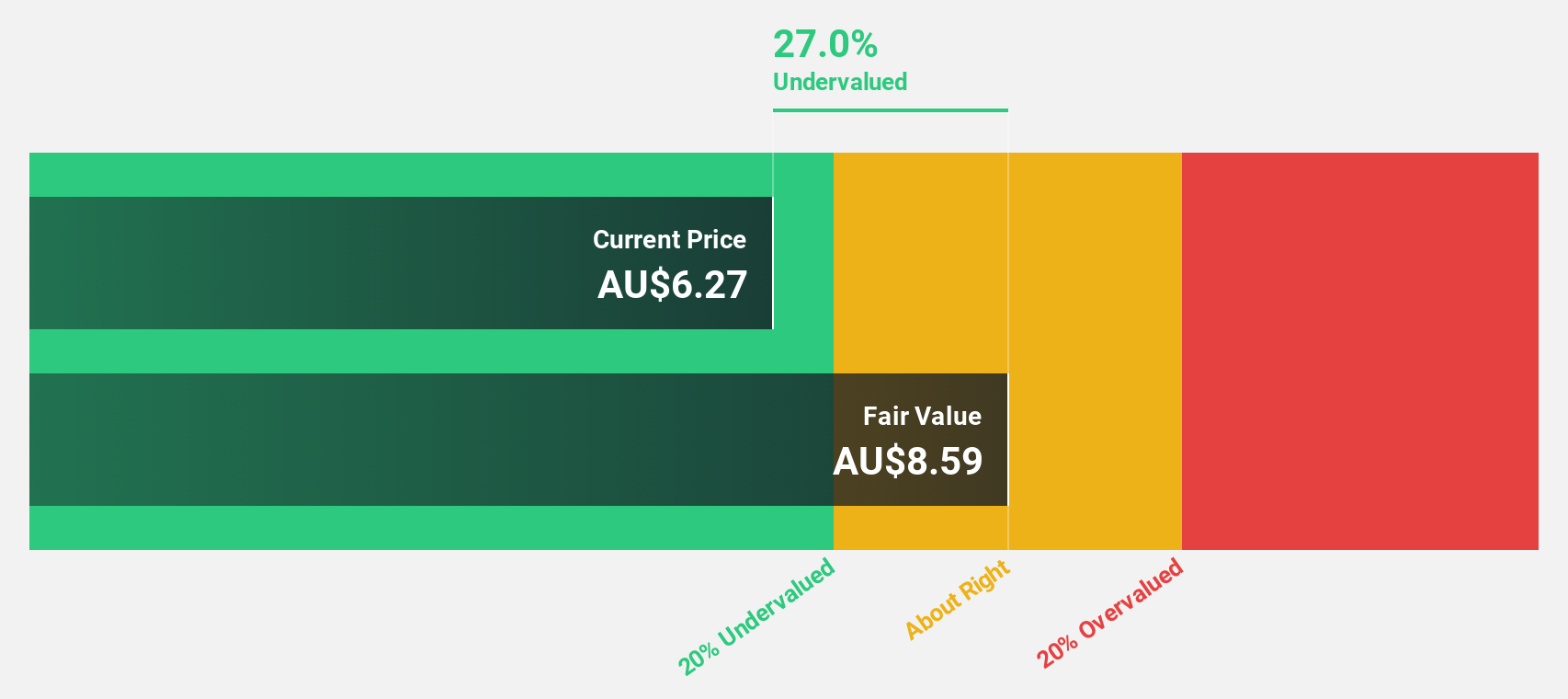

Estimated Discount To Fair Value: 10.4%

PWR Holdings, trading at A$7.86, is below its estimated fair value of A$8.78, indicating potential undervaluation based on cash flows. Earnings are forecast to grow at 15.57% annually, outpacing the Australian market's 12.6%. The recent appointment of Sharyn Williams as CFO could strengthen financial strategies and governance with her extensive ASX-listed experience. Revenue growth is expected at 12% per year, faster than the market's 5.9%.

- Our comprehensive growth report raises the possibility that PWR Holdings is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in PWR Holdings' balance sheet health report.

Make It Happen

- Take a closer look at our Undervalued ASX Stocks Based On Cash Flows list of 39 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MP1

Megaport

Provides on-demand interconnection and internet exchange services to the enterprises and service providers in Australia, New Zealand, Hong Kong, Singapore, Japan, North America, Italy, and rest of Europe.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives