- Australia

- /

- Specialty Stores

- /

- ASX:CTT

ASX Growth Companies With Insider Ownership And 93% Earnings Growth

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has remained flat, though it is up 6.6% over the past year with earnings forecast to grow by 13% annually. In this context, identifying growth companies with high insider ownership can be crucial as they often indicate strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Acrux (ASX:ACR) | 14.6% | 115.3% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.8% |

| Liontown Resources (ASX:LTR) | 16.4% | 51.6% |

| Catalyst Metals (ASX:CYL) | 17% | 75.7% |

| Biome Australia (ASX:BIO) | 34.5% | 114.4% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 49.4% |

| Ora Banda Mining (ASX:OBM) | 10.2% | 106.8% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Change Financial (ASX:CCA) | 26.6% | 77.9% |

Let's uncover some gems from our specialized screener.

Cettire (ASX:CTT)

Simply Wall St Growth Rating: ★★★★★★

Overview: Cettire Limited operates an online luxury goods retailing business in Australia, the United States, and internationally, with a market cap of approximately A$541.58 million.

Operations: Cettire's revenue from online retail sales amounts to approximately A$582.79 million.

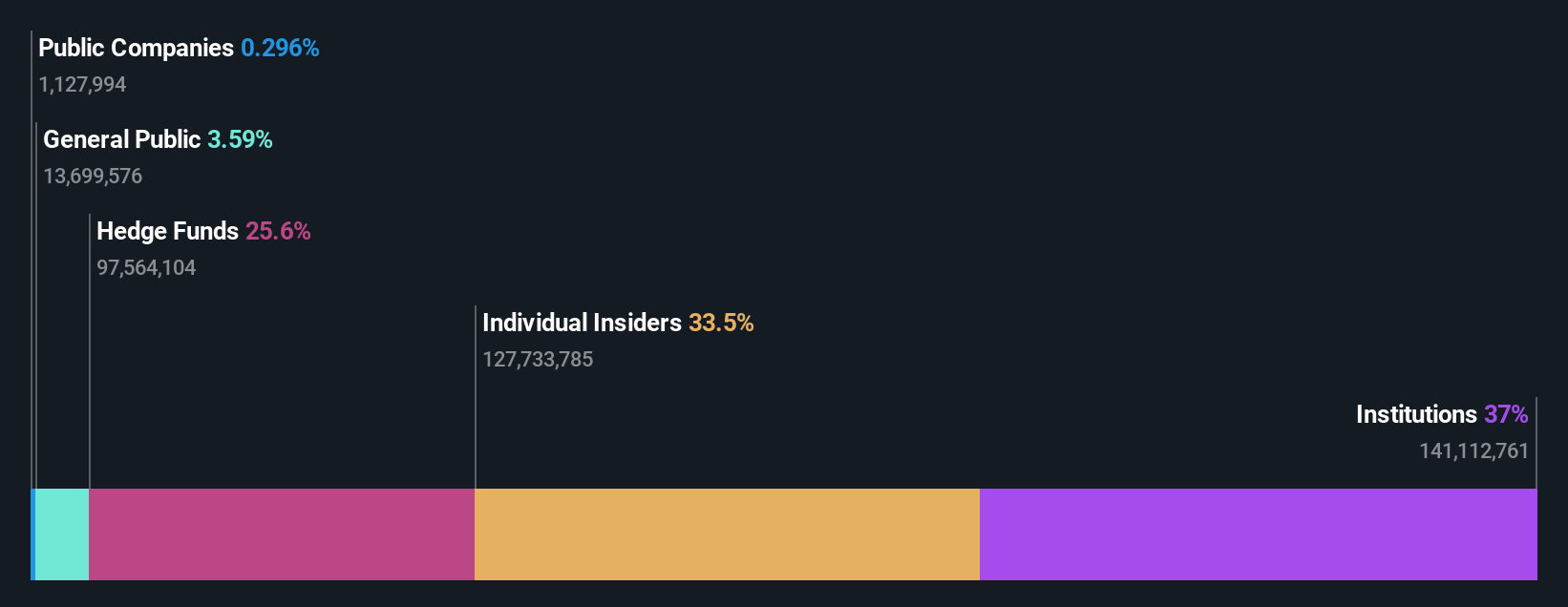

Insider Ownership: 28.7%

Earnings Growth Forecast: 26.7% p.a.

Cettire, a growth company with high insider ownership, is forecast to see revenue grow at 23.7% annually and earnings at 26.7%, both outpacing the Australian market. Despite recent shareholder dilution and share price volatility, it became profitable this year and trades at 72% below its estimated fair value. Recent board additions include Jon Gidney as an independent non-executive director, bringing extensive investment banking experience to the company’s strategic initiatives.

- Unlock comprehensive insights into our analysis of Cettire stock in this growth report.

- The analysis detailed in our Cettire valuation report hints at an deflated share price compared to its estimated value.

IperionX (ASX:IPX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: IperionX Limited focuses on the exploration and development of mineral properties in the United States, with a market cap of A$579.36 million.

Operations: IperionX Limited's revenue segments are currently not available.

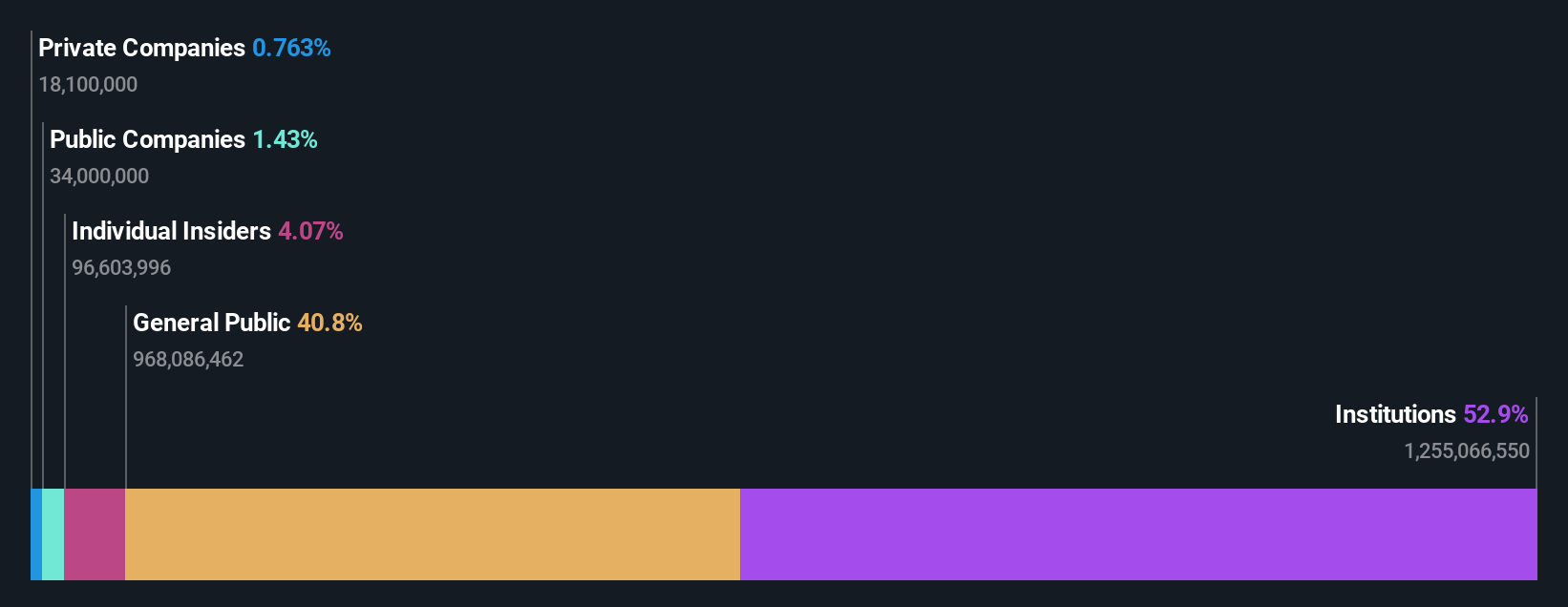

Insider Ownership: 16.8%

Earnings Growth Forecast: 47.4% p.a.

IperionX, with substantial insider ownership, is forecast to achieve 73.5% annual revenue growth and become profitable within three years. Recent agreements with Aperam Recycling and Vegas Fastener Manufacturing highlight its innovative titanium processing capabilities and potential in high-performance markets like aerospace and military applications. Despite past shareholder dilution, insiders have been net buyers recently, indicating confidence in the company's future prospects. Currently trading significantly below fair value estimates, IperionX remains a compelling growth story.

- Dive into the specifics of IperionX here with our thorough growth forecast report.

- Our valuation report unveils the possibility IperionX's shares may be trading at a premium.

Lotus Resources (ASX:LOT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lotus Resources Limited focuses on the exploration, evaluation, and development of uranium properties in Australia and Africa, with a market cap of A$476.26 million.

Operations: Lotus Resources Limited generates revenue primarily from its activities in the exploration, evaluation, and development of uranium properties across Australia and Africa.

Insider Ownership: 12.4%

Earnings Growth Forecast: 93.3% p.a.

Lotus Resources, presenting at the Wedbush Disruptive Transportation Conference in May 2024, is forecast to grow earnings by 93.34% annually and become profitable within three years, surpassing market growth expectations. Despite making minimal revenue (A$102K) and no expected revenue next year, it trades at 53.7% below fair value estimates with a high forecasted return on equity of 23.8%. No recent insider trading activity has been reported.

- Click here to discover the nuances of Lotus Resources with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Lotus Resources' current price could be quite moderate.

Taking Advantage

- Navigate through the entire inventory of 91 Fast Growing ASX Companies With High Insider Ownership here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CTT

Cettire

Engages in the online luxury goods retailing business in Australia, the United States, and internationally.

Flawless balance sheet with high growth potential.