- Australia

- /

- Metals and Mining

- /

- ASX:VAU

3 ASX Stocks Estimated To Be Trading Up To 47.3% Below Intrinsic Value

Reviewed by Simply Wall St

As the Australian stock market experiences a modest upswing amid geopolitical developments and commodity fluctuations, investors are keenly observing opportunities that may arise from undervalued stocks. In this context, identifying stocks trading below their intrinsic value can be particularly appealing, as they present potential for growth when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vault Minerals (ASX:VAU) | A$0.715 | A$1.17 | 38.6% |

| Superloop (ASX:SLC) | A$3.20 | A$5.66 | 43.5% |

| Resimac Group (ASX:RMC) | A$1.12 | A$2.17 | 48.3% |

| NRW Holdings (ASX:NWH) | A$4.81 | A$9.13 | 47.3% |

| Liontown Resources (ASX:LTR) | A$1.22 | A$2.12 | 42.4% |

| James Hardie Industries (ASX:JHX) | A$34.13 | A$61.30 | 44.3% |

| Credit Clear (ASX:CCR) | A$0.285 | A$0.47 | 39.2% |

| CleanSpace Holdings (ASX:CSX) | A$0.70 | A$1.38 | 49.3% |

| Betmakers Technology Group (ASX:BET) | A$0.195 | A$0.32 | 38.7% |

| Airtasker (ASX:ART) | A$0.37 | A$0.71 | 48.1% |

Here we highlight a subset of our preferred stocks from the screener.

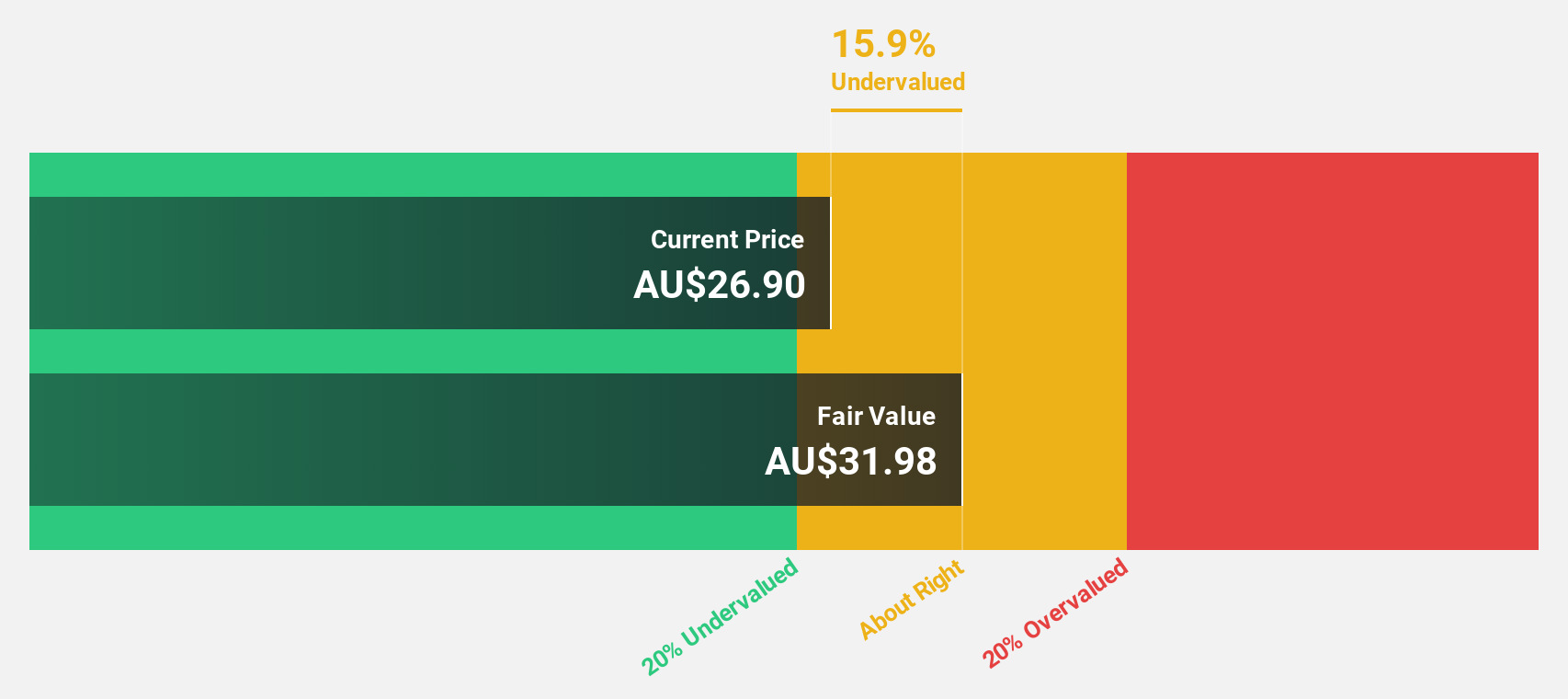

Eagers Automotive (ASX:APE)

Overview: Eagers Automotive Limited owns and operates motor vehicle dealerships in Australia and New Zealand, with a market cap of A$7.97 billion.

Operations: The company generates revenue primarily from car retailing, amounting to A$12.23 billion, with an additional contribution of A$54.69 million from property.

Estimated Discount To Fair Value: 14.0%

Eagers Automotive is trading at A$30.57, below its fair value estimate of A$35.54, indicating potential undervaluation based on cash flows. Despite a recent strategic partnership with Mitsubishi and a follow-on equity offering raising A$501 million, interest payments are not well covered by earnings. However, earnings are forecast to grow significantly at 21.6% annually over the next three years, surpassing the Australian market's growth rate of 14.3%.

- Insights from our recent growth report point to a promising forecast for Eagers Automotive's business outlook.

- Click to explore a detailed breakdown of our findings in Eagers Automotive's balance sheet health report.

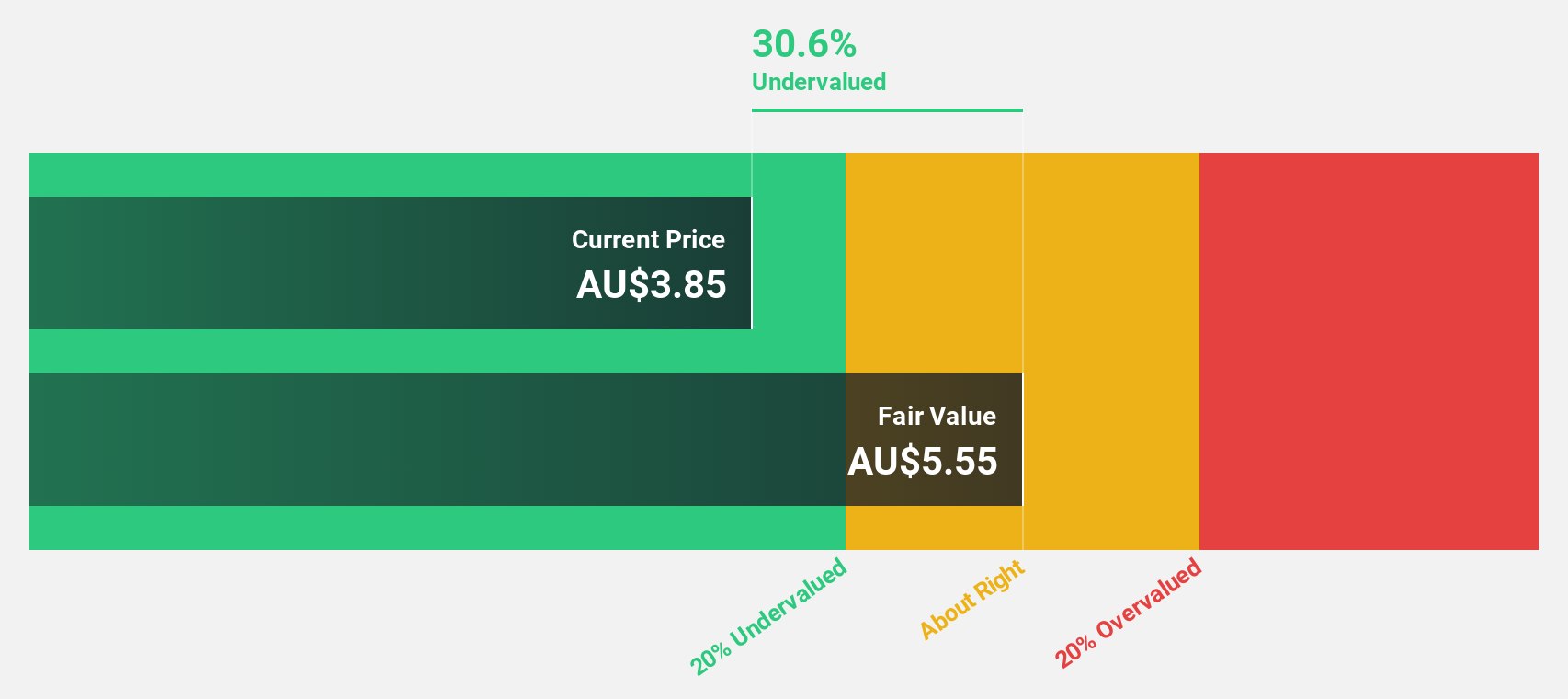

NRW Holdings (ASX:NWH)

Overview: NRW Holdings Limited offers diversified contract services to the resources and infrastructure sectors in Australia, with a market cap of A$2.21 billion.

Operations: The company's revenue is derived from three main segments: Mining at A$1.54 billion, MET at A$932.02 million, and Civil at A$823.72 million.

Estimated Discount To Fair Value: 47.3%

NRW Holdings is trading at A$4.81, significantly below its estimated fair value of A$9.13, suggesting undervaluation based on cash flows. Despite a decline in net income to A$27.67 million for FY2025 and insider selling, earnings are projected to grow substantially at 30.6% annually over the next three years, outpacing the Australian market's growth rate of 14.3%. However, the dividend yield of 3.43% is not adequately covered by earnings.

- In light of our recent growth report, it seems possible that NRW Holdings' financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of NRW Holdings.

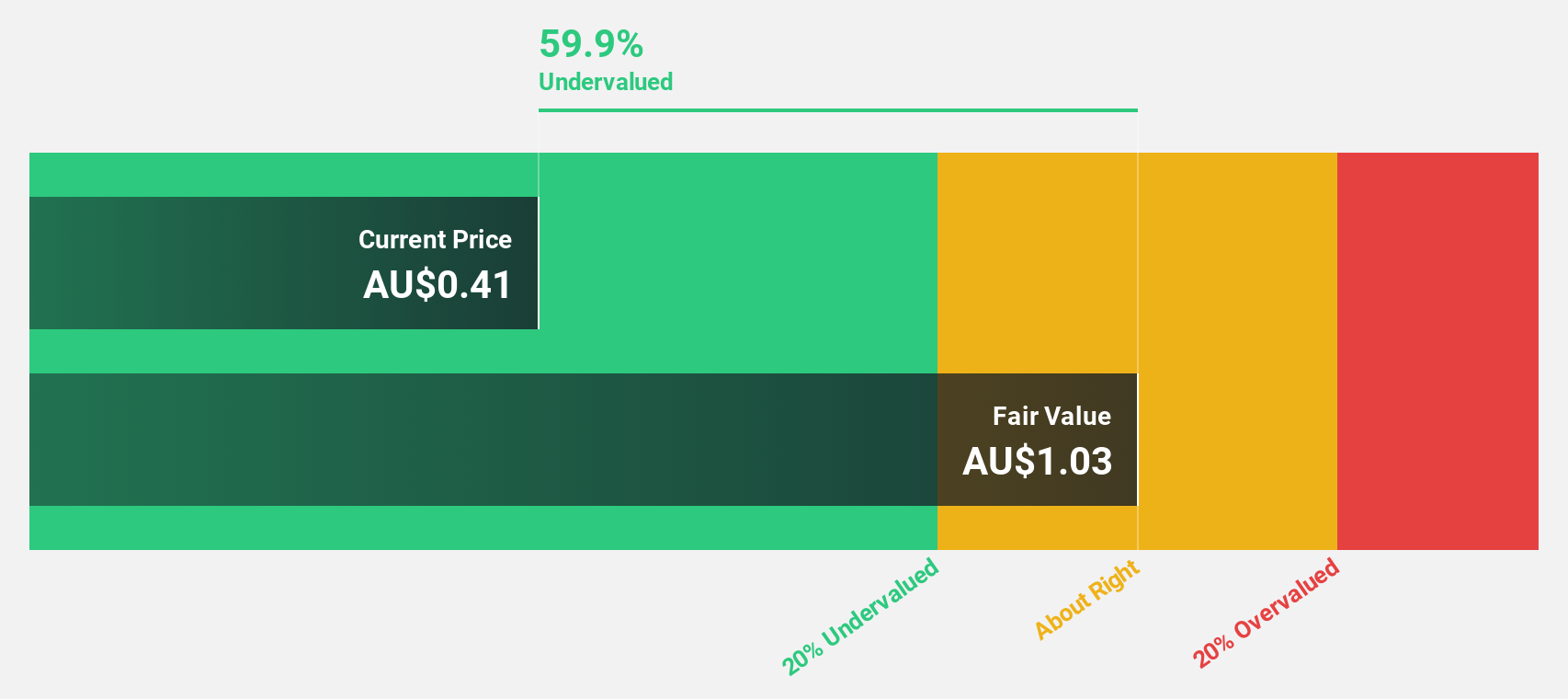

Vault Minerals (ASX:VAU)

Overview: Vault Minerals Limited is involved in the exploration, mine development, operations and sale of gold and gold/copper concentrate in Australia and Canada, with a market cap of A$4.85 billion.

Operations: The company's revenue segments consist of Deflector (A$477.79 million), Sugar Zone (A$0.23 million), Mount Monger (A$287.58 million) and Leonora Operation (A$666.50 million).

Estimated Discount To Fair Value: 38.6%

Vault Minerals, currently priced at A$0.72, is trading well below its estimated fair value of A$1.17, highlighting potential undervaluation based on cash flows. The company has shown a turnaround with net income reaching A$236.98 million from a loss last year and sales jumping to A$1.43 billion from A$620 million. Earnings are forecast to grow significantly at 21% annually over the next three years, supported by a share repurchase program targeting up to 10% of issued capital.

- The analysis detailed in our Vault Minerals growth report hints at robust future financial performance.

- Navigate through the intricacies of Vault Minerals with our comprehensive financial health report here.

Key Takeaways

- Reveal the 32 hidden gems among our Undervalued ASX Stocks Based On Cash Flows screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VAU

Vault Minerals

Engages in the exploration, mine development, mine operations and the sale of gold and gold/copper concentrate in Australia and Canada.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion