- Australia

- /

- Metals and Mining

- /

- ASX:SMI

ASX Growth Companies With High Insider Ownership In March 2025

Reviewed by Simply Wall St

As the ASX200 hovers just below the 8,100 mark, grappling with tariff implications and sector fluctuations, investors are keenly observing how these factors might influence growth opportunities on the Australian market. In this environment of economic uncertainty and shifting currency dynamics, companies with high insider ownership can offer a unique advantage by aligning management's interests closely with shareholders', potentially providing stability and confidence amidst volatility.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Alfabs Australia (ASX:AAL) | 10.8% | 40.9% |

| Medallion Metals (ASX:MM8) | 13.8% | 67.5% |

| Emerald Resources (ASX:EMR) | 18.1% | 38.9% |

| Fenix Resources (ASX:FEX) | 21.1% | 45.1% |

| Acrux (ASX:ACR) | 15.5% | 106.9% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| AVA Risk Group (ASX:AVA) | 15.8% | 108.2% |

| Titomic (ASX:TTT) | 11.2% | 77.2% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Findi (ASX:FND) | 35.6% | 133.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Liontown Resources (ASX:LTR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Liontown Resources Limited focuses on the exploration, evaluation, and development of mineral properties in Australia with a market cap of A$1.59 billion.

Operations: Liontown Resources Limited does not currently report any revenue segments.

Insider Ownership: 15.2%

Earnings Growth Forecast: 57.8% p.a.

Liontown Resources shows promise with forecasted revenue growth of 40.3% annually, outpacing the Australian market's average. Despite low current revenues, its potential profitability within three years suggests strong growth prospects. Insider activity has been positive, with more shares bought than sold recently, indicating confidence in the company's future. However, its Return on Equity is expected to remain modest at 12%. The stock trades significantly below estimated fair value, presenting a potential opportunity for investors.

- Click to explore a detailed breakdown of our findings in Liontown Resources' earnings growth report.

- Our comprehensive valuation report raises the possibility that Liontown Resources is priced lower than what may be justified by its financials.

Santana Minerals (ASX:SMI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Santana Minerals Limited focuses on the exploration and evaluation of gold and silver properties in New Zealand, Cambodia, and Mexico, with a market cap of A$421.62 million.

Operations: Santana Minerals Limited does not report any revenue segments in its financial disclosures.

Insider Ownership: 19.7%

Earnings Growth Forecast: 84.5% p.a.

Santana Minerals, despite generating less than A$1 million in revenue, is expected to achieve profitability within three years with earnings growth forecasted at 84.54% annually. Insider activity has been slightly positive, with more shares bought than sold recently. Recent drilling results at the Rise and Shine deposit suggest potential for resource expansion and improved mine planning. The stock trades below analyst price targets, indicating possible upside potential amidst high Return on Equity projections of 42.9%.

- Dive into the specifics of Santana Minerals here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Santana Minerals' share price might be too optimistic.

Vulcan Steel (ASX:VSL)

Simply Wall St Growth Rating: ★★★★★☆

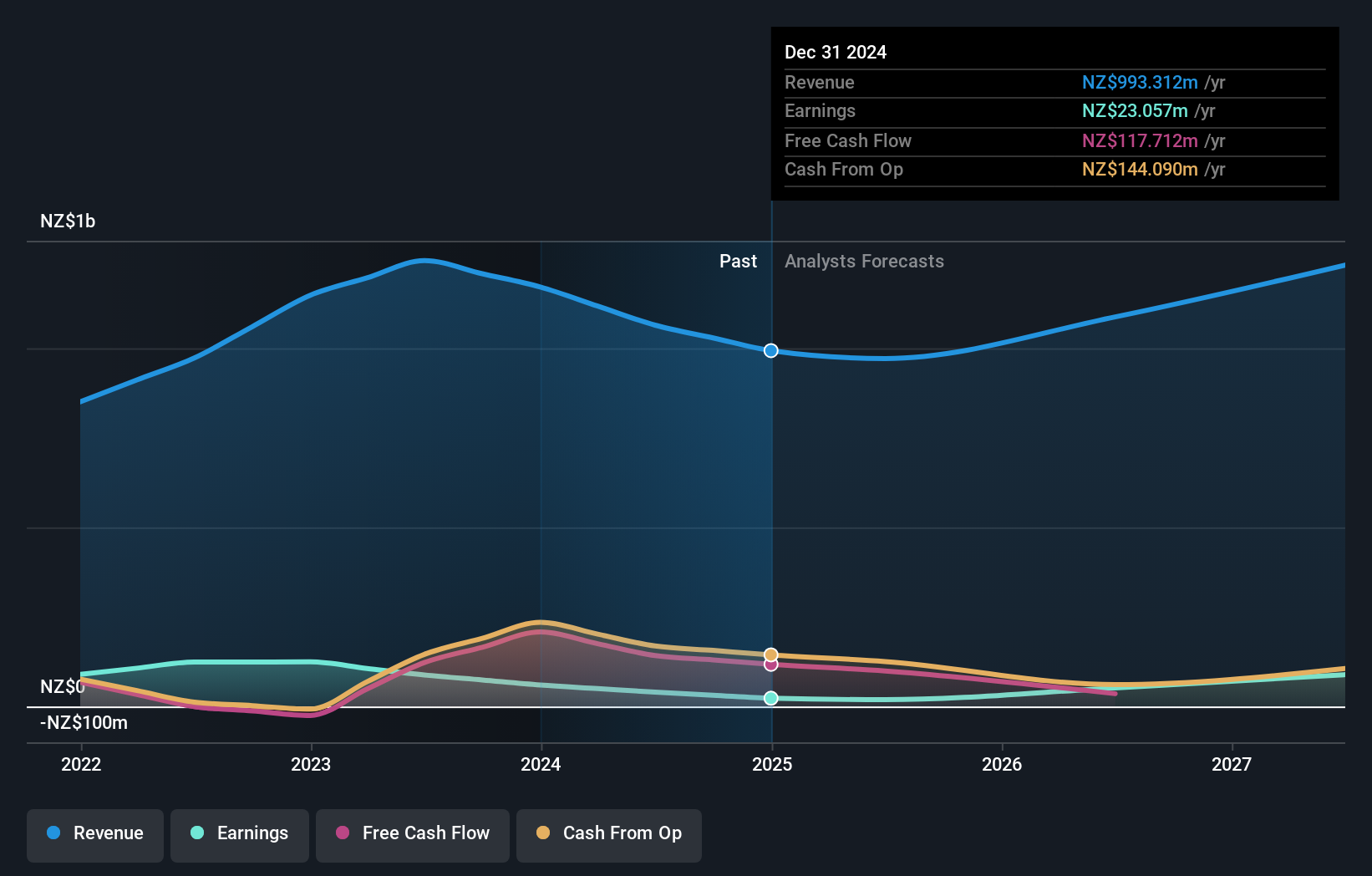

Overview: Vulcan Steel Limited, with a market cap of A$1.03 billion, operates in New Zealand and Australia focusing on the sale and distribution of steel and metal products through its subsidiaries.

Operations: The company's revenue is derived from two main segments: Steel, contributing NZ$428.87 million, and Metals, accounting for NZ$564.44 million.

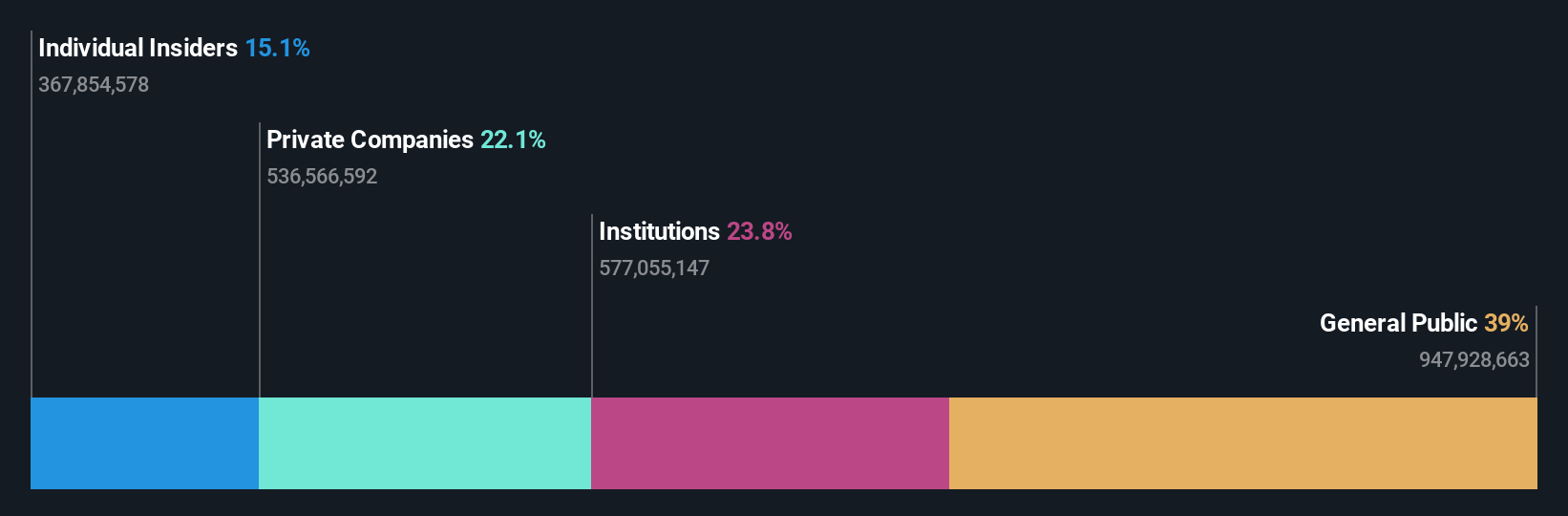

Insider Ownership: 38.4%

Earnings Growth Forecast: 37.7% p.a.

Vulcan Steel is poised for growth, with revenue forecasted to outpace the Australian market at 8.7% annually and earnings expected to grow significantly at 37.7% per year. Despite a recent decline in profit margins and earnings, the company remains financially sound with plans for strategic acquisitions to bolster its market presence. Insider activity shows more shares sold than bought recently, but Vulcan's high insider ownership aligns interests with shareholders amid an unstable dividend history.

- Click here and access our complete growth analysis report to understand the dynamics of Vulcan Steel.

- Our valuation report unveils the possibility Vulcan Steel's shares may be trading at a premium.

Where To Now?

- Take a closer look at our Fast Growing ASX Companies With High Insider Ownership list of 97 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SMI

Santana Minerals

Engages in the exploration and evaluation of gold and silver properties in New Zealand, Cambodia, and Mexico.

Flawless balance sheet with reasonable growth potential.