- Australia

- /

- Metals and Mining

- /

- ASX:VSL

Steering Clear Of Vulcan Steel On The ASX And Exploring One Better Dividend Stock Option

Reviewed by Sasha Jovanovic

Dividend growth is a key indicator of a company's financial health and its ability to sustain and increase payouts to shareholders. However, not every stock that offers dividends is an attractive investment, especially if its dividend history shows signs of decline. In this article, we will explore two Australian stocks: one that presents a promising dividend option and another, Vulcan Steel, which has experienced diminishing dividends, signaling potential caution for investors seeking reliable income streams.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Nick Scali (ASX:NCK) | 5.29% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.10% | ★★★★★☆ |

| Centuria Capital Group (ASX:CNI) | 7.34% | ★★★★★☆ |

| Eagers Automotive (ASX:APE) | 7.23% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.07% | ★★★★★☆ |

| Fortescue (ASX:FMG) | 8.81% | ★★★★★☆ |

| Charter Hall Group (ASX:CHC) | 3.96% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.59% | ★★★★★☆ |

| Diversified United Investment (ASX:DUI) | 3.17% | ★★★★★☆ |

| Australian United Investment (ASX:AUI) | 3.58% | ★★★★☆☆ |

Click here to see the full list of 27 stocks from our Top ASX Dividend Stocks screener.

Let's dive into one of the prime choices out of the screener and one to possibly skip over.

Top Pick

IGO (ASX:IGO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IGO Limited is an Australian exploration and mining company specializing in metals crucial for clean energy, with a market capitalization of approximately A$4.48 billion.

Operations: IGO Limited generates revenue primarily through its Nova Operation and Forrestania Operation, totaling approximately A$903.4 million.

Dividend Yield: 9.3%

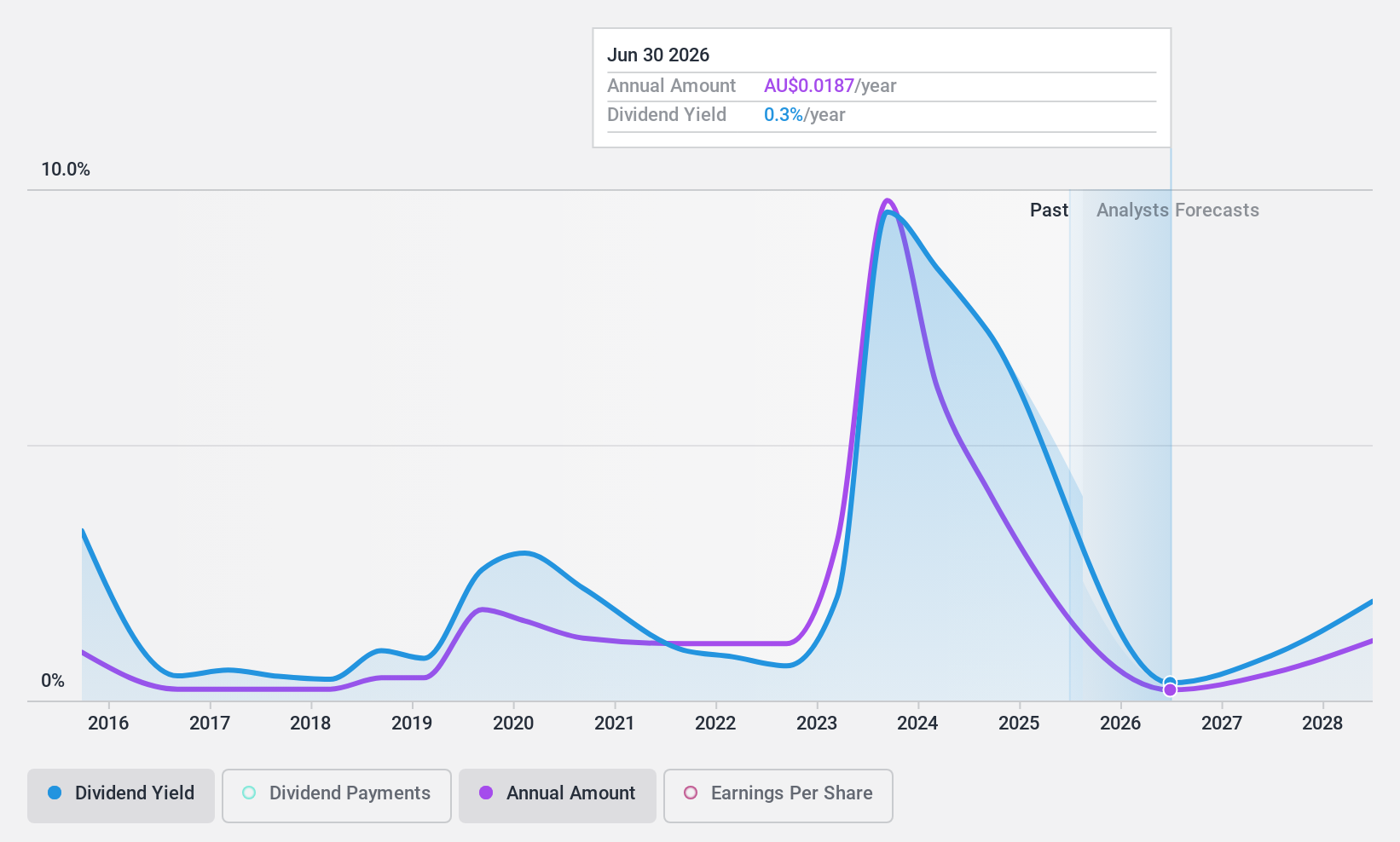

IGO Limited, despite a high dividend yield of 9.27%, faces challenges with its sustainability, as the payout ratio stands at 185%, indicating that dividends are not well covered by earnings. Additionally, while IGO's dividend payments have increased over the past decade, they have been volatile and unreliable during this period. On a positive note, the dividends are supported by cash flows with a cash payout ratio of 39.7%. Recent board changes could influence future financial strategies and performance.

- Unlock comprehensive insights into our analysis of IGO stock in this dividend report.

- The analysis detailed in our IGO valuation report hints at an deflated share price compared to its estimated value.

One To Reconsider

Vulcan Steel (ASX:VSL)

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Vulcan Steel Limited operates in New Zealand and Australia, focusing on the sale and distribution of steel and metal products, with a market capitalization of approximately A$847.59 million.

Operations: The company generates revenue from two primary segments: Metals, contributing NZ$638.86 million, and Wholesale - Miscellaneous, adding NZ$532.02 million.

Dividend Yield: 6%

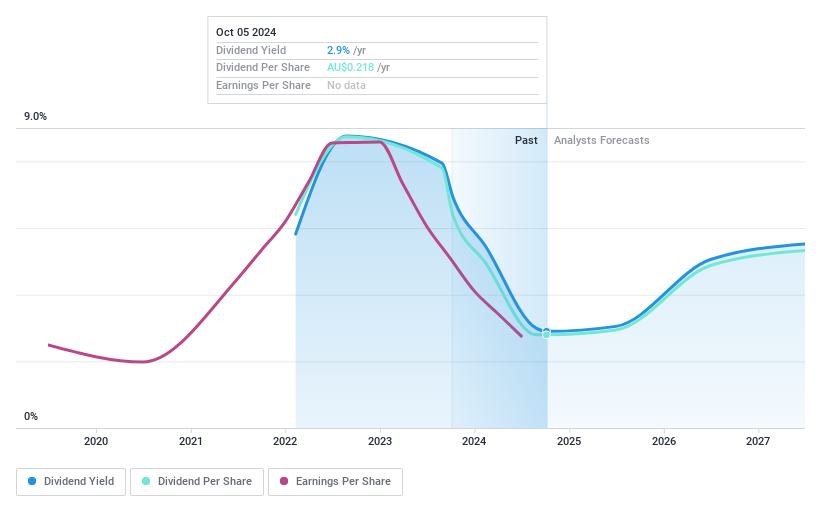

Vulcan Steel's dividend appeal is limited, with a yield of 6%, below the top quartile in Australia at 6.5%. Despite a low cash payout ratio of 26.8%, suggesting cash flow coverage, its high earnings payout ratio at 93.6% raises concerns about sustainability. Dividend payments have not only decreased but also shown volatility since initiation two years ago, reflecting instability and unreliable growth prospects in payouts. Additionally, Vulcan faces challenges with declining profit margins and high debt levels.

Seize The Opportunity

- Investigate our full lineup of 27 Top ASX Dividend Stocks right here.

- Already own any of these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VSL

Vulcan Steel

Engages in the sale and distribution of steel and metal products in New Zealand and Australia.

High growth potential slight.

Similar Companies

Market Insights

Community Narratives