- Australia

- /

- Metals and Mining

- /

- ASX:AMI

ASX Penny Stocks To Watch In December 2025

Reviewed by Simply Wall St

As the Australian market shows signs of a potential rally to close out the year, investors are keenly watching for opportunities that align with these shifting dynamics. Penny stocks, often seen as relics from past market eras, continue to attract attention due to their affordability and growth potential. By focusing on those with strong financial foundations and clear paths forward, investors may uncover promising opportunities among these smaller or newer companies.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.41 | A$117.5M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.495 | A$70.52M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.78 | A$48.57M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.88 | A$442.63M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.12 | A$230.45M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.074 | A$38.98M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.90 | A$3.31B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.24 | A$1.37B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.94 | A$135.3M | ✅ 4 ⚠️ 3 View Analysis > |

| GWA Group (ASX:GWA) | A$2.41 | A$632.09M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 427 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Argosy Minerals (ASX:AGY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Argosy Minerals Limited, with a market cap of A$145.91 million, is involved in the exploration and development of lithium properties in Argentina and the United States.

Operations: Argosy Minerals Limited does not currently report any revenue segments.

Market Cap: A$145.91M

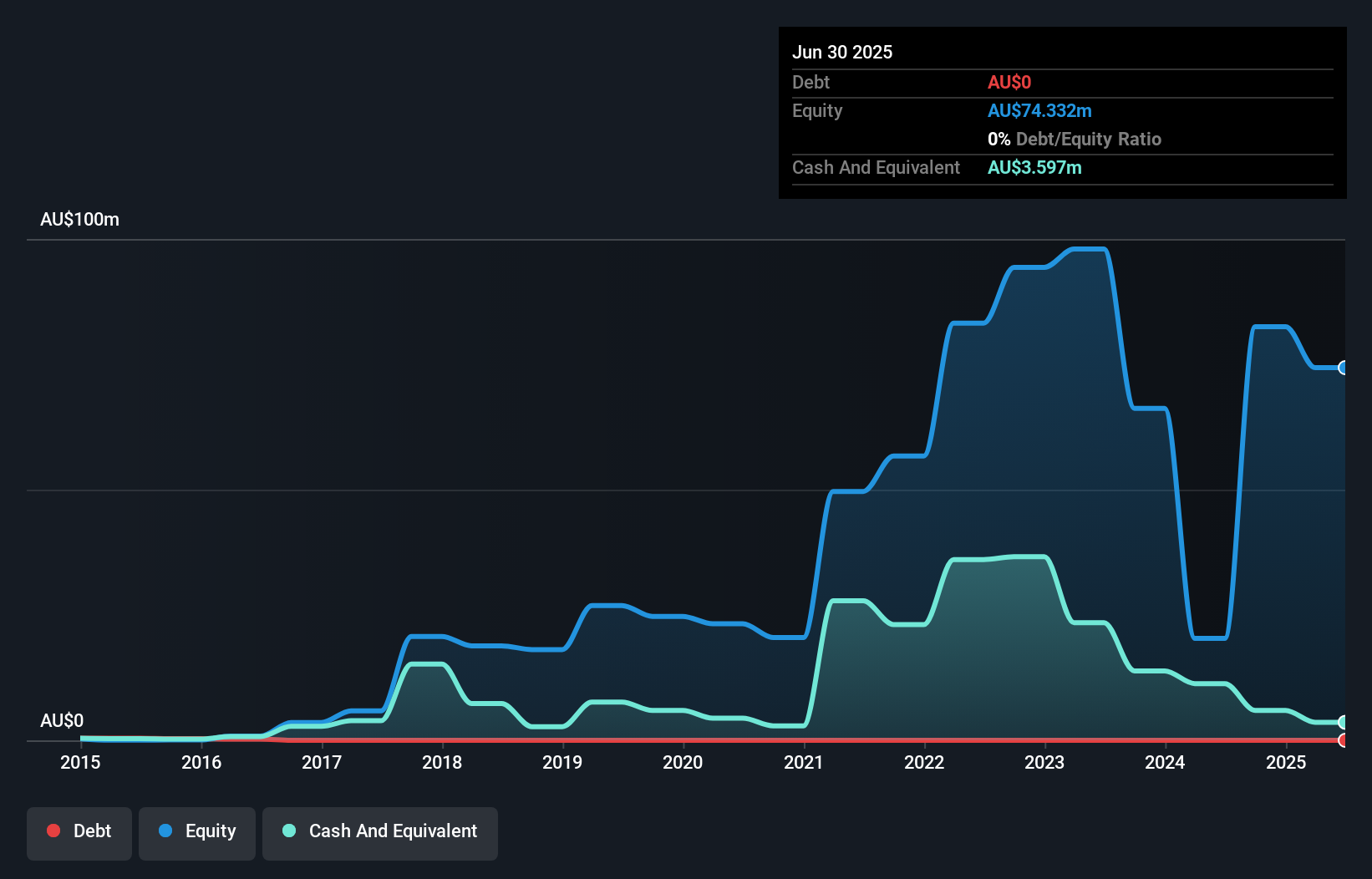

Argosy Minerals, with a market cap of A$145.91 million, is pre-revenue and has recently become profitable, marking a significant milestone for the company. The stock exhibits high volatility, higher than 75% of Australian stocks over the past year. Despite this volatility, Argosy's financial health appears solid with no debt and short-term assets exceeding both long-term and short-term liabilities. The company's board is experienced with an average tenure of 3.7 years. Its outstanding Return on Equity at 66.2% suggests strong profitability potential relative to its peers in the industry despite being pre-revenue.

- Unlock comprehensive insights into our analysis of Argosy Minerals stock in this financial health report.

- Gain insights into Argosy Minerals' past trends and performance with our report on the company's historical track record.

Aurelia Metals (ASX:AMI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aurelia Metals Limited is an Australian company involved in the exploration and production of mineral properties, with a market capitalization of A$440.07 million.

Operations: Aurelia Metals generates revenue from its operations at the Peak Mine (A$290.14 million), Hera Mine (A$31.32 million), and Dargues Mine (A$22.01 million).

Market Cap: A$440.07M

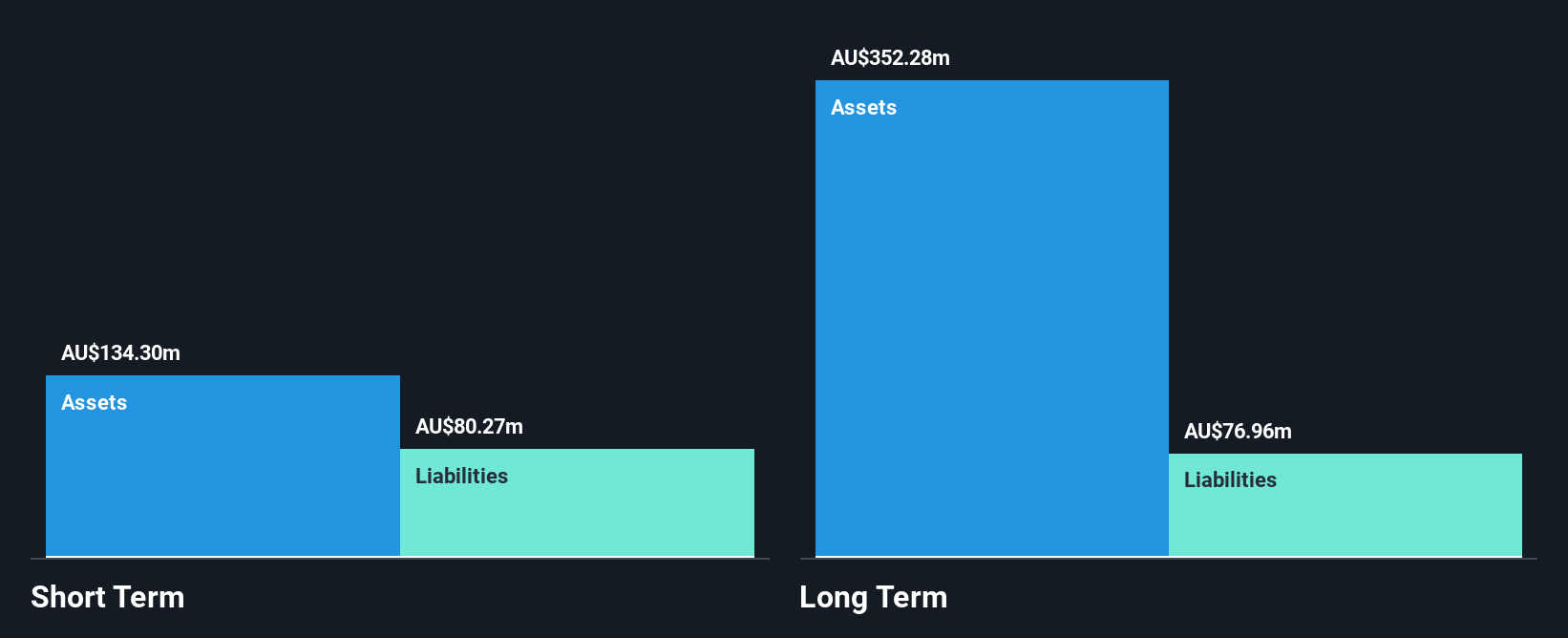

Aurelia Metals, with a market cap of A$440.07 million, has transitioned to profitability in the past year, supported by revenues from its Peak (A$290.14 million), Hera (A$31.32 million), and Dargues Mines (A$22.01 million). Its financial health is robust, with cash exceeding total debt and short-term assets covering liabilities comfortably. The company's interest payments are well covered by EBIT at 7.6 times coverage, indicating strong operational efficiency despite a low Return on Equity of 13.5%. Recent board changes highlight an ongoing search for seasoned leadership to guide future growth strategies effectively.

- Navigate through the intricacies of Aurelia Metals with our comprehensive balance sheet health report here.

- Explore Aurelia Metals' analyst forecasts in our growth report.

Ora Banda Mining (ASX:OBM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ora Banda Mining Limited is an Australian company focused on the exploration, operation, and development of mineral properties, with a market cap of A$2.53 billion.

Operations: The company generates revenue from its gold mining operations, amounting to A$404.29 million.

Market Cap: A$2.53B

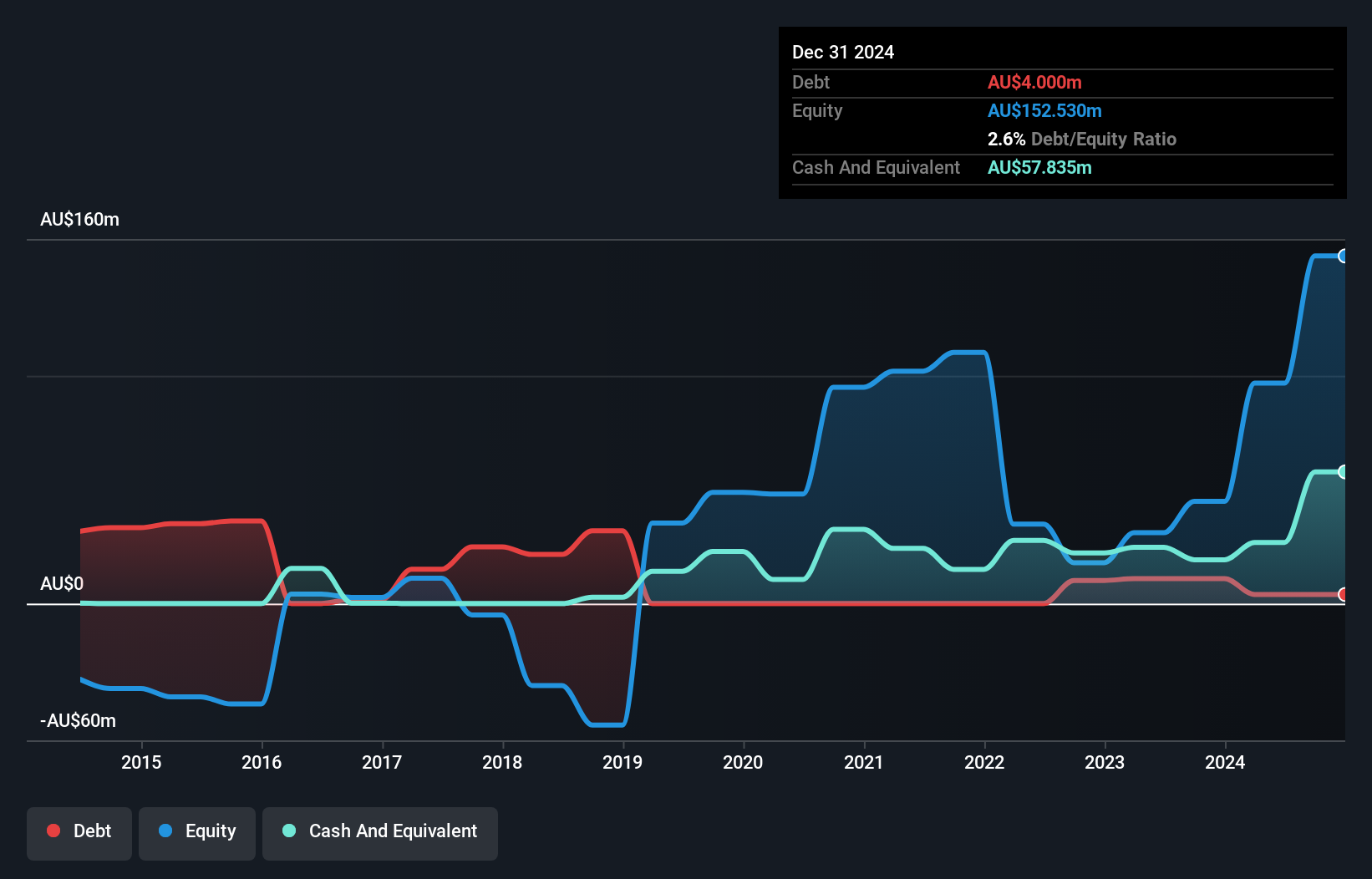

Ora Banda Mining, with a market cap of A$2.53 billion, has shown impressive financial performance, driven by substantial revenue from its gold mining operations totaling A$404.29 million. The company's earnings have grown significantly over the past year, outpacing industry averages and achieving an outstanding Return on Equity of 65%. Its short-term assets surpass both short- and long-term liabilities, indicating strong financial stability. Despite recent insider selling, Ora Banda's debt is well covered by operating cash flow and interest payments are comfortably managed. Recent executive changes include Doug Warden's appointment as CFO and Joint Company Secretary.

- Click here to discover the nuances of Ora Banda Mining with our detailed analytical financial health report.

- Evaluate Ora Banda Mining's prospects by accessing our earnings growth report.

Where To Now?

- Dive into all 427 of the ASX Penny Stocks we have identified here.

- Interested In Other Possibilities? We've found 13 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AMI

Aurelia Metals

Engages in the exploration and production of mineral properties in Australia.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)