- Australia

- /

- Metals and Mining

- /

- ASX:EVN

Evolution Mining Limited's (ASX:EVN) Stock Is Going Strong: Is the Market Following Fundamentals?

Most readers would already be aware that Evolution Mining's (ASX:EVN) stock increased significantly by 46% over the past three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. Specifically, we decided to study Evolution Mining's ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Evolution Mining is:

19% = AU$926m ÷ AU$5.0b (Based on the trailing twelve months to June 2025).

The 'return' is the income the business earned over the last year. One way to conceptualize this is that for each A$1 of shareholders' capital it has, the company made A$0.19 in profit.

See our latest analysis for Evolution Mining

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Evolution Mining's Earnings Growth And 19% ROE

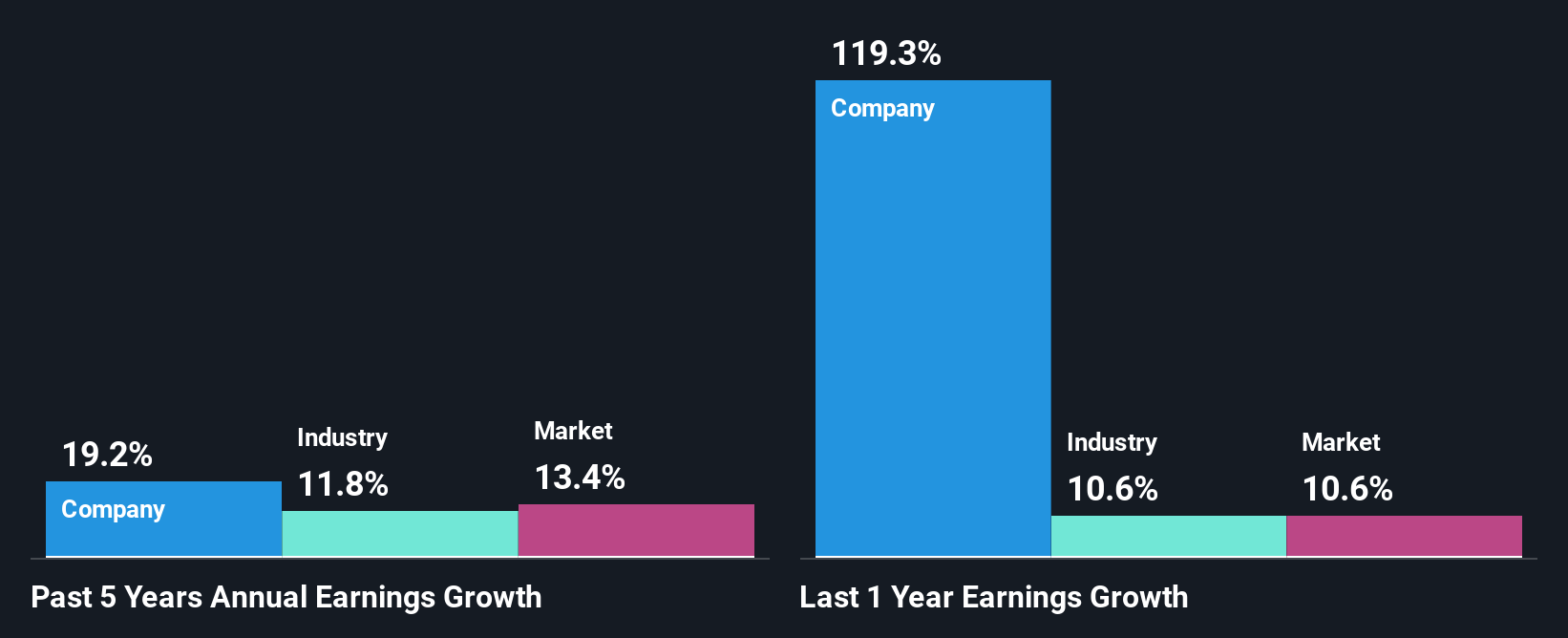

At first glance, Evolution Mining seems to have a decent ROE. On comparing with the average industry ROE of 9.4% the company's ROE looks pretty remarkable. Probably as a result of this, Evolution Mining was able to see a decent growth of 19% over the last five years.

As a next step, we compared Evolution Mining's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 12%.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Evolution Mining fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Evolution Mining Using Its Retained Earnings Effectively?

Evolution Mining has a three-year median payout ratio of 35%, which implies that it retains the remaining 65% of its profits. This suggests that its dividend is well covered, and given the decent growth seen by the company, it looks like management is reinvesting its earnings efficiently.

Additionally, Evolution Mining has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders. Our latest analyst data shows that the future payout ratio of the company is expected to rise to 43% over the next three years. However, the company's ROE is not expected to change by much despite the higher expected payout ratio.

Conclusion

On the whole, we feel that Evolution Mining's performance has been quite good. In particular, it's great to see that the company is investing heavily into its business and along with a high rate of return, that has resulted in a sizeable growth in its earnings. Having said that, the company's earnings growth is expected to slow down, as forecasted in the current analyst estimates. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Evolution Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:EVN

Evolution Mining

Engages in the exploration, mine development and operation, and sale of gold and gold-copper concentrates in Australia and Canada.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)