- Australia

- /

- Trade Distributors

- /

- ASX:IPG

ASX Stocks That May Be Trading Below Estimated Value In July 2024

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has remained flat, but it has risen 6.6% over the past 12 months with earnings forecasted to grow by 13% annually. In this environment, identifying stocks that may be trading below their estimated value can provide opportunities for investors looking to capitalize on potential growth.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| MaxiPARTS (ASX:MXI) | A$2.00 | A$3.96 | 49.5% |

| Ansell (ASX:ANN) | A$27.37 | A$51.84 | 47.2% |

| Telix Pharmaceuticals (ASX:TLX) | A$19.08 | A$37.85 | 49.6% |

| VEEM (ASX:VEE) | A$1.81 | A$3.55 | 49.1% |

| IPH (ASX:IPH) | A$6.13 | A$11.73 | 47.7% |

| ReadyTech Holdings (ASX:RDY) | A$3.35 | A$6.19 | 45.9% |

| hipages Group Holdings (ASX:HPG) | A$1.10 | A$2.06 | 46.7% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Red 5 (ASX:RED) | A$0.39 | A$0.75 | 47.9% |

| EVT (ASX:EVT) | A$11.57 | A$21.45 | 46.1% |

Underneath we present a selection of stocks filtered out by our screen.

IPD Group (ASX:IPG)

Overview: IPD Group Limited, with a market cap of A$498.29 million, distributes electrical equipment across Australia.

Operations: The company's revenue segments include the Products Division, generating A$215.98 million, and the Services Division, contributing A$20.79 million.

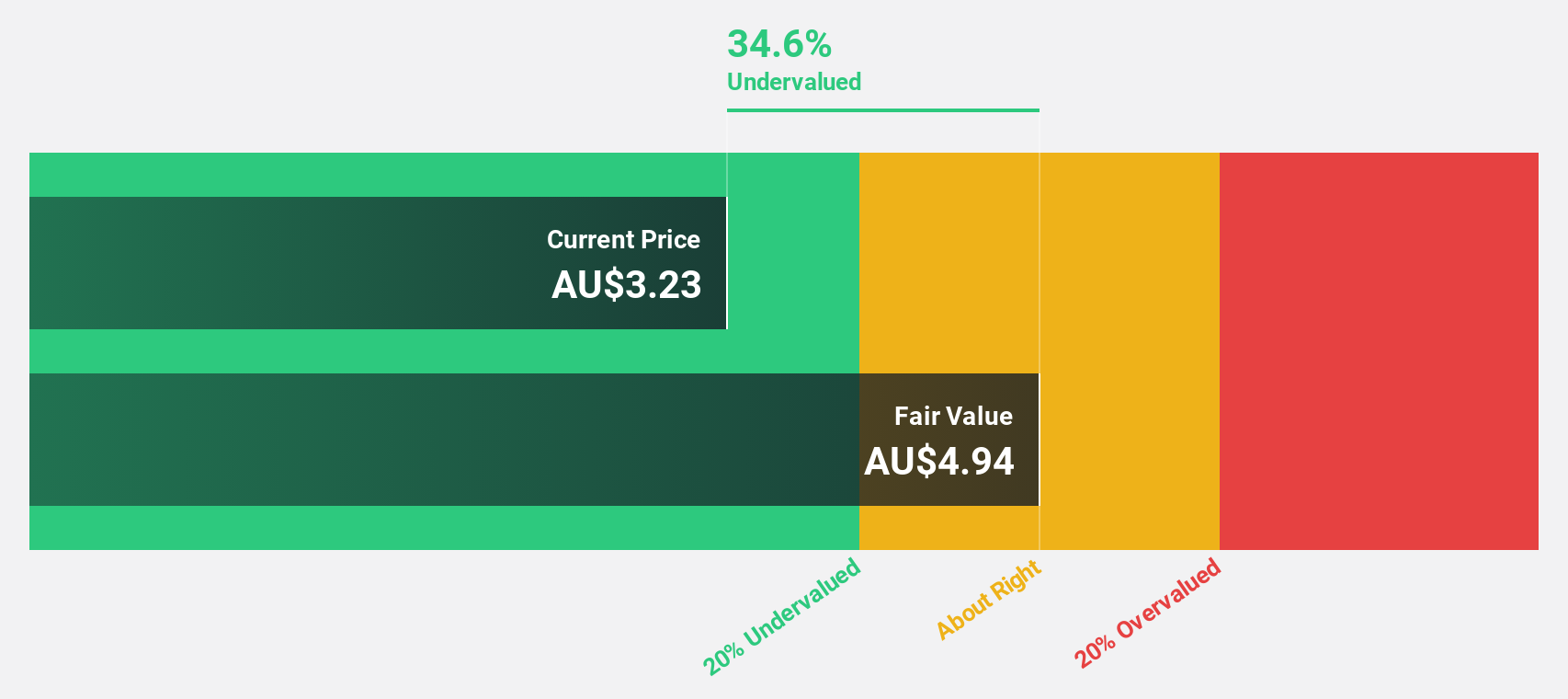

Estimated Discount To Fair Value: 12%

IPD Group's earnings are forecast to grow 25.88% annually, significantly outpacing the Australian market's 13.1%. Despite a recent dilution of shares and significant insider selling over the past three months, IPD remains undervalued trading at A$4.82 against an estimated fair value of A$5.47. Revenue is expected to grow 23.6% per year, well above the market average of 4.9%, reflecting strong future cash flow potential despite a low forecasted return on equity (19%).

- Insights from our recent growth report point to a promising forecast for IPD Group's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of IPD Group.

James Hardie Industries (ASX:JHX)

Overview: James Hardie Industries plc manufactures and sells fiber cement, fiber gypsum, and cement bonded building products for interior and exterior construction in various regions including the United States, Australia, Europe, New Zealand, and the Philippines with a market cap of A$23.59 billion.

Operations: The company's revenue segments are as follows: $2.89 billion from North America Fiber Cement, $562.80 million from Asia Pacific Fiber Cement, and $482.10 million from Europe Building Products.

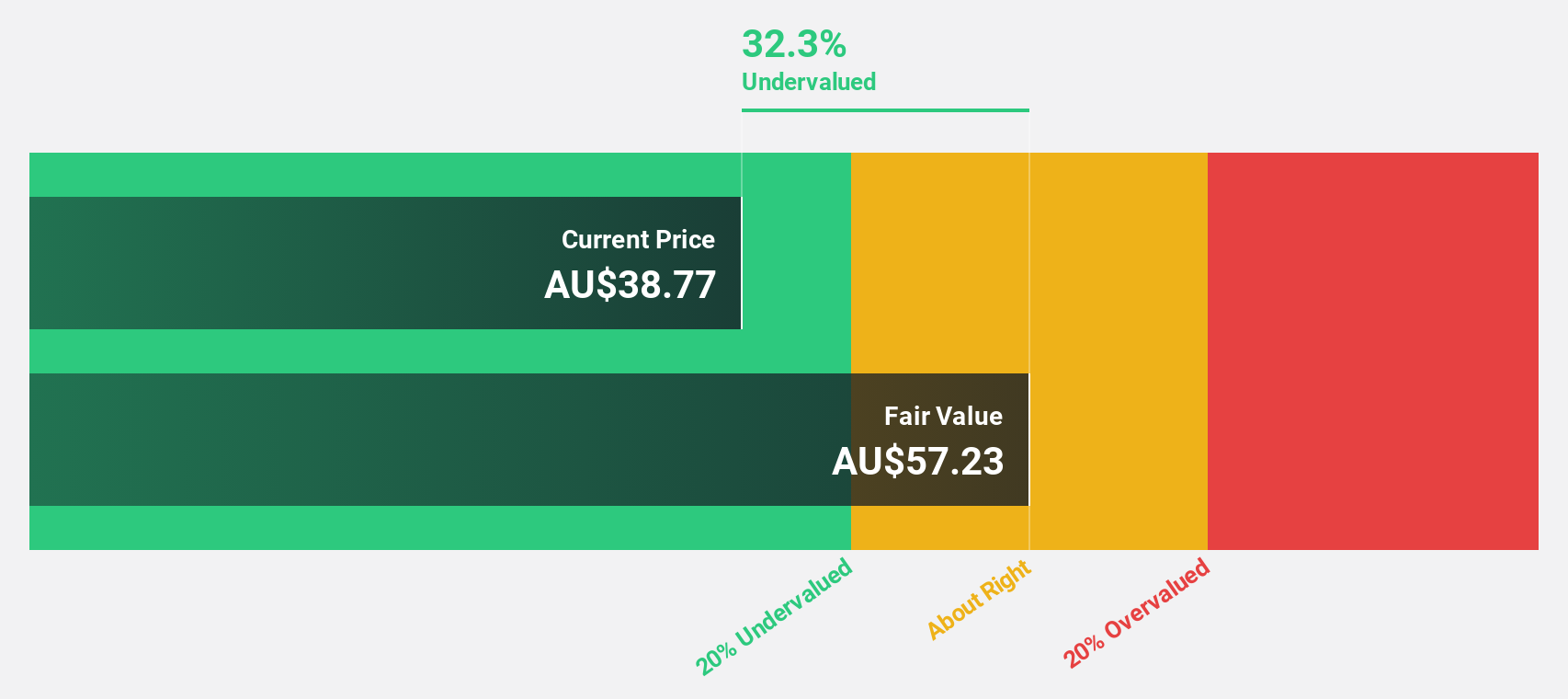

Estimated Discount To Fair Value: 22.2%

James Hardie Industries' recent equity buyback plan increase by US$50 million highlights its strong cash flow management. Trading at A$54.67, it is 22.2% below the estimated fair value of A$70.28, indicating it is undervalued based on discounted cash flows (DCF). Despite high debt levels, its earnings are forecast to grow 13.97% annually and revenue by 8%, outpacing the Australian market's growth rates and supporting robust future cash flow potential.

- The growth report we've compiled suggests that James Hardie Industries' future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in James Hardie Industries' balance sheet health report.

PWR Holdings (ASX:PWH)

Overview: PWR Holdings Limited designs, prototypes, produces, tests, validates, and sells cooling products and solutions globally with a market cap of A$1.20 billion.

Operations: The company's revenue segments include PWR C&R at A$37.35 million and PWR Performance Products at A$104.44 million.

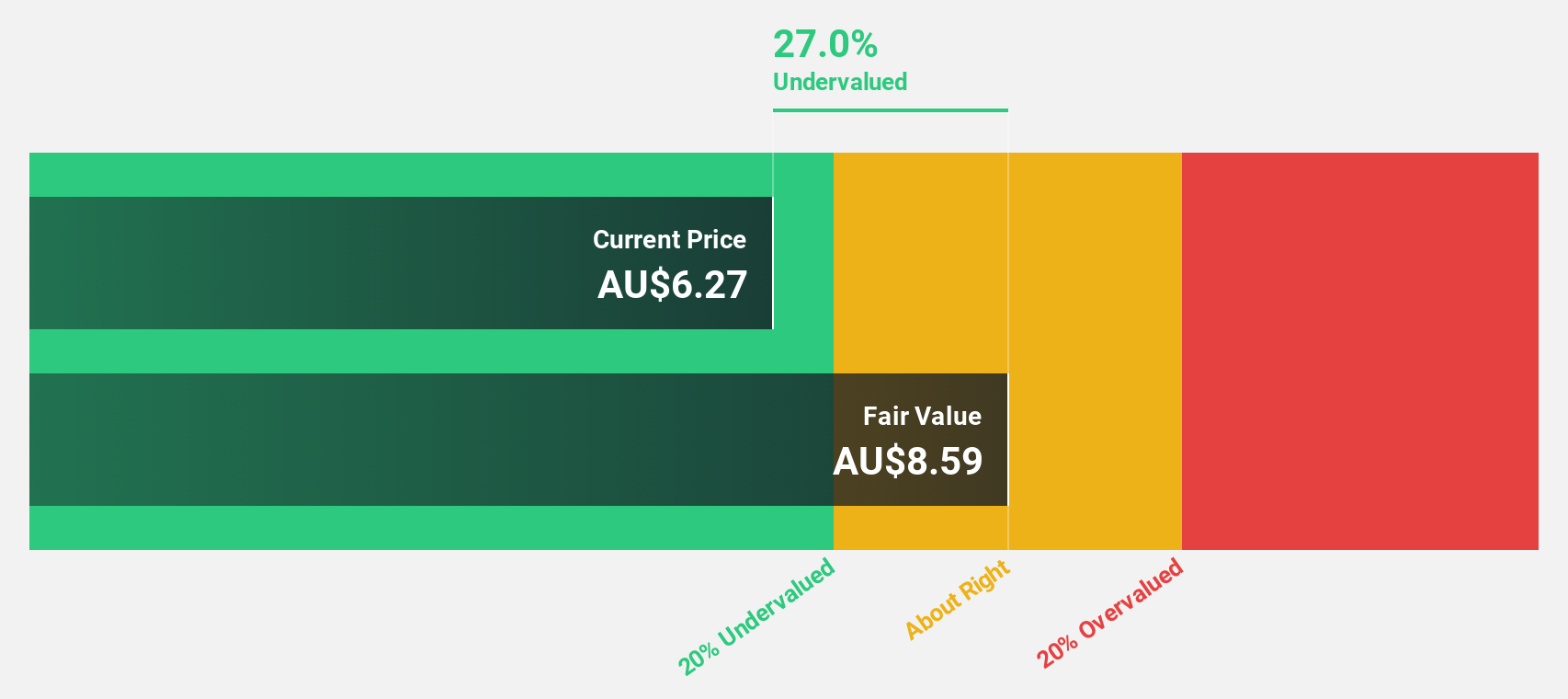

Estimated Discount To Fair Value: 15.1%

PWR Holdings' earnings grew by 12.3% last year and are forecast to increase by 15.37% annually, outpacing the Australian market's growth of 13.1%. Despite trading at A$11.9, it remains undervalued against its fair value estimate of A$14.01, suggesting potential for appreciation based on discounted cash flows (DCF). Revenue is expected to grow at 12.9% per year, faster than the market average of 4.9%, supporting strong future cash flow prospects despite moderate undervaluation.

- Our earnings growth report unveils the potential for significant increases in PWR Holdings' future results.

- Navigate through the intricacies of PWR Holdings with our comprehensive financial health report here.

Make It Happen

- Embark on your investment journey to our 42 Undervalued ASX Stocks Based On Cash Flows selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IPG

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.