- Australia

- /

- Metals and Mining

- /

- ASX:OBM

Ora Banda Mining (ASX:OBM): Assessing Valuation Following Record Gold Production and Operational Gains

Reviewed by Kshitija Bhandaru

Ora Banda Mining (ASX:OBM) caught attention after reporting record gold production in the latest quarter. This performance was driven by higher output at its Sand King underground mine and efficiency gains at the Davyhurst plant.

See our latest analysis for Ora Banda Mining.

Ora Banda Mining’s recent record-setting quarter has clearly resonated with shareholders, with the company posting a remarkable 16.8% share price return over the past month and an 89.4% jump year-to-date. The longer-term story is even more striking, as the total shareholder return reaches 98% over the past year and an eye-catching 1,424% over three years. This shows real growth momentum building as a result of operational improvements and rising production.

If this kind of turnaround sparks your curiosity, it might be a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

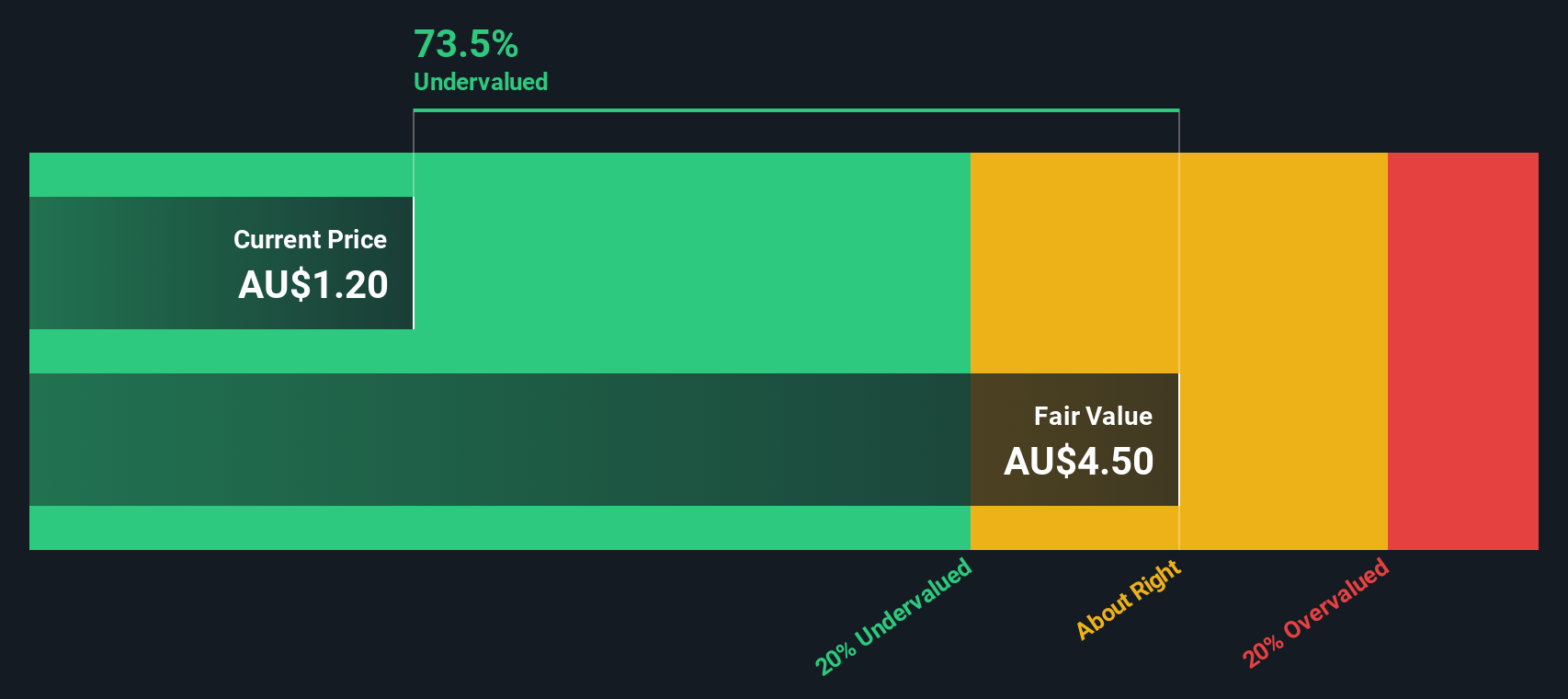

But with such powerful gains and strong operational momentum, the real question now is whether Ora Banda Mining remains undervalued, or if the share price already reflects all its future growth potential. Is this still a buying opportunity, or is the market one step ahead?

Price-to-Earnings of 12.7x: Is it justified?

Ora Banda Mining's price-to-earnings ratio stands at 12.7x, which places the current share price well below both its industry and peer averages. This suggests the market may be discounting the company’s improving performance.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for every dollar of earnings. For a gold producer like Ora Banda Mining, this metric provides a quick snapshot of how the market values its current profits relative to similar companies.

At 12.7x, Ora Banda Mining is priced less aggressively than the broader Australian Metals and Mining industry, which trades at an average of 21.8x earnings. The gap is even wider compared to direct peers, whose average multiple is a significant 63.6x. This disparity suggests Ora Banda Mining could be significantly undervalued relative to both its competitors and the broader sector. Notably, the company is also trading below the estimated Fair Price-to-Earnings Ratio of 22.4x, a level that the market could move toward if its growth momentum continues and operational improvements persist.

Explore the SWS fair ratio for Ora Banda Mining

Result: Price-to-Earnings of 12.7x (UNDERVALUED)

However, investors should watch for potential volatility if gold prices fall or if operational challenges emerge at Ora Banda’s key mining sites.

Find out about the key risks to this Ora Banda Mining narrative.

Another View: What Does the SWS DCF Model Say?

Shifting from earnings multiples to a different lens, our SWS DCF model estimates Ora Banda Mining’s fair value at A$3.91 per share. With the current price at A$1.25, the model suggests a discount of 68%, implying the company could be far more undervalued than pricing ratios alone indicate. So is the gap a real opportunity, or is the market factoring in risks that the numbers do not capture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ora Banda Mining for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ora Banda Mining Narrative

If you have your own perspective on Ora Banda Mining's outlook, why not dive in and analyze the numbers for yourself? See the story from your own angle. You can shape your view in just minutes with Do it your way

A great starting point for your Ora Banda Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know the best opportunities do not wait around long. Get ahead by taking a closer look at new trends and untapped value across the market.

- Capitalize on high yields by checking out these 19 dividend stocks with yields > 3% for reliable income potential in dynamic market conditions.

- Ride the AI investment wave and see which companies stand out by viewing these 24 AI penny stocks that are shaping tomorrow’s industries.

- Catch hidden gems trading below their worth with these 898 undervalued stocks based on cash flows before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:OBM

Ora Banda Mining

Engages in the exploration, operation, and development of mineral properties and mining in Australia.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)