This article will reflect on the compensation paid to Bill Clayton who has served as CEO of Lodestar Minerals Limited (ASX:LSR) since 2007. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for Lodestar Minerals

Comparing Lodestar Minerals Limited's CEO Compensation With the industry

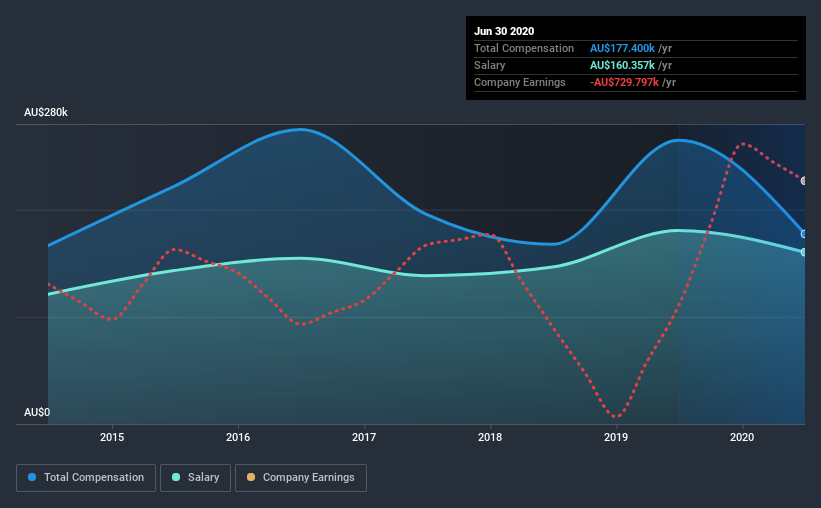

Our data indicates that Lodestar Minerals Limited has a market capitalization of AU$12m, and total annual CEO compensation was reported as AU$177k for the year to June 2020. Notably, that's a decrease of 33% over the year before. In particular, the salary of AU$160.4k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below AU$257m, reported a median total CEO compensation of AU$309k. This suggests that Bill Clayton is paid below the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$160k | AU$181k | 90% |

| Other | AU$17k | AU$84k | 10% |

| Total Compensation | AU$177k | AU$265k | 100% |

Talking in terms of the industry, salary represented approximately 69% of total compensation out of all the companies we analyzed, while other remuneration made up 31% of the pie. Lodestar Minerals is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Lodestar Minerals Limited's Growth Numbers

Over the past three years, Lodestar Minerals Limited has seen its earnings per share (EPS) grow by 33% per year. Its revenue is down 84% over the previous year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. While it would be good to see revenue growth, profits matter more in the end. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Lodestar Minerals Limited Been A Good Investment?

Since shareholders would have lost about 64% over three years, some Lodestar Minerals Limited investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As we noted earlier, Lodestar Minerals pays its CEO lower than the norm for similar-sized companies belonging to the same industry. However we must not forget that the EPS growth has been very strong over three years. Although we would've liked to see positive investor returns, it would be bold of us to criticize CEO compensation when EPS are up. But shareholders will likely want to hold off on any raise for Bill until investor returns are positive.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 4 warning signs for Lodestar Minerals you should be aware of, and 3 of them don't sit too well with us.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading Lodestar Minerals or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:LSR

Lodestar Minerals

Engages in the exploration and evaluation of mineral properties in Australia.

Medium-low with imperfect balance sheet.

Market Insights

Community Narratives