- Australia

- /

- Metals and Mining

- /

- ASX:NST

Northern Star Resources (ASX:NST): Assessing Valuation After Strong Earnings Growth and Insider Confidence

Reviewed by Kshitija Bhandaru

Northern Star Resources (ASX:NST) has continued to attract investor attention because of its steady earnings growth and strengthening margins in recent years. High insider ownership also suggests ongoing conviction in the company’s future direction.

See our latest analysis for Northern Star Resources.

After a period of strong operational performance, Northern Star Resources’ 30-day share price return of 19.3% stands out. This has built significant upward momentum that reflects investor confidence and renewed interest in its growth potential. The stock’s one-year total shareholder return of 55.1% and a three-year total return of 226.6% present a compelling story of both short- and long-term outperformance. Recent gains suggest that optimism is still building ahead of AGM season.

If you're curious what other companies deliver strong results with management skin in the game, this is the perfect moment to discover fast growing stocks with high insider ownership

With Northern Star Resources delivering strong financial results and showing solid momentum, the critical question now is whether current valuations still offer a buying opportunity or if the market has already priced in its growth prospects.

Most Popular Narrative: 5.3% Overvalued

Northern Star Resources’ most-followed narrative pegs its fair value slightly below the latest closing price, pointing to a market pricing in much of its expected growth already. This snapshot frames the debate over whether momentum can continue in the medium term.

Strong ESG track record and ongoing efficiency investments enhance premium market positioning, cost control, and sustained margin improvement amid rising industry barriers. Strategic focus on quality, project execution risk, and rising costs could challenge production growth, pressure margins, and impact long-term revenue and shareholder returns.

What bold financial levers underpin this valuation? The secret sauce here blends expanding margins, swift operational upgrades, and ambitious growth targets that not every miner attempts. Think the profit outlook is obvious? You will want to see what is driving these decisive views and what might upend them inside the full narrative that is catching everyone’s eye.

Result: Fair Value of $22.83 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risk around upcoming projects and potential cost pressures could quickly challenge the bullish narrative if growth targets are not met.

Find out about the key risks to this Northern Star Resources narrative.

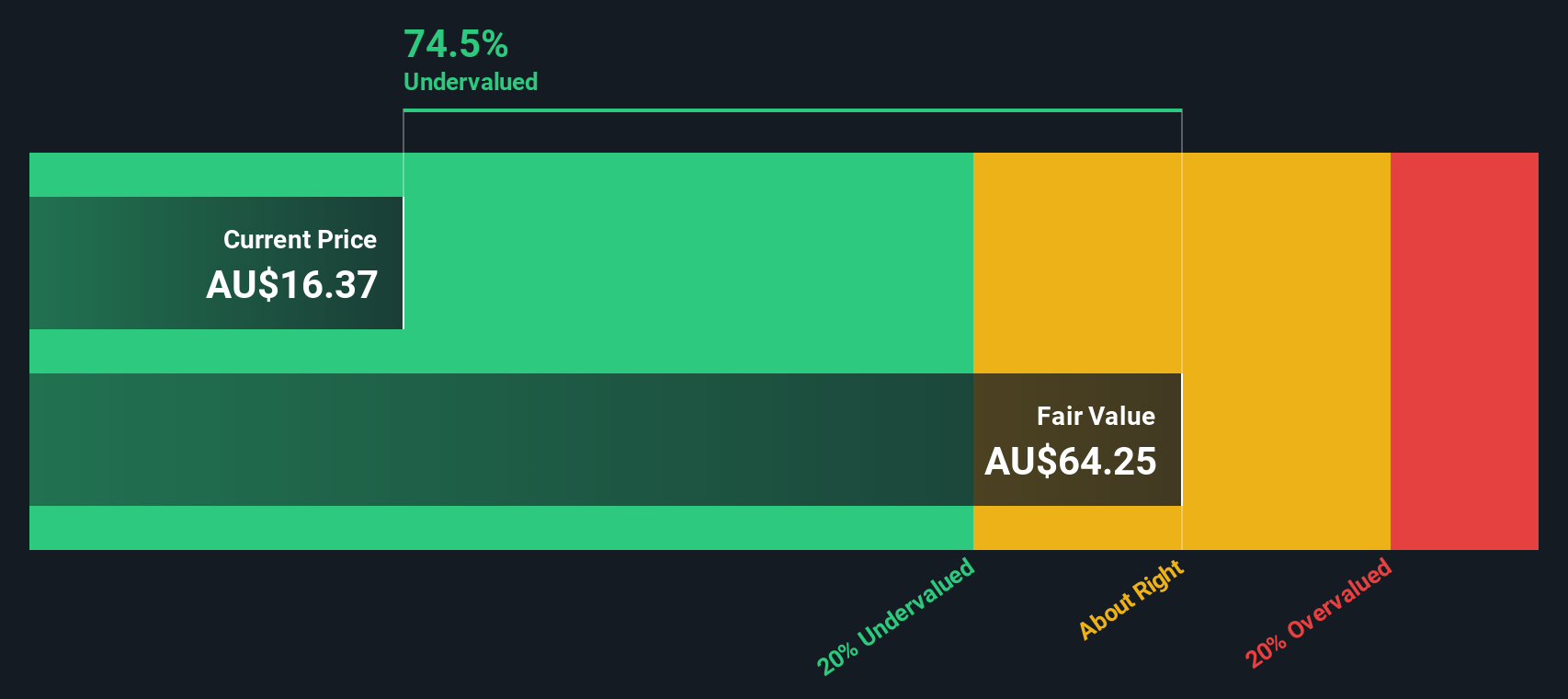

Another View: SWS DCF Model Signals Undervaluation

The SWS DCF model paints a different picture, suggesting Northern Star Resources is trading at a 33.5% discount to its estimated fair value (A$36.14 versus the last close). While market multiples point to overvaluation, this perspective argues that considerable upside remains. Which outlook truly reflects reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Northern Star Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Northern Star Resources Narrative

If you see things differently or want to dig into the numbers yourself, it takes just a few minutes to create your own perspective. Do it your way

A great starting point for your Northern Star Resources research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Turn momentum into opportunity. Expand your horizons and find the next big thing before others catch on. The market moves fast, so do not let great ideas pass you by.

- Capitalize on next-wave technologies by checking out these 24 AI penny stocks. These innovators are shaping tomorrow and could supercharge a growth-oriented portfolio.

- Strengthen your income strategy instantly with these 19 dividend stocks with yields > 3%, offering attractive yields above 3% for steadier returns and consistent cash flow.

- Unleash your potential for outperformance by targeting these 898 undervalued stocks based on cash flows that the market may be overlooking, giving you an edge in value investing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Star Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NST

Northern Star Resources

Engages in the exploration, development, mining, and processing of gold deposits.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives