- Australia

- /

- Metals and Mining

- /

- ASX:NST

Northern Star Resources (ASX:NST): How Strong Earnings and a Higher Dividend Shape Today’s Valuation

Reviewed by Simply Wall St

If you’ve been on the fence about what to do with Northern Star Resources (ASX:NST), the company has just handed investors plenty to think about. Northern Star’s latest earnings release showed full-year sales surged to A$6.4 billion, up from A$4.9 billion last year, while net income more than doubled. Following those results, management also announced a higher ordinary dividend of A$0.30 per share. This increase puts extra cash directly into shareholders’ pockets and signals confidence in ongoing profitability. These developments have quickly become the talk of the market and offer fresh reasons to revisit the stock’s outlook.

This combination of stronger financial results and a richer dividend has caught investor attention at a time when momentum for Northern Star has been building. The share price is up 27% over the year, even as it cooled somewhat in the past three months. Despite short-term swings, the company has delivered solid long-term returns and annual revenue growth around 9%, all while boosting its bottom line. In addition, recent moves such as employee performance incentives indicate that management is focused on aligning strategy and value creation.

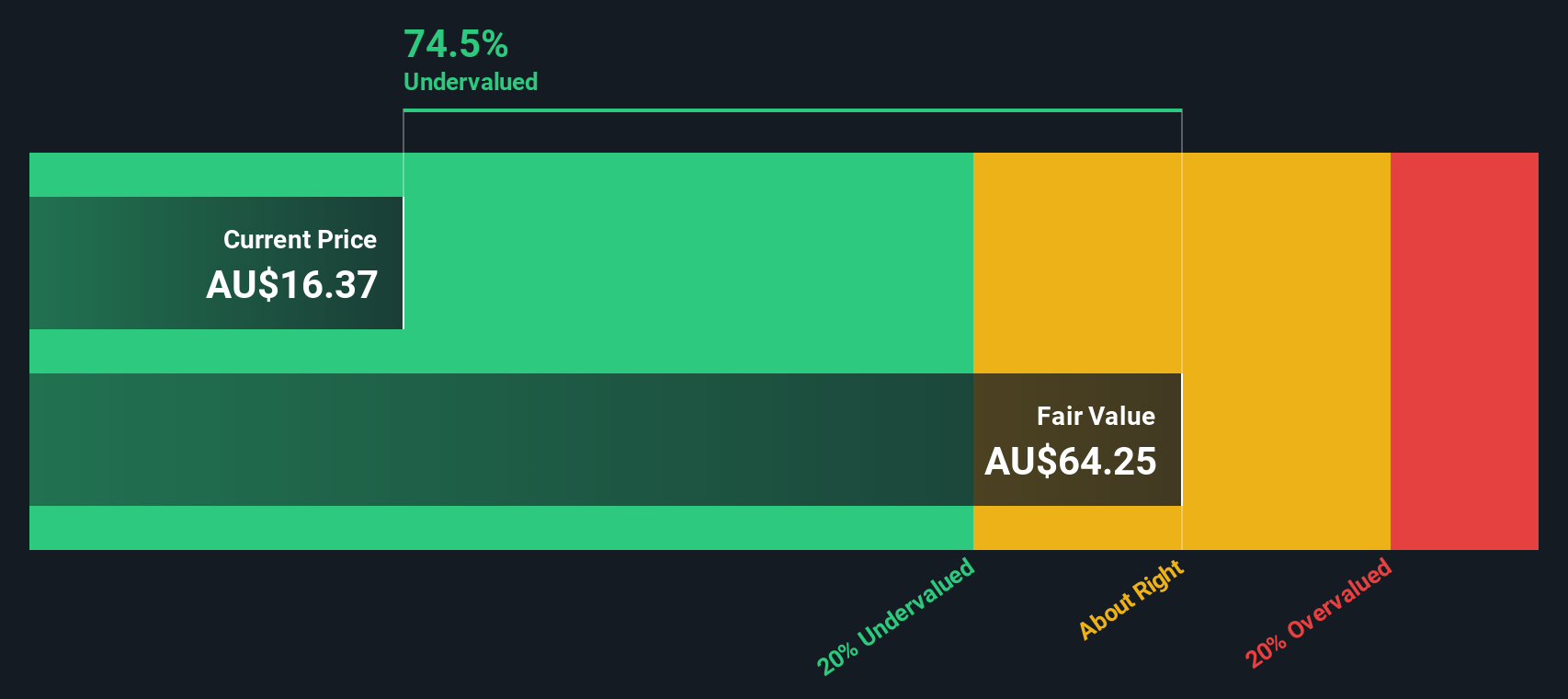

After such a run of good news, the big question remains: Is Northern Star Resources still undervalued after this rally, or has the latest growth already been factored into the price?

Most Popular Narrative: 5% Undervalued

According to community narrative, Northern Star Resources is currently seen as undervalued with a fair value about 5% higher than its market price. This view is based on assumptions of revenue expansion, growing margins, and continued success with the company's major projects and operational improvements.

Improvements and expansions at KCGM, including open pit and underground developments along with a mill expansion project, are expected to enhance mining efficiency and output, which could positively impact revenue and free cash flow generation.

Want to know the real reason analysts are targeting a higher price? This narrative relies on a future where operating leverage and margin expansion could influence the earnings outlook. The key factor is how new projects and operational gains may set the stage for a re-rating. Look closely to see what is really driving this bullish fair value, and consider what the numbers could indicate next.

Result: Fair Value of $19.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, operational setbacks and higher-than-expected costs, especially at KCGM, could quickly challenge this optimistic outlook for Northern Star Resources.

Find out about the key risks to this Northern Star Resources narrative.Another View: Our DCF Model’s Verdict

While most see the shares as slightly undervalued based on price targets and future earnings, our SWS DCF model comes to a different conclusion and suggests Northern Star could actually be overvalued at this time. Which approach is closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Northern Star Resources Narrative

If you see things differently or want to base your view on your own analysis, you can assemble your own narrative quickly and easily in just a few minutes, and do it your way.

A great starting point for your Northern Star Resources research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Why settle for the usual picks when there are standout opportunities waiting just beyond the headlines? Let Simply Wall Street’s screeners help you uncover stocks with strong upside potential and unique market advantages. Make your next investment move smarter and give yourself the edge you deserve. Check out these selected ideas:

- Target generous income streams as you review companies known for reliable payouts with dividend stocks with yields > 3%.

- Accelerate your portfolio’s growth by focusing on firms leading advancements in healthcare technology through healthcare AI stocks.

- Capture the potential of AI innovation by scouting bold businesses redefining what’s possible in tech with AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Star Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NST

Northern Star Resources

Engages in the exploration, development, mining, and processing of gold deposits.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives