- Australia

- /

- Metals and Mining

- /

- ASX:FEX

Fenix Resources (ASX:FEX): Valuation Insights After Key COO Appointment at Westmine

Reviewed by Simply Wall St

Fenix Resources (ASX:FEX) has drawn fresh attention following the appointment of Mr. Fernando Pereira as Chief Operating Officer of its wholly owned mining subsidiary, Westmine. Pereira’s executive experience spans two decades at top-tier iron ore producers.

See our latest analysis for Fenix Resources.

The appointment of Mr. Pereira follows a remarkable period for Fenix Resources. The company’s share price climbed 12.5% in the past month and posted a standout 83.1% increase over the last quarter. Year-to-date momentum is strong, supported by a 105.4% total return over the past 12 months and notable multi-year growth. This suggests confidence is building around strategic moves and operational progress.

If news-driven gains have your attention, now’s a good time to broaden your search and discover fast growing stocks with high insider ownership

Yet with the company’s shares surging and trading well below analyst targets, the question remains: is there genuine value left for investors, or is the market already pricing in Fenix’s future growth?

Most Popular Narrative: 65.5% Undervalued

According to the most widely followed narrative, Fenix Resources’ fair value is placed far above the current share price. This gap is driven by upgraded financial forecasts and ambitious expansion plans.

The ramp-up to a 4 million tonne per annum production run rate, with a third mine (Beebyn-W11) commencing soon and plans for further expansion through collaboration with Sinosteel in the Weld Range, positions Fenix for continued volume growth, driving future revenue and supporting sustainable operating earnings.

Curious what’s fueling this bold valuation call? The calculation leans on projections of rapid growth and a profit rebound, plus assumptions about future market positioning that could change everything for Fenix. Find out the details behind the leap in fair value and why the margin outlook is turning heads among analysts.

Result: Fair Value of $1.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, upcoming regulatory hurdles or unexpected shifts in iron ore prices could quickly alter Fenix Resources’ growth story and valuation outlook.

Find out about the key risks to this Fenix Resources narrative.

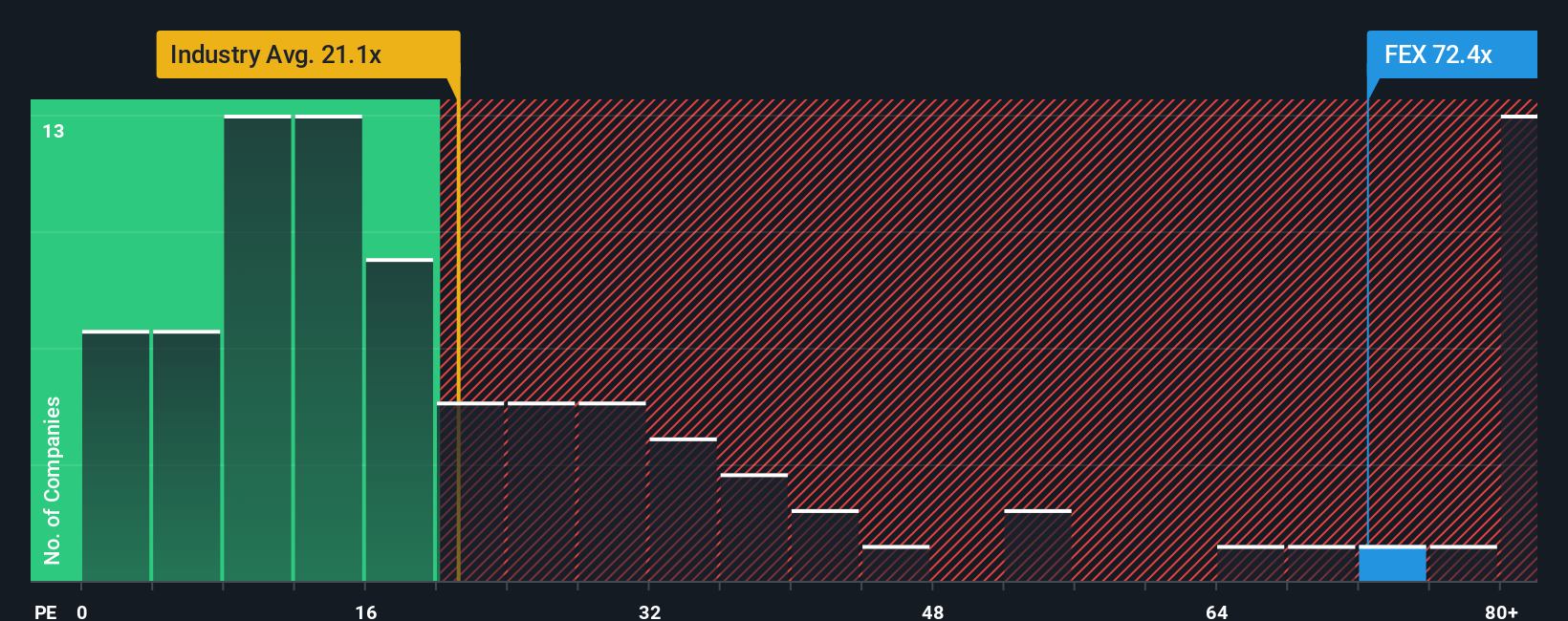

Another View: High Earnings Ratio Raises Questions

Taking a look from a different angle, Fenix Resources is trading at a price-to-earnings ratio of 74.5x, much higher than the sector average of 21.8x and peer average of 33.8x. Even compared to a fair ratio of 24.9x, the shares appear dear. This stark gap signals increased valuation risk as current optimism may already be reflected in the stock, or there could be potential for a surprise upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fenix Resources Narrative

If you see the story differently or want to dive into the numbers yourself, you can build your own in just a few minutes. Do it your way

A great starting point for your Fenix Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Thousands of savvy investors use the Simply Wall Street Screener to spot trends and uncover hidden gems every day. Why not join them and see what you might be missing?

- Boost your portfolio’s income by targeting these 21 dividend stocks with yields > 3% with impressive yields and a proven track record of payouts.

- Accelerate your growth strategy by selecting these 26 AI penny stocks at the forefront of artificial intelligence and automation innovation.

- Strengthen your investment foundation by focusing on value with these 848 undervalued stocks based on cash flows, showcasing stocks that the market may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FEX

Fenix Resources

Provides mining, logistics, and port services in Western Australia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)