- Australia

- /

- Metals and Mining

- /

- ASX:NST

Did Strong EPS Growth and Insider Confidence Just Shift Northern Star Resources' (ASX:NST) Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent news, Northern Star Resources reported strong financial performance, achieving 34% annual earnings per share growth over the past three years and improving EBIT margins to 30% alongside rising revenues.

- Significant insider shareholdings highlight management's confidence in the company's direction and reinforce the positive outlook resulting from these financial achievements.

- With earnings per share growth signaling operational strength, we will assess how these results shape Northern Star Resources’ future investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Northern Star Resources Investment Narrative Recap

Anyone considering Northern Star Resources needs to believe in the company’s ability to convert operational excellence into sustained growth, despite production challenges. The recent strong financial results support ongoing confidence but do not materially change the near-term focus: delivering higher output from major assets while managing risks from shifting production guidance. The main catalyst continues to be the expansion at KCGM, while the key risk lies in maintaining or growing production volumes at Yandal as ore grades fluctuate and future development timelines remain uncertain.

Among recent announcements, Northern Star’s reiteration of its production and sales guidance for both fiscal 2026 and 2027 stands out. This directly supports the company’s outlook for stable or growing annual gold output, and aligns with operational results showing significant margin improvements, yet it also highlights the importance of executing on expansion plans to offset any pressure from asset-level production changes.

However, investors should also be cautious, as a sustained drop in Yandal output could eventually place pressure on group revenues if not addressed...

Read the full narrative on Northern Star Resources (it's free!)

Northern Star Resources is forecast to reach A$9.1 billion in revenue and A$2.0 billion in earnings by 2028. This outlook assumes annual revenue growth of 12.3% and a A$0.7 billion earnings increase from A$1.3 billion today.

Uncover how Northern Star Resources' forecasts yield a A$22.83 fair value, a 7% downside to its current price.

Exploring Other Perspectives

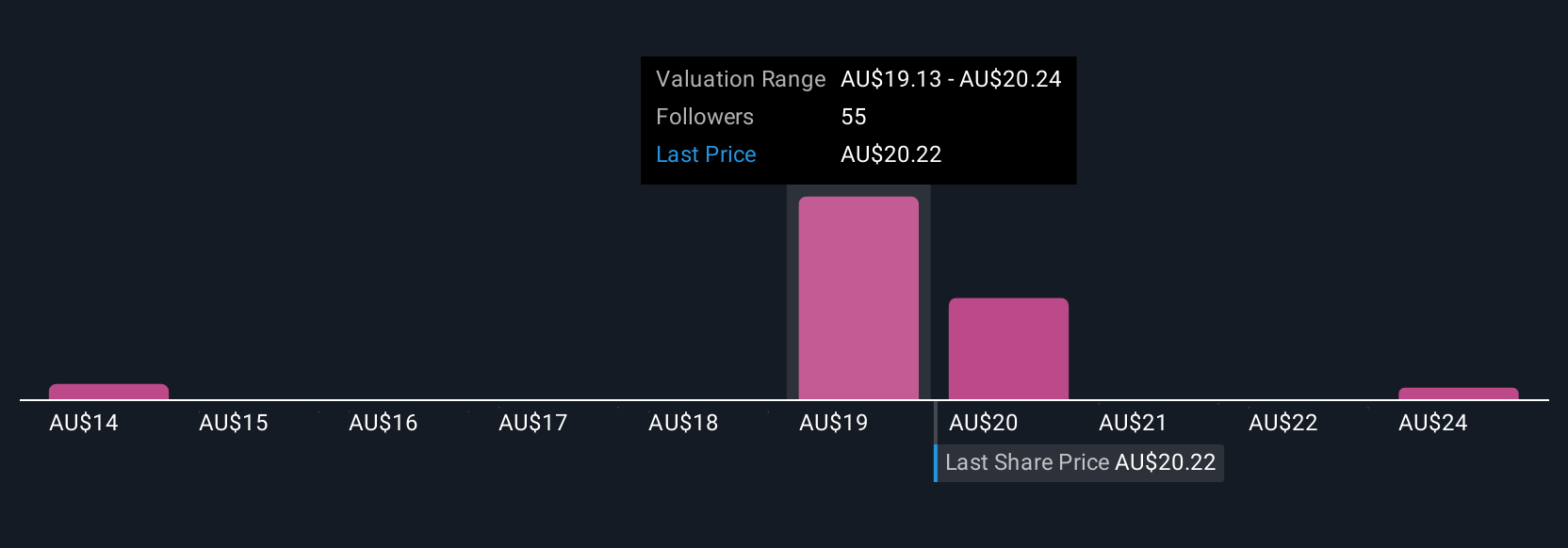

Eleven members of the Simply Wall St Community have estimated Northern Star’s fair value between A$13.56 and A$36.27 per share. With such a wide spread, it’s clear investor expectations differ, especially given ongoing risks around sustaining production at key mining hubs.

Explore 11 other fair value estimates on Northern Star Resources - why the stock might be worth as much as 48% more than the current price!

Build Your Own Northern Star Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northern Star Resources research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Northern Star Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northern Star Resources' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Star Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NST

Northern Star Resources

Engages in the exploration, development, mining, and processing of gold deposits.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives