- Australia

- /

- Metals and Mining

- /

- ASX:CYL

Discover Catalyst Metals Among 3 Promising ASX Penny Stocks

Reviewed by Simply Wall St

The Australian market has been under pressure, with the ASX 200 trading lower by about 1.25% amid concerns over U.S. tariffs on Chinese goods impacting local commodities. In such a fluctuating environment, identifying stocks that combine affordability with growth potential can be appealing to investors. Penny stocks, though an older term, continue to represent opportunities in smaller or newer companies that may offer both value and financial strength.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Bisalloy Steel Group (ASX:BIS) | A$3.30 | A$158.08M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.54 | A$106.04M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.40 | A$371.73M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.90 | A$89.63M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.68 | A$273.53M | ★★★★★★ |

| Regal Partners (ASX:RPL) | A$3.22 | A$1.08B | ★★★★★★ |

| Perenti (ASX:PRN) | A$1.28 | A$1.2B | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.92 | A$241.6M | ★★★★★★ |

| Verbrec (ASX:VBC) | A$0.091 | A$26.42M | ★★★★★☆ |

| Accent Group (ASX:AX1) | A$2.02 | A$1.14B | ★★★★☆☆ |

Click here to see the full list of 1,018 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Catalyst Metals (ASX:CYL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Catalyst Metals Limited engages in the exploration and evaluation of mineral properties in Australia and has a market capitalization of A$924.27 million.

Operations: Catalyst Metals Limited does not report specific revenue segments.

Market Cap: A$924.27M

Catalyst Metals Limited has recently transitioned to profitability, reporting A$46.29 million in net income for the half-year ending December 2024, a significant turnaround from a previous net loss. The company's market capitalization stands at A$924.27 million, with its stock trading at a substantial discount to estimated fair value. It maintains strong financial health, with short-term assets exceeding both short and long-term liabilities and debt well-covered by operating cash flow. Additionally, Catalyst's return on equity is high at 30.7%, supported by stable weekly volatility and an experienced board of directors.

- Click here and access our complete financial health analysis report to understand the dynamics of Catalyst Metals.

- Gain insights into Catalyst Metals' outlook and expected performance with our report on the company's earnings estimates.

Jupiter Mines (ASX:JMS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jupiter Mines Limited is an independent mining company based in Australia, with a market capitalization of A$313.77 million.

Operations: Jupiter Mines Limited has not reported any specific revenue segments.

Market Cap: A$313.77M

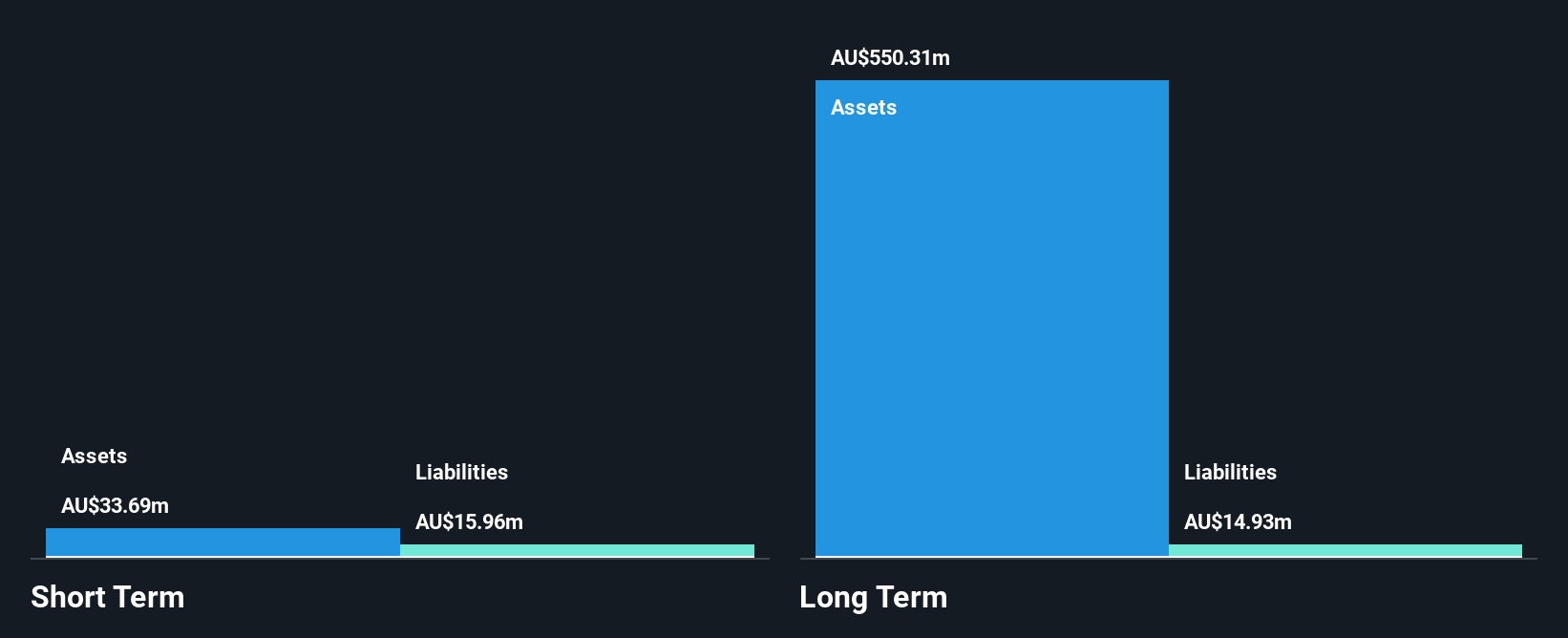

Jupiter Mines Limited, with a market cap of A$313.77 million, is trading below its estimated fair value by 20.2%, indicating potential undervaluation. However, the company faces challenges with declining earnings growth of 24.5% over the past year and lower profit margins compared to last year. Despite these setbacks, Jupiter maintains strong financial health with no debt and sufficient short-term assets (A$33.7M) to cover liabilities (A$16M short term; A$14.9M long term). The board's average tenure suggests inexperience at 2.8 years, while dividends are not well covered by free cash flows despite recent affirmations of payouts.

- Get an in-depth perspective on Jupiter Mines' performance by reading our balance sheet health report here.

- Explore historical data to track Jupiter Mines' performance over time in our past results report.

TPG Telecom (ASX:TPG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: TPG Telecom Limited offers telecommunications services to a diverse range of customers in Australia, including consumer, business, enterprise, government and wholesale sectors, with a market cap of A$8.58 billion.

Operations: No specific revenue segments are reported for TPG Telecom Limited.

Market Cap: A$8.58B

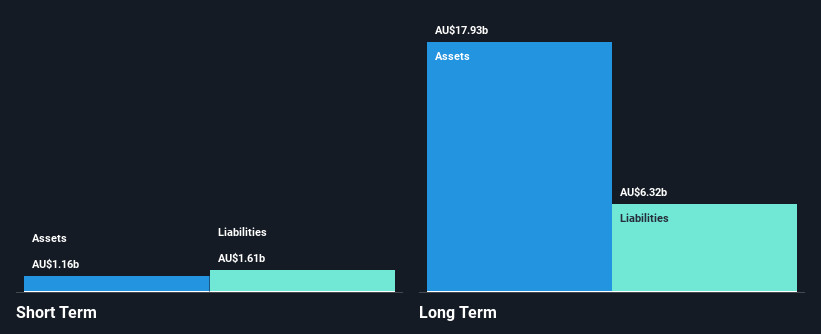

TPG Telecom Limited, with a market cap of A$8.58 billion, faces challenges as it reported a net loss of A$107 million for 2024, contrasting with the previous year's profit. Despite this setback, TPG declared a dividend of A$0.09 per share for the six months ending December 2024. The company's management team is relatively new with an average tenure of 1.9 years, while its board is more seasoned at 4.8 years on average. Although unprofitable and unable to cover liabilities with short-term assets, TPG's cash runway exceeds three years and it trades significantly below estimated fair value by over 70%.

- Unlock comprehensive insights into our analysis of TPG Telecom stock in this financial health report.

- Review our growth performance report to gain insights into TPG Telecom's future.

Where To Now?

- Dive into all 1,018 of the ASX Penny Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Catalyst Metals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CYL

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives