- Australia

- /

- Metals and Mining

- /

- ASX:RNU

ASX Penny Stocks: 3 Picks With Market Caps Under A$3B

Reviewed by Simply Wall St

The Australian market recently ended flat, with the ASX struggling to break into positive territory despite some sectors showing strength. As investors navigate these fluctuating conditions, penny stocks remain an intriguing option for those seeking growth opportunities in smaller or newer companies. Although the term "penny stocks" may seem outdated, they continue to offer potential value when backed by strong financials and clear growth trajectories.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.485 | A$139M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.53 | A$119.35M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.83 | A$51.68M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.72 | A$418.78M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.30 | A$243.56M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.044 | A$51.47M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.071 | A$37.4M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.75 | A$358.29M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.28 | A$1.4B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 423 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Li-S Energy (ASX:LIS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Li-S Energy Limited focuses on developing and commercializing lithium sulphur and metal batteries in Australia, with a market cap of A$110.38 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: A$110.38M

Li-S Energy, with a market cap of A$110.38 million, remains pre-revenue and unprofitable, having reported a net loss of A$6.41 million for the year ending June 2025. Despite this, the company is debt-free and maintains sufficient cash runway for over two years based on current free cash flow trends. Recent executive changes saw Andrew Davies appointed as CFO, bringing extensive experience in finance and strategic planning to support commercialization efforts. While Li-S Energy's board is relatively new with an average tenure of 2.3 years, its management team averages 4.1 years in tenure, suggesting stability at the operational level.

- Unlock comprehensive insights into our analysis of Li-S Energy stock in this financial health report.

- Review our historical performance report to gain insights into Li-S Energy's track record.

NRW Holdings (ASX:NWH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NRW Holdings Limited, with a market cap of A$2.19 billion, offers diversified contract services to the resources and infrastructure sectors in Australia through its subsidiaries.

Operations: The company generates revenue from its segments with A$932.02 million from MET, A$823.72 million from Civil, and A$1.54 billion from Mining operations.

Market Cap: A$2.19B

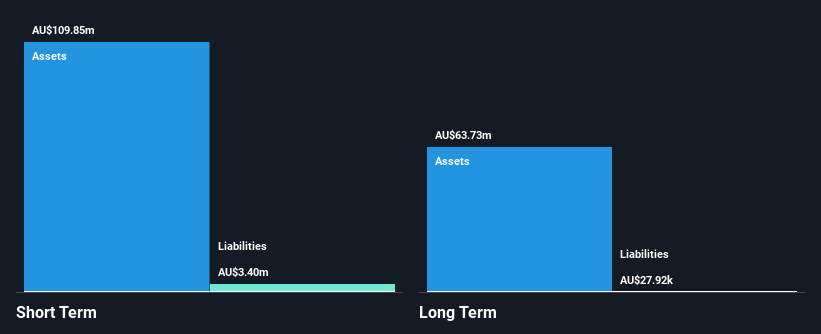

NRW Holdings Limited, with a market cap of A$2.19 billion, has demonstrated stable weekly volatility and no significant shareholder dilution over the past year. The company's revenue streams from MET, Civil, and Mining operations contribute to its robust financial structure, although recent earnings have declined significantly by 73.7%. Despite a low return on equity of 4.5%, NRW's debt is well covered by operating cash flow at 253.2%, and it maintains more cash than total debt. Recent announcements include an ordinary dividend increase and guidance for revenue exceeding A$3.4 billion in 2026 amidst ongoing M&A activities with Fredon Industries Pty Ltd.

- Navigate through the intricacies of NRW Holdings with our comprehensive balance sheet health report here.

- Learn about NRW Holdings' future growth trajectory here.

Renascor Resources (ASX:RNU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Renascor Resources Limited is an Australian company focused on the exploration, development, and evaluation of mineral properties, with a market capitalization of A$190.74 million.

Operations: The company's revenue segment is primarily derived from exploration activities for graphite, copper, gold, uranium, and other minerals, totaling A$0.075 million.

Market Cap: A$190.74M

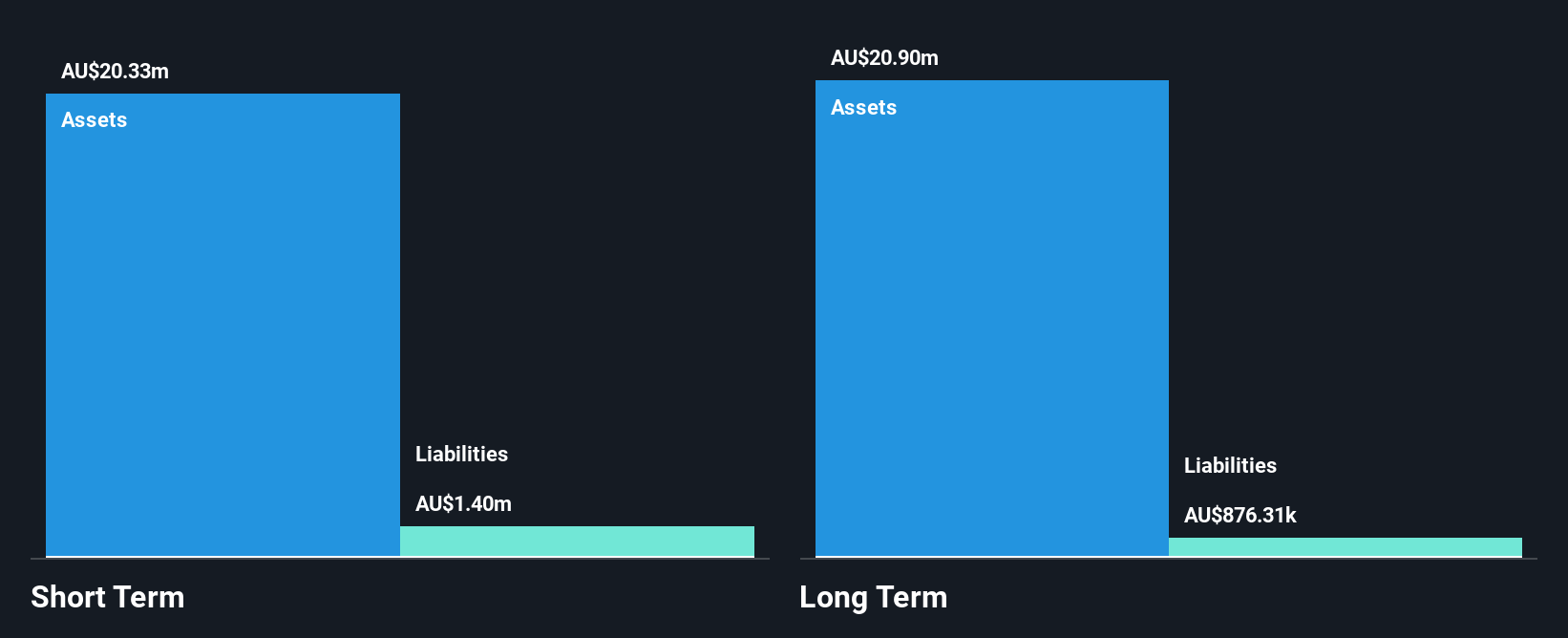

Renascor Resources, with a market cap of A$190.74 million, is pre-revenue, generating only A$0.075 million from exploration activities. Despite being debt-free for five years and having seasoned board members with an average tenure of 15 years, the company faces challenges such as low return on equity at 1.1% and profit margins lower than the previous year. Recent earnings growth has decelerated to 7.1%, below its five-year average of very large growth rates, and it was recently dropped from the S&P Global BMI Index in September 2025 due to performance considerations.

- Click here to discover the nuances of Renascor Resources with our detailed analytical financial health report.

- Gain insights into Renascor Resources' historical outcomes by reviewing our past performance report.

Make It Happen

- Click this link to deep-dive into the 423 companies within our ASX Penny Stocks screener.

- Searching for a Fresh Perspective? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RNU

Renascor Resources

Engages in the exploration, development, and evaluation of mineral properties in Australia.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives