- Australia

- /

- Metals and Mining

- /

- ASX:RVT

ASX Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As 2024 closes, the Australian market has experienced a slight downturn, with the ASX shedding 0.9% on New Year's Eve and most sectors seeing red except for Energy and Utilities. In such fluctuating conditions, investors often seek opportunities in lesser-known areas of the market that may offer unique potential. Penny stocks, while an older term, continue to represent smaller or emerging companies that can provide affordability and growth potential when backed by solid financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.88 | A$238.78M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.955 | A$318.31M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.51 | A$316.27M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$842.94M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.88 | A$103.99M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$205.65M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$2.00 | A$112.19M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.90 | A$483.46M | ★★★★☆☆ |

Click here to see the full list of 1,052 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Fenix Resources (ASX:FEX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fenix Resources Limited is involved in the exploration, development, and mining of mineral tenements in Western Australia, with a market cap of A$190.96 million.

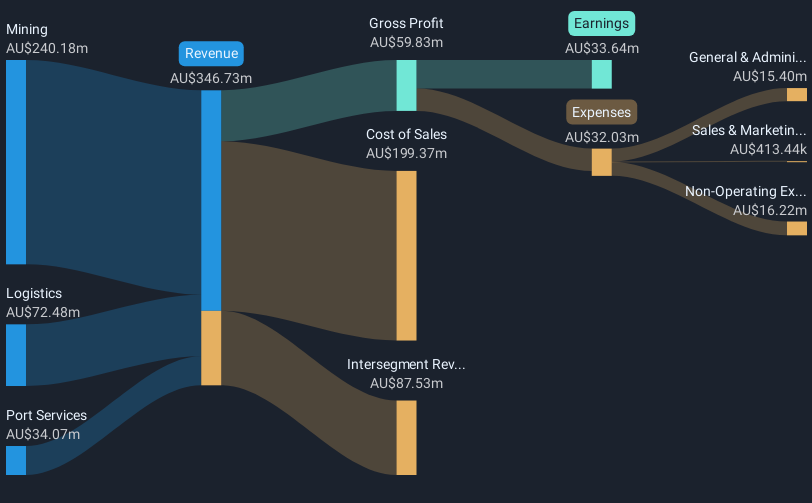

Operations: The company's revenue is derived from three primary segments: Mining (A$240.18 million), Logistics (A$72.48 million), and Port Services (A$34.07 million).

Market Cap: A$190.96M

Fenix Resources Limited, with a market cap of A$190.96 million, derives significant revenue from its mining (A$240.18 million), logistics (A$72.48 million), and port services (A$34.07 million) segments, indicating it is not pre-revenue. The company trades at a notable discount to its estimated fair value and has demonstrated strong earnings growth over the past five years, although recent profit growth has decelerated compared to historical averages. Fenix's short-term assets comfortably cover both short- and long-term liabilities, while its debt is well-managed with ample coverage by operating cash flow and interest payments by EBIT.

- Click here to discover the nuances of Fenix Resources with our detailed analytical financial health report.

- Examine Fenix Resources' earnings growth report to understand how analysts expect it to perform.

Legend Mining (ASX:LEG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Legend Mining Limited is an Australian company focused on the exploration of nickel and copper deposits, with a market cap of A$34.91 million.

Operations: Legend Mining Limited has not reported any revenue segments.

Market Cap: A$34.91M

Legend Mining Limited, with a market cap of A$34.91 million, is pre-revenue, generating less than US$1 million annually. The company has no debt and maintains a sufficient cash runway for over three years due to positive free cash flow growth. Despite its unprofitability and increased losses over the past five years, Legend's short-term assets significantly exceed liabilities. Its share price has been highly volatile recently, yet it trades slightly below estimated fair value. The board and management are experienced with average tenures of 4.3 and 3 years respectively, offering stability in leadership amidst financial challenges.

- Dive into the specifics of Legend Mining here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Legend Mining's track record.

Richmond Vanadium Technology (ASX:RVT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Richmond Vanadium Technology Limited focuses on the exploration and development of mineral properties in Australia, with a market cap of A$52.13 million.

Operations: The company generates revenue primarily from its mineral exploration and development activities, specifically focusing on vanadium resources, amounting to A$0.74 million.

Market Cap: A$52.13M

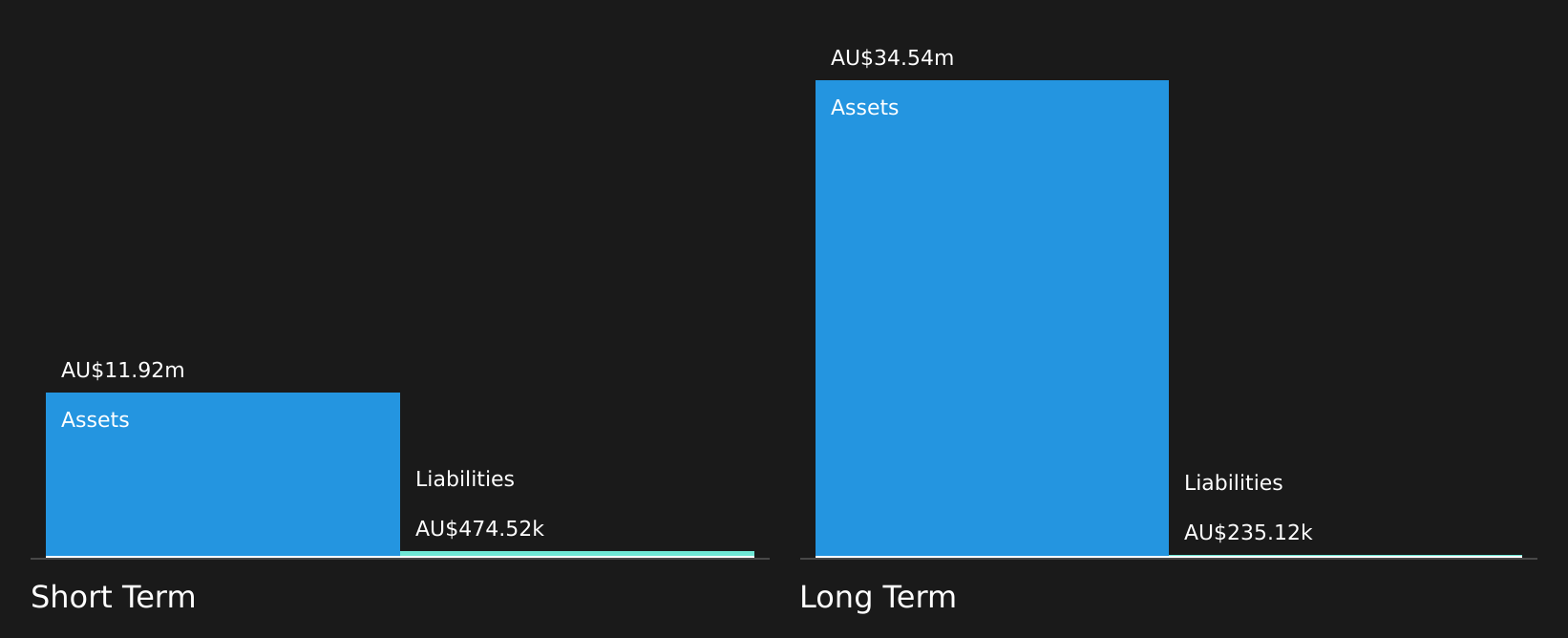

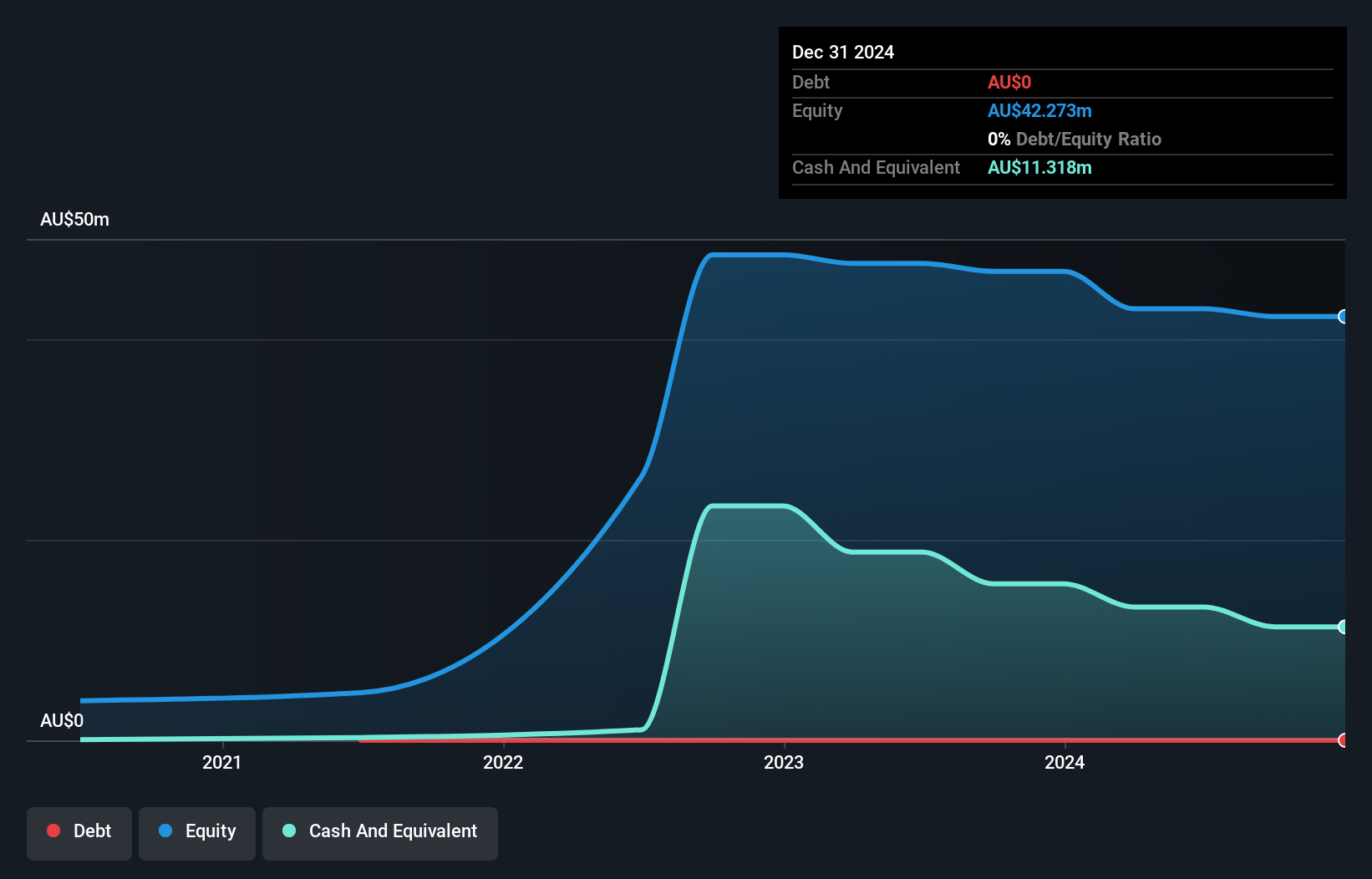

Richmond Vanadium Technology Limited, with a market cap of A$52.13 million, is pre-revenue and generates less than US$1 million annually from mineral exploration activities. The company has no debt, with short-term assets (A$13.6M) exceeding both short-term (A$1.6M) and long-term liabilities (A$26K), suggesting strong liquidity. Despite being unprofitable and experiencing increased losses over the past five years, RVT maintains a cash runway for more than two years even if cash flow declines continue at historical rates. However, significant insider selling and an inexperienced management team raise concerns amidst its highly volatile share price environment.

- Navigate through the intricacies of Richmond Vanadium Technology with our comprehensive balance sheet health report here.

- Explore historical data to track Richmond Vanadium Technology's performance over time in our past results report.

Turning Ideas Into Actions

- Embark on your investment journey to our 1,052 ASX Penny Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RVT

Richmond Vanadium Technology

Engages in the exploration and development of mineral properties in Australia.

Flawless balance sheet slight.

Market Insights

Community Narratives