3 Undervalued Small Caps In Asian Markets Backed By Insider Action

Reviewed by Simply Wall St

In recent weeks, Asian markets have shown resilience amid global economic uncertainties, with China's stock indices advancing as the government signals potential stimulus measures to counter trade tensions. As investors navigate this complex landscape, identifying small-cap stocks that are potentially undervalued and supported by insider activity can be a strategic approach to uncovering opportunities in the region's dynamic market environment.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.7x | 1.1x | 31.71% | ★★★★★★ |

| Puregold Price Club | 8.9x | 0.4x | 27.60% | ★★★★★☆ |

| Atturra | 28.3x | 1.2x | 38.96% | ★★★★★☆ |

| Hansen Technologies | 281.2x | 2.7x | 29.37% | ★★★★★☆ |

| Hong Leong Asia | 9.1x | 0.2x | 45.58% | ★★★★☆☆ |

| Collins Foods | 19.6x | 0.7x | 0.14% | ★★★★☆☆ |

| Dicker Data | 19.5x | 0.7x | -22.48% | ★★★★☆☆ |

| Sing Investments & Finance | 7.3x | 3.7x | 36.12% | ★★★★☆☆ |

| Viva Energy Group | NA | 0.1x | 12.08% | ★★★★☆☆ |

| Integral Diagnostics | 145.1x | 1.7x | 44.12% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

AMP (ASX:AMP)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: AMP is a financial services company involved in banking, wealth management, and investment solutions with a market capitalization of A$3.93 billion.

Operations: AMP generates revenue primarily from its AMP Bank, Platforms, Superannuation & Investments, and New Zealand Wealth Management segments. The company has seen fluctuations in net income margin over the years, with notable periods of negative margins. Operating expenses have consistently been a significant part of its cost structure. Gross profit margin has remained at 100% for several recent periods due to unspecified COGS data.

PE: 17.7x

AMP, a financial services company in Asia, is navigating the small-cap landscape with strategic moves aimed at growth. Despite interest payments not being well-covered by earnings and reliance on higher-risk external borrowing, AMP's forecasted 13% annual earnings growth suggests potential upside. Insider confidence is evident through share purchases over recent months. The company's revenue increased to A$2.87 billion for 2024, although net income declined to A$150 million from the previous year. With acquisitions back on AMP's agenda and new leadership like Tina Cleary enhancing brand strategy, they are positioning for future expansion amidst ongoing industry consolidation talks.

- Unlock comprehensive insights into our analysis of AMP stock in this valuation report.

Evaluate AMP's historical performance by accessing our past performance report.

Orora (ASX:ORA)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Orora is a packaging solutions company that provides a range of products and services including glass bottles, cans, and distribution services primarily in Australasia and North America, with a market cap of A$3.42 billion.

Operations: Orora generates revenue primarily through its operations, with significant costs attributed to COGS and operating expenses. The company's gross profit margin has shown an upward trend, reaching 19.49% by June 2024. Net income margins have fluctuated, with a notable increase in recent periods, peaking at around 5.10% in late 2018 before stabilizing near the mid-3% range by December 2024.

PE: 15.5x

Orora's recent financial performance highlights its potential as a small cap opportunity in Asia. The company reported impressive growth with sales reaching A$1.03 billion for the half-year ending December 2024, compared to A$624 million previously, and net income soaring to A$907.6 million from A$68.2 million year-on-year. Insider confidence is evident through share purchases over the past six months, signaling belief in Orora's prospects despite forecasted earnings declines of 20% annually over three years due to external borrowing risks.

- Delve into the full analysis valuation report here for a deeper understanding of Orora.

Understand Orora's track record by examining our Past report.

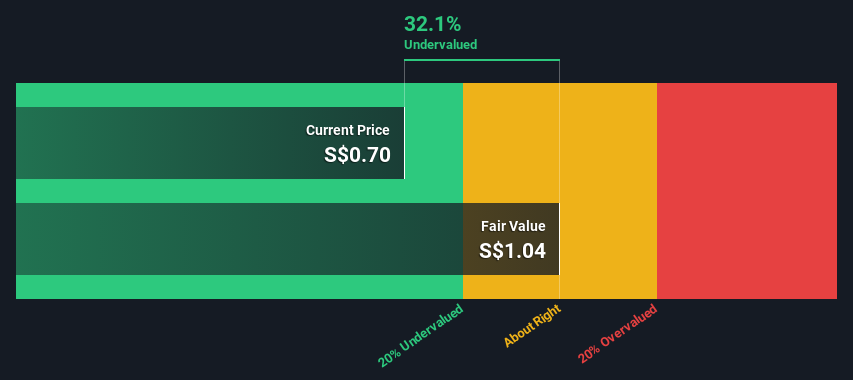

HRnetGroup (SGX:CHZ)

Simply Wall St Value Rating: ★★★☆☆☆

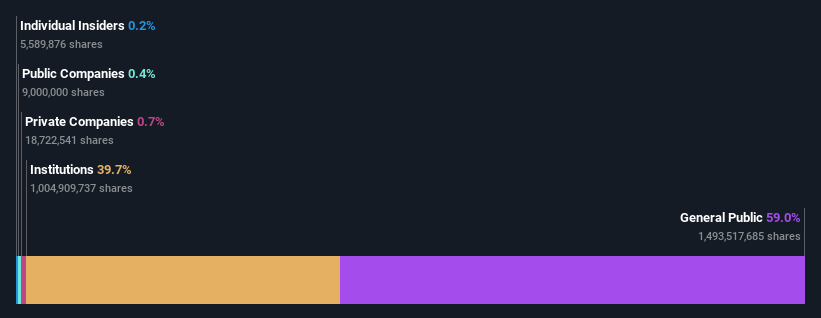

Overview: HRnetGroup is a Singapore-based company specializing in flexible staffing and professional recruitment services, with a market cap of approximately SGD 1.16 billion.

Operations: Flexible Staffing is the primary revenue stream, generating SGD 507.96 million, while Professional Recruitment contributes SGD 54.94 million. Over recent periods, the gross profit margin has shown a decreasing trend, reaching 21.55% by the end of 2024. Operating expenses have been consistently high relative to gross profit, with General & Administrative Expenses being a significant component at SGD 75.35 million in the latest period available.

PE: 15.4x

HRnetGroup, a small cap in Asia, reported a dip in sales to S$567 million for 2024 from the previous year. Despite this, insider confidence is evident through recent share purchases, signaling potential optimism about future growth. The company announced a final dividend of 2.13 cents per share, pending approval. However, net income fell to S$44.52 million from S$63.56 million last year amid leadership changes with Madeline Wan stepping down as Group Managing Director for Greater China and Japan businesses by February's end.

- Click here to discover the nuances of HRnetGroup with our detailed analytical valuation report.

Review our historical performance report to gain insights into HRnetGroup's's past performance.

Next Steps

- Discover the full array of 61 Undervalued Asian Small Caps With Insider Buying right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ORA

Orora

Designs, manufactures, and supplies packaging products and services to the grocery, fast moving consumer goods, and industrial markets in Australia, New Zealand, the United States, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives