- Australia

- /

- Metals and Mining

- /

- ASX:NTU

Northern Minerals (ASX:NTU) Is Up 23.5% After Securing Global Backing for Rare Earths Funding – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Earlier this week, Northern Minerals received non-binding and conditional letters of support from the U.S. Export-Import Bank and Export Finance Australia for potential debt funding of up to US$230 million to advance the Browns Range heavy rare earths project in Western Australia.

- This international government backing reflects the project's positioning within a broader US-Australia push to develop independent global supply chains for critical minerals such as dysprosium and terbium.

- We'll explore how international government financial support could reshape Northern Minerals' investment narrative as a future supplier of key rare earths.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Northern Minerals' Investment Narrative?

For investors considering Northern Minerals, the major long-term thesis hinges on the company's positioning as a potential non-Chinese supplier of heavy rare earths, a sector gaining strategic attention from Western governments. The recent news of coordinated, conditional support from the U.S. Export-Import Bank and Export Finance Australia for up to US$230 million in debt funding could mark a meaningful shift in the near-term catalysts. Access to this funding, if finalized, may alleviate pressing capital constraints and enhance project credibility just as global supply chain security comes under renewed scrutiny. It could also lift some ongoing concerns flagged in recent audits regarding the company’s ability to continue as a going concern. However, shareholders should balance this with risks tied to dilution from ongoing equity offerings, persistent losses, and boardroom uncertainties, all of which still hang over the investment case despite the jump in share price. But, unlike other rare earth hopefuls, one specific balance sheet risk still hangs over Northern Minerals.

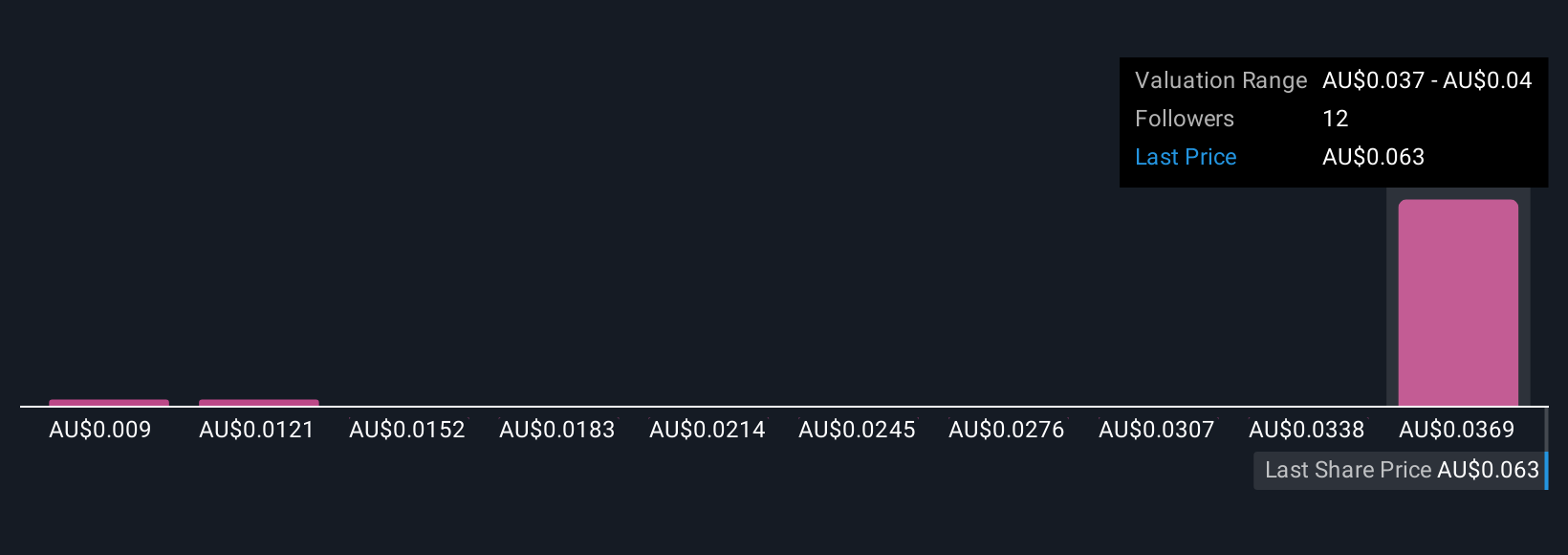

Our valuation report unveils the possibility Northern Minerals' shares may be trading at a premium.Exploring Other Perspectives

Explore 3 other fair value estimates on Northern Minerals - why the stock might be worth less than half the current price!

Build Your Own Northern Minerals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northern Minerals research is our analysis highlighting 6 important warning signs that could impact your investment decision.

- Our free Northern Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northern Minerals' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Northern Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NTU

Northern Minerals

Operates in the mineral exploration industry in Australia.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion