ASX Value Picks Including Kina Securities And 2 Others With Estimated Discount Pricing

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has dropped 1.3%, but it remains up 10% over the past year, with earnings forecast to grow by 12% annually. In this context, identifying undervalued stocks can offer investors opportunities to capitalize on potential growth at a discount, and this article will highlight three such picks including Kina Securities.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hansen Technologies (ASX:HSN) | A$4.35 | A$8.20 | 47% |

| Duratec (ASX:DUR) | A$1.40 | A$2.62 | 46.6% |

| Cettire (ASX:CTT) | A$1.56 | A$3.00 | 48% |

| HMC Capital (ASX:HMC) | A$7.84 | A$15.46 | 49.3% |

| Ansell (ASX:ANN) | A$29.88 | A$57.55 | 48.1% |

| Genesis Minerals (ASX:GMD) | A$2.11 | A$4.04 | 47.8% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Clover (ASX:CLV) | A$0.385 | A$0.72 | 46.7% |

| Ai-Media Technologies (ASX:AIM) | A$0.725 | A$1.42 | 49% |

| Superloop (ASX:SLC) | A$1.72 | A$3.31 | 48.1% |

We're going to check out a few of the best picks from our screener tool.

Kina Securities (ASX:KSL)

Overview: Kina Securities Limited (ASX:KSL) operates in Papua New Guinea, offering commercial banking, financial services, fund administration, investment management, and share brokerage services with a market cap of A$409.63 million.

Operations: Kina Securities Limited's revenue segments include PGK 391.80 million from Banking & Finance (Including Corporate) and PGK 39.65 million from Wealth Management.

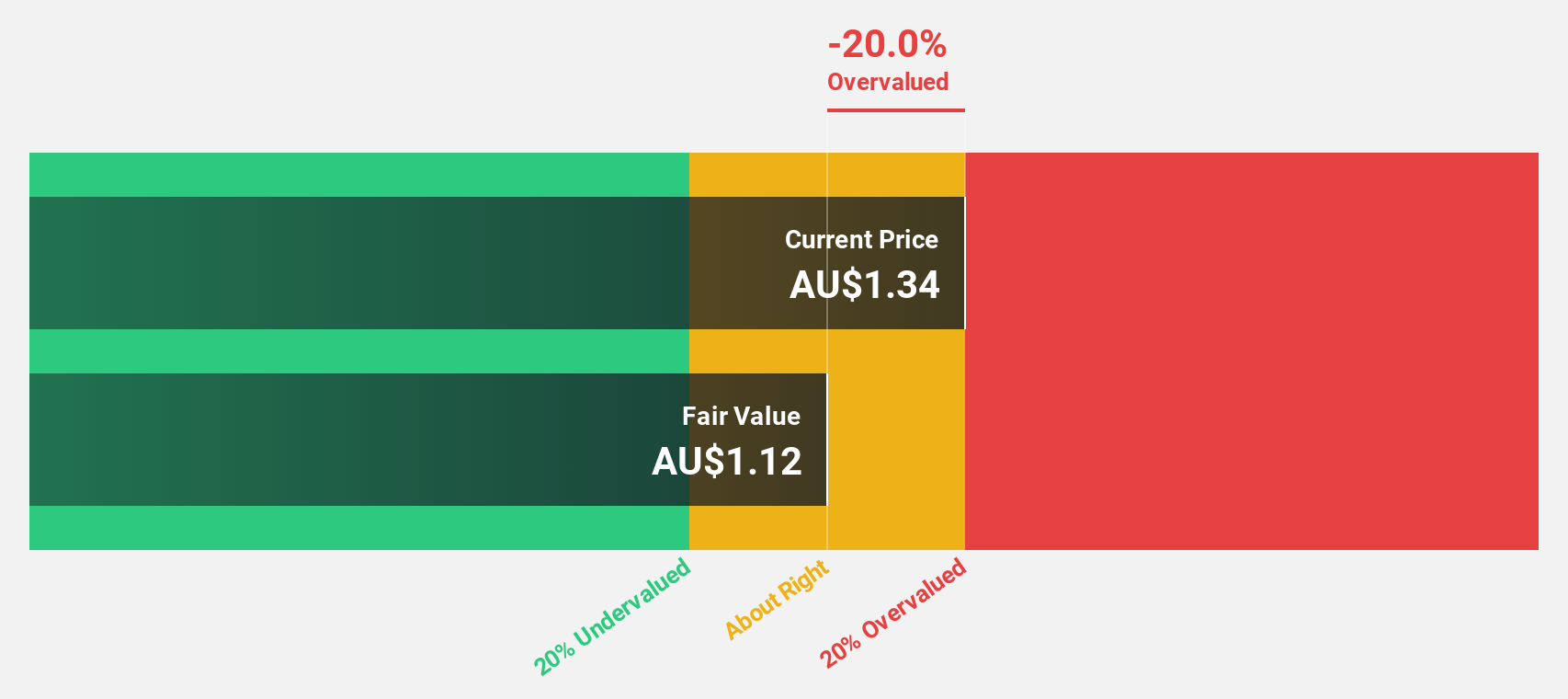

Estimated Discount To Fair Value: 12.4%

Kina Securities is trading at A$1.01, which is 12.4% below its fair value estimate of A$1.15, suggesting it may be undervalued based on cash flows. Despite a high level of bad loans (7.9%), the company reported net interest income of PGK 111.71 million for H1 2024, up from PGK 98.23 million a year ago, though net income slightly decreased to PGK 42.24 million from PGK 46.37 million last year.

- The growth report we've compiled suggests that Kina Securities' future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Kina Securities.

PWR Holdings (ASX:PWH)

Overview: PWR Holdings Limited designs, prototypes, produces, tests, validates, and sells cooling products and solutions across multiple international markets with a market cap of A$934.50 million.

Operations: Revenue segments for PWR Holdings include PWR C&R at A$41.98 million and PWR Performance Products at A$111.26 million.

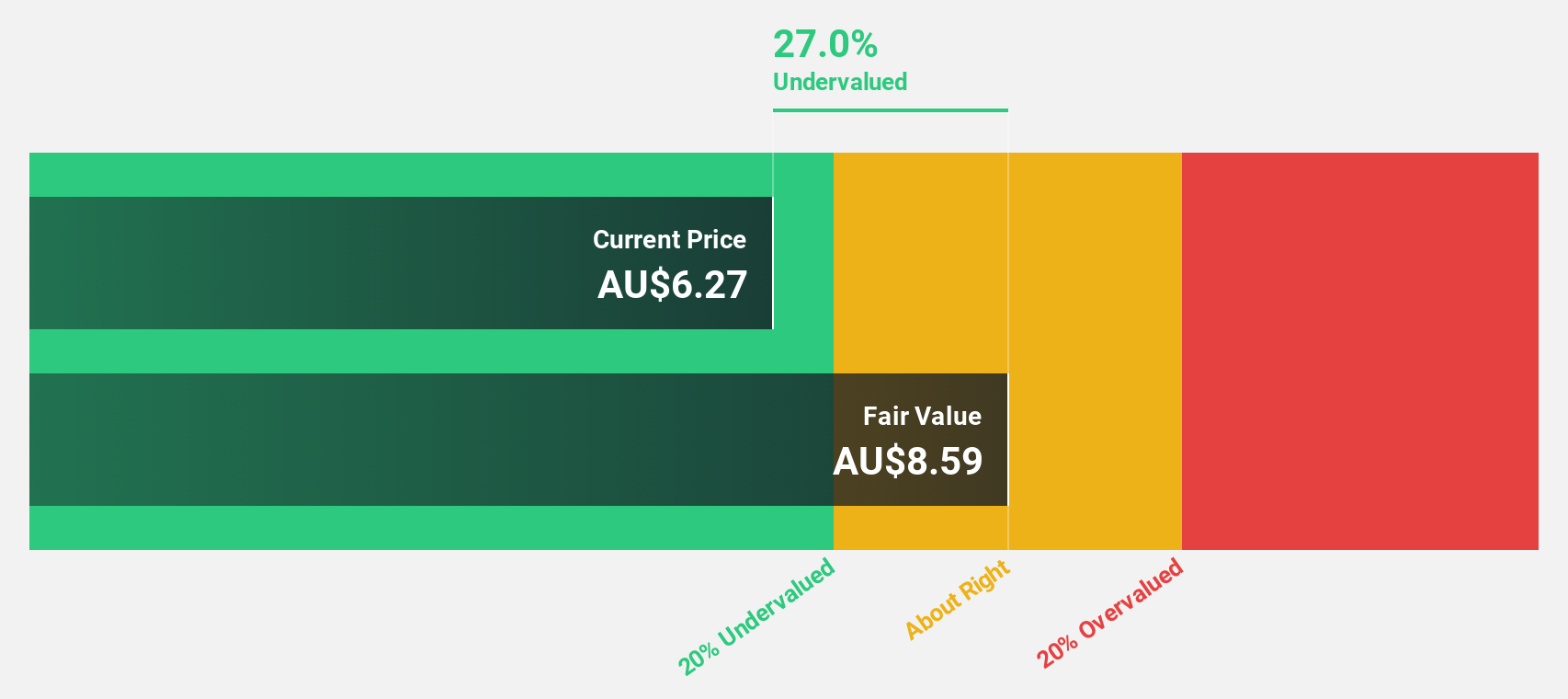

Estimated Discount To Fair Value: 18%

PWR Holdings, trading at A$9.05, is 18% below its fair value estimate of A$11.04, indicating potential undervaluation based on cash flows. The company reported full-year sales of A$97.53 million and net income of A$20.99 million, both up from the previous year. With earnings forecast to grow at 15% annually and a high return on equity projected at 27.9%, PWR Holdings shows strong financial health despite not being significantly undervalued by DCF standards.

- Our growth report here indicates PWR Holdings may be poised for an improving outlook.

- Get an in-depth perspective on PWR Holdings' balance sheet by reading our health report here.

Sandfire Resources (ASX:SFR)

Overview: Sandfire Resources Limited, with a market cap of A$3.89 billion, is a mining company involved in the exploration, evaluation, and development of mineral tenements and projects.

Operations: The company's revenue segments are comprised of $346.47 million from the Motheo Copper Project, $565.68 million from MATSA Copper Operations, and $29.40 million from Degrussa Copper Operations.

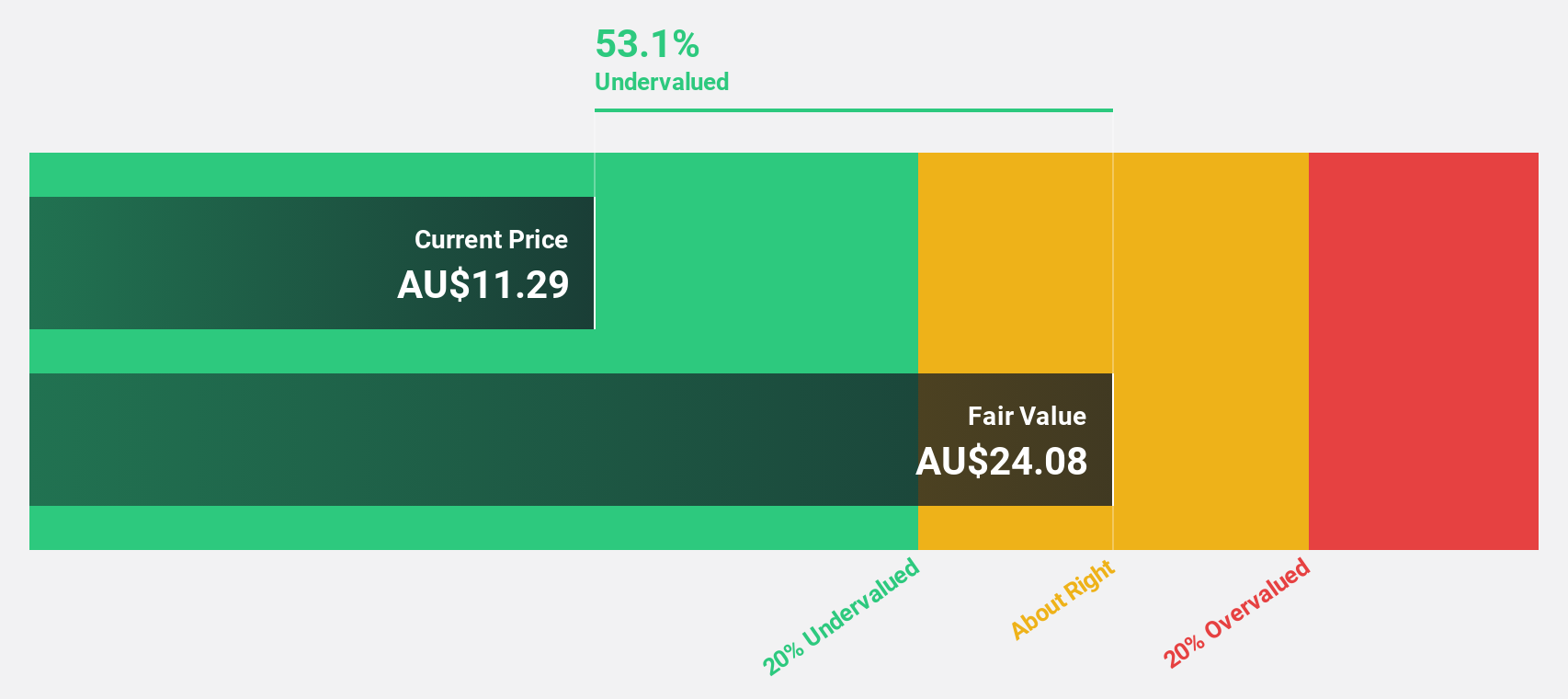

Estimated Discount To Fair Value: 44.3%

Sandfire Resources, trading at A$8.5, is significantly undervalued with a fair value estimate of A$15.26. Despite reporting a net loss of US$17.35 million for FY 2024, the company’s revenue grew to US$935.19 million from US$803.97 million the previous year. Forecasts indicate annual profit growth and profitability within three years, alongside an 8.5% annual revenue increase—outpacing the Australian market's growth rate of 5.3%.

- The analysis detailed in our Sandfire Resources growth report hints at robust future financial performance.

- Navigate through the intricacies of Sandfire Resources with our comprehensive financial health report here.

Make It Happen

- Embark on your investment journey to our 41 Undervalued ASX Stocks Based On Cash Flows selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Kina Securities, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kina Securities might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KSL

Kina Securities

Provides commercial banking and financial, fund administration, investment management, and share brokerage services in Papua New Guinea.

Good value with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives