- Australia

- /

- Metals and Mining

- /

- ASX:OBM

Undiscovered Gems In Australia For January 2025

Reviewed by Simply Wall St

As the Australian market continues to show resilience with the ASX200 closing up 1.38% at 8,327 points, investors are closely watching economic indicators like unemployment and inflation that could influence future interest rate decisions by the Reserve Bank of Australia. In this climate, where financials and real estate sectors are performing well, identifying small-cap stocks with strong fundamentals and growth potential can be particularly rewarding for those looking to uncover hidden opportunities in January 2025.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Schaffer | 24.98% | 2.97% | -6.23% | ★★★★★★ |

| Bisalloy Steel Group | 0.95% | 10.27% | 24.14% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Bailador Technology Investments | NA | 11.17% | 10.16% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Catalyst Metals (ASX:CYL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Catalyst Metals Limited is an Australian company focused on the exploration and evaluation of mineral properties, with a market capitalization of A$707.33 million.

Operations: Catalyst Metals Limited generates revenue primarily from its operations in Western Australia and Tasmania, with contributions of A$243.77 million and A$75.08 million, respectively.

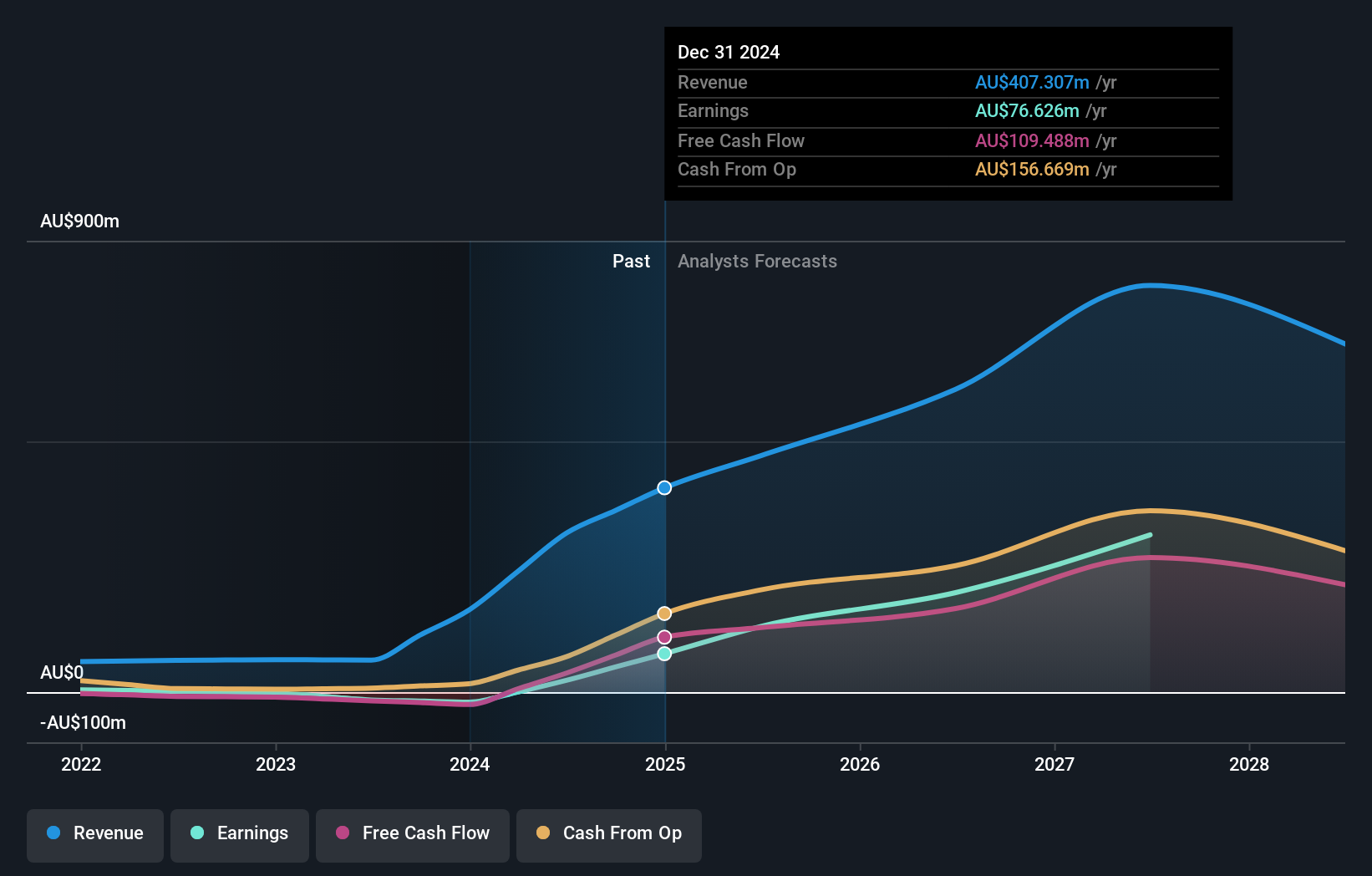

Catalyst Metals, a smaller player in the metals and mining sector, has shown promising developments recently. The company achieved profitability this year, with earnings projected to grow 31% annually. Despite a debt-to-equity ratio increase to 1.8% over five years, interest payments are well covered by EBIT at 6.3 times coverage. Trading at a significant discount of 81% below estimated fair value suggests potential upside for investors considering its high-quality earnings profile and positive free cash flow status. Recent gold production figures reached 28.4koz in December 2024, indicating operational stability across their Henty and Plutonic sites.

- Unlock comprehensive insights into our analysis of Catalyst Metals stock in this health report.

Evaluate Catalyst Metals' historical performance by accessing our past performance report.

Generation Development Group (ASX:GDG)

Simply Wall St Value Rating: ★★★★★★

Overview: Generation Development Group Limited focuses on the marketing and management of life insurance and life investment products and services in Australia, with a market capitalization of A$1.14 billion.

Operations: The primary revenue streams for Generation Development Group Limited include Benefit Funds, generating A$316.26 million, and Benefit Funds Management & Funds Administration, contributing A$37.26 million. The company also derives a smaller portion of its revenue from Other Business activities amounting to A$3.54 million.

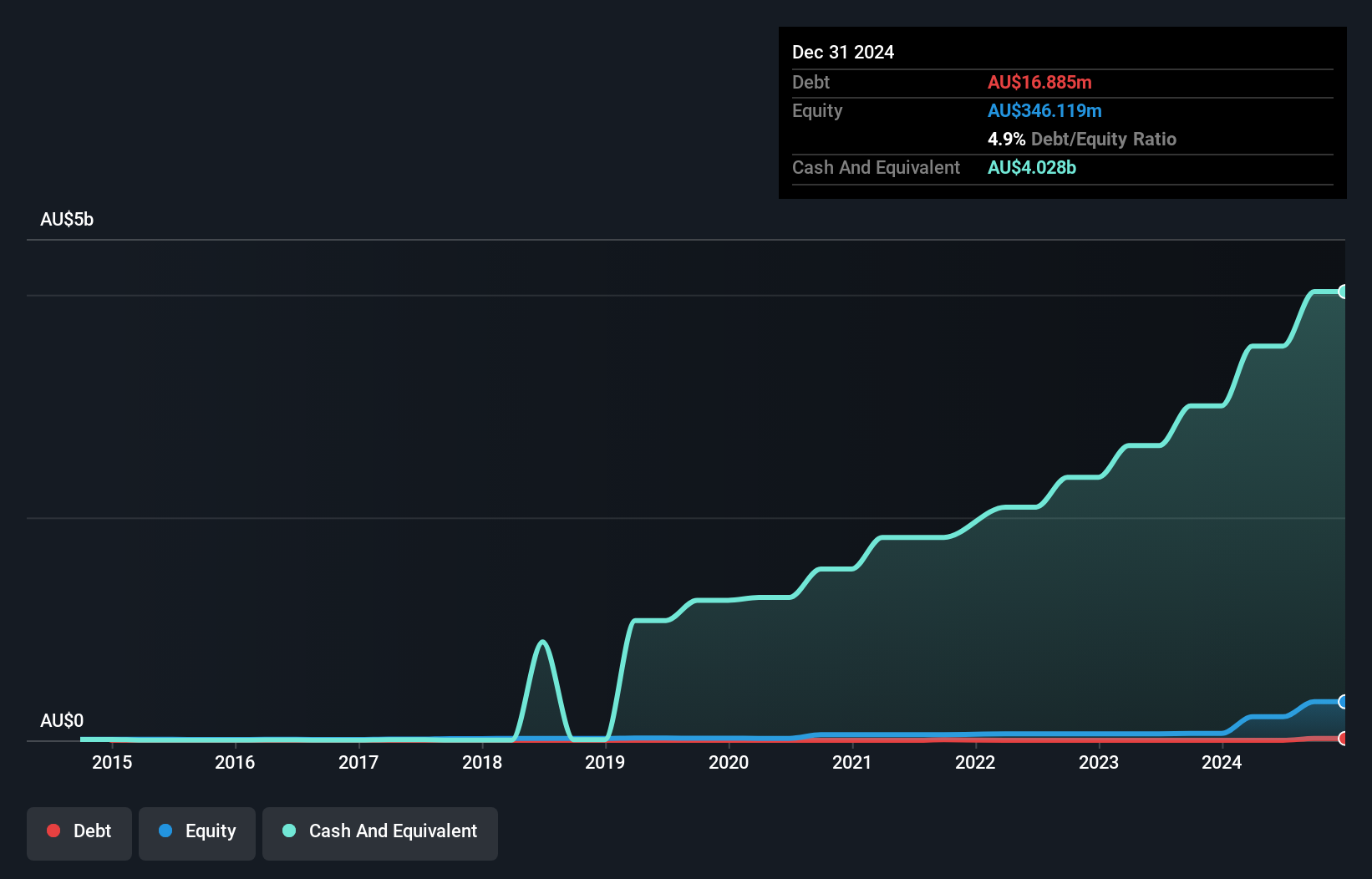

Generation Development Group, a nimble player in the insurance sector, has shown impressive earnings growth of 30% over the past year, outpacing its industry peers. The company operates without debt and boasts high-quality earnings. Despite these strengths, recent shareholder dilution is notable. Leadership changes are underway with Rob Coombe stepping up as Executive Chairman and Grant Hackett taking over as CEO from January 2025. These moves aim to drive strategic initiatives and growth for the group in the coming years. With free cash flow positive at A$16 million recently, GDG seems poised for potential expansion.

Ora Banda Mining (ASX:OBM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ora Banda Mining Limited is an Australian company focused on the exploration, operation, and development of mineral properties, with a market capitalization of A$1.45 billion.

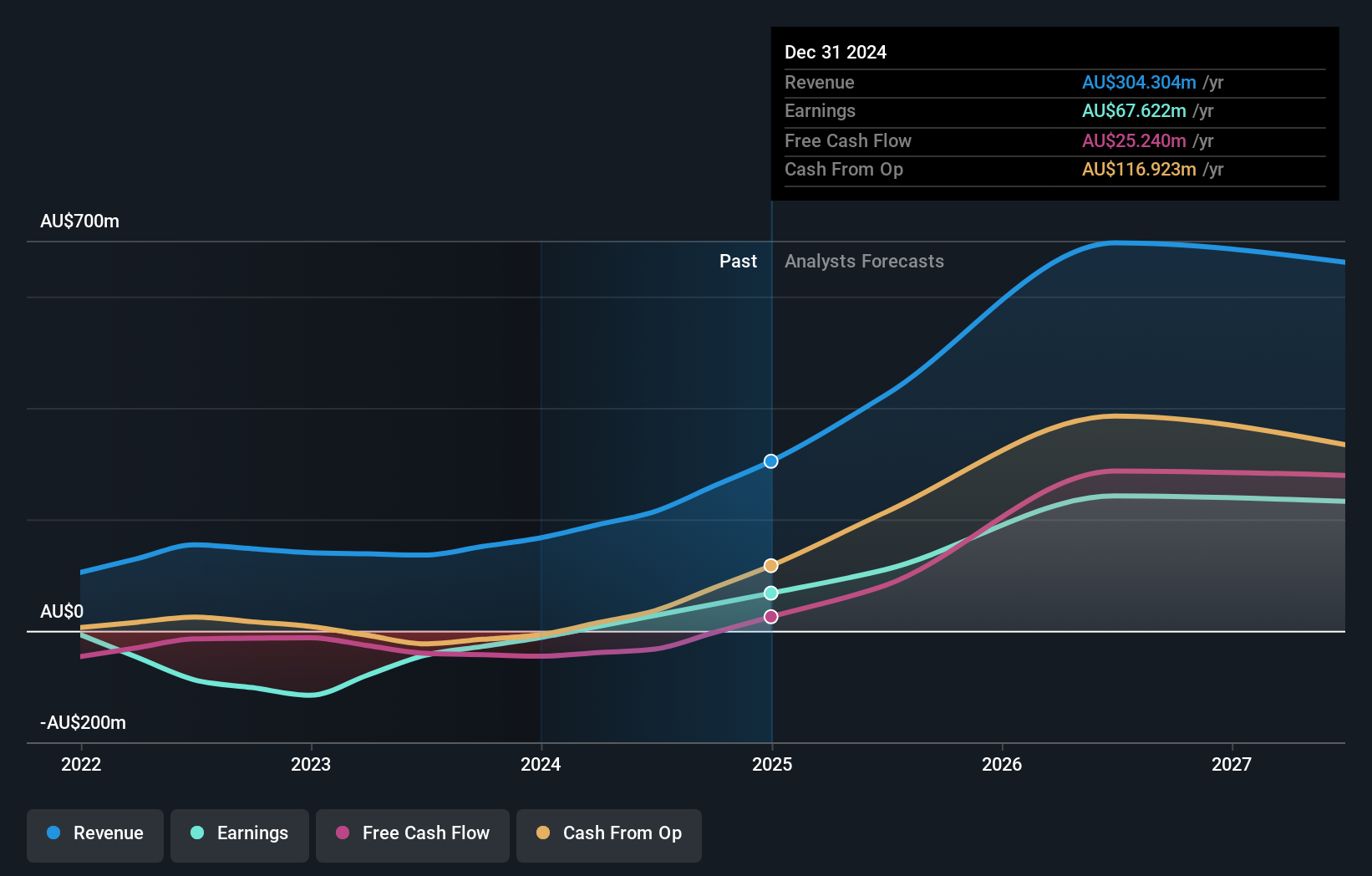

Operations: Ora Banda Mining generates revenue primarily from its gold mining operations, amounting to A$214.24 million.

Ora Banda Mining, a dynamic player in the Australian mining sector, has shown significant financial shifts over the past five years. The debt to equity ratio increased from 0% to 4.1%, indicating a cautious use of leverage. Despite shareholder dilution last year, OBM trades at an attractive 69.8% below its estimated fair value, suggesting potential undervaluation. With earnings forecasted to grow by nearly 46% annually and interest payments well covered by EBIT at a multiple of 7.8x, OBM's profitability trajectory appears promising within its industry context despite challenges in free cash flow positivity.

Key Takeaways

- Unlock more gems! Our ASX Undiscovered Gems With Strong Fundamentals screener has unearthed 48 more companies for you to explore.Click here to unveil our expertly curated list of 51 ASX Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:OBM

Ora Banda Mining

Engages in the exploration, operation, and development of mineral properties in Australia.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives