- Australia

- /

- Metals and Mining

- /

- ASX:ILU

We Ran A Stock Scan For Earnings Growth And Iluka Resources (ASX:ILU) Passed With Ease

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Iluka Resources (ASX:ILU). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Iluka Resources

Iluka Resources' Improving Profits

In the last three years Iluka Resources' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. To the delight of shareholders, Iluka Resources' EPS soared from AU$0.84 to AU$1.21, over the last year. That's a impressive gain of 44%.

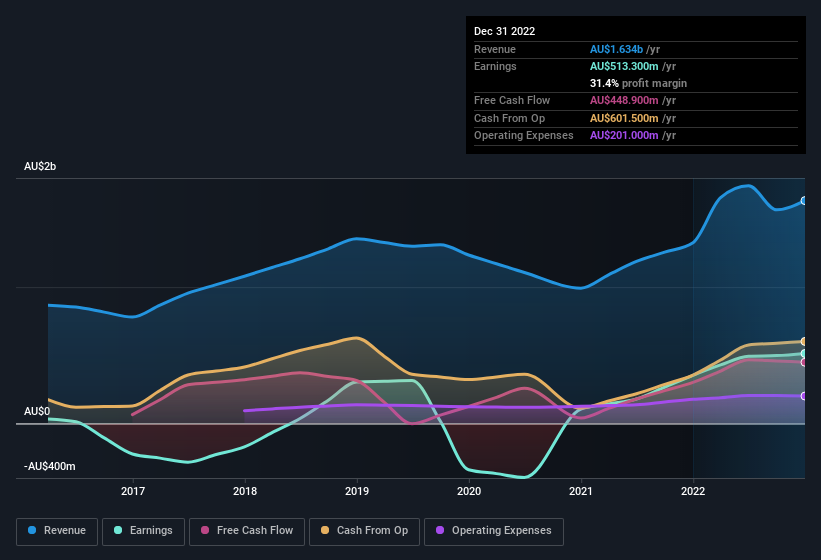

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Iluka Resources shareholders is that EBIT margins have grown from 37% to 43% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Iluka Resources' forecast profits?

Are Iluka Resources Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that Iluka Resources insiders spent AU$191k on stock, over the last year; in contrast, we didn't see any selling. This is a good look for the company as it paints an optimistic picture for the future. It is also worth noting that it was Independent Non-Executive Chairman Robert Cole who made the biggest single purchase, worth AU$131k, paying AU$8.71 per share.

The good news, alongside the insider buying, for Iluka Resources bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold AU$21m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 0.5% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Does Iluka Resources Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Iluka Resources' strong EPS growth. On top of that, insiders own a significant stake in the company and have been buying more shares. These things considered, this is one stock worth watching. Before you take the next step you should know about the 2 warning signs for Iluka Resources (1 is a bit unpleasant!) that we have uncovered.

Keen growth investors love to see insider buying. Thankfully, Iluka Resources isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ILU

Iluka Resources

Engages in the exploration, project development, mining, processing, marketing, and rehabilitation of mineral sands in Australia, China, rest of Asia, Europe, the Americas, and internationally.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)