- Australia

- /

- Metals and Mining

- /

- ASX:RMS

Is Now The Time To Put Ramelius Resources (ASX:RMS) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Ramelius Resources (ASX:RMS). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

How Fast Is Ramelius Resources Growing Its Earnings Per Share?

Ramelius Resources has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. Ramelius Resources' EPS skyrocketed from AU$0.20 to AU$0.25, in just one year; a result that's bound to bring a smile to shareholders. That's a fantastic gain of 27%.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of Ramelius Resources shareholders is that EBIT margins have grown from 30% to 54% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

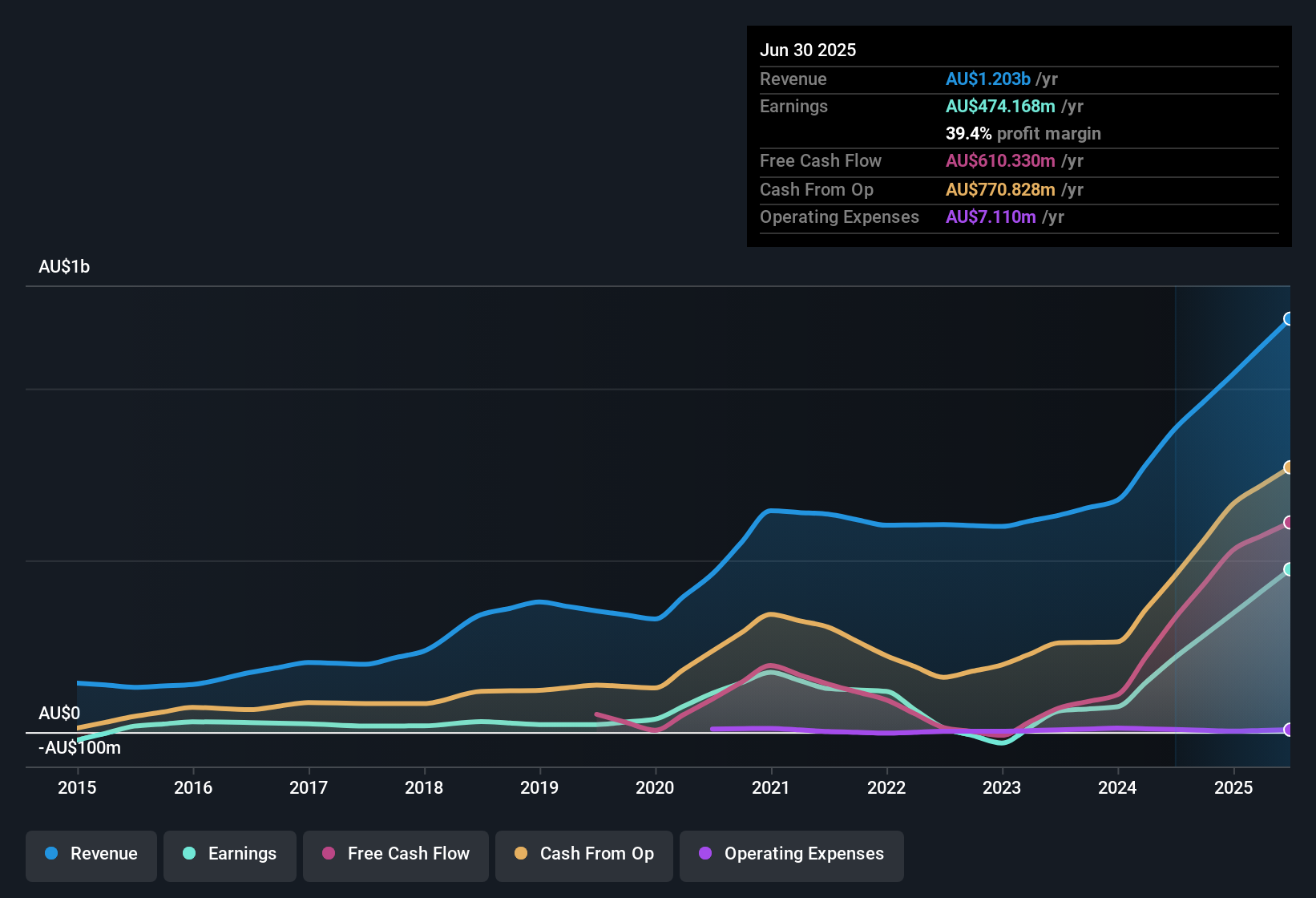

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

View our latest analysis for Ramelius Resources

Fortunately, we've got access to analyst forecasts of Ramelius Resources' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Ramelius Resources Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Not only did Ramelius Resources insiders refrain from selling stock during the year, but they also spent AU$80k buying it. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading.

On top of the insider buying, it's good to see that Ramelius Resources insiders have a valuable investment in the business. With a whopping AU$96m worth of shares as a group, insiders have plenty riding on the company's success. That's certainly enough to let shareholders know that management will be very focussed on long term growth.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. The cherry on top is that the CEO, Mark Zeptner is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalisations between AU$3.1b and AU$9.8b, like Ramelius Resources, the median CEO pay is around AU$3.1m.

The Ramelius Resources CEO received AU$2.2m in compensation for the year ending June 2025. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Ramelius Resources Deserve A Spot On Your Watchlist?

For growth investors, Ramelius Resources' raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant stake in the company and have been buying more shares. These things considered, this is one stock worth watching. We don't want to rain on the parade too much, but we did also find 2 warning signs for Ramelius Resources (1 doesn't sit too well with us!) that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Ramelius Resources, you'll probably love this curated collection of companies in AU that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:RMS

Ramelius Resources

Engages in the exploration, evaluation, mine development and operation, production, and sale of gold.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026