- Australia

- /

- Metals and Mining

- /

- ASX:VAU

Vault Minerals (ASX:VAU): How Does Its Valuation Stack Up After Production Outlook Update?

Reviewed by Kshitija Bhandaru

If you’ve been tracking Vault Minerals (ASX:VAU), the recent market chatter probably caught your eye. The company announced that gold production in FY26 will soften as it transitions to an owner-operator model at its Deflector mine. However, Vault Minerals expects output to bounce back in FY27 and FY28 as expanded capacity at Leonora and Sugar Zone operations comes online. This production update has influenced share price movements and analyst models, leaving investors weighing the real impact beneath the headlines.

This year, Vault Minerals’ stock has climbed an impressive 97%, reaching levels not seen since 2013. Short-term volatility accompanied recent analyst downgrades and news of the FY26 dip, but longer-term momentum still points upward, reflecting the optimism around higher output and operational improvements on the horizon. Though the path hasn’t been linear, the market seems keenly focused on where Vault’s strategic investments could land the business in the years ahead.

After this surge and with future growth already in focus, investors have to decide whether this transition spells a window of opportunity or if the recovery story has already been fully priced in.

Price-to-Earnings of 18.9x: Is it justified?

Based on the price-to-earnings (PE) multiple, Vault Minerals appears slightly more expensive than the average for the Australian Metals and Mining industry, which stands at 18.6x. This suggests the market may be assigning a premium to the company’s future earnings potential compared to its sector peers.

The PE ratio gives a snapshot of how much investors are willing to pay for each dollar of a company’s earnings. In this context, it is a widely used measure to compare valuations across companies in the same industry, reflecting both growth expectations and perceived risk.

For Vault Minerals, the premium valuation hints that investors may expect above-average growth or improvements in earnings quality, despite similar industry dynamics. Whether this optimism is justified will depend on the company’s ability to convert its transition and expansion plans into sustained profit gains.

Result: Fair Value of $0.66 (ABOUT RIGHT)

See our latest analysis for Vault Minerals.However, weak revenue growth or execution hiccups during the transition could pressure earnings and challenge the case for Vault Minerals’ current premium valuation.

Find out about the key risks to this Vault Minerals narrative.Another View: Discounted Cash Flow

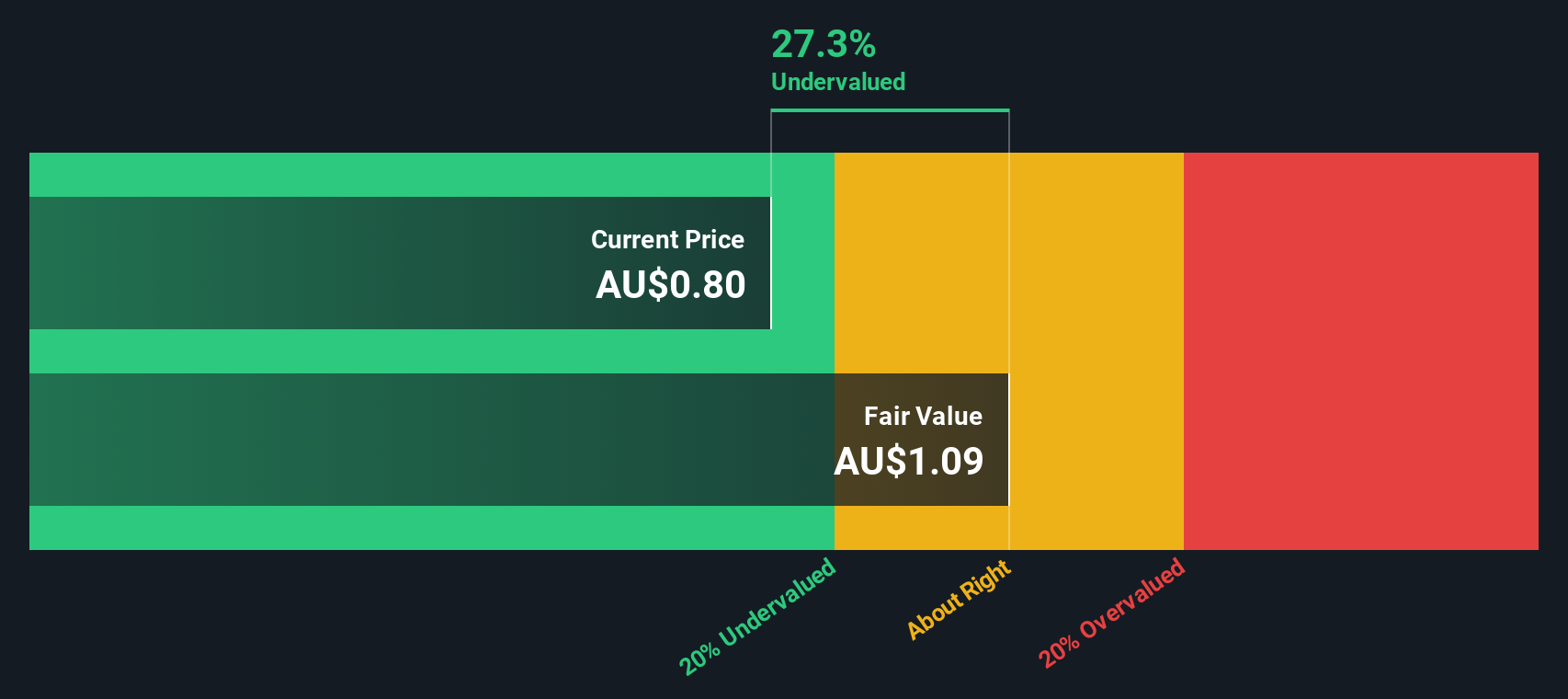

While the first look at valuation used earnings multiples, our SWS DCF model takes a different approach and currently points toward the stock being undervalued. Does this deeper dive alter your outlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Vault Minerals Narrative

If you see things differently or prefer to dive into the data on your own terms, you can quickly craft and share your personal thesis in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vault Minerals.

Looking for more investment ideas?

Take your portfolio to the next level by tapping into fresh trends and unique opportunities with Simply Wall Street. See what you could be missing out on right now.

- Uncover untapped growth by checking out undervalued stocks based on cash flows, which features companies trading below their cash flow potential.

- Capture tomorrow’s tech wave by scanning AI penny stocks. This screen focuses on businesses reshaping industries through groundbreaking artificial intelligence.

- Lock in steady returns by exploring dividend stocks with yields > 3%, highlighting stocks that deliver yields above 3% and provide reliable income streams.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VAU

Vault Minerals

Engages in the exploration, mine development, mine operations and the sale of gold and gold/copper concentrate in Australia and Canada.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)