- Australia

- /

- Aerospace & Defense

- /

- ASX:QHL

3 Promising ASX Penny Stocks With Market Caps Below A$200M

Reviewed by Simply Wall St

As the ASX200 experiences a slight downturn, with sectors like Discretionary and Financials facing challenges, Utilities and Energy have shown resilience. In such fluctuating market conditions, identifying promising investment opportunities can be crucial. Penny stocks, though an older term, still represent smaller or emerging companies that could offer substantial growth potential when supported by strong financials and clear growth strategies.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.85 | A$236.3M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.885 | A$306.91M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.80 | A$99.57M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.49 | A$303.87M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.59 | A$779.23M | ★★★★★☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$177.63M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.80 | A$100.97M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.87 | A$480.5M | ★★★★☆☆ |

Click here to see the full list of 1,053 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Credit Clear (ASX:CCR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Credit Clear Limited develops and implements receivables management platforms and provides receivable collection services in Australia and New Zealand, with a market cap of A$145.08 million.

Operations: The company generates revenue through its Collections segment, contributing A$35.09 million, and Legal Services, which adds A$7.15 million.

Market Cap: A$145.08M

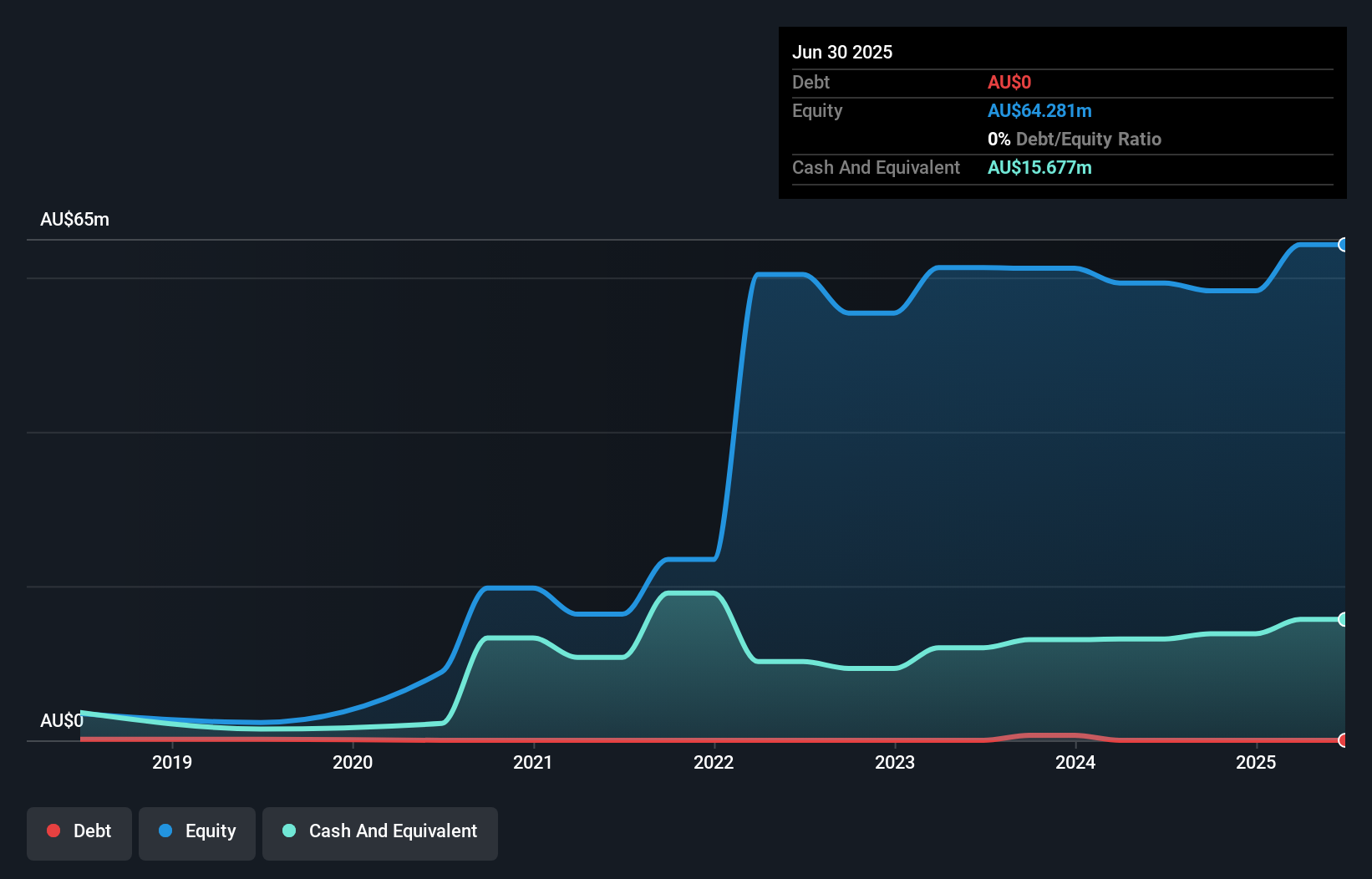

Credit Clear Limited, with a market cap of A$145.08 million, generates revenue through its Collections and Legal Services segments, totaling A$42.24 million. Despite being unprofitable with a negative Return on Equity of -7.59%, the company is debt-free and maintains a positive cash flow runway for over three years. The board's average tenure suggests inexperience, though management is seasoned with 2.8 years average tenure. Recent reaffirmation of fiscal year 2025 earnings guidance indicates potential revenue between A$48 million to A$50 million, highlighting growth prospects amidst stable weekly volatility and no significant shareholder dilution recently observed.

- Jump into the full analysis health report here for a deeper understanding of Credit Clear.

- Gain insights into Credit Clear's future direction by reviewing our growth report.

Cynata Therapeutics (ASX:CYP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cynata Therapeutics Limited, operating under the Cymerus brand, focuses on developing and commercializing proprietary stem cell technologies for human therapeutic use in Australia, with a market cap of A$36.14 million.

Operations: The company's revenue is derived entirely from the development and commercialisation of therapeutic products, amounting to A$2.32 million.

Market Cap: A$36.14M

Cynata Therapeutics, with a market cap of A$36.14 million, is pre-revenue, focusing on stem cell technology development. Despite being unprofitable with a negative Return on Equity of -135.02%, the company benefits from no long-term liabilities and stable weekly volatility. Its short-term assets of A$6.5 million exceed short-term liabilities by a significant margin, ensuring financial stability in the near term. The management team and board are experienced, averaging tenures of 2.3 and 4.5 years respectively. Recent capital raising efforts amounting to A$8.1 million aim to support ongoing clinical trials and operational needs amidst earnings growth forecasts of 72% annually.

- Click here to discover the nuances of Cynata Therapeutics with our detailed analytical financial health report.

- Gain insights into Cynata Therapeutics' outlook and expected performance with our report on the company's earnings estimates.

Quickstep Holdings (ASX:QHL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quickstep Holdings Limited manufactures and sells advanced composites for the defense, commercial aerospace, automotive, and other industries in Australia, the United Kingdom, and the United States with a market cap of A$39.81 million.

Operations: The company's revenue is primarily generated from its Quickstep Structures segment, which accounts for A$88.97 million.

Market Cap: A$39.81M

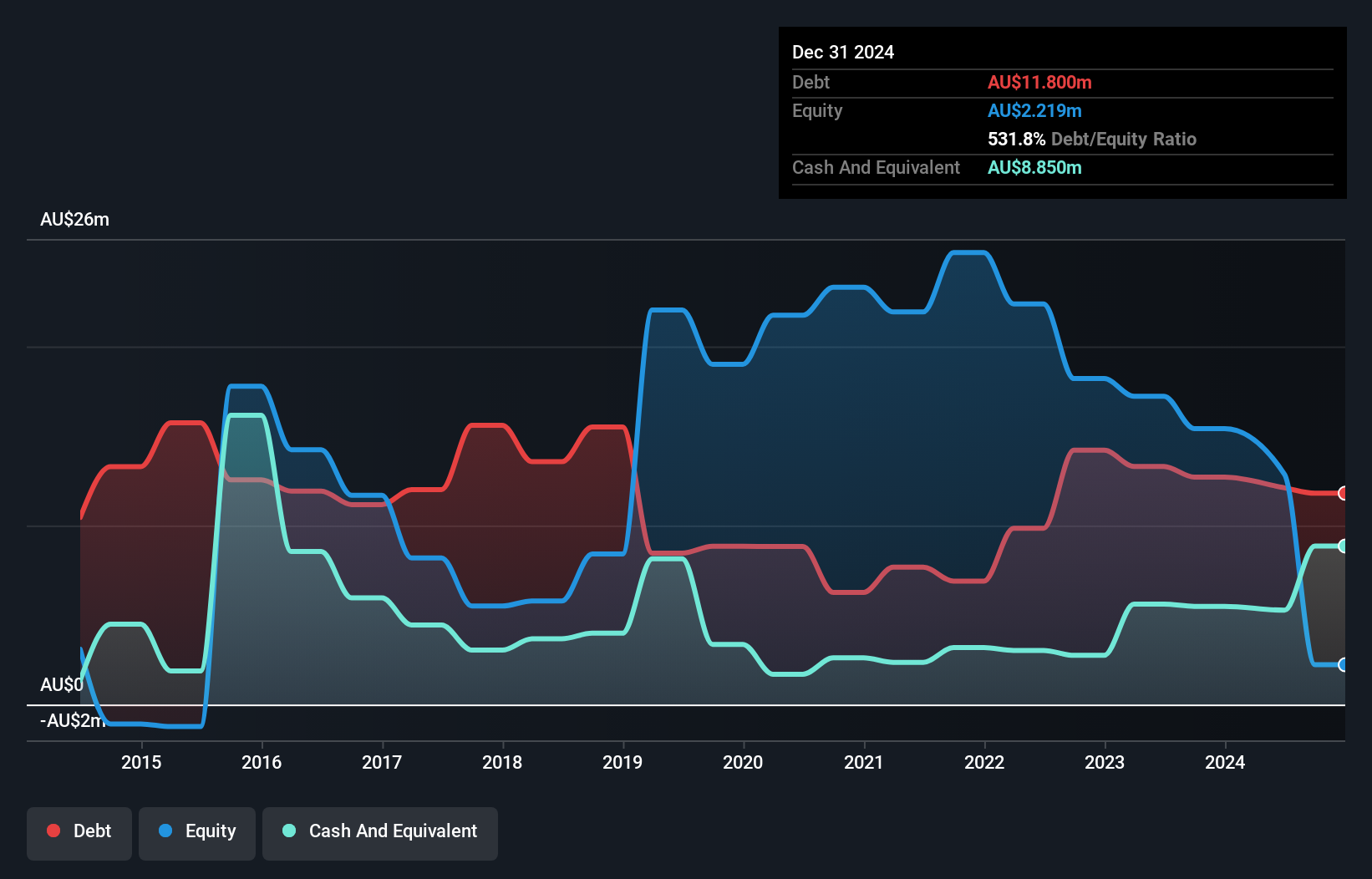

Quickstep Holdings, with a market cap of A$39.81 million, faces challenges as an unprofitable entity with increasing losses over the past five years and a negative Return on Equity of -8.42%. Despite this, the company maintains financial flexibility through short-term assets of A$45.8 million exceeding both long-term liabilities (A$16.8 million) and short-term liabilities (A$44.3 million). Recent executive changes include new interim leadership roles following departures in key positions such as CEO and CFO. The proposed acquisition by ASDAM Operations Pty Ltd for A$28.7 million highlights potential strategic shifts amidst ongoing volatility in its share price.

- Unlock comprehensive insights into our analysis of Quickstep Holdings stock in this financial health report.

- Gain insights into Quickstep Holdings' past trends and performance with our report on the company's historical track record.

Where To Now?

- Dive into all 1,053 of the ASX Penny Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quickstep Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:QHL

Quickstep Holdings

Manufactures and sells advanced composites for the defense and commercial aerospace, automotive, and other industry sectors in Australia, the United Kingdom, and the United States.

Good value with mediocre balance sheet.

Market Insights

Community Narratives