The Australian market has faced a mixed bag of developments recently, with the ASX experiencing fluctuations amid discussions of potential interest rate cuts and global trade uncertainties. In such an environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those who know the business best, offering a degree of stability amidst broader market volatility.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Meteoric Resources (ASX:MEI) | 19.9% | 82.1% |

| Image Resources (ASX:IMA) | 22.3% | 79.9% |

| Findi (ASX:FND) | 33.8% | 91.2% |

| Fenix Resources (ASX:FEX) | 21.1% | 53.9% |

| Echo IQ (ASX:EIQ) | 18% | 51.4% |

| Cyclopharm (ASX:CYC) | 11.3% | 97.8% |

| Brightstar Resources (ASX:BTR) | 11.2% | 115.1% |

| Alfabs Australia (ASX:AAL) | 10.8% | 41.3% |

| Adveritas (ASX:AV1) | 18.1% | 88.8% |

Let's take a closer look at a couple of our picks from the screened companies.

Meteoric Resources (ASX:MEI)

Simply Wall St Growth Rating: ★★★★★★

Overview: Meteoric Resources NL is engaged in the exploration of mineral tenements across Brazil, Canada, Western Australia, and Northern Territory, with a market cap of A$385.66 million.

Operations: Meteoric Resources NL does not report any revenue segments in its financial disclosures.

Insider Ownership: 19.9%

Earnings Growth Forecast: 82.1% p.a.

Meteoric Resources is poised for significant growth with forecasted revenue expansion of 60.1% annually, outpacing the Australian market. Despite recent shareholder dilution from a A$42.5 million equity offering, insider buying remains positive over the past three months. The company is set to become profitable within three years and has formed a strategic alliance with MTM Critical Metals to advance rare earth processing in Brazil, potentially reducing costs and enhancing supply chain independence from China.

- Delve into the full analysis future growth report here for a deeper understanding of Meteoric Resources.

- The valuation report we've compiled suggests that Meteoric Resources' current price could be inflated.

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mineral Resources Limited operates as a mining services company in Australia, Asia, and internationally with a market capitalization of A$6.27 billion.

Operations: The company's revenue is primarily derived from its Mining Services segment at A$3.64 billion, followed by Iron Ore at A$2.36 billion, Lithium at A$1.05 billion, Energy at A$16 million, and Other Commodities at A$28 million.

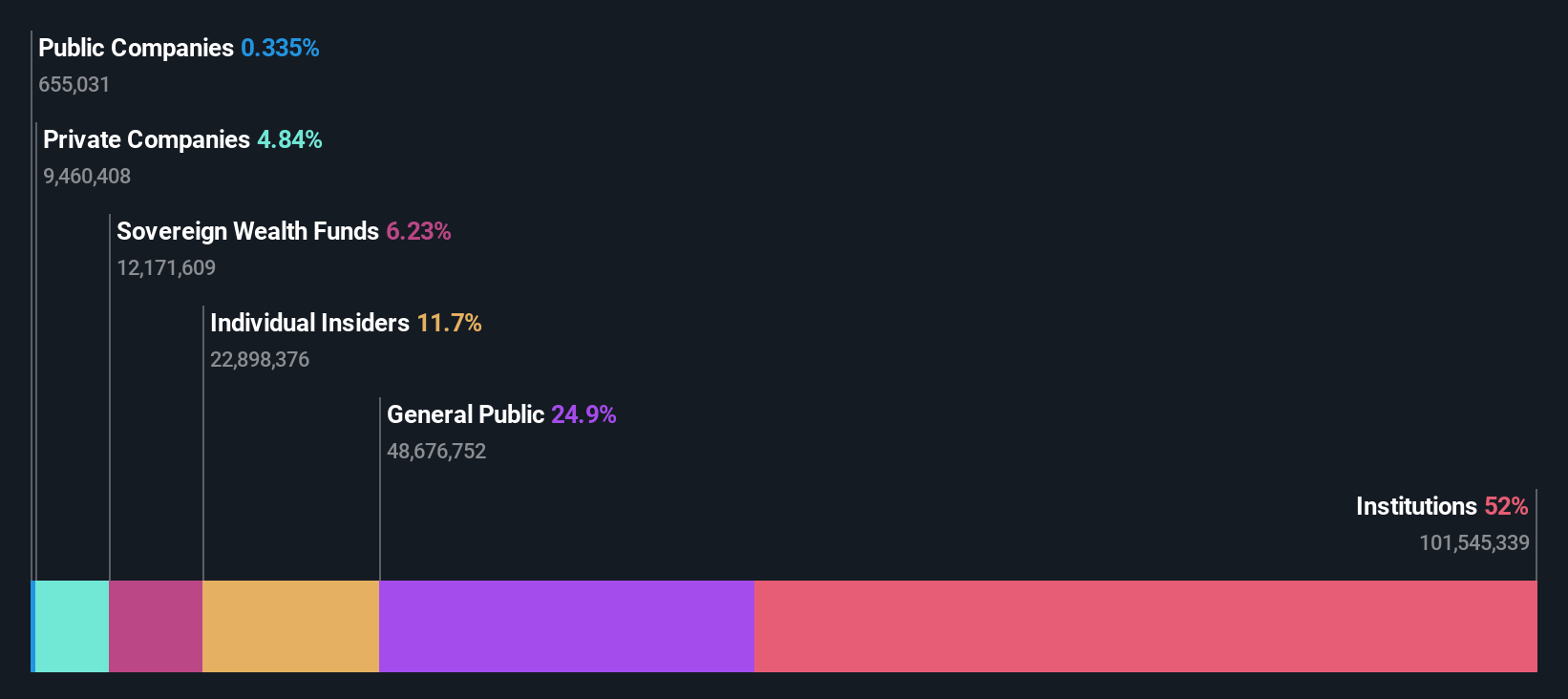

Insider Ownership: 11.7%

Earnings Growth Forecast: 58.5% p.a.

Mineral Resources is set for growth, with revenue expected to rise 7.3% annually, surpassing the Australian market's rate. Insider activity shows more buying than selling recently, though not in large volumes. The company trades at a significant discount to its estimated fair value and aims for profitability within three years. Recent board appointments enhance governance and financial oversight, while potential asset sales could generate up to A$1.1 billion, bolstering liquidity amidst strategic expansions.

- Take a closer look at Mineral Resources' potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Mineral Resources' share price might be too pessimistic.

Mesoblast (ASX:MSB)

Simply Wall St Growth Rating: ★★★★★★

Overview: Mesoblast Limited develops regenerative medicine products across Australia, the United States, Singapore, and Switzerland with a market cap of A$3.30 billion.

Operations: The company's revenue segment focuses on the commercialization of its cell technology platform, generating $5.67 million.

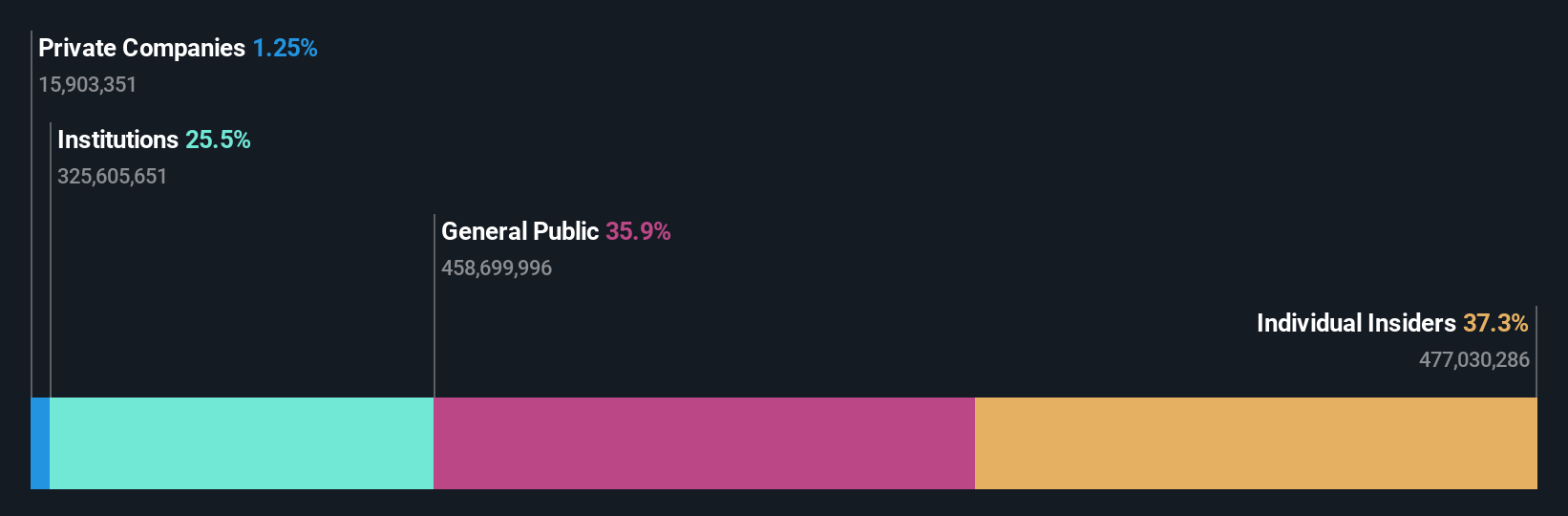

Insider Ownership: 37.3%

Earnings Growth Forecast: 57.4% p.a.

Mesoblast is positioned for growth with revenue forecasted to increase 45% annually, outpacing the Australian market. The company trades significantly below its estimated fair value and aims to achieve profitability within three years. Recent FDA alignment on Revascor's accelerated approval pathway highlights potential market expansion. Additionally, Ryoncil's orphan-drug exclusivity and expanded U.S. coverage strengthen its competitive edge, while new board appointments enhance strategic oversight amidst these developments.

- Dive into the specifics of Mesoblast here with our thorough growth forecast report.

- Our valuation report unveils the possibility Mesoblast's shares may be trading at a discount.

Taking Advantage

- Navigate through the entire inventory of 97 Fast Growing ASX Companies With High Insider Ownership here.

- Want To Explore Some Alternatives? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MSB

Mesoblast

Engages in the development of regenerative medicine products in Australia, the United States, Singapore, and Switzerland.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Community Narratives