- Australia

- /

- Metals and Mining

- /

- ASX:LYC

Lynas Rare Earths (ASX:LYC) Valuation in Focus After U.S. Magnet Supply Chain Partnership With Noveon

Reviewed by Kshitija Bhandaru

Lynas Rare Earths (ASX:LYC) has signed a Memorandum of Understanding with Noveon Magnetics to form a strategic partnership focused on building a domestic U.S. supply chain for rare earth permanent magnets. The collaboration directly addresses supply chain concerns and rising U.S. demand for critical minerals that are important to defense and commercial sectors.

See our latest analysis for Lynas Rare Earths.

Lynas Rare Earths’ announcement comes on the back of a remarkable year. The company’s 30-day share price return sits at an impressive 38.7%, with a year-to-date surge of 203%. While short-term swings remain, resilient investor optimism is evident in Lynas’s 1-year total shareholder return of 156%, underpinned by ongoing expansion and its pivotal new U.S. partnership.

If this momentum has you looking for your next idea, now's a great time to discover fast growing stocks with high insider ownership.

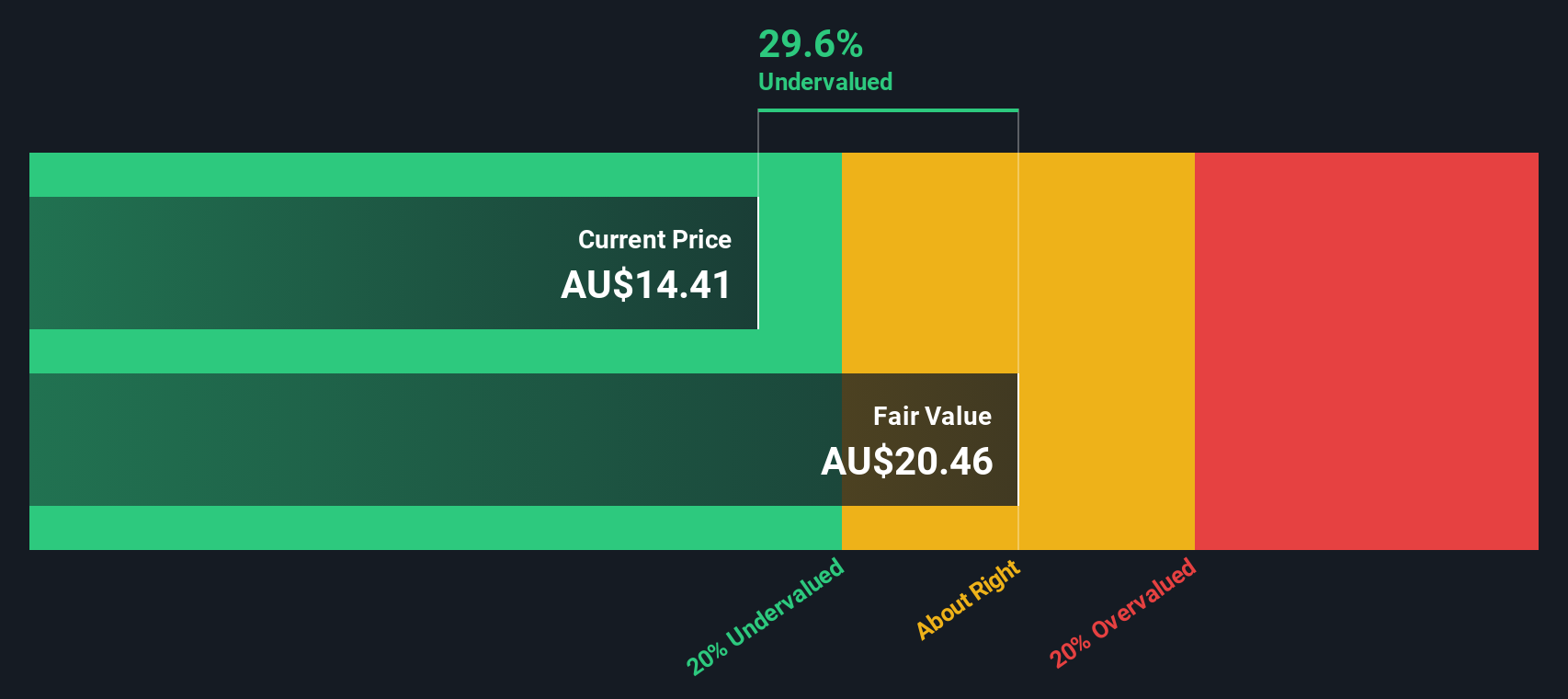

With shares rallying on optimism about new partnerships and future growth, investors are left to consider whether Lynas Rare Earths is still undervalued or if expectations for long-term expansion are already reflected in the stock price.

Most Popular Narrative: 39% Overvalued

Lynas Rare Earths' most popular narrative assigns it a fair value well below the last close, flagging a disconnect between business momentum and what’s currently priced in. The narrative weighs rapid earnings expansion and government support against real-world risks to sustainability and future profitability.

There is an assumption that the accelerating global electrification transition (EVs, renewables, energy storage) will deliver consistent volume growth and greater pricing power for Lynas's rare earth products, underpinning a long runway of strong top-line and earnings expansion. The market seems to be pricing in flawless execution of Lynas's aggressive expansion into downstream processing and magnet manufacturing, including successful ramp-up of the new Kalgoorlie and Malaysian facilities, as well as anticipated revenue from potential magnet JV/partnerships, which projects significant margin and earnings growth.

Curious how bold growth targets and future profit multiples shape this verdict? There is a single, ambitious assumption fueling the narrative’s pricing logic. See which projections and financial levers drive this outlook inside the full narrative.

Result: Fair Value of $14.23 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, renewed regulatory scrutiny in Malaysia or a slowdown in global electrification could significantly challenge these bullish growth assumptions.

Find out about the key risks to this Lynas Rare Earths narrative.

Another View: What About Discounted Cash Flow?

While the main valuation flags Lynas Rare Earths as overvalued based on its market excitement and future growth assumptions, our DCF model arrives at a different conclusion. It suggests the current price is actually above fair value, indicating that investors may be paying a premium for expected growth. Could this premium persist if future expectations shift?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Lynas Rare Earths Narrative

If you’d like to dig into the numbers and shape your own perspective, you can quickly build your own view in just a few minutes. Do it your way.

A great starting point for your Lynas Rare Earths research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't let great opportunities pass you by. Broaden your watchlist with strategies designed for bold, forward-thinking investors like you.

- Tap into high-yield potential by scanning these 19 dividend stocks with yields > 3% with attractive returns and rising income streams.

- Uncover tomorrow’s tech leaders by checking out these 24 AI penny stocks, packed with innovators pushing the boundaries of artificial intelligence.

- Benefit from unmatched value by evaluating these 899 undervalued stocks based on cash flows that may be trading at discounts to their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LYC

Lynas Rare Earths

Engages in the exploration, development, mining, extraction, and processing of rare earth minerals in Australia and Malaysia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives