- Australia

- /

- Metals and Mining

- /

- ASX:LTR

ASX Growth Companies Insiders Are Banking On

Reviewed by Simply Wall St

Amidst a fluctuating ASX200 and mixed signals from Wall Street, the Australian market is navigating through a period of cautious optimism, with sectors like IT showing resilience despite broader challenges. In such an environment, growth companies with high insider ownership can be particularly appealing as they often signal confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 14.7% | 91.2% |

| Pointerra (ASX:3DP) | 23.4% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Image Resources (ASX:IMA) | 22.3% | 79.8% |

| Findi (ASX:FND) | 33.6% | 91.2% |

| Emerald Resources (ASX:EMR) | 18.1% | 35.6% |

| Echo IQ (ASX:EIQ) | 18% | 49.9% |

| BlinkLab (ASX:BB1) | 39.8% | 56.6% |

| Adveritas (ASX:AV1) | 18.8% | 96.8% |

| Acrux (ASX:ACR) | 15.5% | 121.1% |

Let's explore several standout options from the results in the screener.

GemLife Communities Group (ASX:GLF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GemLife Communities Group operates as a developer, builder, owner, and operator in the land lease community sector, providing resort-style communities for homeowners aged 50 and over in Australia, with a market cap of A$1.75 billion.

Operations: GemLife Communities Group generates revenue primarily from its operations in the land lease community sector, focusing on developing and managing resort-style living spaces for Australians aged 50 and over.

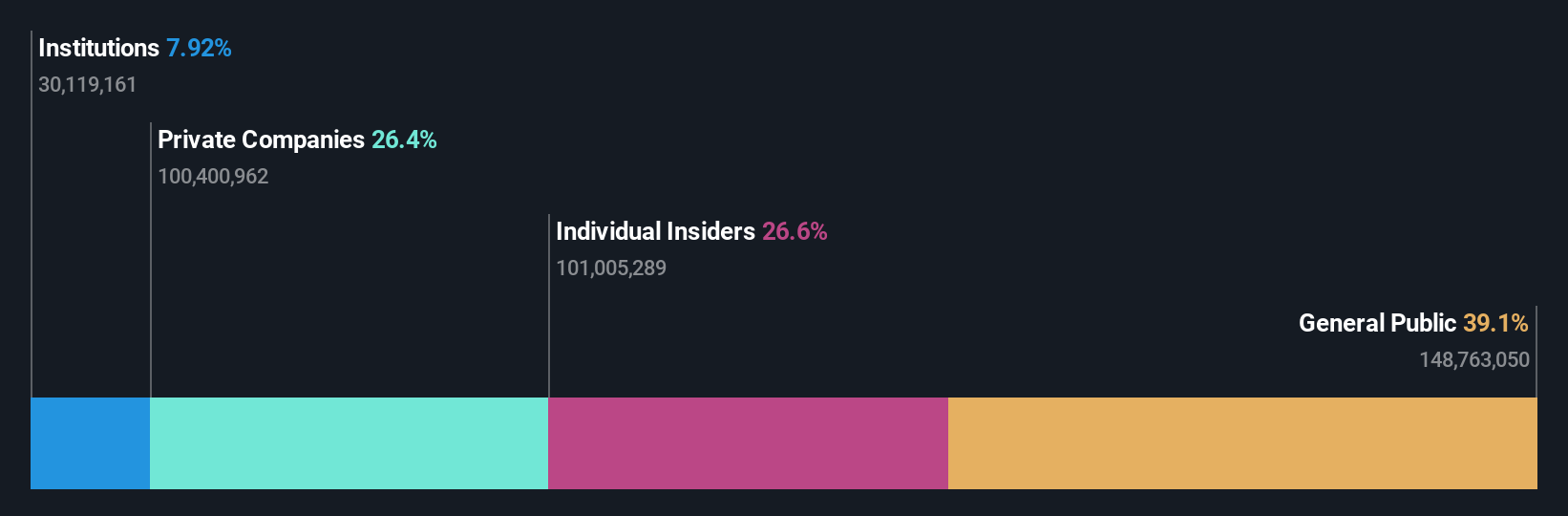

Insider Ownership: 26.6%

GemLife Communities Group recently completed an IPO raising A$750 million, indicating strong market interest. The company is forecasted to achieve significant earnings growth of 21.71% annually, outpacing the Australian market's 10.9%. However, its return on equity is expected to remain low at 9.2% in three years, and interest payments are not well covered by earnings. Despite these concerns, GemLife's revenue growth of 14.8% per year surpasses the broader market rate of 5.4%.

- Get an in-depth perspective on GemLife Communities Group's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of GemLife Communities Group shares in the market.

Liontown Resources (ASX:LTR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Liontown Resources Limited focuses on the exploration, evaluation, and development of mineral properties in Australia with a market capitalization of A$2.73 billion.

Operations: Liontown Resources Limited generates its revenue through the exploration, evaluation, and development of mineral properties within Australia.

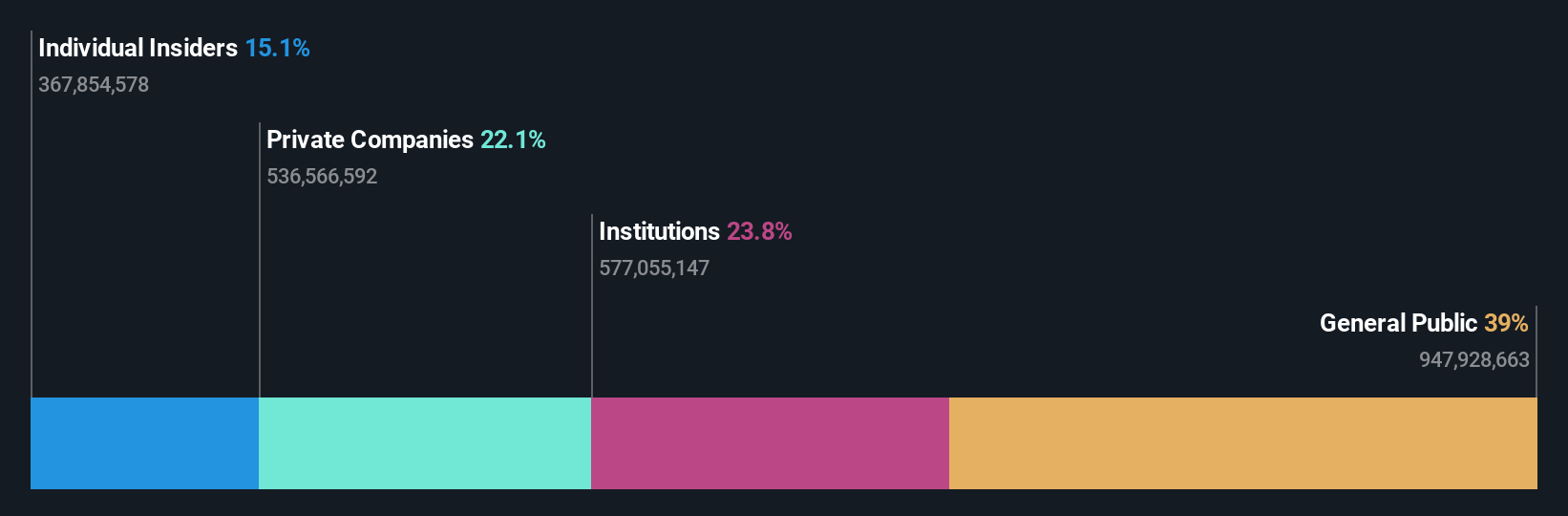

Insider Ownership: 12.8%

Liontown Resources has demonstrated significant growth potential with forecasted revenue expansion of 30% annually, outpacing the Australian market's 5.4%. Despite recent share dilution due to follow-on equity offerings totaling over A$600 million, insider ownership remains high without substantial insider selling. The company is expected to become profitable within three years, surpassing average market growth rates. However, its return on equity is projected to be low at 1.9% in the same period, suggesting room for improvement in capital efficiency.

- Unlock comprehensive insights into our analysis of Liontown Resources stock in this growth report.

- The analysis detailed in our Liontown Resources valuation report hints at an deflated share price compared to its estimated value.

Temple & Webster Group (ASX:TPW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Temple & Webster Group Ltd operates as an online retailer specializing in furniture, homewares, and home improvement products in Australia, with a market cap of A$2.76 billion.

Operations: The company's revenue primarily comes from the sale of furniture, homewares, and home improvement products, totaling A$600.72 million.

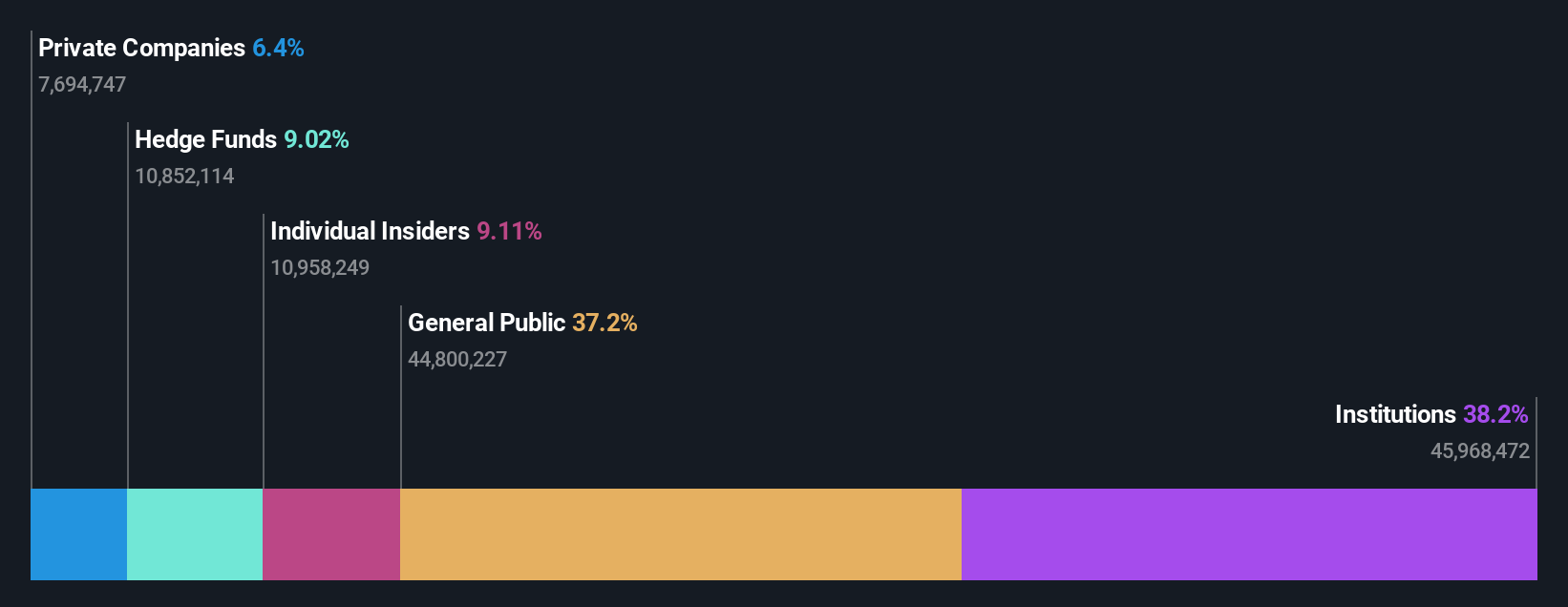

Insider Ownership: 10.6%

Temple & Webster Group shows promising growth potential with earnings forecasted to increase by 34.3% annually, surpassing the Australian market's 10.9%. Recent full-year results indicate strong performance, with sales reaching A$600.7 million and net income rising significantly to A$11.3 million. The company remains debt-free and is actively seeking acquisitions for expansion, supported by a robust deferred revenue balance of A$28 million. Despite no recent insider trading activity, insider ownership is substantial, aligning management interests with shareholders'.

- Dive into the specifics of Temple & Webster Group here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Temple & Webster Group's current price could be inflated.

Key Takeaways

- Explore the 105 names from our Fast Growing ASX Companies With High Insider Ownership screener here.

- Want To Explore Some Alternatives? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LTR

Liontown Resources

Engages in the exploration, evaluation, and development of mineral properties in Australia.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives