- Australia

- /

- Metals and Mining

- /

- ASX:MIN

3 ASX Growth Stocks With At Least 11% Insider Ownership

Reviewed by Simply Wall St

The ASX200 has been up 0.6% at 8,173 points in early afternoon trade, with the Aussie market climbing this morning despite Wall Street’s overnight slide. Back home, all sectors are in the green with Utilities and Telecommunication leading the way. In such a resilient market environment, growth companies with high insider ownership can offer unique investment opportunities as they often signal strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Catalyst Metals (ASX:CYL) | 17% | 54.5% |

| Genmin (ASX:GEN) | 12% | 117.7% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Pointerra (ASX:3DP) | 18.7% | 126.4% |

| Liontown Resources (ASX:LTR) | 16.4% | 69.4% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 70.9% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

We're going to check out a few of the best picks from our screener tool.

Chrysos (ASX:C79)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chrysos Corporation Limited, with a market cap of A$638.27 million, develops and supplies mining technology.

Operations: Chrysos generates A$45.36 million in revenue from its mining services segment.

Insider Ownership: 17.5%

Chrysos Corporation Limited, recently added to the S&P Global BMI Index, reported significant revenue growth for the full year ending June 30, 2024 with A$48.17 million compared to A$28.41 million a year ago despite a net loss of A$0.704 million. The company is forecast to achieve high annual profit and revenue growth over the next three years, with expected annual revenue growth of 28.3% and earnings projected to grow at 48.34% per year, though shareholders experienced dilution in the past year.

- Delve into the full analysis future growth report here for a deeper understanding of Chrysos.

- Our comprehensive valuation report raises the possibility that Chrysos is priced higher than what may be justified by its financials.

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★☆☆

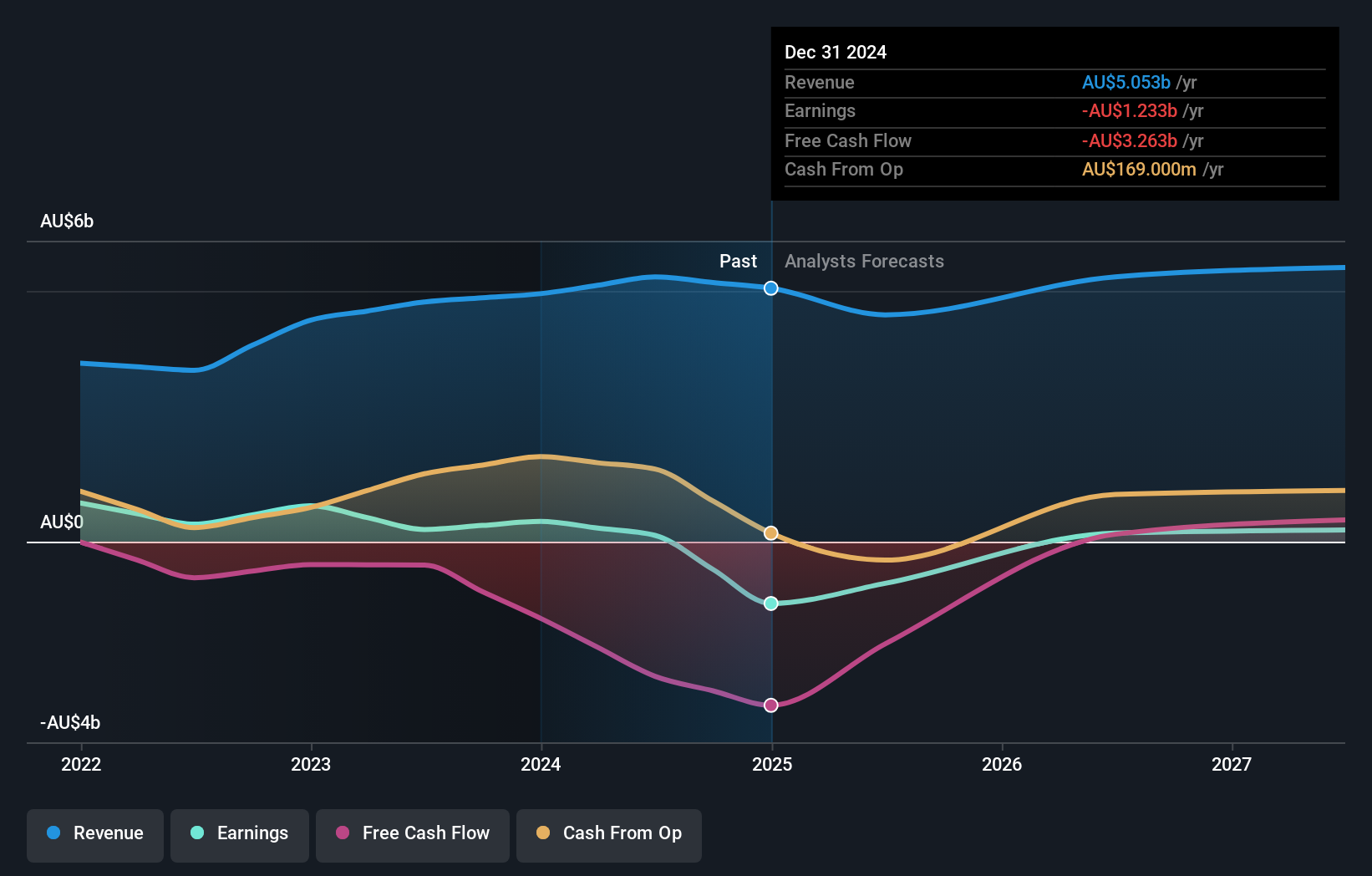

Overview: Mineral Resources Limited, with a market cap of A$8.05 billion, operates as a mining services company in Australia, Asia, and internationally through its subsidiaries.

Operations: Mineral Resources Limited generates revenue from several segments including Energy (A$16 million), Lithium (A$1.41 billion), Iron Ore (A$2.58 billion), Mining Services (A$3.38 billion), and Other Commodities (A$19 million).

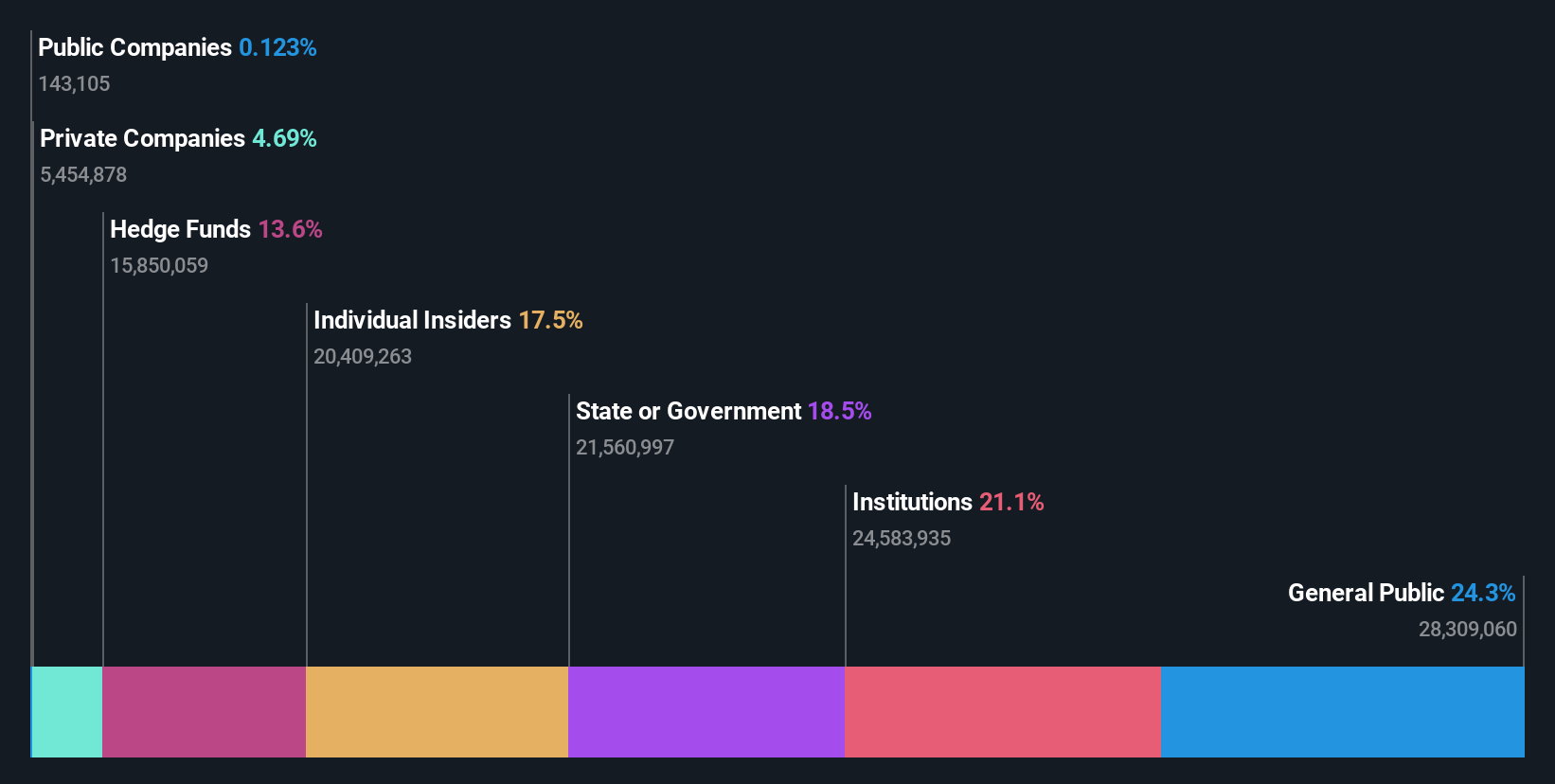

Insider Ownership: 11.7%

Mineral Resources Limited, a growth company with high insider ownership, is forecast to achieve significant earnings growth of 38.3% per year, outpacing the Australian market's 12.3%. Despite trading at 55% below its estimated fair value and insiders buying more shares recently, the company faces challenges such as lower profit margins (2.4%) compared to last year (5.1%) and insufficient earnings coverage for interest payments. Recent earnings reported A$5.28 billion in sales but a net income drop to A$125 million from A$243 million last year.

- Unlock comprehensive insights into our analysis of Mineral Resources stock in this growth report.

- Upon reviewing our latest valuation report, Mineral Resources' share price might be too optimistic.

SiteMinder (ASX:SDR)

Simply Wall St Growth Rating: ★★★★★☆

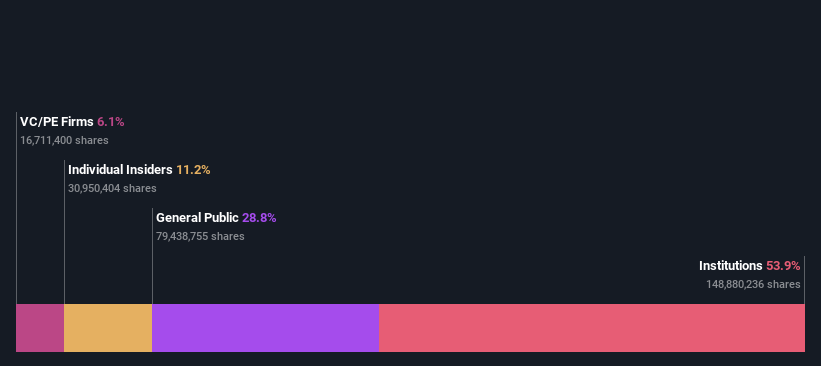

Overview: SiteMinder Limited (ASX:SDR) develops, markets, and sells online guest acquisition platforms and commerce solutions for accommodation providers in Australia and internationally, with a market cap of A$1.51 billion.

Operations: Revenue from the company's software and programming segment amounted to A$190.84 million.

Insider Ownership: 11.2%

SiteMinder, with high insider ownership, has shown robust revenue growth, reporting A$190.67 million for FY2024 compared to A$151.38 million last year. Despite a net loss of A$25.13 million, this is an improvement from the previous year's A$49.3 million loss. The company's earnings are forecast to grow 60.31% annually and it is expected to become profitable within three years, outpacing market growth rates while trading 25.7% below its estimated fair value.

- Take a closer look at SiteMinder's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of SiteMinder shares in the market.

Make It Happen

- Explore the 100 names from our Fast Growing ASX Companies With High Insider Ownership screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MIN

Mineral Resources

Together with subsidiaries, operates as a mining services company in Australia, Asia, and internationally.

Reasonable growth potential low.