- Australia

- /

- Metals and Mining

- /

- ASX:OBM

Ora Banda Mining (ASX:OBM) Is Up 27.8% After Major Waihi Drilling Success and New Lode Discovery

Reviewed by Simply Wall St

- Ora Banda Mining Limited recently reported exceptional drilling results at its Waihi deposit, successfully extending the Waihi West Lode over 350 meters below the surface and uncovering a new lode system near the historical Golden Pole mine.

- This exploration success has strengthened the potential for Waihi to become a third underground mine at the Davyhurst Project, increasing the company’s resource base and operational prospects.

- We'll explore how these significant drilling results and resource expansion efforts may influence Ora Banda Mining's broader investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Ora Banda Mining's Investment Narrative?

For anyone considering a stake in Ora Banda Mining, the key conviction centers on belief in the firm’s ability to convert resource exploration wins, like those just announced at Waihi, into sustainable long-term production and cash flows. The exceptional Waihi drilling results and the potential to unlock a third underground mine could shift the biggest short-term catalysts, previously focused on delivering to guidance and boosting operating margins, toward how quickly and efficiently new resources can be brought into development. This recent news also has the effect of easing some earlier concerns around resource depletion, at least for now. Still, with the company’s share price having surged after the announcement, and some analysts setting price targets below current levels, the risk of over-optimism creeping in may have increased alongside the operational opportunities. On the other hand, integrating these new discoveries into profitable production may not be without its challenges.

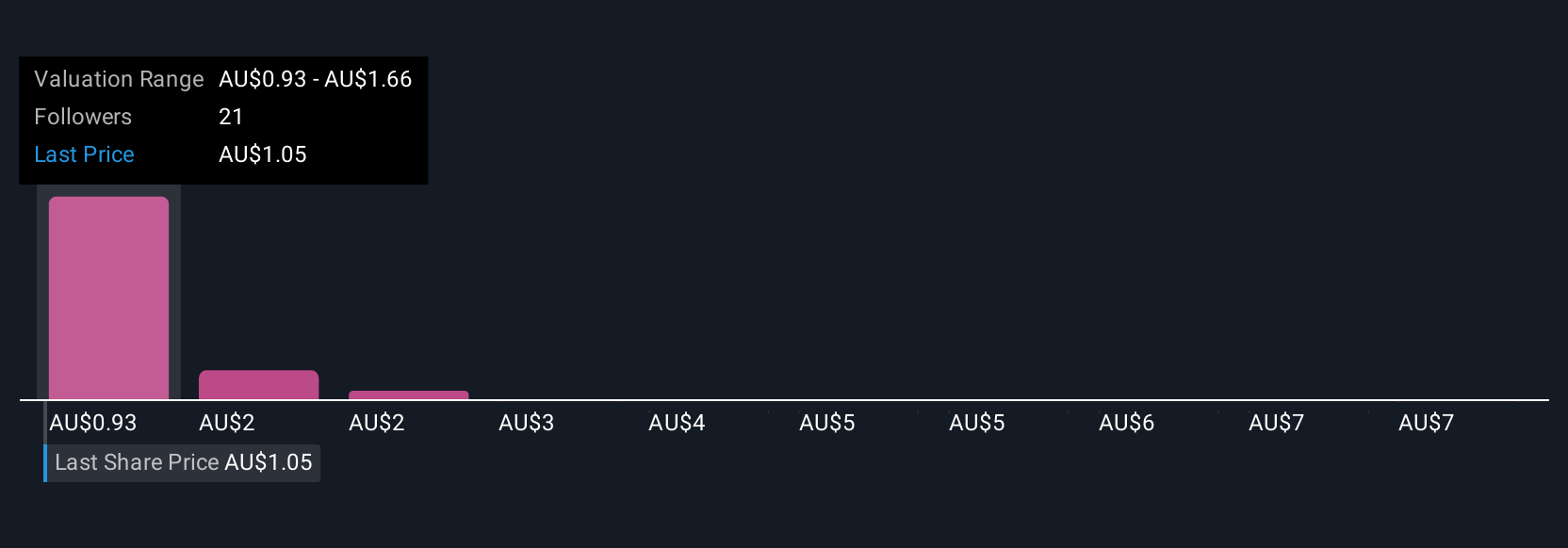

Ora Banda Mining's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 14 other fair value estimates on Ora Banda Mining - why the stock might be worth 14% less than the current price!

Build Your Own Ora Banda Mining Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ora Banda Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ora Banda Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ora Banda Mining's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:OBM

Ora Banda Mining

Engages in the exploration, operation, and development of mineral properties and mining in Australia.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives