- Australia

- /

- Metals and Mining

- /

- ASX:NIM

Nimy Resources (ASX:NIM) Is In A Good Position To Deliver On Growth Plans

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

Given this risk, we thought we'd take a look at whether Nimy Resources (ASX:NIM) shareholders should be worried about its cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

View our latest analysis for Nimy Resources

When Might Nimy Resources Run Out Of Money?

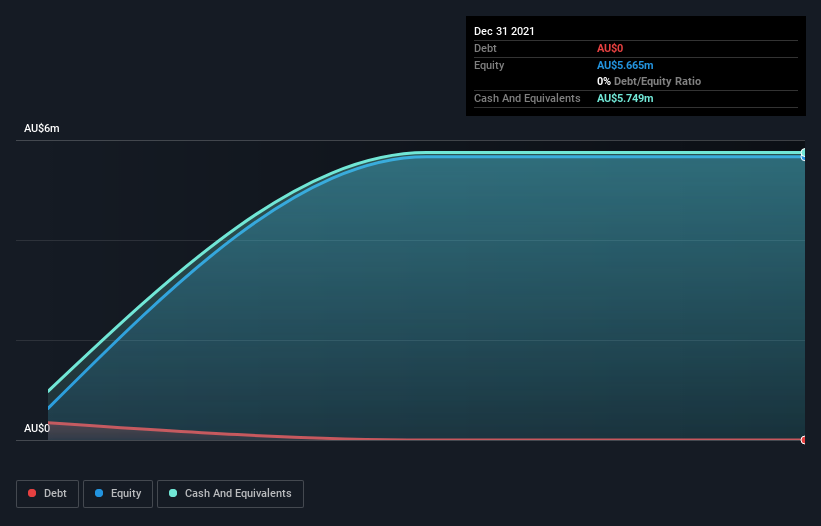

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. As at December 2021, Nimy Resources had cash of AU$5.7m and no debt. Importantly, its cash burn was AU$1.5m over the trailing twelve months. So it had a cash runway of about 3.8 years from December 2021. A runway of this length affords the company the time and space it needs to develop the business. You can see how its cash balance has changed over time in the image below.

How Is Nimy Resources' Cash Burn Changing Over Time?

While Nimy Resources did record statutory revenue of AU$2.2k over the last year, it didn't have any revenue from operations. That means we consider it a pre-revenue business, and we will focus our growth analysis on cash burn, for now. Remarkably, it actually increased its cash burn by 257% in the last year. Given that sharp increase in spending, the company's cash runway will shrink rapidly as it depletes its cash reserves. Admittedly, we're a bit cautious of Nimy Resources due to its lack of significant operating revenues. We prefer most of the stocks on this list of stocks that analysts expect to grow.

How Easily Can Nimy Resources Raise Cash?

While Nimy Resources does have a solid cash runway, its cash burn trajectory may have some shareholders thinking ahead to when the company may need to raise more cash. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Nimy Resources has a market capitalisation of AU$46m and burnt through AU$1.5m last year, which is 3.3% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

So, Should We Worry About Nimy Resources' Cash Burn?

It may already be apparent to you that we're relatively comfortable with the way Nimy Resources is burning through its cash. For example, we think its cash runway suggests that the company is on a good path. While we must concede that its increasing cash burn is a bit worrying, the other factors mentioned in this article provide great comfort when it comes to the cash burn. Looking at all the measures in this article, together, we're not worried about its rate of cash burn; the company seems well on top of its medium-term spending needs. On another note, Nimy Resources has 3 warning signs (and 1 which is potentially serious) we think you should know about.

Of course Nimy Resources may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Nimy Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NIM

Nimy Resources

An exploration company, engages in the exploration and development activities of Mons project in Australia.

Excellent balance sheet with moderate risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)