Orora's (ASX:ORA three-year decrease in earnings delivers investors with a 17% loss

As an investor its worth striving to ensure your overall portfolio beats the market average. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term Orora Limited (ASX:ORA) shareholders, since the share price is down 32% in the last three years, falling well short of the market return of around 42%.

Since Orora has shed AU$86m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

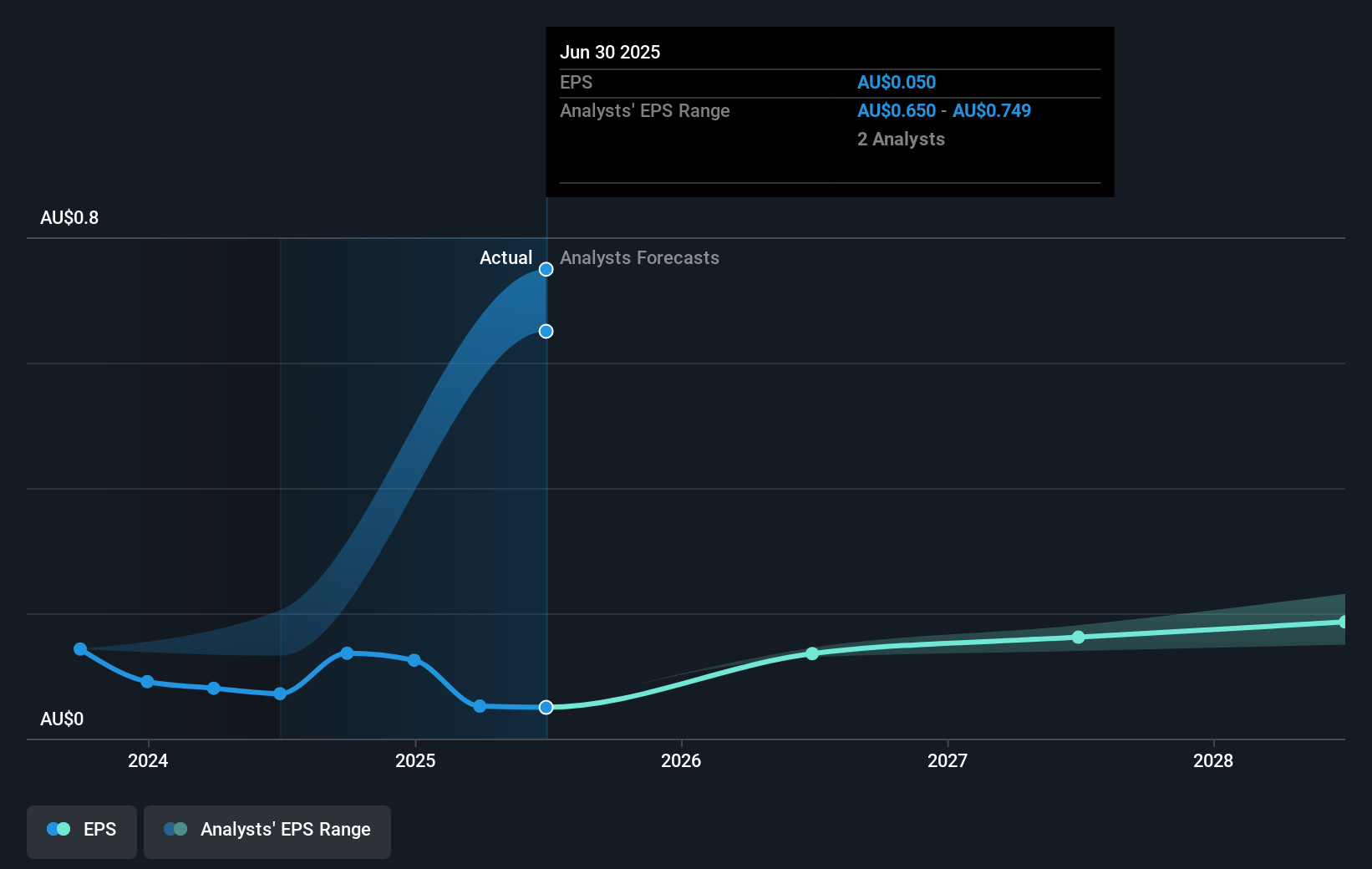

During the three years that the share price fell, Orora's earnings per share (EPS) dropped by 37% each year. In comparison the 12% compound annual share price decline isn't as bad as the EPS drop-off. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on Orora's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Orora the TSR over the last 3 years was -17%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Investors in Orora had a tough year, with a total loss of 13% (including dividends), against a market gain of about 13%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 0.4% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 4 warning signs we've spotted with Orora (including 1 which makes us a bit uncomfortable) .

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ORA

Orora

Designs, manufactures, and supplies packaging products and services in Australia, New Zealand, the United States, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Sunny Returns with On the Beach

High Quality Business and a true compounding machine

Roche Holding AG To Benefit From Strong Drug Pipeline In 2027 And Beyond

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

AGAG still in exploration, in bull market, such company will be the last to participate. It's high risk but can results in 20-30 baggers potential. The best play with current bull are with producers or near-producer miners, you can get 5-10 baggers with much lower risk. See my analysis on santacruz silver, andean silver.