- Australia

- /

- Metals and Mining

- /

- ASX:FEX

How Investors May Respond To Fenix Resources (ASX:FEX) Appointing Veteran COO to Oversee Major Projects

Reviewed by Sasha Jovanovic

- Fenix Resources has appointed Mr. Fernando Pereira as Chief Operating Officer of its wholly owned mining subsidiary, Westmine, bringing over 20 years of operational leadership in iron ore from industry giants including Fortescue, Hancock Prospecting, BHP, and most recently Mineral Resources.

- Pereira's proven expertise in managing large-scale supply chains and his focus on safety and operational discipline offer Fenix additional capabilities as it pursues expansive projects such as Weld Range.

- With a seasoned executive now leading operations, we'll look at how Pereira's appointment could influence Fenix Resources' growth trajectory and project execution.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Fenix Resources Investment Narrative Recap

To see value in Fenix Resources, shareholders need to be confident in the company’s ability to ramp up iron ore production from multiple mines and control costs to offset profit margin pressure, even as the iron ore market faces ongoing volatility and cost inflation risks. The appointment of Fernando Pereira as COO brings seasoned operational leadership, which could enhance execution on near-term expansion projects like Weld Range, but does not materially alter the biggest short-term catalyst: achieving targeted production rates, nor the key risk of iron ore price swings impacting earnings.

One of the most relevant recent announcements is Fenix’s FY26 production guidance, forecasting 4.0 to 4.4 million tonnes in sales at C1 cash costs of A$70 to A$80 per wet metric tonne. This aligns closely with the company’s expansion ambitions and highlights how operational changes may support efficiency as Fenix seeks to meet these goals under Pereira’s leadership.

However, investors should also be aware that, in contrast to the optimism around expansion, the risk of iron ore price volatility continues to...

Read the full narrative on Fenix Resources (it's free!)

Fenix Resources' narrative projects A$550.0 million revenue and A$28.0 million earnings by 2028. This requires 20.3% yearly revenue growth and a A$22.6 million earnings increase from A$5.4 million today.

Uncover how Fenix Resources' forecasts yield a A$1.56 fair value, a 213% upside to its current price.

Exploring Other Perspectives

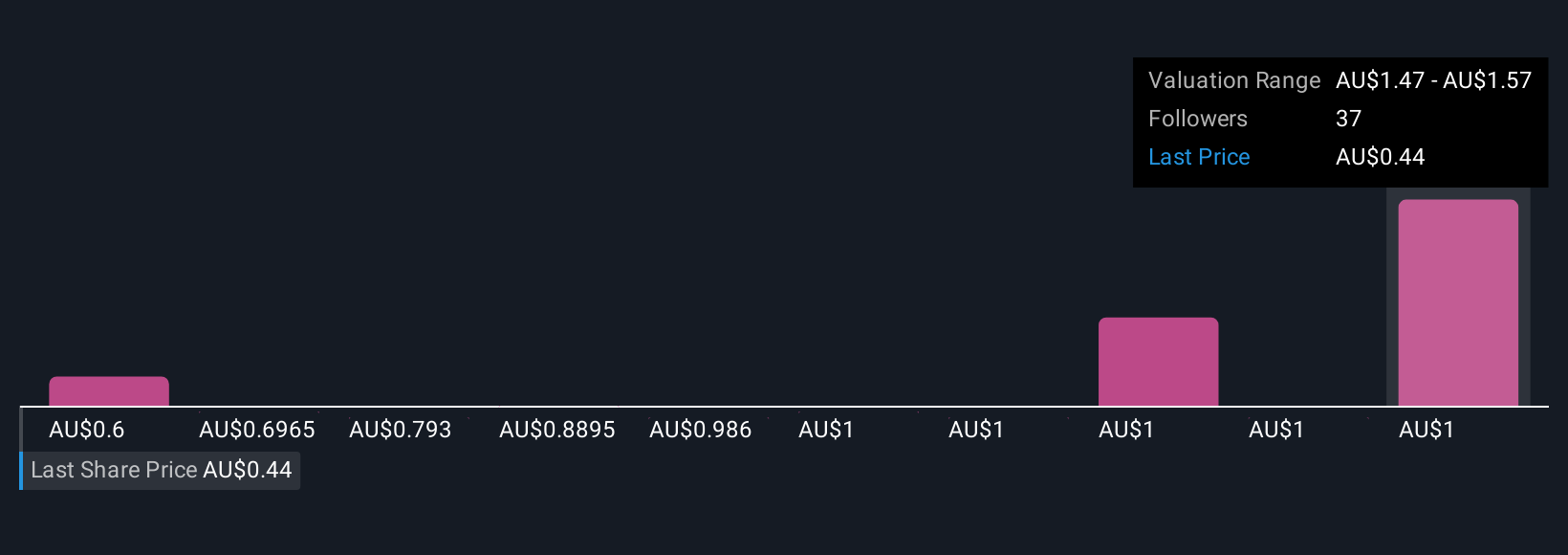

Simply Wall St Community members have published 11 fair value estimates for Fenix Resources, ranging from A$0.60 to A$1.57 per share. While these views span a wide spectrum, the company’s reliance on iron ore demand and exposure to commodity price swings remain fundamental factors that could shape future performance, consider reviewing multiple opinions before making any assumptions.

Explore 11 other fair value estimates on Fenix Resources - why the stock might be worth over 3x more than the current price!

Build Your Own Fenix Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fenix Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fenix Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fenix Resources' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FEX

Fenix Resources

Provides mining, logistics, and port services in Western Australia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)